biBERK is a dedicated small business insurance company that is part of the Berkshire Hathaway Insurance Group (BHIG). It was founded in 2015 with the goal of providing the most important types of insurance for small businesses in a quick, and easy way: by producing quotes online that can then be purchased online.

While it does have a quick turnaround system for quotes, its coverages are both limited in what type of insurance is available and in which states it sells insurance. In our biBERK insurance review, we dive into the insurer’s availability, coverage, services, and reviews.

Pros

- Financial strength

- In-house claims

- Purchase policy online

Cons

- Coverage limited to certain states

- Limited line of coverages offered

- Can be difficult to contact

Standout Features

- Tiered quotes with different coverages to fit your needs

- Get a quote and purchase a policy online

- Create and obtain a certificate of insurance (COI) quickly

- Discounts available when bundling coverages

Financial stability: biBERK is part of BHIG, and AM Best rated BHIG A++ (Superior).

biBERK Insurance Alternatives

Best for businesses looking to save money by comparing quotes | Best for businesses that need more than core policies | Best for small business owners having trouble finding coverage |

A- to A+ (Excellent to Superior) financial rating | A- (Excellent) financial rating | A- to A+ (Excellent to Superior) financial rating |

biBERK Small Business Insurance Options

biBERK offers the standard key insurance policies any small business would need. These policies are underwritten by different insurance companies, all of which are owned by BHIG. The companies that underwrite biBERK policies are:

- Berkshire Hathaway Direct Insurance

- Wellfleet Insurance Company

- National Liability & Fire Insurance Company

All of these companies carry an A++ (Superior) rating from AM Best.

As we will detail below, biBERK’s coverage availability varies widely based on the state.

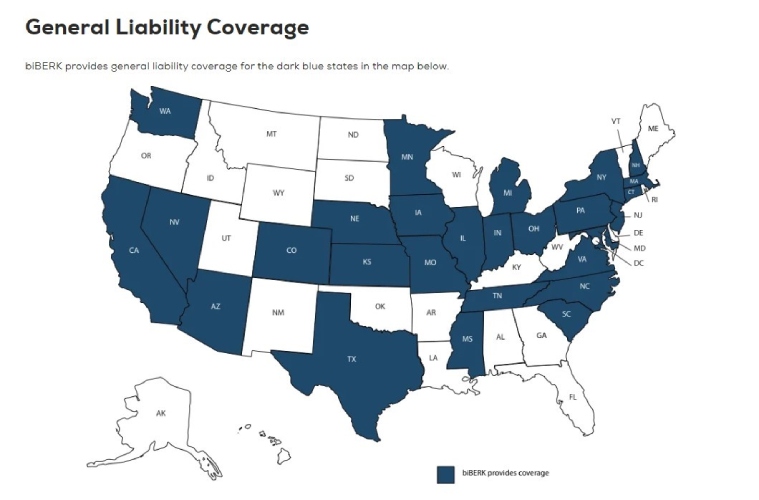

biBERK has a dedicated map where you can see which coverage is available within the country:

biBERK offers general liability coverage in 28 states

biBERK’s general liability insurance, like most general liability insurance policies, provides coverage for property damage, bodily injury, and personal and advertising injury coverage. It also includes medical payment coverage.

Unfortunately, general liability is only offered in 28 states (as you can see in the state guide above).

biBERK also calls this coverage errors and omission (E&O) insurance. It offers professional liability insurance in all 50 states and Washington, D.C. This is a liability policy for businesses that are in the service sector. biBERK’s policy offers insurance in three main areas: unfulfilled duties, negligence related to duties, and mistakes.

While biBERK doesn’t offer standalone property insurance, it does have a BOP. Its BOP combines general liability and commercial property with business income. In addition to including loss of business income, it has several endorsements.

biBERK’s workers’ compensation insurance is offered in all nonmonopolistic states. As a standout feature with biBERK, you can usually get a quote for workers’ comp online, something that doesn’t happen with many other carriers. You can also do payroll audits entirely online—log in to your account to get started.

biBERK offers commercial auto insurance in 20 states. It will insure standard, small sedans, and larger work trucks. The coverages available are the standard auto coverages.

biBERK’s umbrella liability policy is a standard excess liability policy. It is available for small, midsize, and large businesses.

biBERK Industries Covered

Since biBERK’s target audience is small business owners, the industries biBERK insures are the standard ones you will find in the small business space, like:

- Accountants

- Investors

- Bakeries

- Cleaning and janitorial services

- Foodservice

- Hospitality management

- Liquor stores

These are just some industries that it will cover. There is an appetite guide available for download online. It is 15 pages long and provides a comprehensive overview of how many industries it will cover.

biBERK Business Insurance Quotes & Costs

The primary way to get insurance from biBERK is online—that is really the reason behind the creation of the company. However, it does have agents you can call and speak with, and sometimes after requesting a quote, instead of providing one, it will request that you call to answer more questions.

Obtaining a quote from biBERK is easy. From nearly every page on its website, there is an option to get a quote. You’ll need to provide information on your business, like:

- Year it started

- Number of employees

- Revenue

- Payroll

- Physical location

- Claims history

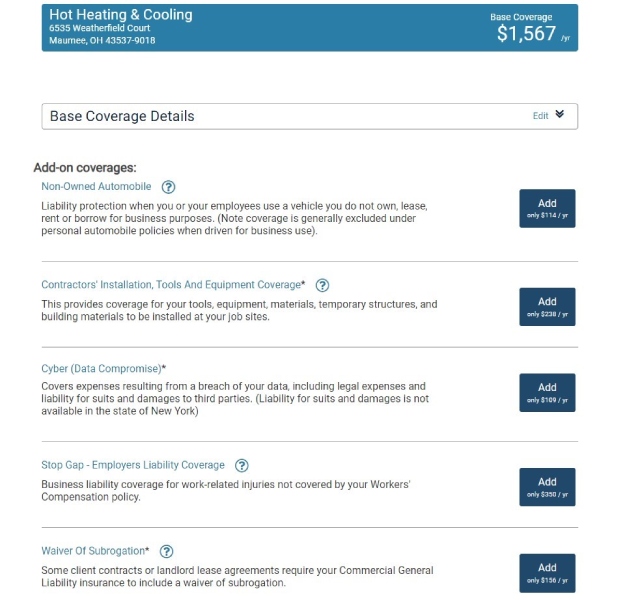

Once biBERK generates a quote, you’ll have the option to add any additional coverages that fit your business.

biBERK’s sample quote and optional endorsements

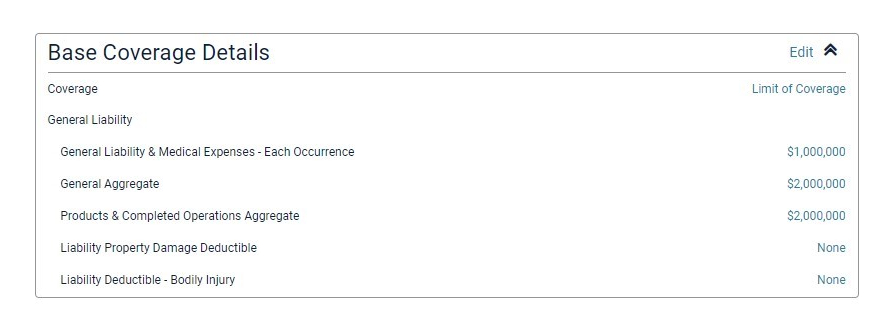

You can also edit the limits through a drop-down menu:

biBERK’s page showing how to adjust limits during the quote process

Once you’ve selected the type of coverage that works well for you, you can then purchase the insurance online.

For the purposes of this article, I received a quote for general liability insurance for a heating, ventilation, and air conditioning (HVAC) service technician. The insurance costs $1,567 annually and includes $1 million per occurrence and $2 million aggregate in coverage.

Helpfully, data about biBERK insurance pricing details is available on its website. According to biBERK, general liability starts at $360 annually. A BOP usually starts at $500 a year, and most businesses pay less than $2,000 annually for a BOP.

Commercial auto has a wider range, with policyholders paying anywhere from $600 to $1,500 per vehicle for a smaller commuter-type car. A larger truck can run anywhere from $5,000 to $15,000 annually.

Finally, a professional liability policy starts around $300 a year.

biBERK Claims Process & Other Services

While biBERK doesn’t have an app, you can sign up for texting, where biBERK will text you updates/messages about your policy and coverage. Most of the messages are related to normal policy management and payment, but biBERK will send you information related to claims reporting and vehicle inspection reminders.

If you need to speak with someone, biBERK does not maintain a 24/7 call center. You can reach it at (844) 472-0966, and its hours of operation are:

- Monday through Friday from 7 a.m. to 9 p.m. Eastern time

- Saturday from 10 a.m. to 3 p.m. ET

You can file a claim online or by calling during its hours of operation. If you have claim-related documents, those can be emailed to biBERK or the adjuster handling the loss.

If you need a COI, those can be created online. However, biBERK calls these “basic COIs,” so it is unclear how that is different from the usual process of requesting and obtaining a COI for your business.

Additionally, while it does have a number of workplace flyers available for download, the services offered to small businesses are rather limited.

biBERK Insurance Reviews

During my research into biBERK, I examined information drawn from third-party sources, including nonprofit organizations and websites.

Complaints With the Department of Insurance

While it may come as a surprise, insurance is not federally regulated. However, each state maintains its own department of insurance run by an insurance commissioner. These commissioners belong to the National Association of Insurance Commissioners (NAIC). Among other responsibilities and services, the organization tracks complaints filed at the state level against a carrier.

biBERK seems to function like an MGA, but all the companies that underwrite its policies are owned by BHIG. In evaluating the providers that biBERK works with, the complaints are higher than expected and above the national average. The NAIC complaint index of 1 is average and, for example, Berkshire Hathaway Direct Insurance has an average score of 2.95, which is nearly triple the national average.

Third-party Reviews

When looking at customer reviews on other sites, it seems customers are more pleased with its service than the DOI complaints would indicate.

- Trustpilot[1]: 4.1 out of 5 from nearly 800 reviews

- Better Business Bureau (BBB)[2]: 4.24 out of 5 from more than 900 reviews

- biBERK review page[3]: 4.9 out of 5 from more than 40,000

Frequently Asked Questions (FAQs)

Yes, biBERK is a reputable and legitimate insurance company that specializes in offering the key policies a small business might need.

biBERK is part of Berkshire Hathaway, meaning it has a strong financial position. The companies that underwrite its policies are all part of Berkshire Hathaway.

biBERK specializes in offering the key policies a small business needs. This means it offers workers’ comp, general liability, a BOP, and commercial auto. and professional liability insurance.

The costs of small business insurance will vary a lot depending on the type of business. However, biBERK states general liability starts at around $30 a month and professional liability begins at about $25 per month.

biBERK can be reached online, through email, or by phone at (844) 472-0966. It is open Monday through Friday from 7 a.m. to 9 p.m. ET and Saturday from 10 a.m. to 3 p.m. ET.

Its coverage availability varies significantly depending on the state. Professional liability and workers’ comp are available nationwide. For the rest, you’ll want to check biBERK’s coverage maps to see what is available in your state.

Bottom Line

biBERK is a dedicated insurer for small businesses offering essential, core policies. Its goal is to be able to provide insurance at a more affordable price by bypassing brokers and making insurance easier to purchase by offering it online, directly to consumers. Founded in 2015, biBERK currently insures approximately 200,000 customers.

Provided via Simply Business

User review references:

[1]Trustpilot

[2]BBB

[3]biBERK