We’ve compared TurboTax vs H&R Block in terms of features, customer service, ease of use, and other offerings to help you determine the best fit for your business. However, the choice between the two ultimately depends on individual needs, the complexity of the tax situation, preferred support options, and budget considerations.

TurboTax is a widely used tax preparation software known for its user-friendly interface and step-by-step guidance and is optimal for QuickBooks Self-Employed users and businesses needing cryptocurrency support. Meanwhile, H&R Block has both online and in-person tax preparation services and is ideal for small business owners who want to use desktop software and to meet with a tax advisor in person.

TurboTax vs H&R Block Quick Comparison

| ||

|---|---|---|

Best for | QuickBooks Self-Employed users | Small business owners who want the option of in-person services |

Online DIY Pricing |

|

|

Schedule C Business Income & Loss | ✓ | ✓ |

Data Import | ✓ | ✓ |

Audit Guidance and/or Defense | ✓ | ✓ |

Deduction Maximizer | ✓ | ✕ |

Tax Pro Assistance With Business Returns | ✓ | ✓ |

S Corporation (S-corp) & Partnership Returns | ✓ | ✓ |

Average User Review Score on Third-party Sites | 1.5 out of 5 | 1.5 out of 5 |

For More Information |

Taxes are easier with clean books. Get on top of your financials today with Merritt Bookkeeping. |

|

When To Use

TurboTax vs H&R Block: Pricing

When comparing H&R Block vs TurboTax in terms of pricing, H&R Block is much more affordable than TurboTax, which charges quite a bit more for both individual and business tax returns for both DIY desktop and online filing. However, both offer a free option for online filing if you just need to file a 1040 tax return.

For online returns, H&R Block’s prices start at $35 for individual returns and $85 for self-employed returns. All online returns come with assistance from a tax pro for particular questions, but if you want a tax pro to review your entire return it will cost and additional $85 for self-employed returns. For business returns, you can DIY with their desktop software for $99 or have it prepared by Block Advisors starting at $203. Block Advisors is H&R Block’s online bookkeeping and tax service. For more information, check out our review of Block Advisors.

Meanwhile, TurboTax users can prepare self-employed returns online for $129 or pay $219 to prepare the return with help from a tax pro. TurboTax uses can prepare business returns with the desktop software for $190 or have TurboTax prepare the return for them starting at $1,749.

TurboTax vs H&R Block: Live Assistance

TurboTax | H&R Block | |

|---|---|---|

Communication Method | Phone, chat, and one-way videoconferencing | Phone, live chat, and in-person |

Qualifications of Professionals | CPAs, enrolled agents (EAs), or tax specialists | CPAs or EAs |

Tax Pro Assistance for Individual Returns | ✓ | ✓ |

Tax Pro Assistance for Business Returns | ✓ | |

Full-service Filing for Individual Returns | ✓ | ✓ |

Full-service Filing for Business Returns | ✓ | ✓ |

While both providers offer assisted and full-service tax filing options, one of the major differences between TurboTax vs H&R Block is that the former doesn’t offer an option to meet in person. However, it does offer one-way videoconferencing, something H&R Block does not, which can help streamline communications. TurboTax also offers tax pro assistance for business returns, although this is limited to California, Texas, Florida, Washington, Nevada, Wyoming, South Dakota, Alaska, Colorado, Georgia, North Carolina, Illinois, Arizona, and Ohio.

TurboTax vs H&R Block: Helpful Tools

TurboTax | H&R Block | |

|---|---|---|

Deduction Maximizer | ✓ | ✕ |

Audit Support | ✓ | ✓ |

Cryptocurrency Support | ✓ | ✕ |

Tax Calculator | ✓ | ✓ |

Data Import | ✓ | ✓ |

Expat Tax Services | ✕ | ✓ |

In that battle between H&R Block vs TurboTax in terms of helpful tools, TurboTax wins, with useful features like a deduction maximizer and cryptocurrency support. However, H&R Block stands out with its expat tax services, which offers United States citizens and green card holders both DIY and assisted tax filing. Note that both providers offer some type of audit support, the option to import data, and a tax calculator.

TurboTax vs H&R Block: Mobile App

TurboTax App | MyBlock App | |

|---|---|---|

Availability | iOS and Android | iOS and Android |

Products Supported | Free | Free, Deluxe, and Premium |

Talk Live with Tax Specialist | ✓ | ✓ |

E-File Return | ✓ | ✓ |

Scan & Upload W-2 | ✓ | ✓ |

IRS Refund Tracking | ✕ | ✓ |

View/Print/Save Return as PDF | ✕ | ✕ |

While both TurboTax and H&R Block have mobile apps, H&R Block’s has more features. MyBlock, H&R Block’s app, lets you perform a couple more tasks than TurboTax, including IRS refund tracking and e-file return, and it supports the Free, Deluxe, and Premium versions.

TurboTax vs H&R Block: Customer Service & Ease of Use

TurboTax | H&R Block | |

|---|---|---|

User Interface (UI) | Easy to use | Straightforward |

Support Channels | Phone, live chat, and online form | Phone, live chat, and in-person meetings |

Expert Help Offered | CPAs, EAs, and tax professionals | CPAs, EAs, and tax professionals |

Additional Services | TurboTax Full Service Live users receive access to a tax expert who will meet with you twice before filing your return | In-person meetings are available in almost 9,000 offices across the US |

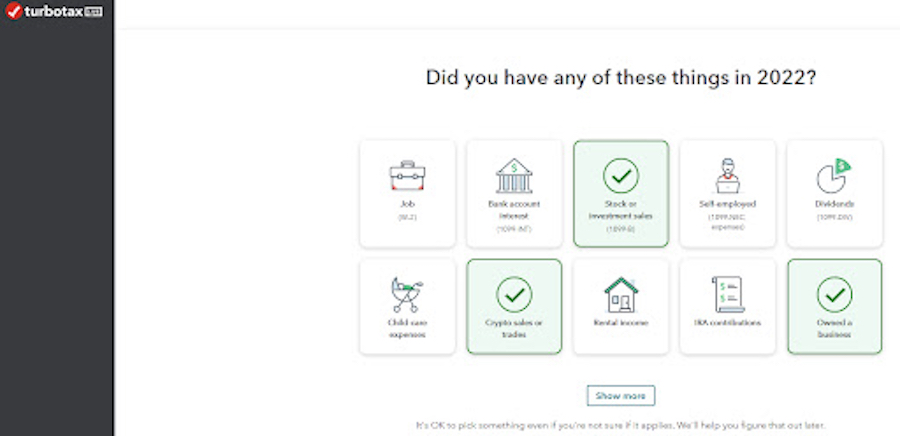

TurboTax is designed with a user-friendly interface that simplifies the tax preparation experience. It offers a step-by-step process that guides users through entering their tax information, maximizing deductions, and ensuring accurate calculations. It provides clear explanations and instructions at each stage, making it accessible even for individuals without extensive tax knowledge.

The provider’s customer service options include live chat via a chatbot or an online form if you’re a free user—and paid users get access to TurboTax specialists. If you sign up for TurboTax Live, you’ll receive a one-on-one review with a tax expert prior to filing and unlimited advice as you work to prepare your taxes.

The TurboTax Live Full Service plan gives you access to a tax expert who will prepare and file your taxes, with the ability to meet with them before they begin work and again when your return is ready for review.

TurboTax input screen

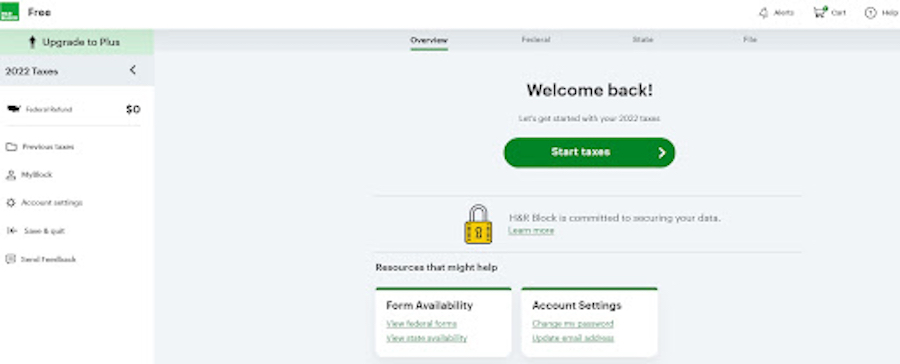

Meanwhile, H&R Block’s UI may not be as clean as TurboTax’s, but it is still easy to navigate and easy to get started. Every page includes clear instructions, and it allows you to skip some sections to return to later. Once you log in, you can check the status of your refund and check your history. A tax calculator is also provided so that you can access your tax refund.

In terms of customer support, the provider offers comprehensive online support through its website, where users can access a knowledge base, frequently asked questions (FAQs), and articles that cover a wide range of tax topics. It also provides unlimited live chat and telephone support for paid users. What’s more, you can meet with an H&R Block agent in any of its almost 9,000 offices. Visit H&R Block’s local tax office page to find an office near you.

H&R Block input screen

H&R Block vs TurboTax: User Reviews

We evaluated user reviews from independent review websites Trustpilot and Consumer Reviews. Both tax providers receive horrible user reviews from users at both websites. Most tax software providers do receive poor reviews that we attribute to the stress and confusion of filing a federal income tax return. However, TurboTax stands apart in the number of users that are disgusted with their pricing policies and what they see as bait-and-switch tactics around their free and low-priced offerings. Many users say they are steered towards unnecessary upgrades and once an upgrade is made there is nothing customer support can do to reverse it.

TurboTax earned the following average scores on popular review sites:

- Consumer Affairs1: 1.8 out of 5 based on 3,410 reviews

- Trustpilot2: 1.2 out of 5 based on 390 reviews

The reviews we read for H&R Block were a mixture of the full-service offices and their software, since both are offered through the same website. We didn’t see as many complaints about pricing, but there were complaints about the reliability of their system and problems with e-filing. There were also a lot of issues with the competence of the tax professionals and customer service.

H&R Block earned the following average scores on popular review sites:

- Consumer Affairs3: 1.7 out of 5 based on 2,876 reviews

- Trustpilot4: 1.3 out of 5 based on 1,160 reviews

FAQs

If your business is audited, H&R Block will review, research, and respond on behalf of your business to any IRS letter or notice.

Yes, TurboTax offers a free mobile app for both iOS and Android users.

H&R Block uses proprietary software to prepare taxes for both individuals and businesses. For those wanting to prepare their own taxes, it offers both an online and desktop version of its software.

TurboTax offers two products for small business owners: TurboTax Home & Business and TurboTax Business. While TurboTax Home & Business is designed for sole proprietors and 1099 contractors, TurboTax Business assists with preparing taxes for corporations, partnerships, and LLCs.

Bottom Line

Based on our expert TurboTax vs H&R Block comparison, we found that TurboTax excels in its user-friendly interface and self-guided tax preparation process while H&R Block stands out with its in-person support and physical office locations, making it a preferred choice for those who value face-to-face assistance. We advise evaluating the specific features, pricing, and user reviews for both providers to determine the best fit for your tax filing requirements.

User review references:

1Consumer Affairs | TurboTax

2Trustpilot | TurboTax

3Consumer Affairs| H&R Block

4Trustpilot | H&R Block