Bench Accounting is a virtual accounting service provider that offers bookkeeping and tax support for businesses and individuals. Monthly prices are either $299 or $499 per month, depending on whether you need tax services. When you sign up, you’ll be matched with a dedicated bookkeeper who is backed by a team of in-house accountants. Your bookkeeper will categorize transactions, reconcile accounts, and prepare reports on your behalf. You’ll also be granted access to an online application that allows you to view the status of your financial data and communicate with your bookkeeper.

The main reason the platform didn’t score better in our Bench Accounting review is that it lacks bill payment and invoicing services, but most companies choose to handle those back-office tasks themselves. Also, it doesn’t have financial planning services like investment and business expansion. Finally, because it operates on proprietary software, it doesn’t sync with commonly used accounting solutions like QuickBooks Online and Xero.

The Fit Small Business editorial policy is rooted in the company’s mission, which is to deliver the best answers to people’s questions. This serves as the foundation for all content, demonstrating a clear dedication to providing valuable and reliable information. Our team leverages its expertise and extensive research capabilities to identify and address the specific questions our audience has—and this ensures that our content is rooted in knowledge and accuracy.

In addition, we employ a comprehensive editorial process that involves expert writers. This process ensures that articles are well-researched and organized, offering in-depth insights and recommendations. Fit Small Business maintains stringent parameters for determining the “best” answers, including accuracy, clarity, authority, objectivity, and accessibility, and these see to it that our content is trustworthy, easy to understand, and unbiased.

Pros

- Matches you with a team of trained in-house bookkeepers

- Has affordable plans that include a business income tax return

- Offers catch-up bookkeeping for those behind on their books

- Provides unlimited support, which is included in the monthly price

Cons

- Is proprietary software, making it difficult to switch to another provider

- Requires separate software for you to perform your own invoicing, bill payment, payroll, and inventory

- Offers accounts payable (A/P) and accounts receivable (A/R) tracking as add-ons

- Lacks an Android app

Bench Alternatives & Comparison

Our Comparisons of Bench Accounting vs Other Software

If you’re unsure whether Bench Accounting is the right assisted bookkeeping service for your business, check out our list of the best online bookkeeping services for more choices.

| Users Like | Users Dislike |

|---|---|

| Easy to use with an intuitive user interface | No mobile app for Android |

| Remote access lets you access Bench from anywhere | No bill pay or invoicing services available |

| Unlimited year-round tax advisory services | No chief financial officer (CFO) advisory services |

Those who left a Bench Accounting review on third-party sites said that the platform is easy to use and that the user interface is very intuitive. They also like the ability to access Bench from anywhere when on the go and its tax and consulting services.

One of the platform’s biggest drawbacks is that it doesn’t offer a mobile app for Android. Other users said that they wished that it was possible to use the service for bill payment and invoicing.

The solution earned the following average scores on these popular review sites:

- Trustpilot[1]: 4.2 out of 5 based on around 960 reviews

- GetApp[2]: 4.7 out of 5 based on nearly 300 reviews

- G2.com[3]: 4.3 out of 5 based on about 75 reviews

Bench New Features

- Import business transactions from personal accounts: Bench now allows you to connect eligible personal bank accounts and credit cards that are used for business and your information will automatically flow into Bench in real time. Once you indicate which transactions are business-related, your bookkeeper will assign them to the correct accounts.

- Centralized notifications: All of your notifications are now in one centralized location so that you can view a complete list of what is required to complete your books. You can click on a notification task to learn what information is needed, expediting the communication process.

The Bench Accounting pricing guide shows two monthly plans, Essential and Premium, which cost $299 and $499, respectively. If you elect for an annual contract, then monthly prices go down to $249 for Essential and $399 for Premium. Both include monthly bookkeeping and year-end reporting, but Premium gives you more features, such as unlimited tax advisory services and federal and state income tax filings.

Bench also offers a pay-as-you-go option, which is available for $349 per month on the Essential plan.

Essential | Premium | |

|---|---|---|

Monthly Contract (Price per Month) | $299 | $499 |

Annual Contract (Price per Month) | $249 | $399 |

Monthly Bookkeeping | ✓ | ✓ |

Access to a Dedicated Bookkeeping Team | ✓ | ✓ |

Year-end Reporting | ✓ | ✓ |

Unlimited Communication With Bench’s Research Team | ✓ | ✓ |

Unlimited Tax Advisory Services | ✕ | ✓ |

One-on-One Tax Strategy Planning | ✕ | ✓ |

Annual Tax Filing for Businesses Like S Corporations (S-corps), C Corporations (C-corps) & Partnerships | ✕ | ✓ |

Annual Tax Filing for Sole Proprietors, including Schedule C & 1099-MISC | ✕ | ✓ |

Add-ons:

| ||

Upon enrollment, you’ll be paired with your own dedicated bookkeeper. They’ll get to know your business, explain how Bench works, and gather everything they need from you to get started, which includes your information for bank accounts, credit cards, loans, and merchant processors. If you need to contact your bookkeeper, you can book a call or message them directly through the app. One of the most appealing features of Bench is that you have access to unlimited support, no matter which plan you choose.

Bench Accounting’s mobile app is available for iOS users and provides financial reporting functionality and real-time cash flow updates. It also gives you the ability to check accounts, vendors, spending categories, dates, credit, and more to ensure that your business is on track. As of this writing, there’s no mobile app for Android devices.

Bench Accounting is best for freelancers and small businesses with basic bookkeeping needs, such as providing cash-basis financial statements for tax return preparation. It’s an ideal solution if you have limited time or want to outsource your books to a certified bookkeeper so that you can focus on the other aspects of your business. You’ll also have access to a tax professional to help you make tax preparation and filing easier.

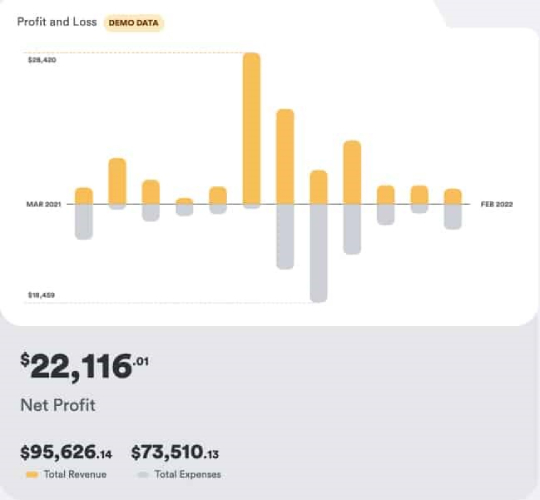

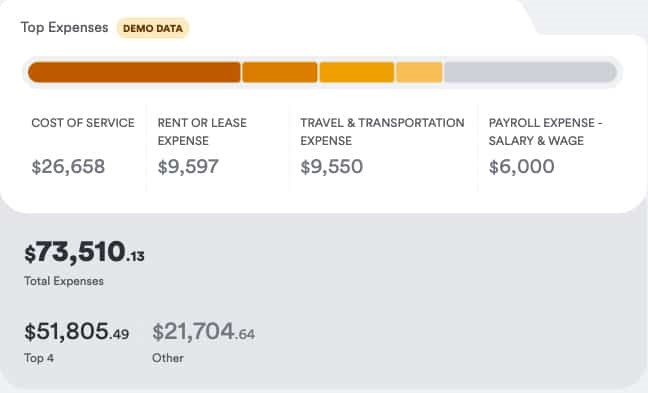

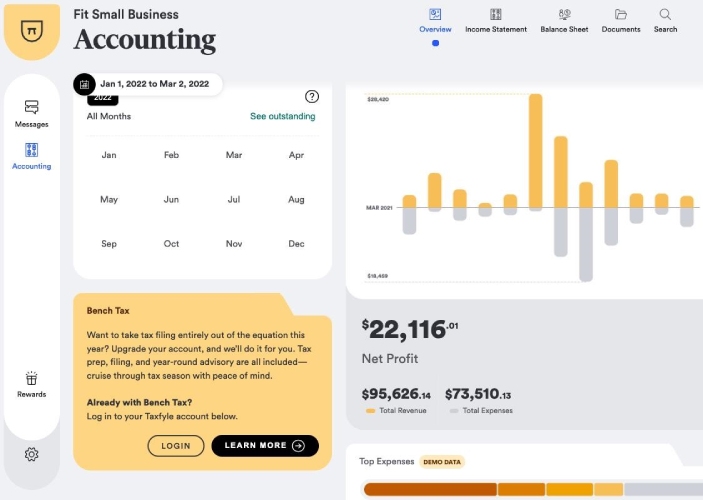

The Bench dashboard contains two menus: Accounting and Messages. The Accounting tab gives you an overview of your financial standing and allows you to instantly view reports, if needed. You can also upload documents, run reports, and connect your bank accounts from the tab.

Accounting Tab on Bench’s Dashboard

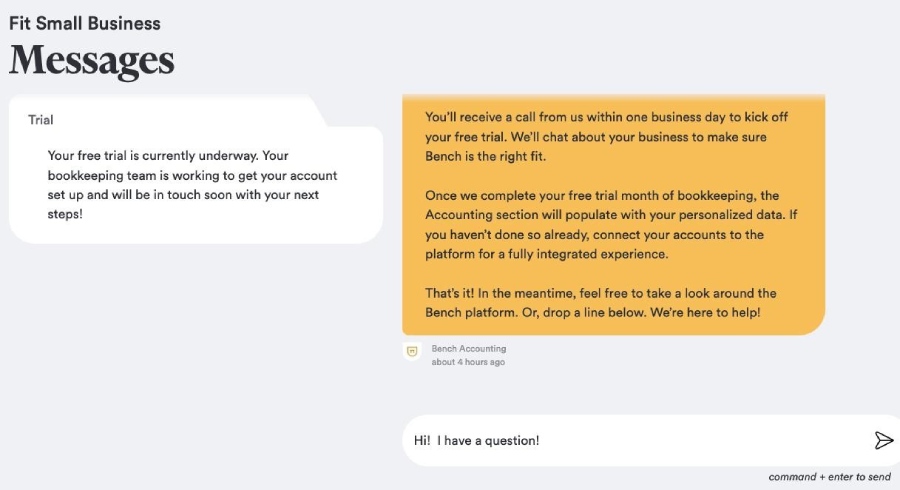

The Message tab enables you to send and receive messages from your assigned bookkeeper.

Message Tab on Bench’s Dashboard

For an additional fee, Bench’s bookkeepers can provide overdue bookkeeping services, depending on how far you’ve fallen behind on your books. If you’re less than two years behind on your bookkeeping, you’ll need the catch-up bookkeeping add-on. Your bookkeeper will update your books accordingly on your behalf. If you’re behind on your books for more than two years, Bench offers a special program called Bench Retro.

Bench Accounting integrates with Gusto to help you manage your payroll transactions. Gusto files local, federal, and state payroll taxes automatically and generates W-2s. It helps you manage employees’ information, benefits, and deductions. Learn more about the solution by reading our review of Gusto.

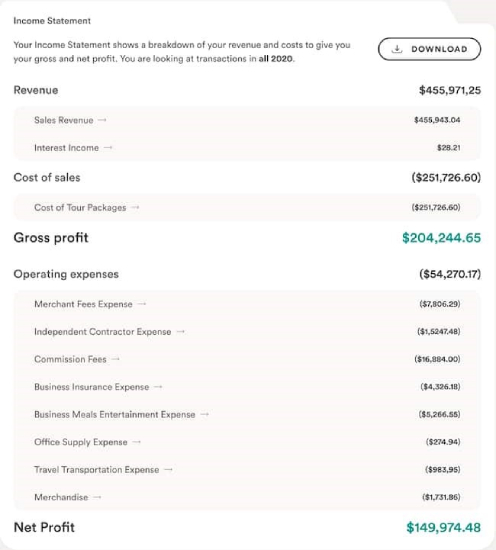

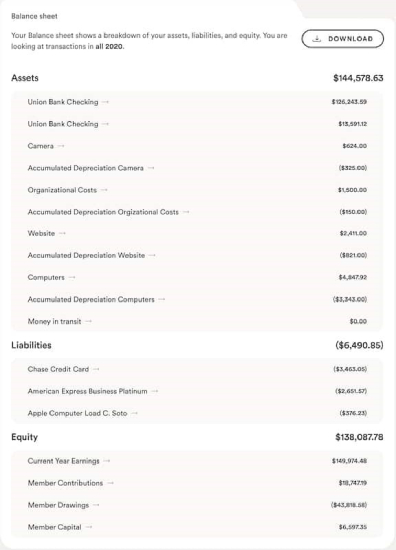

The Accounting tab on your dashboard provides you with real-time updates of your financials, showing exactly how much money you have and how you’re spending it. You can access your income statement, balance sheet, and other reports that are fully customizable. You can tag transactions with labels like products, clients, locations, or sales channels to see exactly how your business is performing.

Click on the tabs below to see each of the reports that Bench Accounting generates.

Bench’s Essential plan includes the preparation of a year-end financial package needed to file your taxes. To make taxes more hassle-free, you can upgrade to the Premium tier, which includes unlimited bookkeeping and tax support. Premium also has filing for sole proprietors, contractors, and businesses (S-corps, C-corps, and partnerships).

When your books are completed, your dedicated tax coordinator will help you track down forms to help you simplify the filing process. Bench partners with Taxfyle for filing your return at the end of the year.

Bench recently added 1099 reporting, with reports available year-round. Your 1099 transactions will be categorized with the date, details, and the payee name, making it easier to process forms. You’ll have access to IRS forms for filing and reports that provide the information you need to process your 1099s.

How We Evaluated Bench Accounting

We evaluated Bench Accounting based on user reviews, pricing, personal bookkeeper, bookkeeping services, and tax and consulting services.

35% of Overall Score

Because each plan depends on many factors, we looked at the value provided in terms of the time and potential money that you’re saving by using the service.

20% of Overall Score

You should be able to access a dedicated bookkeeper for any questions or advice and one-on-one assistance.

15% of Overall Score

The best online bookkeeping service should offer a wide range of bookkeeping solutions, including catch-up bookkeeping, invoicing, bill pay, bank reconciliation, payroll, and tax filing.

10% of Overall Score

We evaluated whether the online bookkeeping service offered tax and consulting, and the scope of those services.

20% of Overall Score

We consider the opinions of users and the service’s ratings on various review sites. These criteria were disregarded for providers where no reviews were found.

Frequently Asked Questions (FAQs)

Each month, your bookkeeper will import all of your business transactions and categorize them, then reconcile your bank accounts and prepare financial statements. If your bookkeeper has any questions about a particular transaction, they’ll send you an in-app message. When your bookkeeping has been completed for the month, you’ll receive a message inviting you to view your financial statements and account information online.

You can book a call with your bookkeeper or send them an in-app message directly through the Bench app. There’s no extra fee or hourly charges for support, and you’re welcome to reach out to them whenever you have a question.

Once your bookkeeper wraps up your books every month, the information is reviewed by an in-house support team that ensures accuracy. Also, they never make assumptions about your business, preferring instead to reach out with any questions.

Bench Accounting offers two monthly subscription plans, Essential for $299 and Premium for $499. If you sign up for an annual contract, the monthly price goes down to $249 for Essential and $399 for Premium. While both offer basic bookkeeping and year-end reporting, Premium has unlimited tax advisory services and federal and state tax filing.

Once you sign up for Bench Accounting, you’ll be assigned a dedicated bookkeeper who will learn more about your business and help you connect your bank and credit card accounts. They’ll also categorize your transactions and send you monthly reports and a year-end financial package. Premium subscribers will also receive tax assistance.

Bottom Line

Bench Accounting is a great option if you lack in-house accountants or don’t want to purchase or learn how to use accounting software. Bench bookkeepers are trained professionals, so you can be sure that your books are well taken care of, at a fraction of the cost of hiring a local certified public accountant (CPA).

If you only need basic bookkeeping and your business makes enough money to sustain the $299 price tag for unlimited monthly bookkeeping support, then Bench is a cost-effective solution. You can try Bench Accounting for free to see if it’s a good fit.

User review references:

[1]Trustpilot

[2]GetApp

[3]G2.com