A petty cash voucher, also referred to as a petty cash slip, is a formal document used to record small cash disbursements from a petty cash fund.

What Is a Petty Cash Voucher or Slip?

This article is part of a larger series on Bookkeeping.

It is used to record small expenses paid with cash, such as office supplies, small repairs, courier fees, and small gifts for clients or customers. By implementing a petty cash voucher system, you can effectively track expenses, enhance financial control, and simplify the accounting process.

Key Takeaways:

- Slips help maintain control over petty cash. By requiring one for every expense, it reduces the risk of misuse or theft.

- Vouchers are a vital component of internal controls. They contribute to the overall financial integrity of a business.

- Accurate and complete information—which includes date, amount, payee, description, and relevant supporting documentation—is crucial.

Important Items on a Petty Cash Voucher

A petty cash slip typically includes the following information:

- Date: When the cash was dispensed

- Amount: The specific amount of cash given out

- Payee: The person or business receiving the cash

- Description: A brief explanation of the purchase or expense

- Account code (optional): A code for the expense category

- Approvals: Signature of the person who authorized the spending

- Receipts: These are often attached as proof of the purchase

By completing this information, the voucher provides a clear record of the petty cash transaction for accounting, reconciliation, and auditing purposes.

Example of a Petty Cash Voucher

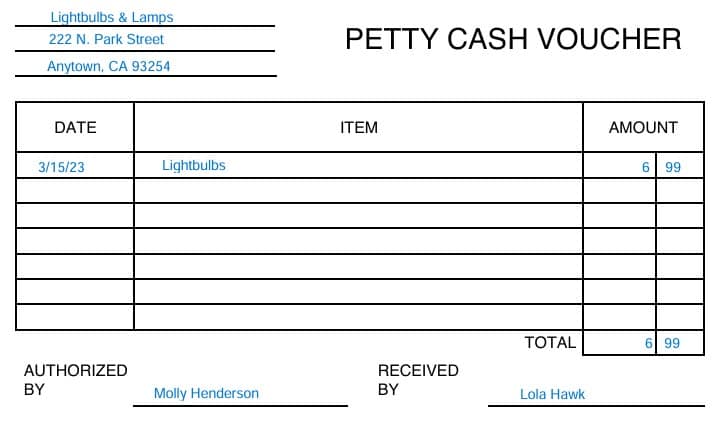

In the example below, a petty cash slip was completed to record a $6.99 expense for lightbulbs. You’ll see that the items discussed above are included, and the vendor (Lightbulbs & Lamps) and its address have been recorded. Also note that the “Authorized By” and “Received By” fields are completed, in case there are any questions about the transaction.

Petty Cash Voucher Example

Benefits of Using Petty Cash Vouchers

- Improved financial control: Petty cash slips provide detailed records of all petty cash transactions, which helps prevent overspending and unauthorized use of funds. They also aid in accurate financial reporting by providing records of how the cash was spent.

- Enhanced accountability: They require a clear justification for each expense, which ensures that the cash is being used for legitimate business purposes.

- Simplified reconciliation: Vouches provide supporting documentation for petty cash reconciliations, making it easier to identify discrepancies and errors and streamline the process of balancing the petty cash fund.

- Effective expense tracking: They help categorize expenses by type and support budgeting and cost control.

Common Petty Cash Voucher Mistakes and How to Avoid Them

Common Mistakes | How to Avoid Them |

|---|---|

Missing or incomplete information on vouchers | Require detailed information on all vouchers, including date, amount, reason, and supporting documentation |

Commingling personal funds with petty cash | |

Allowing employees to use petty cash for personal items | Define the purpose of the petty cash fund clearly and require authorized signatures for all petty cash disbursements |

Missing or unclear receipts | Create a consistent format to streamline data entry and analysis |

Lacking standardization (i.e., inconsistent voucher formats) | Ensure that all receipts are attached to the corresponding voucher and are clear and legible |

Best Practices for Petty Cash Management

By following the best practices below, you can minimize the risks associated with petty cash and ensure accurate financial reporting.

- Establish clear guidelines: Clearly outline what petty cash is used for, and determine an appropriate amount based on your company’s needs. Designate a custodian responsible for managing the fund, and enforce the submission of receipts for all expenditures. You should also implement approval procedures by establishing a process for approving petty cash disbursements.

- Maintain accurate records: Document all transactions with detailed petty cash vouchers, and conduct frequent reconciliations to identify discrepancies. Keep petty cash slips organized and accessible in case of an audit.

- Enhance security: Restrict access to the petty cash fund to authorized personnel, and store cash in a secure location. Also, conduct surprise audits by performing random checks to deter theft.

- Improve efficiency: Evaluate if prepaid cards or expense management software could be more efficient, and educate staff about petty cash policies and procedures. Periodically assess your petty cash management system for improvement.

Our related resources:

Frequently Asked Questions (FAQs)

A petty cash voucher is a document used to record small cash disbursements from a petty cash fund. It includes details like date, amount, reason, and recipient.

No, a petty cash voucher is an internal document recording a cash disbursement from a petty cash fund. However, it should require a supporting receipt to justify the expense. So, while the slip itself isn’t a receipt, it is typically accompanied by one.

Yes, it’s highly recommended to attach receipts to the petty cash slip for verification and audit purposes.

Petty cash vouchers provide documentation for disbursements of cash from the petty cash fund. They help track expenses, support reconciliation, and prevent misuse of petty cash funds.

Bottom Line

Petty cash vouchers are simple tools with a big impact on your business. They help you keep track of small expenses paid with cash and make it easier to control your finances. By accurately using petty cash slips to document your expenses, you can easily see where your money is going and ensure everything adds up. It is crucial to keep your petty cash organized, count it regularly, and see to it you have receipts for everything.