We’re excited to compare two popular tax prep products to help you determine the best fit for your business. I have analyzed TurboTax vs H&R Block by comparing their features, customer service, ease of use, and other offerings. The optimal choice ultimately depends on individual needs, the complexity of the tax situation, preferred support options, and budget considerations.

TurboTax is a widely used tax preparation software known for its user-friendly interface and step-by-step guidance. It is optimal for QuickBooks Self-Employed users and businesses needing cryptocurrency support. Meanwhile, H&R Block has both online and in-person tax preparation services and is ideal for small business owners who want to use desktop software and meet with a tax advisor in person.

Here are the ideal consumers for each product:

- TurboTax: Small businesses with complex tax situations seeking full-service tax preparation and filing

- H&R Block: Business owners looking for online and in-person tax prep options

TurboTax vs H&R Block quick comparison

| ||

|---|---|---|

Best for | QuickBooks Self-Employed users | Small business owners who want the option of in-person services |

Online DIY Pricing |

|

|

Schedule C Business Income & Loss | ✓ | ✓ |

Data Import | ✓ | ✓ |

Audit Guidance and/or Defense | ✓ | ✓ |

Deduction Maximizer | ✓ | ✕ |

Tax Pro Assistance With Business Returns | ✓ | ✓ |

S Corporation (S-corp) & Partnership Returns | ✓ | ✓ |

Average User Review Score on Third-party Sites | 1.5 out of 5 | 1.5 out of 5 |

Use cases and pros & cons

Pricing: H&R Block wins

H&R Block generally provides more affordable pricing than TurboTax for both desktop and assisted tax preparation services. Both programs offer free options for simple 1040 returns, but H&R Block’s Deluxe version starts at $35, while TurboTax’s equivalent is nearly twice as much.

For federal business tax preparation, H&R Block’s service starts at $109.The corresponding cost from TurboTax is $190. Additionally, state filing fees with TurboTax can add significant costs. Overall, H&R Block provides the best pricing options, especially for budget-conscious filers.

Live Assistance: H&R Block Wins

TurboTax | H&R Block | |

|---|---|---|

Communication Method | Phone, chat, and one-way videoconferencing | Phone, live chat, and in-person |

Qualifications of Professionals | CPAs, enrolled agents (EAs), or internally-trained tax specialists | CPAs, enrolled agents (EAs), or internally-trained tax specialists |

Tax Pro assistance for individual returns | ✓ | ✓ |

Full-service filing for individual returns | ✓ | ✓ |

Full-service filing for business returns | ✓ | ✓ |

While both providers offer assisted and full-service tax filing options, one of the major differences is that TurboTax doesn’t offer an option to meet in person. However, it does offer one-way videoconferencing, something H&R Block does not, which can help streamline communications.

TurboTax Live Assisted Business only offers business tax services in Alaska, Arizona, California, Colorado, Connecticut, Delaware, Florida, Georgia, Illinois, Kansas, Massachusetts, Maryland, Maine, Michigan, Minnesota, Missouri, North Carolina, New Jersey, Nevada, New York, Ohio, Pennsylvania, Rhode Island, South Dakota, Tennessee, Texas, Utah, Virginia, Washington, West Virginia, and Wyoming.

Helpful tools: TurboTax wins

TurboTax | H&R Block | |

|---|---|---|

Deduction Maximizer | ✓ | ✕ |

Audit Support | ✓ | ✓ |

Cryptocurrency Support | ✓ | ✕ |

Tax Calculator | ✓ | ✓ |

Data Import | ✓ | ✓ |

Expat Tax Services | ✕ | ✓ |

With features like a deduction maximizer and cryptocurrency support, TurboTax wins the competition for most helpful tools. However, H&R Block deserves an honorable mention for its expat tax services, which offer United States citizens and green card holders options for both DIY and assisted tax filing. Note that both providers offer some type of audit support, the option to import data, and a tax calculator.

Mobile app: tie

TurboTax App | MyBlock App | |

|---|---|---|

Availability | iOS and Android | iOS and Android |

Products Supported | Free | Free, Deluxe, and Premium |

Talk Live with Tax Specialist | ✓ | ✓ |

E-File Return | ✓ | ✓ |

Scan & Upload W-2 | ✓ | ✓ |

IRS Refund Tracking | ✓ | ✓ |

View/Print/Save Return as PDF | ✕ | ✕ |

The mobile apps of H&R Block and TurboTax, both have all-inclusive features that allow users to prepare and file taxes as effectively as possible directly from their mobile devices.

TurboTax Mobile App:

- Performance: Stable & consistent performance, minimal glitches

- User interface: Clean and appealing design

- In-app support: Features the TurboTax Assistant, which provides speedy and comprehensive responses

H&R Block Mobile App:

- Performance: Solid performance, few bugs or disruptions

- User interface: Replicates the desktop experience with straightforward navigation and a clean appearance.

- In-app support: Utilizes the browser-based help system, which users have noted as offering quick and thorough assistance.

Both apps are practical and user-friendly. H&R Block’s app offers faster performance and a straightforward interface, while TurboTax provides a more dynamic user experience with an advanced help assistant. Choosing the better option will boil down to personal preference for interface design and desired assistance features.

Customer service & ease of use: H&R Block wins

TurboTax | H&R Block | |

|---|---|---|

User Interface (UI) | Easy to use | Easy to use |

Support Channels | Phone, live chat, and online form | Phone, live chat, and in-person meetings |

Expert Help Offered | CPAs, EAs, and tax professionals | CPAs, EAs, and tax professionals |

Additional Services | TurboTax Full Service Live users receive access to a virtual tax expert | In-person meetings are available in almost 9,000 offices across the US |

This competition is a close call since both TurboTax and H&R Block have largely similar offerings. H&R Block edges out the competition through its in-person service offerings. Outside of this single divergence, Turbo Tax and H&R Block are relatively equal in terms of expert assistance and simplicity of the user interface.

Both products provide online support. Users can access a knowledge base, frequently asked questions (FAQs), and articles that cover a wide range of tax topics.

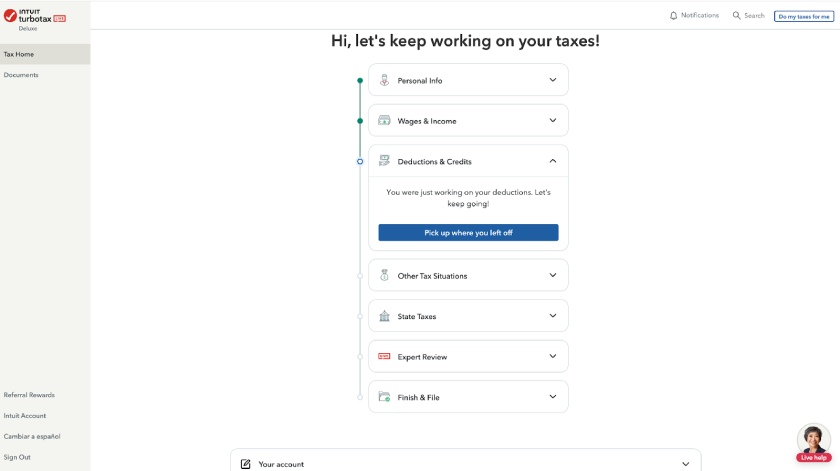

TurboTax and H&R Block get equivalent marks for simplicity of interface use. An example of the simple interface used by TurboTax is shown below. For additional ease of navigation, the dashboard includes a chat option in the lower right corner to provide assistance.

TurboTax dashboard

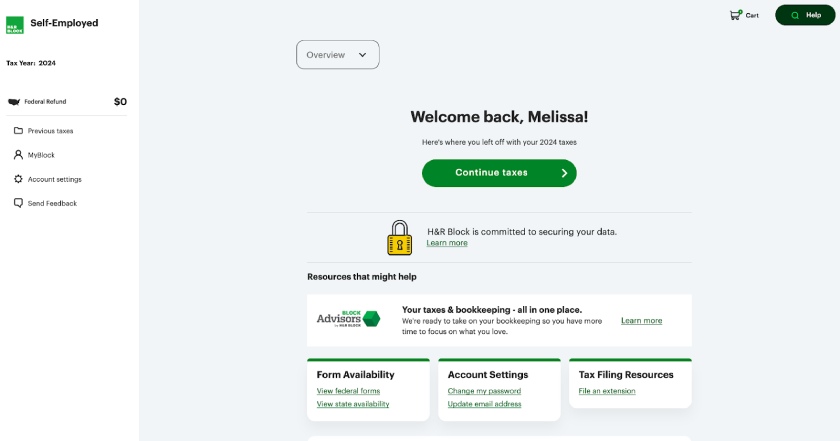

H&R Block’s user interface is equally easy to navigate. Every page includes clear instructions, and you can skip sections to revisit later. By logging in, you can access a tax calculator and the status of your refund.

H&R Block input screen

User reviews: TurboTax wins

TurboTax | H&R Block | |

|---|---|---|

Users like | Intuitive and streamlined user interface. Suitable for users needing guidance without complex tax situations. | More affordable pricing compared to competitors. Offers both online and in-person filing options |

Users dislike | Higher cost, especially for premium versions. Some users report discrepancies in tax calculations. | Customer support issues, including unresponsive tax professionals. Potential for encountering inexperienced preparers in in-person services. |

Average rating on third-party sites | 1.1 out of 5

| 1.2 out of 5

|

In the world of user ratings, Turbo Tax edged out H&R Block by a narrow tenth of a point. However, the rating points don’t align with the general comments. This is likely in part due to the fact that users leaving a rating often do so after a frustrating experience. While these ratings should not be ignored, they should be taken in conjunction with the other user comments, identifying what consistently works and doesn’t work about the products.

How I evaluated TurboTax vs H&R Block

I compared TurboTax and H&R Block based on these criteria:

- Features: I considered product characteristics such as ease of data import, navigation, refund tracking tools, and in-product support.

- Pricing: I verified the availability of free trials and confirmed pricing for varying tax prep packages.

- Technical support: Being able to access help when needed is a primary concern for users, so I assessed the ease of access to product experts via phone, email, or chat options.

- Ease of use: Particularly with DIY software, it’s important that software be easy to navigate. I reviewed how easy it is to move around the product from inception to completion of the tax return.

Frequently Asked Questions (FAQs)

If your business is audited, H&R Block will review, research, and respond on behalf of your business to any IRS letter or notice.

Yes, TurboTax offers a free mobile app for both iOS and Android users.

H&R Block uses proprietary software to prepare taxes for both individuals and businesses. For those wanting to prepare their own taxes, it offers both an online and desktop version of its software.

TurboTax offers two products for small business owners: TurboTax Home & Business and TurboTax Business. While TurboTax Home & Business is designed for sole proprietors and 1099 contractors, TurboTax Business assists with preparing taxes for corporations, partnerships, and LLCs.

Bottom Line

Based on our expert TurboTax vs H&R Block comparison, H&R Block comes out as the winner in the categories evaluated. This top spot was earned by H&R Block by a razor-thin margin, but since both products have a strong interface and their own variation of industry-standard tech support, the best option is ultimately one of user preference.