A fixed asset roll forward is an accounting process used to track changes in the fixed assets and accumulated depreciation accounts from the beginning to end of the year. It shows all fixed asset acquisitions, fixed asset disposals, and depreciation for the year, thus reconciling the beginning balance sheet amounts to the ending balance sheet amounts.

What Does a Fixed Asset Roll Forward Include?

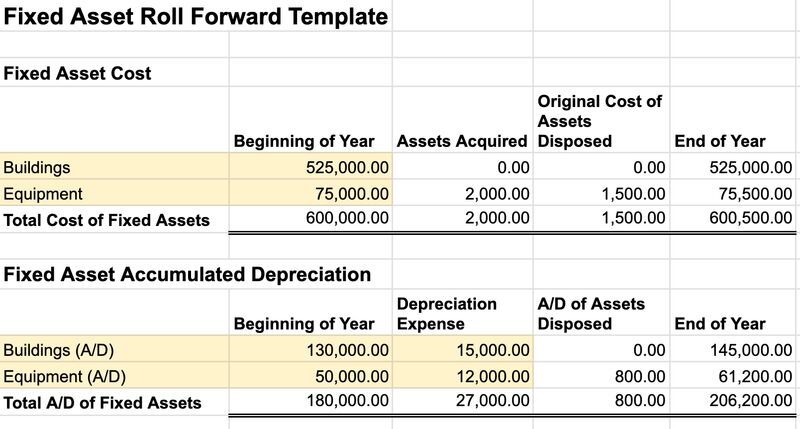

A fixed asset roll forward details the annual activity in fixed assets and accumulated depreciation—including additions, disposals, and other adjustments—leading to the ending balance.

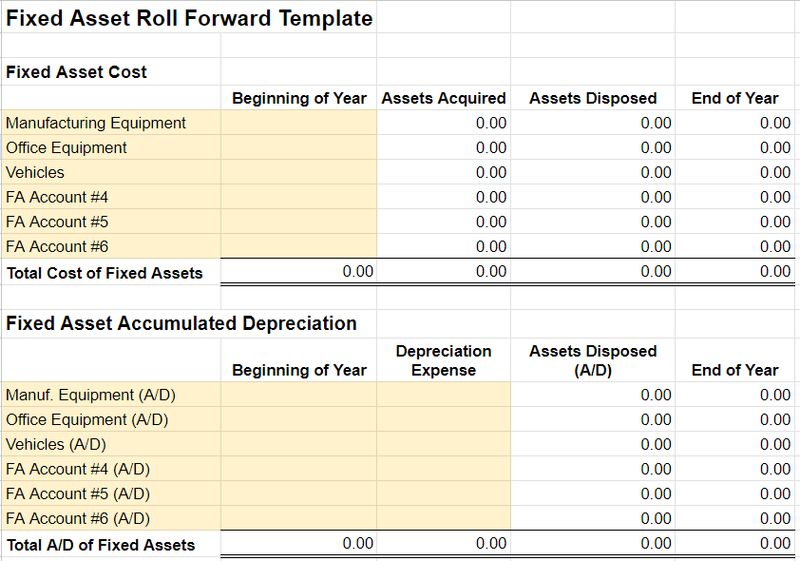

Here’s the basic structure of a roll forward of the fixed asset account:

Beginning Fixed Assets | |

|---|---|

Plus | Cost of assets placed in service during the year |

Minus | Original cost of assets disposed of during the year |

Plus/Minus | Other adjustments |

Equals | Ending Fixed Assets |

Here’s the outline of the roll forward of the accumulated depreciation account:

Beginning Accumulated Depreciation | |

|---|---|

Plus | Current-year depreciation expense |

Minus | Life-to-date accumulated depreciation of assets disposed of during the year |

Plus/Minus | Other adjustments |

Equals | Ending Accumulated Depreciation |

Before adding other adjustments to your roll forward, review the adjustments carefully to determine they are corrected posted to the fixed asset or accumulated depreciation. If there are mistakes, then remove them from the account by making an adjusted journal entry and exclude them from the roll forward.

Purposes of a Fixed Asset Roll Forward

A fixed asset roll forward serves many purposes in financial management, reporting, and analysis. Here are a few:

- Tax reporting: The most basic use of a fixed asset roll forward is to provide the tax preparer with the needed detail to pick up all asset acquisitions and disposals for reporting on the tax return.

- Accurate financial reporting: It ensures that the financial statements accurately reflect the depreciated cost of the company’s fixed assets. This accuracy is crucial for stakeholders, including investors, creditors, and regulatory bodies.

- Compliance: Companies are required to comply with accounting standards and regulations, such as GAAP Generally Accepted Accounting Principles and IFRS International Financial Reporting Standards . A fixed asset roll forward helps in adhering to these standards.

- Asset management: It also aids in tracking the acquisition, usage, and disposal of fixed assets. This tracking helps in effective asset management and planning for future capital investments.

- Depreciation calculation: By detailing asset acquisitions, it facilitates accurate calculation of depreciation, which affects net income and tax liabilities.

- Audit support: During audits, a fixed asset roll forward provides a clear and detailed record of changes in fixed assets, making it easier for auditors to verify the accuracy and completeness of asset records.

- Internal controls: Fixed asset roll forward strengthens internal controls by ensuring all fixed asset transactions are recorded and reconciled. This helps to prevent and detect errors, fraud, or mismanagement of assets.

- Decision making: Management can use information from a fixed asset roll forward to make informed decisions about asset utilization, budgeting for new assets, and strategic planning for asset replacement or expansion.

- Historical tracking: It provides a historical record of fixed asset changes over time, which can be useful for trend analysis, forecasting, and understanding the lifecycle of assets.

Our related resources:

How to Do a Fixed Asset Roll Forward

A fixed asset roll forward is a valuable tool for ensuring accuracy, analyzing asset management, and supporting financial reporting. Use the template we supplied to create your own fixed asset roll forward, and follow these steps.

Step 1: Gather All Necessary Reports

When preparing to fill out the template, you’ll need to gather the following reports:

- Prior-year ending balance sheet or trial balance

- Current-year ending balance sheet or trial balance

- Current-year income statement or trial balance

- Current-year depreciation schedule

Step 2: Fill in the ‘Roll Forward Summary’ Tab

- Step 2.1: Replace the account names for your fixed asset cost and accumulated depreciation accounts in column A of the Roll Forward Summary tab.

- Step 2.2: Enter the beginning balances for each account from your prior-year ending balance sheet or trial balance.

- Step 2.3: Enter the current-year depreciation expense from your income statement or trial balance separated into each accumulated depreciation account for which it relates.

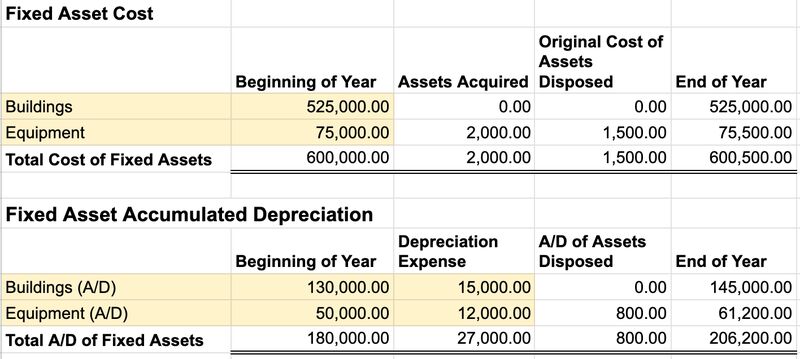

For our example, we have just two fixed asset accounts and two accumulated depreciation accounts.

Fixed Asset Roll Forward Template

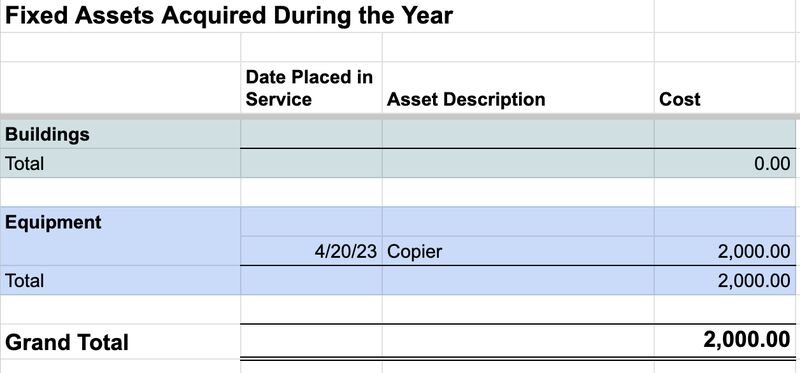

Step 3: Fill in the ‘Assets Acquired’ Tab

Enter the requested info for each asset acquired during the year on the Assets Acquired tab, while separating the acquisitions by the fixed asset account they were recorded in. This data will automatically populate on the Roll Forward Summary tab.

For our example, the only fixed asset purchased during the year was a copier for $2,000. The cost of $2,000 was recorded in the Equipment account when purchased, so this copier acquisition must be shown in our fixed asset roll forward.

Fixed Assets Acquired tab

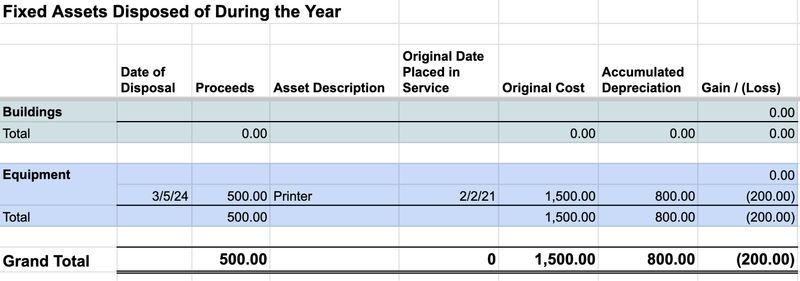

Step 4: Fill in the ‘Assets Disposed’ Tab

Enter the requested info for each of the assets disposed of during the year. The original cost and accumulated depreciation should be found on your most recent depreciation schedule. The data will automatically populate the Roll Forward Summary tab.

For our example, our only disposition was a printer that was originally acquired for $1,500. We claimed $800 of depreciation on the printer prior to its sale. These are amounts that must be removed from the fixed asset and accumulated depreciation accounts, respectively, in order for our roll forward to work.

Fixed Assets Disposed tab

Step 5: Check Figures on Each Tab

Once you have entered the required information on each tab, it is important to check each of the figures.

Keep these tips in mind:

- The ending balance in each of the fixed asset costs account on the roll forward summary should match the amount on your end-of-year balance sheet or trial balance. If not, review your GL for the year to determine which entry in the GL is not reflected in the roll forward summary.

- The ending balance in each of the fixed asset and accumulated depreciation accounts in the roll forward summary should also match your end-of-year balance sheet or trial balance.

- The gain or loss shown on the Asset Disposed tab should match the gain or loss shown on your trial balance or income statement.

Common Reasons for Checked Figures Not Matching

Discrepancies in a fixed asset roll forward can be frustrating, but identifying the root cause is crucial for accurate financial reporting. Here are some common reasons:

- Beginning balances were recorded inaccurately. Errors in the starting point can propagate through the entire roll forward.

- Disposals of fixed assets were not recorded correctly. See our article on the disposal of fixed assets to learn more about how to properly record the journal entry.

- Missing asset acquisitions that were recorded to fixed assets in the GL.

- Asset acquisitions included in this roll forward were recorded to repairs or similar expense account rather than fixed assets.

Financial Statement Treatment of Fixed Assets

Fixed assets, often referred to as PP&E, play a significant role in financial statements. Here’s a breakdown of the three most common reports:

- Balance sheet: Fixed assets are classified as long-term assets, as their useful life extends beyond one accounting period. The gross book value, or original cost of the asset, is recorded on the balance sheet, and the total depreciation charged to the asset up to the balance sheet date is subtracted from the gross book value. The net book value is the difference between the gross book value and accumulated depreciation, which represents the asset’s value on the balance sheet.

- Income statement: The depreciation expense, or portion of a fixed asset’s cost allocated as an expense over its useful life, is recorded on the income statement. This reduces net income. Also, if an asset’s value declines significantly, an impairment loss may be recognized on the income statement.

- Cash flow statement: The purchase of fixed assets is classified as a cash outflow from investing activities. The proceeds from the sale of a fixed asset are classified as a cash inflow from investing activities.

Frequently Asked Questions (FAQs)

“Roll forward” is a term used in accounting to describe the process of updating the balances of accounts or financial statements from one period to the next. It involves taking the ending balance of a previous period and adjusting it for all relevant transactions that have occurred in the current period to arrive at a new ending balance. This concept is essential to ensure that financial records are accurate.

The frequency of preparing a fixed asset roll forward depends on the company’s needs. However, it’s commonly prepared annually, quarterly, or monthly.

The biggest challenge in preparing a fixed asset roll forward is commonly dealing with dispositions. It’s important to remove the original cost and life-to-date accumulated depreciation for disposed-of assets. The sales proceeds and gain or loss on the disposal of assets have no effect on the asset roll forward.

To record a journal entry for a fixed asset purchase, you’ll debit the fixed asset account and credit the cash account, or the notes payable account if the purchase is financed. To learn more, read our guide on fixed asset accounting.

Bottom Line

The fixed asset roll forward helps ensure that all fixed assets reported on the balance sheet are accurate and up-to-date, reflecting all relevant transactions and changes during the period. It is an essential part of financial reporting and asset management, providing a clear picture of the company’s investments in long-term assets and their current value.