Listed property consists of items that can be used for business and personal purposes. They include the following categories:

- Passenger vehicles are defined as any four-wheeled vehicle intended for use on public streets and weighing no more than 6,000 pounds.

- Equipment designated for entertainment and recreational use, such as photography and audio/visual equipment.

- Other assets used for transit would include planes, trains, and boats—with the exception of qualified nonpersonal use vehicles An ambulance, hearse, police car, or school bus would be considered qualified nonpersonal use vehicles—as long as each is clearly marked for official use. , which are generally designed for limited personal use Forklifts and garbage trucks would have limited personal use due to their design. .

Property that is only used in a trade or business is not considered listed property. The IRS has special rules for listed property to prevent taxpayers from abusing the deduction for mixed-use property.

Key Takeaways:

- With the Tax Cuts and Jobs Act (TCJA), computers, computer accessories, and cell phones are exempt from the IRS’s definition of listed property.

- If business use of listed property is:

- Over 50%, depreciation can be claimed using either regular or accelerated depreciation methods

- 50% or less, depreciation can only be claimed using the straight-line (SL) method. Depreciation taken in excess of the SL method in earlier years is subject to tax.

- To take any deduction, detailed records showing the division of personal and business use must be maintained.

Special Rules for Depreciating Listed Property

The rules for depreciation of listed property differ depending on the amount of business use.

Depreciation for Listed Property With Business Use of Over 50%

Listed property with business use of more than 50% is eligible for both regular and accelerated depreciation methods. Accelerated depreciation allows for the taxpayer to take a larger portion of the cost of the asset as an upfront deduction instead of taking smaller amounts evenly over time.

The primary methods of accelerated depreciation are:

For listed property, only the business percentage of the asset can be depreciated or deducted. The deduction must be substantiated by thorough records.

Depreciation for Listed Property With Business Use of 50% or Less

If business use for the property is 50% or less, accelerated depreciation methods are not permitted, and SL depreciation must be used. Under this method, the cost of the asset is deducted evenly over a prescribed period. The IRS has established the periods over which different classes of assets can be depreciated.

For listed property, only the business use percentage would be depreciated or deducted under section 179. With accelerated depreciation methods, you can deduct a larger percentage of the cost of the asset as a deduction than you could with SL depreciation.

Depreciation Recapture for Less Than 50% Business Use

If you initially use listed property for more than 50% business but then in a later year reduce the use to below 50%, you must pay tax on the excess depreciation taken. The tax is based on the difference between SL depreciation for those assets and the accelerated depreciation method that you actually used.

That difference will be taxed at ordinary income rates and apply to the first year that your business use was less than 50%. This income is reported on Form 4797, Part II, which then transfers to your personal Form 1040, line 14.

Examples of Listed Property Depreciation

The following examples illustrate how listed property is depreciated.

50% or More Business Use

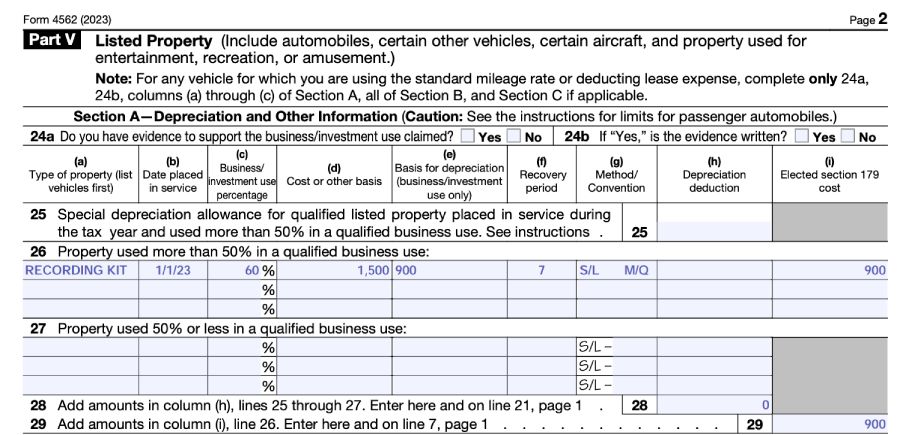

Lou gives violin lessons to local students. His business is organized as a sole proprietorship. Lou purchased a $1,500 studio sound kit that he uses to provide students with recordings of their studio sessions. He also uses the sound kit for personal reasons.

Based on his detailed records, he calculates the business usage of the studio kit to be 60%. Since Lou’s business use is greater than 50%, Lou can use the section 179 election to fully expense the business portion of the recording kit’s cost in the year of purchase.

Lou would report the purchase of this listed property in Part V of IRS Form 4562 and take a $900 deduction for 2023.

Form 4562, Part V, Sample Input: 50% or Greater Business Use

Less than 50% Business Use

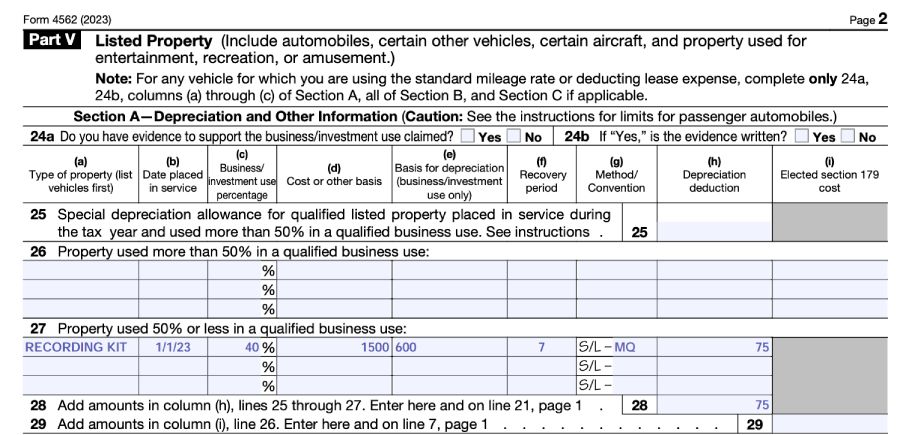

Let’s now assume the same fact pattern for Lou, but in this scenario, he calculated his business use percentage to be 40%. Since Lou’s business use is less than 50%, Lou may not accelerate the depreciation of the studio recording kit; it must be depreciated on the SL basis.

He should report the purchase of this listed property in Part V of IRS Form 4562 and report a $75 deduction for the year.

Form 4562, Part V, Sample Input: Less than 50% Business Use

Recapture When Business Use Drops Below 50%

Now let’s look at what happens if a taxpayer has a 60% business use in the first year but then the business use drops to 40% in the second year. Let’s assume that Lou purchases equipment with a five-year life for $10,000. He wants to use the double-declining-balance (DDB) when allowed and doesn’t claim section 179.

In year 1, Lou claims $1,200 of depreciation expense calculated as follows:

- $10,000 × 60% = $6,000 depreciable basis

- $6,000 × 20% (factor from MACRS DDB table for year 1) = $1,200

In year 2, Lou must use SL depreciation since the business-use percentage is less than 50%. He can claim depreciation of $800.

- $10,000 × 40% = $4,000 depreciable basis

- $4,000 ÷ 5 year life = $800

In addition to having a reduced depreciation amount in year 2, Lou must also recognize income for the recapture of excess depreciation in year 1.

- Year 1 SL depreciation would have been:

- $10,000 × 60% = $6,000 depreciable basis

- $6,000 ÷ 5 = $1,200 full-year depreciation

- $1,200 ÷ 2 = $600 half-year depreciation for the initial year of service

- Recapture amount is:

- $1,200 (actual depreciation) − $600 (SL depreciation) = $600

Below is a summary of the results for Lou in years one and two:

Year 1 | Year 2 | |

|---|---|---|

Business Usage | 60% | 40% |

Depreciation Expense | $1,200 (DDB) | $800 (SL) |

Recapture Income | - | $600 |

Recordkeeping Requirements

Logging your usage of the listed property is required. No deduction (accelerated or otherwise) is permitted without proper records. For vehicles used for business and personal purposes, a mileage log should provide adequate evidence of business usage.

Usage records for all other properties should be logged with the following information:

- Dates of usage

- Duration of usage

- Business reason for usage of the property; information provided here should include enough detail for a prospective auditor to identify the business intent of the activity

- Purchase and repair costs for the asset

Frequently Asked Questions (FAQs)

No. While bonus depreciation is permissible for listed property used more than 50% for business, under current IRS statute, 2022 was the last year that 100% bonus depreciation could be taken for any property, barring any changes to the law.

Examples of listed property include vehicles and equipment designated for entertainment and recreational use.

Depreciation recapture can occur on listed property when business use drops below 50% and accelerated depreciation was previously taken.

Bottom Line

Listed property includes assets that are used for both business and personal use. If business use drops below 50%, additional tax may be assessed on the depreciation taken in excess of what would have been taken using the SL method. Detailed records must be maintained showing the division of personal and business use, or the IRS may disallow the deduction.