AssetAccountant is a fixed asset management software that integrates with QuickBooks Online and other accounting software. It can record tax and financial depreciation, account for asset disposals, and adjust asset values for revaluations and impairment. It is free forever for up to 10 assets; however, QuickBooks Online integration requires the Lite plan at $5 per month per 100 assets.

AssetAccountant Alternatives

|  |  |

|---|---|---|

Best for: Businesses looking for accounting software with a fixed asset manager | Best for: Businesses that want to track tangible and intangible assets | Best for: Businesses with a complex information technology (IT) infrastructure and in-house IT department |

Starts at: $13 per month | Custom quote | Starts at: $955 per year for 250 IT assets |

Why We Like AssetAccountant

We like AssetAccountant because it covers most of the important features in fixed asset accounting. First, it records depreciation using different methods. You can compute standard depreciation for financial reporting and tax depreciation for tax reporting. It’s also ideal if you want to maximize tax savings from depreciation.

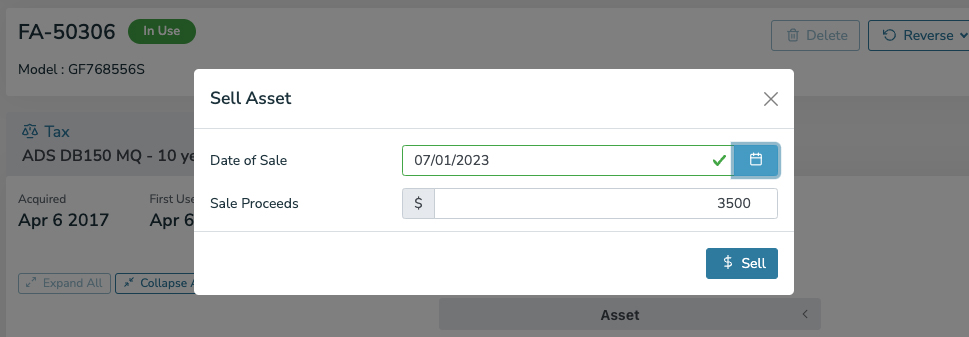

Second, it can account for leases. Whether it’s United States Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), lease standards are complicated. AssetAccountant can help you keep track of leased fixed assets, report the correct right-of-use asset and lease liability, and track lease payments. You can also classify leased assets as a finance lease, operating lease, and lease with repurchase agreements.

Lastly, the platform extends to asset revaluation and impairment. If your business owns land, revaluations are important since land doesn’t depreciate. Moreover, owning sophisticated equipment susceptible to obsolescence will need impairment adjustments. In AssetAccountant, you can account for revaluations and impairment using US GAAP rules.

AssetAccountant Pricing

The AssetAccountant pricing page shows five subscription options. You may start with the Free plan to try the software. All plans accommodate unlimited users.

Free | Lite | Basic | Standard | Standard + Leases | |

|---|---|---|---|---|---|

Monthly Price | $0 | $5 | $10 | $15 | $45 |

Number of Assets per Plan | Up to 10 | per 100 | per 100 | per 100 | per 100 |

MACRS Methods | ✓ | ✓ | ✓ | ✓ | ✓ |

US GAAP Methods | ✓ | ✓ | ✓ | ✓ | ✓ |

Bonus Depreciation | ✓ | ✓ | ✓ | ✓ | ✓ |

QuickBooks & Xero Integration | ✓ | ✓ | ✓ | ✓ | ✓ |

Classes | ✓ | ✕ | ✓ | ✓ | ✓ |

Custom Fields | ✓ | ✕ | ✓ | ✓ | ✓ |

Partial Disposals & Acquisitions | ✕ | ✕ | ✓ | ✓ | |

Revaluations | ✓ | ✕ | ✕ | ✓ | ✓ |

Bulk Actions | ✓ | ✕ | ✕ | ✓ | ✓ |

Asset Components | ✓ | ✕ | ✕ | ✓ | ✓ |

Finance Leases | ✓ | ✕ | ✕ | ✕ | ✓ |

ASC 842 Compliance | ✓ | ✕ | ✕ | ✕ | ✓ |

Right of Use Assets | ✓ | ✕ | ✕ | ✕ | ✓ |

AssetAccountant & QuickBooks Online Integration

Once you have both AssetAccountant and QuickBooks Online, get the AssetAccountant integration link on the QuickBooks App Store. After you connect, AssetAccountant will import all fixed assets within QuickBooks Online based on entries in the fixed asset general ledger. You will see all imported fixed assets in the Draft Assets menu on AssetAccountant.

You then need to review all imported assets to save them on AssetAccountant. You might also need to fill out missing fields or change the depreciation method manually. By default, AssetAccountant selects the best depreciation method for a specific asset and you can either go with the software’s recommendation or change it.

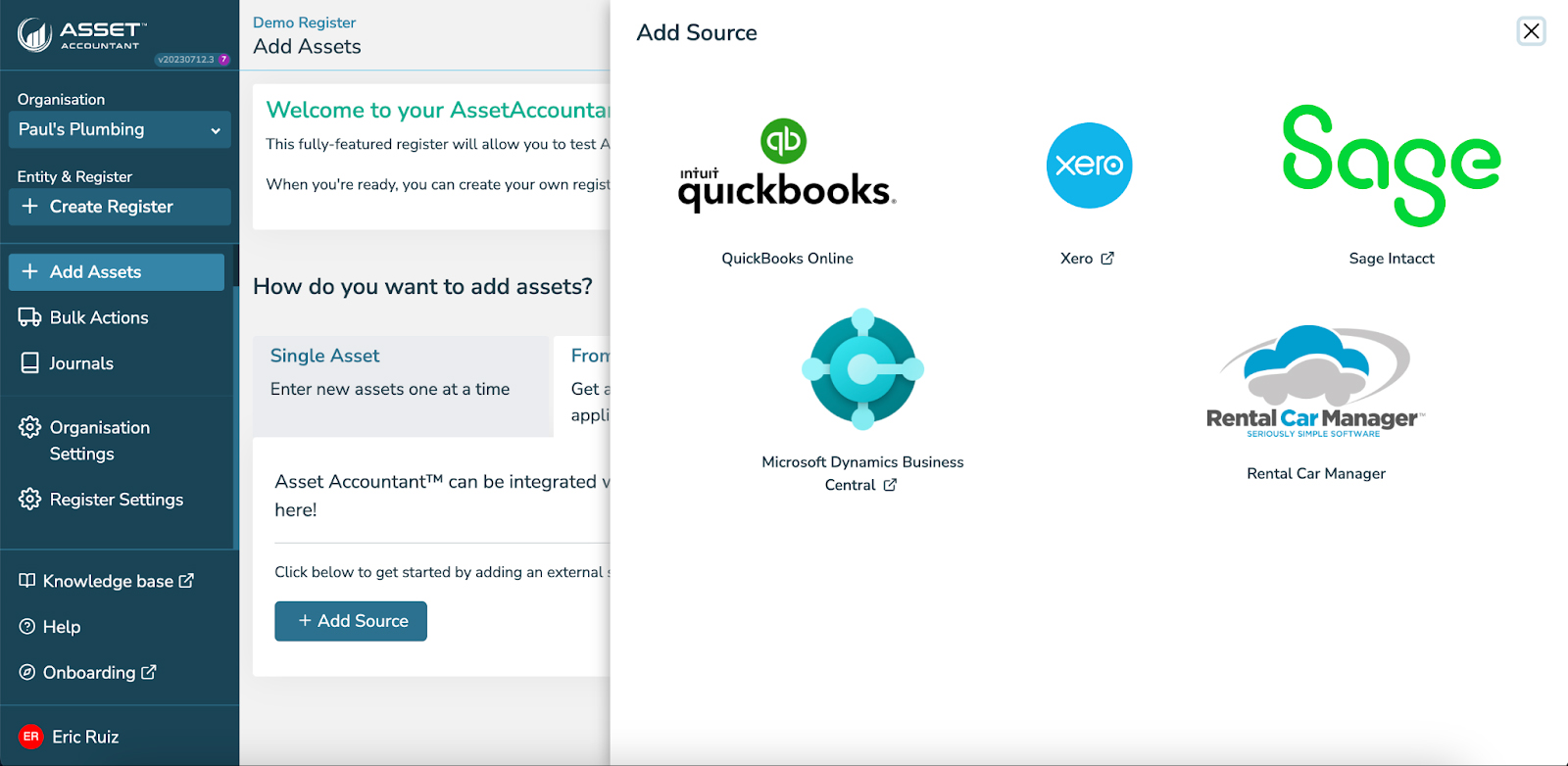

The image below shows the five integration options for AssetAccountant. Select QuickBooks Online to integrate your account to AssetAccountant. However, there are also other options like Xero, Sage Intacct, Microsoft Dynamics Business Central, or Rental Car Manager.

Adding Assets From Integrated Apps

You may need to purchase new fixed assets. To include them in AssetAccountant, you need to add the new asset in QuickBooks Online first. Below are the steps to follow:

- Set up a clearing or suspense account within QuickBooks Online. You can do this at the chart of accounts.

- Enter the newly created asset as an expense and select the Clearing account as the category

- Click Save to finish.

- Go back to AssetAccountant and head to Draft Assets. You’ll see the newly created asset from QuickBooks Online. Click it and add more details to the account.

- Click Save Asset to record it in the fixed asset register.

- Head to Journals and click Create. AssetAccountant will automatically generate the entries here and you’ll see that it will record the new fixed asset and zero out the balance of the Clearing account.

- Click Post to QuickBooks Online to reflect all the journal entries.

AssetAccountant Features

AssetAccountant’s features revolve around fixed asset management. You can manage asset information, depreciate individual assets or asset groups, and facilitate asset disposal. Let’s look at this software’s best features; click on any of the headers below to expand or collapse the information.

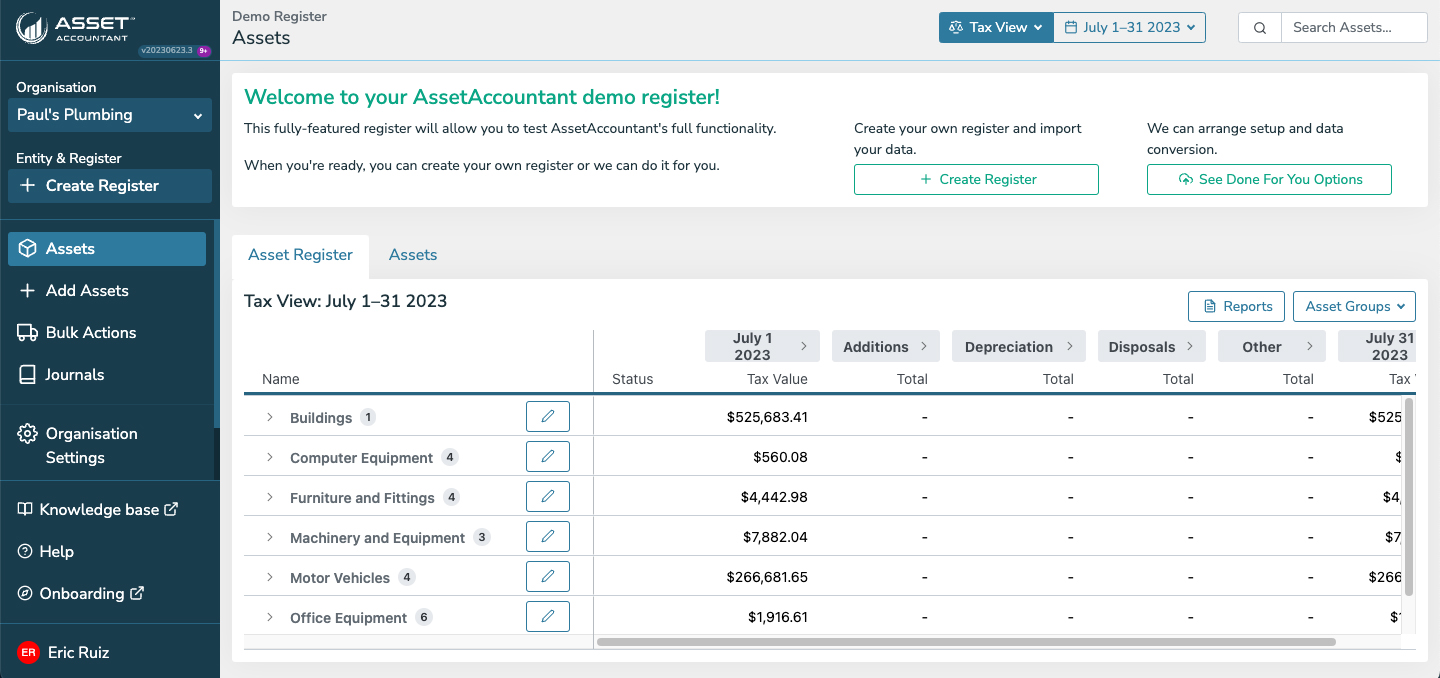

After signing up, AssetAccountant will ask you to either create a new register or check out the demo register first. Use the demo register to see AssetAccountant’s features in action then create your register once you understand how things work.

The image below shows the demo asset register of AssetAccountant.

AssetAccountant Dashboard

Overall, we like the interface design and organization of the dashboard. From the get-go, you’ll see all asset groups and their tax values. At the topmost part of the window, you’ll see Tax View. This means that all asset values are for tax purposes. By clicking the drop-down arrow, you can switch to Account View, which will show you asset values based on US GAAP. By default, AssetAccountant automatically sets the proper accounting standard based on your country.

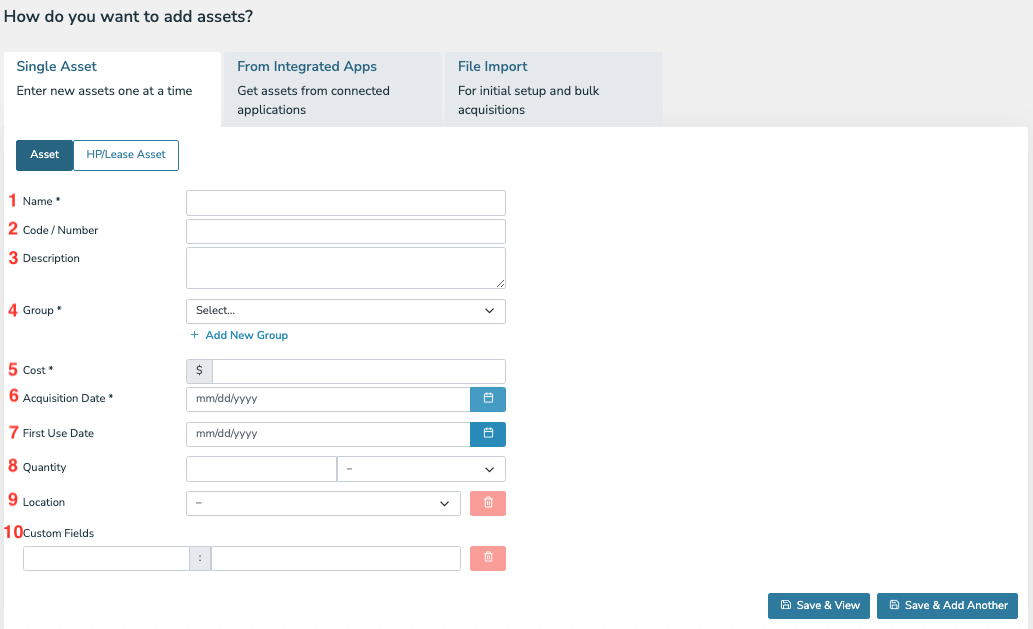

There are three ways to add assets: manual, accounting software integration, or file import. The image below shows how you can add an asset manually. You’ll use this module more often if you use AssetAccountant without integrations.

Adding Assets Manually

- Name: Enter here the name of the asset like Lenovo ThinkPad or 2017 Ford Transit.

- Code/Number: This field indicates the asset number. You may enter an asset number manually, but AssetAccountant can automatically number assets for you.

- Description: Enter a simple but detailed description of the asset. However, this is not a required field.

- Group: Click the drop-down arrow to see asset groups. By default, you’ll be able to choose among the following: Buildings, Computer Equipment, Furniture and Fittings, Machinery and Equipment, Motor Vehicles, and Office Equipment. To add more groups, click + Add New Group below the box.

- Cost: Enter the purchase price of the asset. You should include all costs incurred to bring the fixed asset to its intended use, which includes shipping insurance and installation costs.

- Acquisition Date: Enter the date you purchased the asset.

- First Use Date: Enter the date when you first used the asset. This date commences the depreciation of the asset.

- Quantity: You may indicate the length, height, or volume of the asset here.

- Location: If your business has multiple locations, be sure to select the location where the asset will be used.

- Custom Fields: You can add custom fields if the above fields aren’t enough. For example, you may add serial numbers, registration numbers, or plate numbers as custom fields.

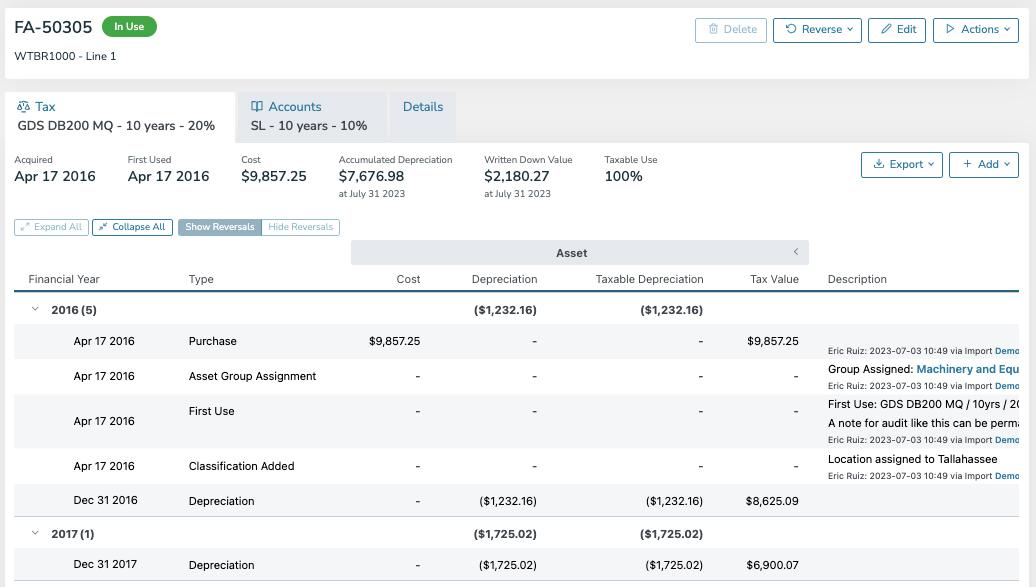

Below is a sample of an asset record. You’ll see that AssetAccountant shows you the cost, accumulated depreciation, written-down value, and tax use percentage.

Asset Information

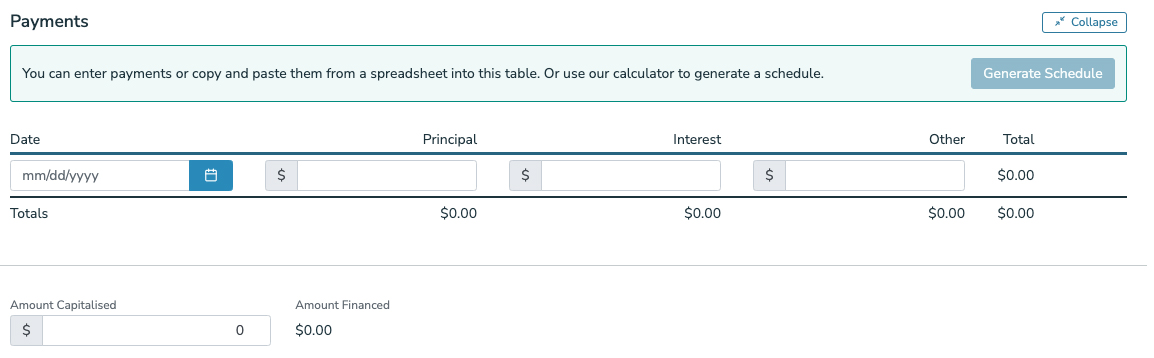

For leased assets, you’ll have to enter the same information as above. However, there are additional fields for payments, as shown in the image below.

Adding Lease Payments

You can fill out the table manually, but AssetAccountant can generate a lease amortization schedule for you, shown in the image below.

Generating Lease Payment Schedule

The sample schedule shows how the lease payment schedule looks like. All you need to do is enter the lease payment details above and AssetAccountant will generate a schedule for you, which can be applied in the lease payments details to avoid manually entering each payment.

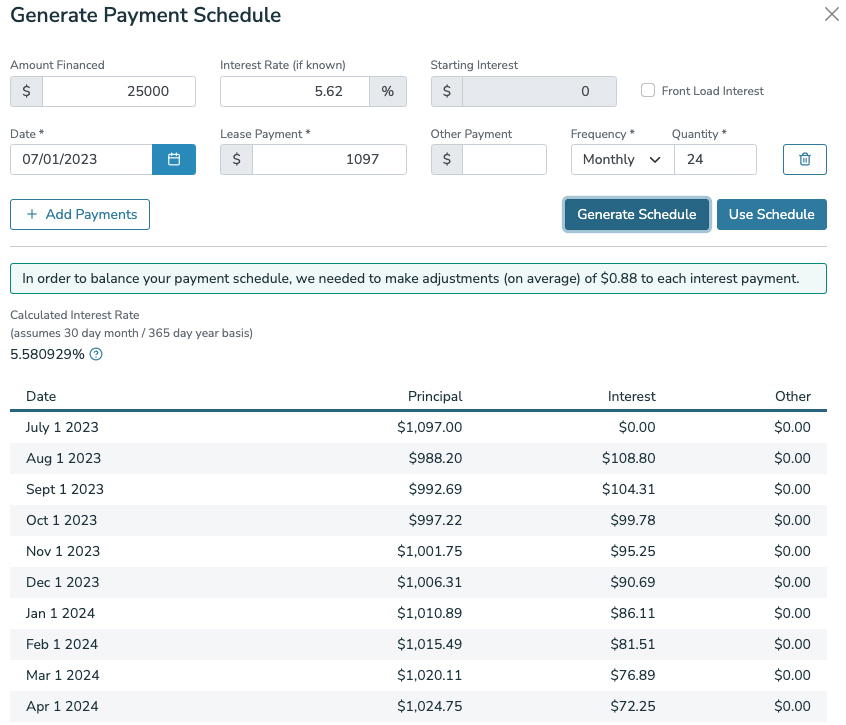

AssetAccountant automatically computes depreciation for you. In the image below, we’ll see that asset FA-57254 is using 150% double declining balance under the GDS for tax purposes. But for accounting purposes, the asset is using the straight-line method.

Financial and Tax Depreciation Methods

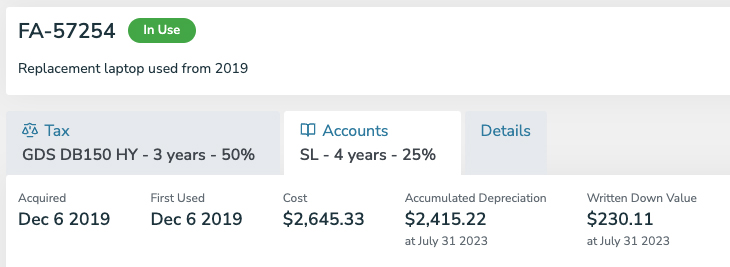

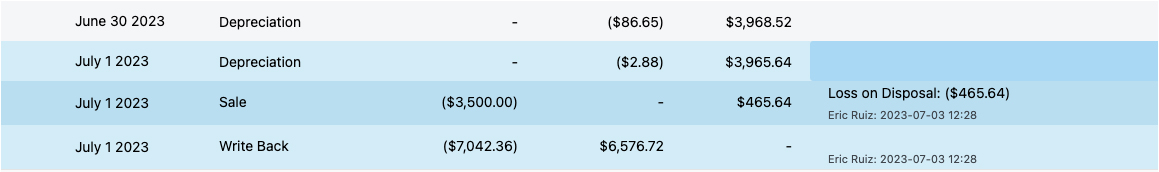

You can either sell or write off an asset to dispose of it. For either option, you have to enter the sales proceeds or write off value. Let’s try to sell asset FA-50306 for $3,500, which has a current book value of $3,968.52. When it was purchased on April 6, 2017, its cost was $10,542.36.

Recording Asset Sale

When recording a sale, all you need to do is enter the date of sale and the sale proceeds. AssetAccountant will do the rest, as shown in the image below.

Adjustments for Asset Sale

On June 30, 2023, AssetAccountant recorded a full-month depreciation of $86.65. But on the next day, we sold the asset. AssetAccountant recorded additional depreciation of $2.88, which represents one-day depreciation in July ($86.65 ÷ 30 days). Now, the asset’s book value is $3,965.64 (see image above). The sale of the asset for $3,500 resulted in a loss of $465.64 because the selling price is less than the asset’s book value.

The Write Back entry removes the asset from the books. The presentation looks confusing from an accounting perspective. Ideally, we should see the asset’s cost written off or reversed. However, this difference is probably due to how AssetAccountant designed the system—and we don’t see this in a negative light. Here’s the journal entry so that you can visualize what it looks like.

Debit | Credit | |

|---|---|---|

Cash Accumulated Depreciation Loss on Disposal Canning Machine | $3,500 $6,576.72 $465.64 | $10,542.36 |

If you add the sales proceeds of $3,500 and write off of $7,042.46, you’ll get the asset’s total cost of $10,542.36. The debit to cash is the sales proceeds while the debit to accumulated depreciation is the reversal of the outstanding balance of the account.

AssetAccountant Ease of Use

Overall, AssetAccountant is relatively easy to use after you have familiarized yourself with the software—in fact, we tested the demo register to come to this conclusion. Also, users with no knowledge in fixed asset accounting can still use AssetAccountant to perform basic data entry, such as encoding new assets to the system.

The interface is not hard to understand because all major menu categories are on the left side of the screen and submenus will be presented in tabs. Moreover, the home page shows you the asset register that shows all asset additions, depreciation, disposals, and other items.

AssetAccountant Reviews From Users

During our research of the software, we found that there are few AssetAccountant reviews from users on third-party sites. We took the scores below from the app stores of Xero and QuickBooks. Because of the limited feedback, we can’t provide an expert opinion about AssetAccountant’s impact to end users.

- Xero App Store1: 5 out of 5 stars based on around 20 reviews

- QuickBooks App Store2: 4.3 out of 5 stars based on around 20 reviews

Frequently Asked Questions (FAQs)

No, QuickBooks Online has no fixed asset register. It can only record assets in the general ledger. But if you integrate it with AssetAccountant, you can import these assets from QuickBooks Online and manage them within the software.

Yes, you can. AssetAccountant can be a standalone fixed asset management software. However, we highly recommend that you integrate with QuickBooks Online for better fixed asset management.

Bottom Line

AssetAccountant provides a convenient way to manage and track fixed assets. It provides you with depreciation computations regardless of the method used, which could be a great help for users with no knowledge about fixed asset accounting. We recommend getting AssetAccountant with QuickBooks Online for a complete accounting experience.

User review references:

1Xero App Store

2QuickBooks App Store