To compare Bench vs Merritt Bookkeeping, consider your business needs. Bench provides a broader variety of services besides bookkeeping while Merritt Bookkeeping offers a flat rate for basic bookkeeping services―no matter the size of your business. We recommend Bench as the better option for businesses that require more than basic bookkeeping services:

- Bench: Best for small businesses that want tax advice and filing services along with their bookkeeping

- Merritt Bookkeeping: Best for small businesses looking for basic bookkeeping at the lowest price

Neither Bench nor Merritt will invoice your customers or pay your bills. For this, we recommend Bookkeeper360, one of our top-recommended online bookkeeping services:

- Bookkeeper360: Ideal for small businesses seeking invoicing and bill pay services

The Fit Small Business editorial policy is rooted in the company’s mission, which is to deliver the best answers to people’s questions. This serves as the foundation for all content, demonstrating a clear dedication to providing valuable and reliable information. Our team leverages its expertise and extensive research capabilities to identify and address the specific questions our audience has—and this ensures that our content is rooted in knowledge and accuracy.

In addition, we employ a comprehensive editorial process that involves expert writers. This process ensures that articles are well-researched and organized, offering in-depth insights and recommendations. Fit Small Business maintains stringent parameters for determining the “best” answers, including accuracy, clarity, authority, objectivity, and accessibility, and these see to it that our content is trustworthy, easy to understand, and unbiased.

| |||

|---|---|---|---|

4.46 ★ | 3.95 ★ | 4.21 ★ | |

Monthly Pricing |

| Flat rate of $190 |

|

Service Frequency | Monthly | Monthly | Monthly, weekly, or pay-as-you-go |

Free Trial | Fit Small Business readers get 2 months of bookkeeping | ✕ | ✕ |

100% Money-back Guarantee | ✕ | ✓ | ✓ |

Accounting Software Supported | Bench’s proprietary software and FreshBooks | QuickBooks Online | Xero (included) and QuickBooks Online |

Dedicated Bookkeeper | ✓ | ✕ | ✓ |

Catch-up Bookkeeping | Starts at $299 per month | $70 to $140 per month | Custom quote |

Segment Reporting | ✓ | ✕ | ✓ |

Accounts Receivable (A/R) & Accounts Payable (A/P) Tracking | ✓ | ✕ | ✓ |

Invoicing | Available with a separate subscription | ✕ | ✓ |

Pay Bills | ✕ | ✕ | ✓ |

Tax Advisory & Filing | Included in Premium plan | ✕ | Separate plan; starts at $800 per filing for businesses |

Key Features |

|

|

|

What’s Missing | Chief financial officer (CFO) advisory services, invoicing and bill pay | Invoicing, bill pay, and CFO and tax services | Sales tax management and a mobile app |

Mobile App | iOS | ✕ | ✕ |

Ease of Use | Easy | Easy | Easy |

User Review Ratings (Out of 5) | 4.8 | ||

Use Cases and Pros & Cons

User Reviews: Merritt Bookkeeping Wins

| ||

|---|---|---|

Average Rating on Third-party Sites | ||

Users Like |

|

|

Users Dislike |

|

|

When we compare Bench and Merritt Bookkeeping for user reviews, the latter is the winner based on its higher scores. However, both platforms received mostly positive feedback. Bench’s reviewers praised the unlimited customer support while Merritt Bookkeeping users appreciated the affordable flat-rate pricing.

Reviewers like that the service is affordable and that it offers a free trial of one month of bookkeeping—but Fit Small Business readers get two free months of bookkeeping! Another bonus is that Bench offers unlimited customer support and unlimited year-round tax advisory services. However, users wished that a mobile app for Android was available and that a phone number to call for customer support was provided.

Bench has earned the following average scores on popular review sites:

Merritt Bookkeeping received the highest customer reviews of any bookkeeping service we’ve reviewed. Of the more than 100 reviews we found online, only one user gave a less than a perfect 5. Reviewers commended the service’s attention to detail and outstanding customer service. The affordable flat rate is also praised by many, as is its in-depth reporting and consistency with bookkeepers. The only complaint we found is that the UI could be made more interactive. Overall, customers love this provider.

Merritt Bookkeeping earned the following average scores on popular review sites:

Pricing: Merritt Bookkeeping Wins

| ||

|---|---|---|

Monthly Pricing |

| Flat rate of $190 |

Free Trial | Fit Small Business readers get 2 months of free bookkeeping | ✕ |

90-day Money-back Guarantee | ✕ | ✓ |

Catch-up Bookkeeping | Starts at $299 per month | $70 to $140 per month |

A/R & A/P Tracking | Starts at $100 per month | ✕ |

Invoicing | Starts at $100 per hour | ✕ |

Bill Pay | Starts at $100 per hour | ✕ |

Tax Services | Included in Premium plan | ✕ |

CFO Services | ✕ | ✕ |

Merritt Bookkeeping’s pricing is very straightforward: a flat rate of $190 per month—regardless of the size of your business and the number of transactions, accounts, monthly expenses, and employees. It is because of its affordable and transparent pricing that it takes the lead in the pricing category. You can also opt for its catch-up bookkeeping services, which run from $70 to $140 a month, depending on the number of transactions that must be entered.

Meanwhile, Bench provides a more extensive menu of services, with the ability to add on features as needed. These include invoicing (A/R) and bill payment (A/P), which are available with its specialized bookkeeping package (starts at $100 per month). We also like that Bench’s Premium plan includes tax services, a feature that Merritt lacks. Both of the provider’s tiers include monthly bookkeeping and year-end reporting, but the higher one offers more features, such as unlimited federal and state tax filings and tax advisory services.

Features: Bench Wins

| ||

|---|---|---|

Catch-up Bookkeeping | ✓ | ✓ |

Cash-basis Accounting | ✓ | ✓ |

Reconcile Accounts | ✓ | ✓ |

Categorize Transactions | ✓ | ✓ |

Provide Monthly Financial Statements | ✓ | ✓ |

Connect Bank Accounts | ✓ | ✕ |

Pay Bills & Invoicing | ✓ | ✕ |

Dedicated Bookkeeper | ✓ | ✕ |

Tax Consulting | ✓ | ✕ |

Tax Preparation & Filing | ✓ | ✕ |

Payroll Integration | ✓ | ✕ |

1099 Filing | ✕ | |

Fractional CFO Services | ✕ | ✕ |

Bench offers many more services than Merritt, which is restricted to basic bookkeeping, like categorizing transactions and providing monthly financial statements. Therefore, we chose Bench as the winner in this category.

Tax Services: Bench Wins

Bench offers various services besides basic bookkeeping, including tax preparation and filing and unlimited year-round tax support and consulting. Merritt doesn’t offer any tax services but does provide 1099 electronic filing services.

A/R and A/P Tracking: Bench Wins

While Bench doesn’t offer invoicing and bill pay, it does allow you to track A/R and A/P. Merritt doesn’t offer any of these services, which is why we declared Bench the winner in this category.

Ease of Use: Tie

| ||

|---|---|---|

Overall Ease of Use | Easy | Easy |

Accessibility | Cloud | Cloud |

Online Help Section | ✓ | ✕ |

User-friendly Dashboard | ✓ | ✓ |

Both Bench and Merritt Bookkeeping are easy to use, with cloud accessibility and a user-friendly dashboard, which is why we called this category a tie. With Bench, both you and your bookkeeper can leave notes on transactions, ultimately saving time. Also, the provider’s historical bookkeeping services let you pass on months or years of mismanaged books and recover missing documents to get you back on track. This can be beneficial if you need supporting documents to apply for loans.

Once you enroll with Bench, you’ll be assigned a team of three dedicated bookkeepers, one of which will be your account manager. They’ll learn more about your business and assist you with customizing your account to ensure accurate expense tracking. They’ll also help you connect your bank and merchant accounts so that read-only data will be imported into your Bench account automatically.

You’ll receive monthly financial statements from your bookkeeper, plus a year-end financial package. This includes all of the necessary information for your accountant to file your taxes.

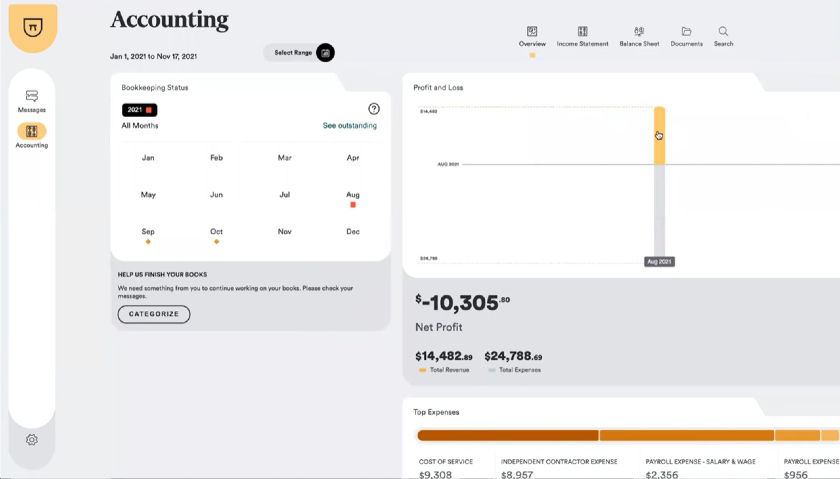

Onboarding process with Bench (Source: Bench Accounting)

While Merritt Bookkeeping is run by a small team in San Diego, it outsources the actual bookkeeping to several overseas contractors. The San Diego team serves as the point of contact, providing quality control and answering any questions that may come up. You can also reach your assigned bookkeeper by email or phone during regular business hours.

Once you enroll, an employee will assist you with setting up your bank and merchant accounts. Your finances will be managed using QuickBooks Online, which will import read-only versions of your bank statements using LedgerSync, a free third-party software. If you don’t have a QuickBooks file, Merritt Bookkeeping will create one for you, but you won’t have personal access to your file.

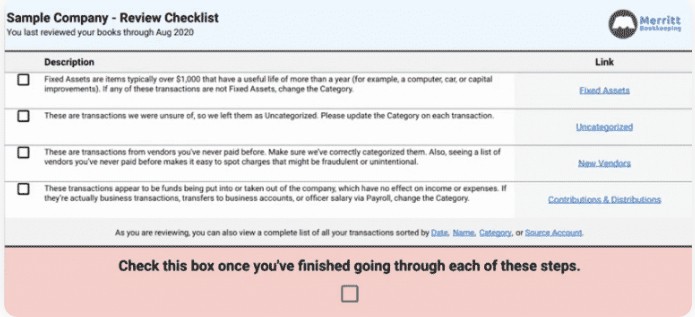

Your bookkeeper will categorize your transactions based on the chart of accounts, reconcile your QuickBooks file with the bank statements, and send you PDF reports of your financial data on a monthly basis. After setup, contact will be limited. You’ll receive a link to your dashboard each month that gives you access to your financial reports, transaction details, and links to the support center. If you spot any inaccuracies, type them into the sheet and they’ll be updated.

Example of Merritt Bookkeeping’s review checklist (Source: Merritt Bookkeeping)

Integrations: Bench Wins

| ||

|---|---|---|

Built-in Integrations | 0 | 0 |

Third-party Integrations | 10 | 0 |

Bench currently has 10 third-party integrations while Merritt has none, so Bench takes the lead here. Here’s a list of Bench’s integrations:

- Bench integrations: Gusto, FreshBooks, Stripe, Square, Shopify, Attune, Keap, Brex, PayPal, and Clio

Mobile App: Bench Wins

| ||

|---|---|---|

Mobile App | ✓ | ✕ |

Availability | iOS | ✕ |

Real-time Cash Flow Updates | ✓ | ✕ |

Report Access | ✓ | ✕ |

View Accounts | ✓ | ✕ |

Check Spending Categories | ✓ | ✕ |

Share Documents With Bookkeeper | ✓ | ✕ |

Schedule Appointments | ✓ | ✕ |

Correspond With Bookkeeper | ✓ | ✕ |

Due Date Reminders | ✕ | ✕ |

Available for iOS, Bench’s mobile app even lets you streamline communication with your dedicated bookkeeper and upload bills or receipts. You can also access reports, view accounts and real-time cash flow updates, check your spending categories, upload documents, and schedule appointments. Merritt Bookkeeping doesn’t currently offer a mobile app, so Bench is the clear winner in this category.

Customer Support: Bench Wins

| ||

|---|---|---|

Phone Support | ✓ | ✓ |

Email Support | ✓ | ✓ |

Online Help Resources | ✓ | ✕ |

Community Support | ✓ | ✕ |

Unlimited Support | ✓ | ✕ |

Searchable Knowledge Base | ✓ | ✕ |

One-way Video Chat | ✕ | ✕ |

Live Chat Support | ✕ | ✕ |

We award Bench the win in customer support because it has online help and community support resources available to its users. However, we know Merritt also has fantastic customer support based on its near-perfect user reviews.

While both allow you to communicate via a client portal, neither allow direct access to your file. To access your financial information, you need to log onto your account on the Bench website. You can also communicate with your bookkeeper via the mobile app, email, and direct message on the Bench website.

How We Evaluated Bench vs Merritt Bookkeeping

We compare Bench and Merritt Bookkeeping based on the following criteria:

35% of Overall Score

Because each plan depends on many factors, we looked at the value provided in terms of the time and potential money that you’re saving by using the service.

20% of Overall Score

You should be able to access a dedicated bookkeeper for any questions or advice and one-on-one assistance.

15% of Overall Score

The best online bookkeeping service should offer a wide range of bookkeeping solutions, including catch-up bookkeeping, invoicing, bill pay, bank reconciliation, payroll, and tax filing.

10% of Overall Score

We evaluated whether the online bookkeeping service offered tax and consulting, and the scope of those services.

20% of Overall Score

We consider the opinions of users and the service’s ratings on various review sites. These criteria were disregarded for providers where no reviews were found.

Frequently Asked Questions (FAQs)

Yes, Merritt Bookkeeping allows you to file 1099s.

Yes, Bench will prepare and file your taxes for you as part of the Premium plan.

No, Bench uses its own proprietary software to complete your books, and everything is performed within its easy-to-use platform.

Merritt Bookkeeping charges a flat rate of $190 per month for basic bookkeeping services.

Bottom Line

If you want to save money and are looking for basic bookkeeping services at an affordable rate, then Merritt Bookkeeping is a good option. However, if you prefer the ability to add services, such as tax filing and invoicing clients, then Bench is the best choice. We awarded Bench as the overall winner due to its wide range of services available and unlimited support that is available with both plans.

[1]Software Advice | Bench

[2]G2.com | Bench

[3]Trustpilot | Bench

[4]Yelp | Merritt Bookkeeping

[5]Google | Merritt Bookkeeping

[6]G2.com | Merritt Bookkeeping