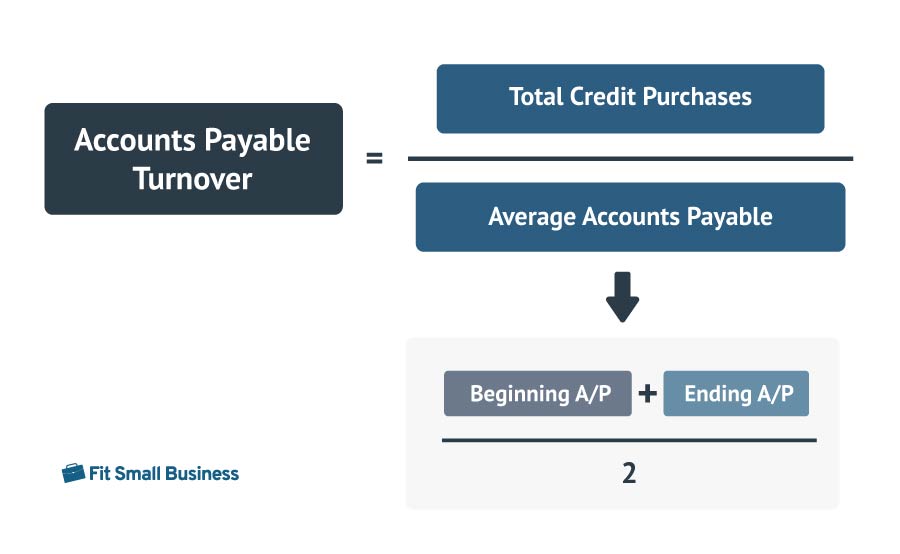

The accounts payable (A/P) turnover ratio is a liquidity measure that shows how fast a business pays its suppliers during a specific period. The A/P Turnover formula is:

KEY TAKEAWAYS

- Comparing A/P turnover with industry averages is the best way to assess if your business’ A/P turnover ratio is within normal levels.

- Theoretically, a high A/P turnover would mean that the business is able to pay its debt more frequently. Meanwhile, a low A/P turnover may imply cash flow problems since the business may be having a hard time settling payables.

- The A/P turnover ratio can provide insights about the business’ cash management and payables management.

Summer Savings: Get 70% off QuickBooks for 3 months. Ends July 31th. |

|

Accounts Payable Turnover Ratio Calculator

Generate A/P reports faster by using accounting software. Our list of the best small business accounting software can help you find the solution that fits your needs.

Understanding the Accounts Payable Turnover Ratio

The A/P turnover ratio is one of the financial ratios used in financial ratio analysis. Here are some ways that you can use the A/P turnover:

- Comparing against industry standards: A high or low A/P turnover may mean a lot of things if analyzed individually. However, the meaning could change if compared with industry standards. There are industries wherein a high or low A/P turnover is normal. Hence, it’s best to look at companies within the same industry to determine if your business’ A/P turnover is within the normal level. You may check IBISWorld for industry-related ratios and information.

- Spotting inefficient cash management: In relation to the first bullet, a high and low cash position may indicate inefficient cash management. The A/P turnover can reveal if the business is struggling with or swimming in cash. If it’s the former, it may affect the business’ credit score and reputation with vendors. Otherwise, the latter would mean that the business is not reinvesting excess cash to improve business operations to generate more revenue.

- Assessing the cash position of the business: The A/P turnover can provide information about the business’ cash position by looking at how many times the business pays its payables. While analyses are not necessarily conclusive, a high turnover may indicate a high cash position, while a low turnover may indicate a low cash position.

- Detecting poor A/P management: A low A/P turnover is an indication of poor A/P management. The business’ inability to settle payables could translate into many things. First, there might be a cash flow problem. Second, the business is not effectively monitoring all payables. Third, the business is not utilizing lines of credit for purchases and instead uses cash payments. The third possibility is unhealthy since lines of credit can improve overall liquidity without burning too much cash.

- Looking for ongoing trends: Part of financial analysis is studying trends. You may compare month-to-month or year-over-year A/P turnovers to spot seasonalities and normal occurrences in business operations.

A/P management is one of the most important bookkeeping responsibilities. You may check out our A/P best practices article to learn how you can efficiently manage payables and stay fairly liquid.

Accounts Payable Turnover Ratio Example

To illustrate how to compute the A/P turnover, let’s assume the following data:

- Total credit purchases: $8,000

- Beginning A/P: $2,000

- Ending A/P: $3,000

Step 1: Calculate average A/P

Add the beginning and ending balance of A/P then divide it by 2 to get the average.

Average A/P = ($2,000 + $3,000) / 2 = $2,500

When getting the beginning and ending balances, set first the desired accounting period for analysis. For example, get the beginning- and end-of-month A/P balances if you want to get the A/P turnover for a single month.

Step 2: Determine A/P turnover

By using the formula we provided, let’s compute the A/P turnover. Remember to include only credit purchases when determining the numerator of our formula. Cash purchases are excluded in our computation so make sure to remove them from the total amount of purchases.

A/P Turnover = $8,000 / $2,500 = 3.2 times

Ways To Improve Your Accounts Payable Turnover Ratio

Now that you know how to calculate your A/P turnover ratio, you can try to improve it by following our tips below.

- Take advantage of early payment discounts: Many vendor suppliers offer early payment discounts to encourage prompt payment. Generally, it’ll run 1% to 3% if payment is made within seven to 10 days of the invoice date. If you take advantage of these discounts, you won’t only save money but also increase your A/P turnover ratio automatically because you’ll make your payments well before the standard due date.

- Pay vendor supplier bills on time: A quick way to increase your A/P turnover ratio is to pay your bills on time consistently. To maintain positive cash flow, we don’t recommend you pay bills early—unless you can take advantage of early payment discounts. In this case, you should schedule your payments to arrive one to two days before the due date.

- Review cash management policies and practices: Cash shortage is a common problem for most small businesses. If you spot an ongoing trend of low A/P turnovers, you might want to investigate your business’ cash management policies and practices to determine where cash problems lie.

- Review A/P practices: Sometimes, problems with cash flow arise from poor collection of accounts receivable (A/R), which would then affect your ability to pay payables.

A/P Turnover vs A/R Turnover Ratios

While both are turnover ratios, each reveals a different aspect of business operations. As discussed earlier, A/P turnover measures how quickly a company pays its suppliers. Meanwhile, A/R turnover pertains to how quickly a company collects from customers.

These two ratios have a direct relationship. If the company can’t collect receivables quickly, there will be little cash. With little cash, it would be impossible to pay suppliers quickly, which would then result in a low A/P turnover. Overall, it is beneficial to analyze these two ratios together when conducting financial analysis.

Frequently Asked Questions (FAQs)

In general, you want a high A/P turnover because that indicates that you pay suppliers quickly. However, you should always find out why your A/P turnover ratio is trending high or low. While a high A/P turnover can be positive, it could also mean that you pay bills too quickly, which could leave you without cash in an emergency.

While the A/P turnover ratio quantifies the rate at which a company can pay off its suppliers, the days payable outstanding (DPO) ratio indicates the average time in days that a company takes to pay its bills. They essentially measure the same thing—how quickly are bills paid—but use different measurement units. The turnover ratio is measured in the number of times per year, whereas days outstanding is measured in days.

Here is the formula for DPO:

DPO = Accounts Payable x Number of Days / Cost of Goods Sold

An increasing A/P turnover ratio indicates that a company is paying off suppliers at a faster rate than in previous periods, which also means that the number of days payables are outstanding is less.

To calculate A/P turnover in days, use this formula:

(Average Accounts Payable / Cost of Goods Sold) / 365 days

Bottom Line

The accounts payable turnover ratio tells you how quickly you’re paying vendors that have extended credit to your business. The keys are to calculate the ratio on a periodic basis to identify trends and compare your ratio to the industry standard. It only takes a few minutes to run reports with the information required to compute the ratio if you use accounting software.

So, it’s time to upgrade if you don’t use accounting software like QuickBooks Online. It allows you to keep track of all of your income and expenses for your business. You can also run several reports that will help you not only calculate your A/P and A/R turnover ratios but also analyze cash flow and profitability.