Xero is an online accounting software program for self-employed individuals, small businesses, and growing companies. It can help you track and pay bills, manage inventory and invoices, claim expenses, and store files. It even integrates with Gusto for your payroll needs. You can try it for free for 30 days and then subscribe to any of the three Xero plans, which have prices that range from $15 to $78 per month for unlimited users.

While Xero is both affordable and easy to use, it only allows one subscription per email address, with no option to add more. It also doesn’t offer telephone support, so you are limited to making contact via email. See if it fits your business’ needs by reading our in-depth Xero review and evaluation.

The Fit Small Business editorial policy is rooted in the company’s mission, which is to deliver the best answers to people’s questions. This serves as the foundation for all content, demonstrating a clear dedication to providing valuable and reliable information. Our team leverages its expertise and extensive research capabilities to identify and address the specific questions our audience has—and this ensures that our content is rooted in knowledge and accuracy.

In addition, we employ a comprehensive editorial process that involves expert writers. This process ensures that articles are well-researched and organized, offering in-depth insights and recommendations. Fit Small Business maintains stringent parameters for determining the “best” answers, including accuracy, clarity, authority, objectivity, and accessibility, and these see to it that our content is trustworthy, easy to understand, and unbiased.

Pros

- Excellent inventory accounting

- Ideal for project accounting

- Easy-to-understand bank reconciliation

- Robust integration choices with third-party apps through the Xero App Store

Cons

- Lowest plan is limited to 20 invoices and five bills

- A subscription can only be used to keep a single set of books

- No discounted annual billing option

- Xero Advisor network is small compared to the QuickBooks ProAdvisor network

Xero Alternatives & Comparison

| Users Like | Users Dislike |

|---|---|

| Easy to set up and use | Issues with foreign exchange (forex) translations |

| Integrates with many useful third-party apps | Each Xero subscription is good for one organization, with no option to add more |

| Affordable and transparent pricing | No telephone support |

Those who left a Xero review gave a lot of positive feedback and excellent ratings on third-party user review websites. Most cited that they switched to the platform because it’s easier to use than those of competitors while others mentioned that it integrates with third-party apps that they use in their business. Some negative reviews seem to focus on very niche features, like problems with forex translations and customization options.

Here are the Xero review scores on third-party sites:

- Software Advice[1]: 4.4 out of 5 based on around 2,800 reviews

- G2.com[2]: 4.3 out of 5 based on about 600 reviews

- Google Play[3]: 4.3 out of 5 based on around 12,000 reviews

- App Store[4]: 4.6 out of 5 based on about 1,000 reviews

Fit Small Business Case Study

In our internal case study, we compared Xero against QuickBooks Online and Zoho Books using criteria that our experts developed.

Xero vs Competitors FSB Case Study

Touch the graph above to interact Click on the graphs above to interact

-

Xero Xero: Starting at $12/month; $65 as tested

-

QuickBooks Online QuickBooks Online: Starting at $30 per month; $90 as tested

-

Zoho Books Zoho Books: Starting at free; $60 as tested

Zoho Books and QuickBooks—which is among our best small business accounting software programs—and Xero are tight competitors in the United States accounting software market. Xero beats QuickBooks Online Plus in terms of pricing, as it’s obvious that Xero offers similar accounting software at a lower price point. But if we consider all other competitors, Zoho Books appears to be the most mobile-friendly and flexible option because you choose among its six-tiered pricing plans.

In other features, Xero, Zoho Books, and QuickBooks Online are head-to-head, and their differences don’t have a significant effect on the overall experience. However, the most notable difference is that Xero has no user limit—you can add as many users as you like, making it more scalable and flexible than QuickBooks Online and Zoho Books. But if you intend to hire external bookkeepers and certified public accountants (CPAs) to handle your business’ accounting, QuickBooks Online is more popular for United States accountants and bookkeepers.

Xero New Features

- Report formats: Access new common formats and related reports on the Aged Receivables Summary, Accounts Payable Summary, Receivable Invoice Summary, and Payable Invoice Summary. For example, you can now view approved, sent, and paid transactions on the Receivable Invoice Summary with just one click.

- Report preferences: You can now set report preferences for all reports. This includes the accounting basis and whether to show or hide decimals.

- Foreign currency reporting: Details of foreign currency transactions within the Income by Contact and Expenses by Contact reports are now available. You can also now run the following reports in another currency: Balance Sheet, Budget Variance report, and Profit and Loss report.

- Analytics: View six new financial ratios on the business snapshot dashboard, including current ratio, debt ratio, and current liabilities to net worth.

- Bank statement extraction via Hubdoc: Hubdoc now supports data extraction from PDF bank statements generated by U.S. Bank and Bank of America.

The Xero pricing guide shows three plans, all of which accommodate unlimited users. That’s why Xero is our best ecommerce accounting software for companies that need to include multiple users in the program. Before subscribing, you can access all of Xero’s features for free for 30 days to help you decide which plan best suits your needs.

Early | Growing | Established | |

|---|---|---|---|

Monthly Cost | $15 | $42 | $78 |

Number of Monthly Invoices | 20 | Unlimited | Unlimited |

Number of Monthly Bills | 5 | Unlimited | Unlimited |

Set Up Bank Feeds | ✓ | ✓ | ✓ |

Reconcile Transactions | ✓ | ✓ | ✓ |

Manage Inventory | ✓ | ✓ | ✓ |

Generate Reports | ✓ | ✓ | ✓ |

Send Purchase Orders (POs) | ✓ | ✓ | ✓ |

Bulk Reconcile Transactions | ✕ | ✓ | ✓ |

Multiple Currencies | ✕ | ✕ | ✓ |

Project Tracking Tools | ✕ | ✕ | ✓ |

Expense Claims | ✕ | ✕ | ✓ |

Advanced Analytics Tools | ✕ | ✕ | ✓ |

Xero Accounting Features

In our expert evaluation, we found that Xero has many great, useful features that can work with different businesses. Overall, it did an excellent job in most of the areas we examined, even though it fell short in customer service and the mobile app. Let’s look at our accounting expert’s walkthrough, analysis, and evaluation of Xero’s accounting features.

We like how easy it is to set up your business on Xero. The chart of accounts has default accounts set up, but you can modify existing accounts or add new ones. The most accessible general feature is the user-friendly conversion balances window, which allows you to input your beginning balances while clearly distinguishing if you’re entering a debit or credit. You can also invite an additional user and set limits to their access.

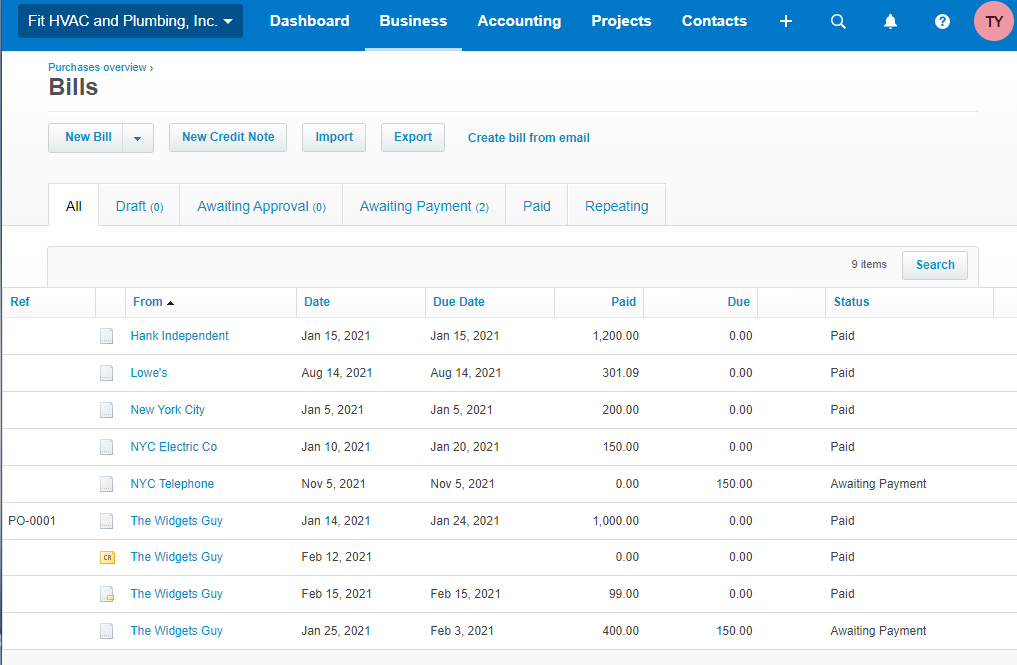

A/P management is one of Xero’s strongest features in our evaluation. From vendor creation to recording of payments, Xero can help in keeping your billing system organized. It also has an outstanding PO system to convert POs into bills, track unpaid bills, record e-payments, and apply vendor credits.

Bills window in Xero

The bills window is presented in a tabular format, wherein you can see pertinent billing details like vendor, invoice date, due date, amount paid or due, and the status of the bill. Navigation is very user-friendly—everything is laid out neatly, and it’s not complicated, even for first-time users.

However, Xero cannot record recurring expenses automatically. It can create recurring bills, but you’ll need to record the payment of that bill manually. It would be nice to have an option for a recurring expense to be deducted from your checking account automatically.

We also found a minor problem in POs and inventory. In Xero’s system, inventory on a PO isn’t reduced automatically when only a portion of a PO is received. Instead, you’ll need to edit the original PO and adjust the quantity not yet received. Otherwise, the number of units available and in a PO will be overstated. Although it can work this way, we still don’t see it as a great solution since there’s no paper trail or change log when editing POs.

Aside from those minor issues, the A/P management system is outstanding, easy to use, and comprehensive. Overall, we gave it a high score since it performs well in most of the A/P aspects we want to see in accounting software.

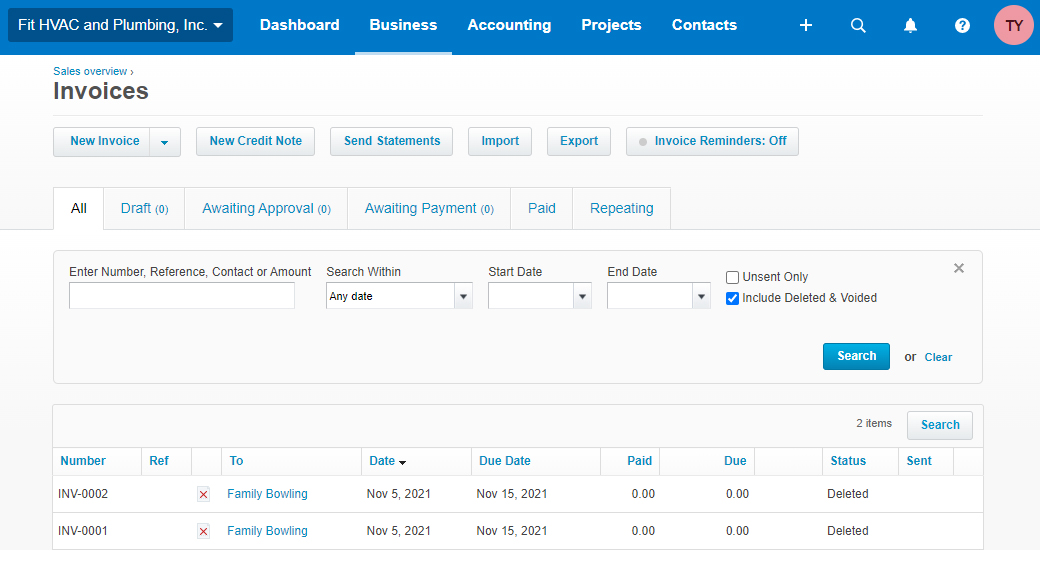

In the A/R management portion, we evaluated major aspects like invoice creation, inventory adjustments, and customer payments. For invoice creation, we found that Xero doesn’t give users the ability to customize the invoice in terms of invoice color, layout, and font. Although it lets you customize invoice elements, such as invoice line items, we wanted to see some personalization in creating invoices.

However, we’re satisfied with how Xero takes into account COGS and inventory adjustments when creating invoices. It can accommodate short payments, which is a great feature, and can issue sales receipts for immediate payments:

Invoices window in Xero

The invoices window of Xero is similar to the billing window. We like its advanced search feature, which you can use to search invoices using multiple fields and filter them appropriately. In summary, Xero’s A/R management is competitive when compared to applications like QuickBooks and FreshBooks. Its ease-of-use score is also high, making it a great software for A/R.

Xero’s banking and cash management features score high in our evaluation because they include all the functions we want to see in accounting software. We like the side-by-side layout when reconciling transactions because it’s easy to match transactions and spot bank statement items that haven’t yet been recorded.

Users can also upload files like bank statements to register the transactions in the books. The only setback we see here is that users can’t enter ending balances of checking accounts—they have to upload the bank statement first before reconciling.

We also found that it’s impossible to combine multiple checks along with cash into a single deposit entry. Xero does provide an account to hold undeposited checks, but the feature doesn’t track when checks are removed and deposited and doesn’t allow cash to be added to the deposit. Though such a feature doesn’t impact the overall performance of Xero that much, not being able to group payments into bank deposits makes it difficult to reconcile your bank account.

Xero got a perfect score for project accounting. In our rubric, we emphasized heavier weights on project estimate assignment, labor cost assignment, and the recording of inventory used in projects. We saw all of these features in Xero, and we’re satisfied with how it can help companies stay on top of projects in terms of income, expenses, and profitability.

In this area, we gave more weight to certain features like creating inventory items, viewing inventory levels, adding inventory to invoices, and calculating COGS automatically. Xero has all of these features alongside minor features that can help in inventory management, like viewing inventory cost information and POs.

To reiterate our point in the A/P section of our case study, the only shortcoming we see is with viewing inventory in the PO. Overall, we’re satisfied with how Xero’s inventory features performed based on our rubric. We evaluated inventory as part of our A/P and A/R testing, so there’s no separate video.

In evaluating the reporting features of Xero, we set 16 necessary reports that every accounting software should have. Xero has 14 of the reports we want to see, such as basic financial statements, specialized reports, and other accounting reports. It’s missing two special reports: income/loss by customer and unbilled time. But even though it doesn’t have these, it doesn’t affect the overall experience.

Reports Included | Missing Reports |

|---|---|

|

|

We want to see comprehensive features in a mobile app, like sending invoices, entering bills, receiving payments, and entering vendor payments. Xero’s mobile app, available for both Android and iOS devices, is basic, with features like receipt scanning, sending invoices, and expense categorization. However, users can’t receive payments from customers, record time worked, assign billable time, and generate reports.

Xero fell short in customer service. In general, accounting software companies should have open lines of communication with customers. Unfortunately, Xero only has a chatbot, a customer service email, and self-help information.

Xero Assisted Bookkeeping Options

You can access Xero-certified independent accountants and bookkeepers or accounting firms when you visit Xero’s Advisor Directory. Aside from Xero advisors, Bookkeeper360 also offers assisted bookkeeping services for Xero users. Check out our review of Bookkeeper360 for more information about its services and pricing.

Xero Integrations

There are more than a hundred apps available in the Xero App Store. From accountant tools to customer relationship management (CRM) solutions, it’s easy to integrate Xero with your existing software services.

How To Get Started With Xero

If you have decided that Xero is a good fit for your business, get started by visiting the Xero website and clicking on “Try Xero for free” or “Pricing & plans” to explore Xero’s features and subscription options. Choose a plan that best suits your business needs and budget. You can sign up for a free trial by entering your contact and business information, including your business name, email address, and password.

Once subscribed to a free trial, we encourage you to check out our series of five tutorials that will walk you through the basics of Xero:

Frequently Asked Questions (FAQs)

Xero has a moderate learning curve. It’s not extremely easy to use, but if you get some training or guidance, you can navigate and use its features in no time.

Users can try Xero for 30 days before signing up for a subscription. However, accountants and bookkeepers can register in the Xero Partner program to get it for free. If your business isn’t offering accountancy services, you are ineligible for the free Xero account.

No, you can use Xero without hiring an accountant. However, as the need arises, you may hire a Xero-certified accountant to help you keep your books of accounts accurate and organized.

Yes, you can, as Xero has Android and iOS mobile apps that allow you to access your account and manage your finances. However, it is not the most comprehensive mobile app because it doesn’t allow you to generate reports, receive payments from customers, or record time worked. Check out our guide to the best mobile accounting apps for our top picks.

Yes, Xero offers customer support via email and live chat. It also has extensive help resources, including a knowledge base, community forum, and video tutorials.

Xero offers a choice of three subscription plans, which range in price from $15 to $78 per month.

Bottom Line

Xero is a great QuickBooks alternative for budget-conscious small businesses. With its relatively affordable price points, you get features that you’ll only see in higher-priced plans of other accounting software. However, we found that Xero isn’t great for mobile accounting or businesses that need multicompany accounting features. Although overall, it’s ideal for daily accounting, inventory keeping, and project management. We recommend it for project- and product-based companies because of its flexible features.

[1] Software Advice

[2]G2.com

[3]Google Play

[4]App Store