A general ledger, or GL, is essentially the backbone of a company’s financial record-keeping system. It functions as a centralized repository that tracks all of a company’s transactions over time, organized by specific accounts.

These accounts are categorized as assets, liabilities, equity, revenue, and expenses. The GL supports the double-entry accounting system, where each transaction has two corresponding entries, impacting two separate accounts in the GL.

Key Takeaways

- A GL summarizes all of your financial transactions, providing a historical record for analysis and reporting.

- A GL relies on debits and credits to ensure balanced accounts.

- A GL provides the data used to generate financial reports like a balance sheet and income statement.

- A GL offers insights into financial health, cash flow, and performance, empowering informed business decisions.

How Does a General Ledger Work?

A GL works by recording all of a company’s financial transactions on an ongoing basis. Here’s a step-by-step overview of how a GL functions in a manual system:

- Setting up accounts: The initial step involves establishing a chart of accounts, which categorizes all financial transactions. These accounts fall into five categories: assets, liabilities, owner’s equity, revenue, and expenses (discussed in the next section).

- Recording transactions: Individual financial transactions aren’t directly recorded in the GL. Instead, they are first captured chronologically in a general journal. This journal includes details like the date, description, and amounts involved. Most importantly, the general journal shows which accounts are being debited and credited and that the total debits equal the total credits.

- Posting to ledgers: From the general journal, transactions are then transferred, or posted, to their corresponding accounts in the GL. Each account has its own ledger sheet, which tracks debits and credits for that specific account.

- Catering to the double-entry system: A critical aspect of the GL is the double-entry accounting system. This means that every transaction has two entries: a debit in one account and an equal and opposite credit in another account. This ensures the fundamental accounting equation (Assets = Liabilities + Owner’s Equity) always remains balanced.

- Preparing a trial balance: Periodically, a trial balance is prepared. This report summarizes the ending balance (debit or credit) for each account in the GL. The total debits should equal the total credits, verifying the accuracy of the accounting records.

- Adjusting entries: At the end of an accounting period, additional adjustments might be needed to ensure financial statements reflect a complete picture. These adjustments are first recorded in the general journal and then transferred to the GL.

- Preparing the financial statements: Once the GL has been determined to be in balance with the trial balance and any adjusting entries have been made, the ending balances in the GL are used to prepare the financial statements.

- Closing the books: After the financial statements have been created, income statement accounts are closed, and their balance is adjusted to zero with the offsetting entry going to retained earnings. This prepares GL accounts for the next period since revenue and expenses must always be zero at the beginning of a period. Balance sheet accounts are not closed since their balance rolls forward to the next period.

All of these steps also occur in an automated system, but most of them happen instantaneously when you record a transaction.

Our related resources:

What Is Included in a General Ledger?

The GL includes all transactions recorded by the company, broken out by account. Accounts are broken into five categories, which represent the core financial elements of a business. These sections are as follows:

- Assets encompass everything of value that the company owns. This includes cash, inventory, property, equipment, and investments.

- Liabilities represent the company’s financial obligations or what it owes to others. Examples of liabilities include accounts payable, loans payable, and accrued expenses.

- Equity reflects the owner’s claim on the company’s assets after liabilities are settled. It represents the net worth of the business, including owner contributions and retained earnings.

- Revenue captures all of the income generated by the company such as sales of products or services.

- Expenses represent all of the costs incurred by the company in running its business, such as rent, salaries, utilities, and cost of goods sold.

These five sections work together to maintain the fundamental accounting equation: Assets = Liabilities + Owner’s Equity. The income and expenses recorded throughout the year ultimately impact the equity section of the balance sheet.

General Ledger Example

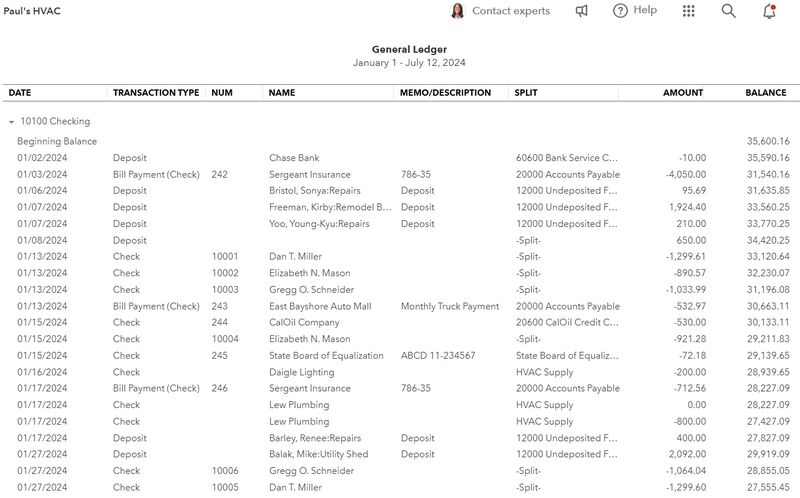

Sample General Ledger in QuickBooks Online

Paul’s HVAC has produced a GL statement for January 1 through July 12, 2024. The screenshot above is the portion of the report showing transactions in the Checking Account for January 2 through January 27. The complete GL report shows every transaction for every account between January 1 and July 12.

- For balance sheet accounts—assets, liabilities, and equity accounts—the GL for each account starts with the beginning balance that must match the beginning balance on the balance sheet.

- For income statement accounts—revenue and expense accounts—the beginning balance must be zero.

The GL then shows every transaction recorded to that account for the time period along with a cumulative balance. The ending balance in each GL account must agree to the account balance on either the ending balance sheet or the income statement, depending on the type of account.

Each entry in the GL shows the date, transaction type, number if applicable, name, memo or description, account, amount, and balance. This report has been generated from QuickBooks Online, which automates the process.

Benefits of a General Ledger

The GL is the backbone of all double-entry accounting systems—whether manual or automated. Without a GL, there is no double-entry accounting.

Here’s a breakdown of its advantages:

- Accuracy and transparency: By keeping all financial transactions in one central location, the GL ensures a clear and accurate record of your financial activity. This transparency is essential for both internal management and external stakeholders.

- Financial reporting: The GL serves as the foundation for generating financial statements like the balance sheet and income statement. These reports provide insight into your company’s financial health, performance, and overall position.

- Decision-making: With your financial data readily available, you can leverage the GL for informed decision-making. This can involve activities like budgeting, allocating resources, and strategic planning.

- Compliance and audits: The GL plays a vital role in ensuring adherence to accounting regulations and standards. During audits, it acts as a primary source of reference for auditors to verify the accuracy of financial records.

- Fraud detection: The systematic organization of transactions in a GL makes it easier to identify inconsistencies and unusual patterns. This can potentially help uncover fraudulent activity in your company.

- Tax filing: Having a well-maintained GL streamlines the tax filing process. Easy access to organized financial records saves time and reduces errors during tax preparation.

- Cash flow tracking: The GL facilitates the tracking of cash inflows and outflows, enabling you to monitor your cash flow and make informed decisions regarding cash management strategies.

Continue reading:

How to Optimize the Use of a General Ledger

Optimizing the use of a GL for your business involves implementing best practices, leveraging technology, and maintaining accurate and timely records. By following these techniques, you can ensure your GL serves as a reliable and efficient source of financial information, empowering you to make sound business decisions.

- Streamline your chart of accounts: Conduct periodic reviews of your chart of accounts to identify unused accounts or accounts with very low balances. These can be archived or merged with similar accounts. Also, having too many accounts can be cumbersome, while too few can limit the detail you capture. Aim to provide enough details, yet keep it manageable. Use consistent naming conventions to improve clarity and searchability within the GL.

- Standardize procedures: Develop and document standard operating procedures for recording transactions, posting to the GL, and reconciling accounts. Ensure all employees involved in accounting are trained in these procedures.

- Leverage automation: Implement accounting software that automates tasks like data entry, posting transactions, and reconciliations. This can minimize errors and free up time for analysis. Also, create pre-defined journal entries for frequently-recorded transactions to expedite the recording process.

- Enhance data quality: Establish internal controls to ensure the accuracy of data entered into the GL. This might involve separating duties and approval processes. Conduct regular reconciliations between your GL accounts and external sources like bank statements and vendor invoices, which will identify any potential discrepancies.

- Focus on reporting and analysis: Use the reporting functionalities within your accounting software to generate customized reports that provide valuable insights into your financial performance. Categorize transactions by department, location, or other relevant segments within the GL for more in-depth analysis. Identify key financial metrics relevant to your business and highlight these metrics for informed decision-making.

Frequently Asked Questions (FAQs)

Yes, a general ledger and double-entry bookkeeping are intrinsically linked. The general ledger relies on the double-entry system, where every transaction gets recorded twice with a debit in one account and an offsetting credit in another. The general ledger acts as the central repository for these double-entry transactions. Each account within the general ledger maintains a record of debits and credits for that specific account category.

No, a general ledger isn’t the same as a balance sheet. A general ledger is a record of all financial transactions of a business, organized by accounts. It includes all debits and credits and is used to prepare financial statements. A balance sheet is a financial statement that summarizes a company’s assets, liabilities, and equity at a specific point in time. It is derived from the information in the general ledger.

A general ledger can be an effective tool for your business because it is used to centralize and accurately record all financial transactions, ensure compliance and accountability, prepare financial statements, aid in decision-making, and facilitate efficient and automated accounting processes.

The main difference between a journal entry and a general ledger lies in their roles within the accounting process. A journal entry is the initial record of a financial transaction, detailing the accounts affected, the amounts, and whether they are debits or credits. It serves as the first step in documenting financial activities.

The next step is to carry the debits and credits of the journal entry to the general ledger for each of the accounts included in the entry. A general ledger provides a complete and organized view, separated by account, of all financial transactions over time, allowing for the preparation of financial statements and overall financial analysis.

Bottom Line

The GL records, summarizes, and categorizes all financial transactions of a business. It ensures the accuracy and completeness of financial data, facilitates the preparation of financial statements, and supports the double-entry accounting system by maintaining balanced books. This process enables you to monitor your company’s performance, comply with regulatory requirements, and make informed financial decisions.