Deferred revenue (also called unearned revenue or income) is a liability owed to a customer for the value of goods or services the customer has paid for but not yet received. When a customer prepays for goods or services, the business must record the receipt of cash as deferred revenue on the balance sheet and only recognize the revenue on the income statement once the goods or services are delivered.

In this article, we’ll talk about what deferred revenue is, how it occurs in a normal business setup, and why it’s crucial in overall revenue recognition.

Deferred Revenue Journal Entries

The deferred revenue journal entry upon receipt of the customer payment is:

Debit | Credit | |

|---|---|---|

Cash | xxx | |

Unearned Revenue | xxx |

This journal entry increases cash for the amount received and records a liability for the goods or services we owe the customer. The unearned revenue account is a liability account in the balance sheet. We temporarily park this amount here since the seller or service provider has yet to fulfill the obligation.

When you perform the service or deliver the goods, the journal entry is:

Debit | Credit | |

|---|---|---|

Unearned Revenue | xxx | |

Revenue | xxx |

This journal entry reduces our liability to the customer for unperformed services or undelivered goods and records the revenue that has now been earned.

How To Compute Deferred Revenue

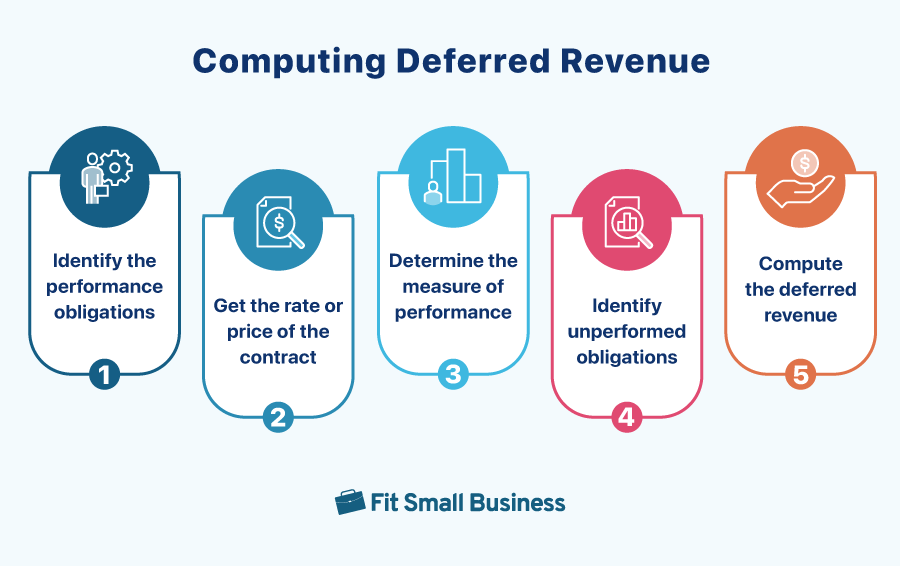

Deferred revenue is simply computed as the total contract price minus the earned portion of the contract price. However, here’s a more detailed way of computing deferred revenue.

Steps in Computing Deferred Revenue

- Identify the performance obligations. What are the things that you need to do? List down the tasks you need to do or the items you need to produce and deliver to the client. For example:

- How many deliverables do you need to submit at the end of the month?

- How many hours do you need to render every week?

- How many units do you need to produce and deliver every week?

- Get the rate or price of the contract. How much is the agreed-upon price for these performance obligations? How much is your rate in providing a service? How much is the selling price of the goods you’re selling? For example:

- Price per month

- Hourly rate per day

- Selling price per unit

- Determine the measure of performance. What is the unit of measurement that can help you determine if you’ve already fulfilled a portion of the contract? For example:

- Number of documents submitted or processed

- Number of hours rendered

- Number of units delivered

- Identify unperformed obligations. How many units do you still need to perform to complete the contract? What’s the portion that’s unfulfilled?

- Compute the deferred revenue. The deferred revenue is the dollar amount of revenues from unperformed obligations. You can compute this by multiplying the rate in Step 2 and the unfinished portion in Step 4.

Deferred Revenue Example

Let’s assume that Mr. Sky Scraper will visit Japan later this year. He booked a round-trip flight with United Airlines bound for Tokyo with a ticket price of $1,800. His departure is on September 3, and he’ll be back in the US by September 20.

- Determine the performance obligations: United Airlines’ performance obligation is to provide round-trip airline transportation service to Mr. Sky Scraper for his trip to Japan.

- Determine the rate or the price: The round-trip flight ticket costs $1,800.

- Determine the measure of performance: The number of flights purchased, regardless if taken or not.

- Determine the unperformed obligations: Since Mr. Sky Scraper hasn’t boarded the flight, there are still two unperformed obligations.

- Compute the deferred revenue: The deferred revenue is $1,800.

Based on the information above, the journal entries are as follows:

After Mr. Sky Scraper booked and paid for the flight, United Airlines records the entry below:

Debit | Credit | |

|---|---|---|

Cash | $1,800 | |

Unearned Revenue | $1,800 |

Since United Airlines hasn’t fulfilled the service, it must recognize the passenger’s payment as unearned.

Once Mr. Sky Scraper boards the flight on September 3, United Airlines should recognize the revenue for that flight only. The journal entry should be:

Debit | Credit | |

|---|---|---|

Unearned Revenue | $900 | |

Passenger Revenue | $900 |

The unearned revenue account still has a balance of $900.

After Mr. Sky Scraper enjoys his Japan trip, he boards his flight bound for the US on September 20. United Airlines can now recognize the revenue for the return trip.

Debit | Credit | |

|---|---|---|

Unearned Revenue | $900 | |

Passenger Revenue | $900 |

Frequently Asked Questions (FAQs)

Yes, because the seller or service provider owes the customer a good or service that is yet to be fulfilled.

The adjusting entry to recognize deferred revenue originally recorded as revenue during the period is a debit to revenue and a credit to unearned revenue.

Bottom Line

We hope this article taught you what deferred revenue is, along with important journal entries. Recognizing deferred revenue in the balance sheet is crucial in revenue recognition. Since the principle states the revenue is recorded only when it is earned, payments for future performance of goods and services should not be recorded as revenues.