Section 1250 property is your depreciable real property—like buildings—owned for more than one year and used in your business, trade, or rental activity. It’s important to identify your 1250 property because the gain on the sale of such property is taxed differently than ordinary assets, capital assets, and other 1231 assets.

Key Takeaways:

- Section 1250 property is a subset of section 1231 property.

- Loss on the disposal of 1250 property is a 1231 loss.

- Gain on the disposal of 1250 property can generate 1250 recapture, unrecaptured 1250 gain, and 1231 gain—depending on the sales price and amount of accumulated depreciation.

What Is Section 1250 Property?

Common examples of sec. 1250 property includes:

- Office buildings

- Warehouses

- Factories

- Rental houses

- Improvements made to 1250 property

Assets That Are Not 1250 Property

While the determination of 1250 property is simple for the majority of cases, there are a few buildings that are specifically defined as section 1245 property instead of 1250 property.

- Nonresidential real property purchased from 1981 through 1986

- Structures with the single purpose of housing livestock (including poultry) or their produce

- Greenhouses used for the commercial production of plants or mushrooms

Other assets excluded from 1250 property include land and capital assets—usually personal-use assets and investments.

How Section 1250 Property Is Taxed

Losses on the disposal or sale of 1250 property is a 1231 loss and netted with all other 1231 gains and losses. This is the same treatment as any other 1231 asset; there’s no special treatment for losses on 1250 property.

However, gain on the sale of 1250 property must be broken into three components.

- Section 1250 recapture is taxed as ordinary income.

- Unrecaptured section 1250 gain is taxed as a 1231 gain but subject to a maximum capital gains tax rate of 25%.

- Remaining 1231 gain is the gain remaining after section 1250 recapture and unrecaptured 1250 gain. It is taxed as typical 1231 gain.

How to Calculate Section 1250 Recapture

Section 1250 recapture is the portion of the gain on section 1250 property that is attributable to accelerated depreciation that is in excess of straight line depreciation—commonly referred to as excess depreciation. Specifically, section 1250 recapture is the lesser of:

- Excess depreciation; or

- Total gain on disposal

It’s important to identify any section 1250 recapture because it is taxed as ordinary income and is not part of your 1231 gain.

How to Calculate Unrecaptured 1250 Gain

The unrecaptured 1250 gain is the portion of the gain attributable to the straight line depreciation claimed over the life of the asset. So, the unrecaptured 1250 gain is the lesser of:

- Straight-line accumulated depreciation; or

- Total gain on disposal less any section 1250 recapture

The unrecaptured 1250 gain is part of your 1231 gain and should be netted with all other 1231 gains and losses for the year. If you have a net 1231 gain for the year, it’s treated as a capital gain. However, any unrecaptured 1250 gain included in the net 1231 gain is taxed at a maximum tax rate of 25% instead of your normal maximum capital gains rate.

How to Calculate the Remaining Section 1231 Gain

Any gain remaining after section 1250 recapture and unrecaptured section 1250 gain is taxed as a typical section 1231 gain. This remaining section 1231 gain is calculated as:

- Total gain

- Less 1250 recapture

- Less unrecaptured 1250 gain

Another way of looking at the remaining 1231 gain is that it is the gain attributable to the sales price being in excess of the original cost or basis of the property. If the property is being sold for less than its original cost, then there won’t be any remaining gain—which makes sense since all of the gain is due to the depreciation claimed on the property.

Section 1250 Property Examples

Example With No Excess Depreciation

Let’s start with a very common scenario where a building is purchased, depreciated straight line for several years, and then sold after it increases in value. Since straight line depreciation was used, there is no excess depreciation and thus no section 1250 recapture.

Assume that ABC Company purchased and sold a warehouse:

- Purchase date: June 15, 2019

- Sale date: February 15, 2024

- Purchase price: $390,000

- Accumulated depreciation (S/L): $46,667

- Net sales price: $450,000

Step 1: Calculate the Total Gain

The total gain on the sale is calculated as the sales price less the adjusted basis:

Total gain: $450,000 – ($390,000 – $46,667) = $106,667

Step 2: Calculate the Section 1245 Recapture

The section 1245 recapture is the lesser of A/D in excess of straight line, or the total gain. Since there is no excess depreciation in this example, the 1245 recapture is zero.

Step 3: Calculate the Unrecaptured 1250 Gain

The unrecaptured 1250 gain is the lesser of

- Straight line A/D: $46,667; or

- Total gain less 1245 recapture: $106,667

So, the unrecaptured 1250 gain $46,667.

Step 4: Summarize Your Gain

The remaining 1231 gain is the total gain of $106,667 less the unrecaptured 1250 gain of $46,667. The total gain can be summarized as:

Gain on Warehouse | |

|---|---|

Section 1250 Recapture | -0- |

Unrecaptured 1250 Gain | $46,667 |

Remaining 1231 Gain | $60,000 |

Total Gain | $106,667 |

Example With Excess Depreciation

Let’s make things a bit more complicated by introducing some excess depreciation. A common section 1250 asset eligible for accelerated depreciation is QIP—essentially interior improvements made after 2017 to an existing nonresidential building. QIP is depreciated under MACRS using a 15-year life and 150% declining balance method. It’s also eligible for section 179 expense and bonus depreciation.

Let’s assume in January of 2023 we built a small office within the warehouse that is QIP. The QIP qualified for 80% bonus depreciation plus 150% decline-balance depreciation over 15 years. The office was sold with the warehouse and increased the sales price by $50,000.

Here is a summary of our QIP:

- Placed in service date: January 15, 2023

- Sale date: February 15, 2024

- Cost: $60,000

- Actual A/D: $48,000 bonus + $1,170 MACRS = $49,170

- Hypothetical S/L accumulated depreciation: $4,333

- Sales price allocated to QIP: $50,000

Good tax software will calculate accumulated depreciation for you, but if you’d like to learn more, see our articles:

Step 1: Calculate the Total Gain

The total gain on the sale is calculated as the sales price less the adjusted basis:

Total gain: $50,000 – ($60,000 – $49,170) = $39,170

Step 2: Calculate the Section 1245 Recapture

The section 1245 recapture is the lesser of A/D in excess of straight line or the total gain:

- Excess depreciation: $49,170 – $4,333 = $44,837; or

- Total gain: $39,170

Since the excess depreciation is greater than the total gain, the entire gain of $39,170 is section 1250 recapture and must be reported as ordinary income.

Step 3: Summarize Your Gain

There is no need to calculate unrecaptured 1250 gain or remaining 1231 gain since we know the entire gain is section 1250 recapture.

Gain Qualified Improvement Property | |

|---|---|

Section 1250 Recapture | $39,170 |

Unrecaptured 1250 Gain | -0- |

Remaining 1231 Gain | -0- |

Total Gain | $39,170 |

How to Report the Sale of Section 1250 Property

Section 1250 property sales are reported on Form 4797.

- Losses on section 1250 property are reported on Part I, line 2.

- Gains on the sale of section 1250 property must be reported in Part III.

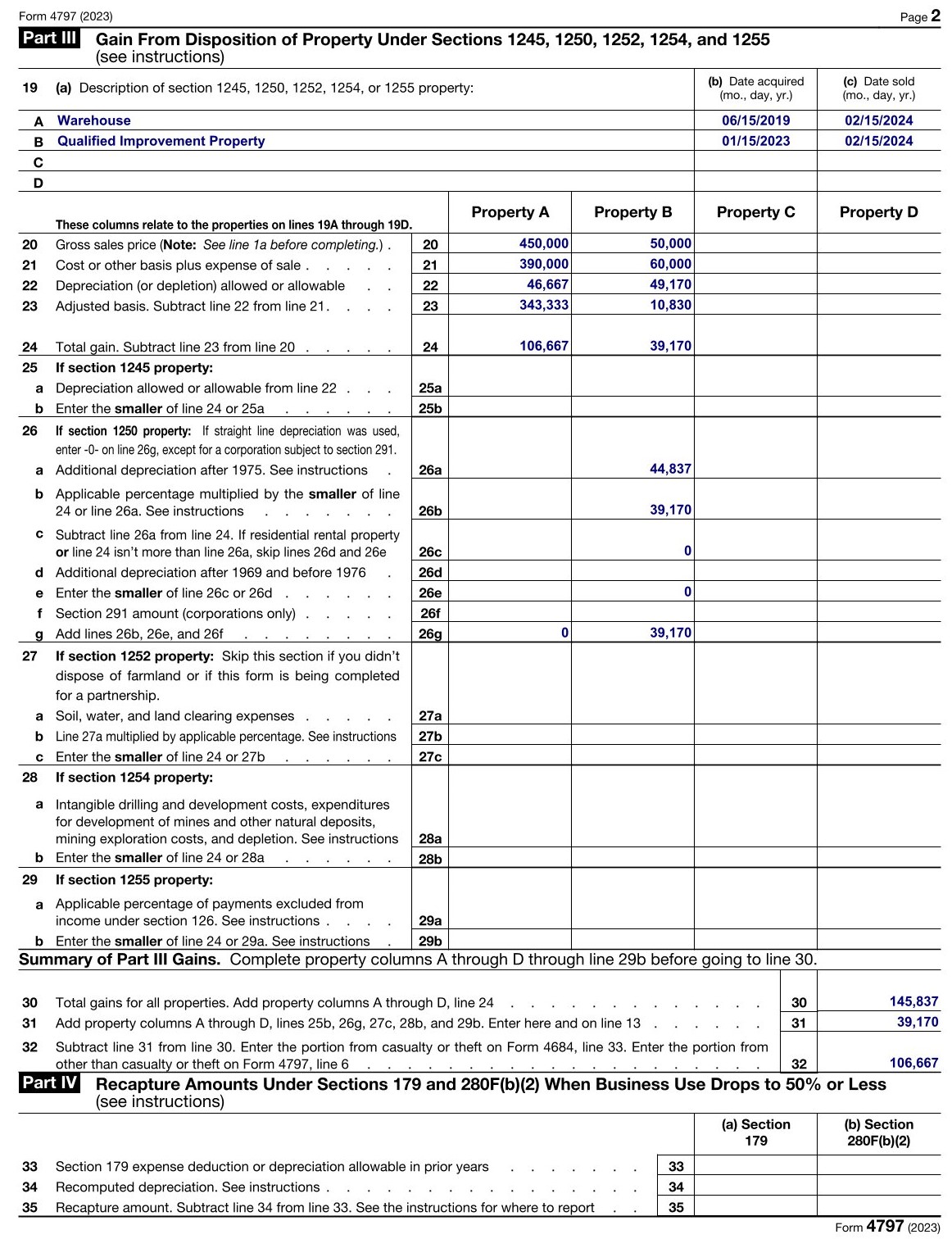

The purpose of Part III is to separate ordinary income from section 1231 gain for various types of property, including section 1250 property. As an example, I’ve completed Part III for the two section 1250 assets from the examples above.

Form 4797 Part III

- Lines 19 through 24 capture the basic information presented in the examples for each asset.

- Line 26 calculates any section 1250 recapture. As shown in the example, the Warehouse has no section 1250 recapture and the QIP’s entire gain of $39,170 is section 1250 recapture.

- Line 26 does not calculate unrecaptured 1250 gain. Remember, unrecaptured 1250 gain is still section 1231 gain, so form 4797 allows it to flow to Part I along with the remaining 1231 gain. Unrecaptured 1250 gain matters once you start calculating your capital gains tax on Schedule D.

- Lines 31 and 32 separate the total gain into the section 1250 recapture (line 31) and the 1231 gain (line 32).

- Line 31 flows to Part II, line 13.

- Line 32 flows to Part I, line 6.

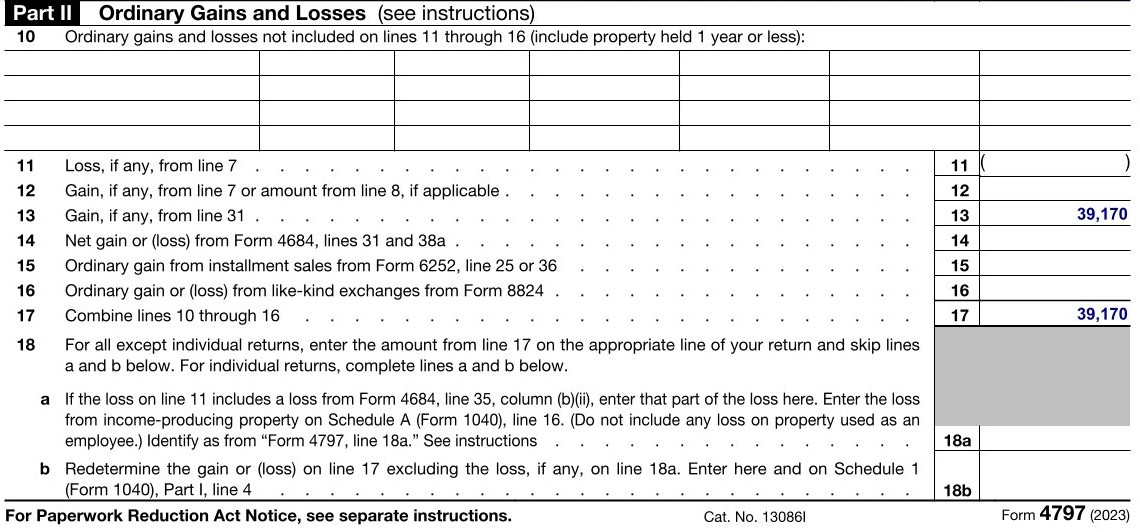

Part II includes all of your ordinary income from the sale of assets, including the section 1250 recapture from Part III line 31, which is shown on line 13.

Form 4797, Part II

All of the ordinary gains and losses in Part II are summarized on Line 17, which is taxed as ordinary income. It appears in various places on tax returns depending on your type of entity:

- Schedule C business: Form 1040, Schedule 1, Part I, line 4

- Partnership: Form 1065, Page 1, line 6

- S-corp: Form 1120-S, Page 1, line 4

- C-corp: Form 1120, Page 1, line 9

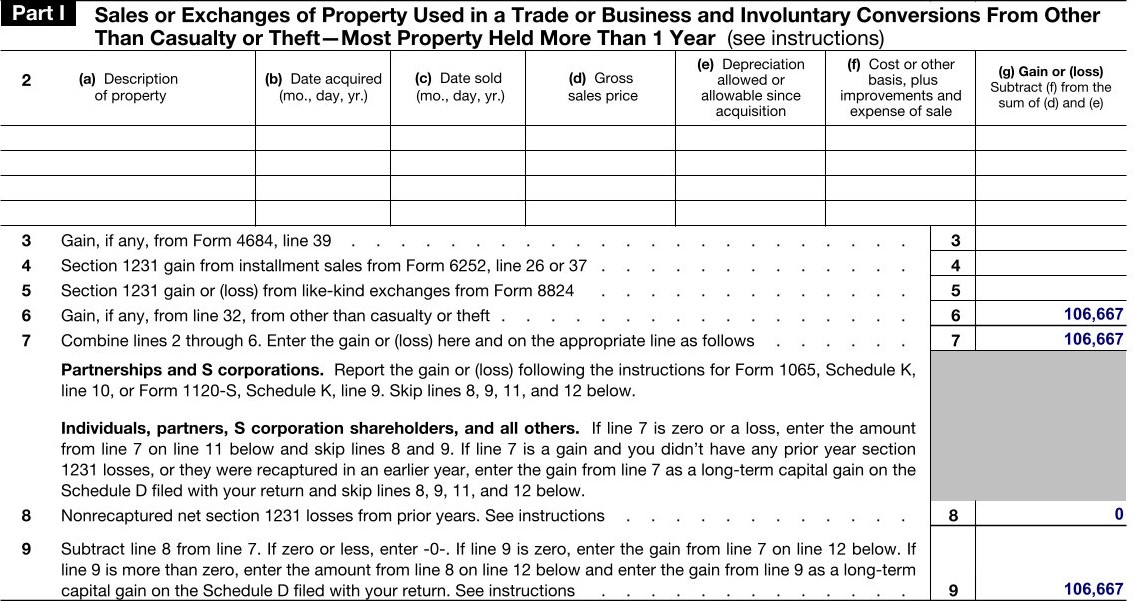

Part I reports all of the 1231 gains for the year, including 1231 gain from Part III, line 32.

Form 4797, Part I

If line 9 is positive, it’s treated as a capital gain and reported on the Schedule D filed with your business tax return. You’ll need to use the Unrecaptured Section 1250 Gain Worksheet included in the Schedule D instructions to calculate the tax since the unrecaptured 1250 gain on the Warehouse needs to be taxed at 25% instead of the normal capital gains rate.

Frequently Asked Questions (FAQs)

The gain on disposal of section 1250 assets must be separated into 1250 recapture (taxed as ordinary income), unrecaptured 1250 gain (taxed as 1231 gain at 25%), and remaining 1231 gain.

Yes, improvements to real property are section 1250 property.

Section 1250 recapture no longer applies to 27.5- and 39-year real property because those property types are required to be depreciated straight line; thus, there is no excess depreciation to recapture. However, section 1250 recapture still applies to less common forms of 1250 property, like QIP that is depreciated over 15 years using an accelerated method.

Bottom Line

Section 1250 property is depreciable real property—like buildings—that are used in your trade, business, or rental. Losses on the sale of 1250 property are treated as 1231 losses, while gains on the sale of 1250 property must be separated into 1250 recapture, unrecaptured 1250 gain, and 1231 gain.