A business liability waiver that outlines the risks and rights being waived and is in compliance with state law can help protect your business from lawsuits. While your business can still be sued, the waiver serves as part of your defense that the plaintiff waived their rights. However, there are cases where the waiver may be unenforceable, such as with a minor whose parents waived their rights.

A liability waiver, sometimes called a release of liability or a general waiver, is a document that a business has patrons sign to acknowledge risks and releases the business from claims arising from injury or loss. It cannot violate state law and is common in recreational, fitness, and high-risk businesses.

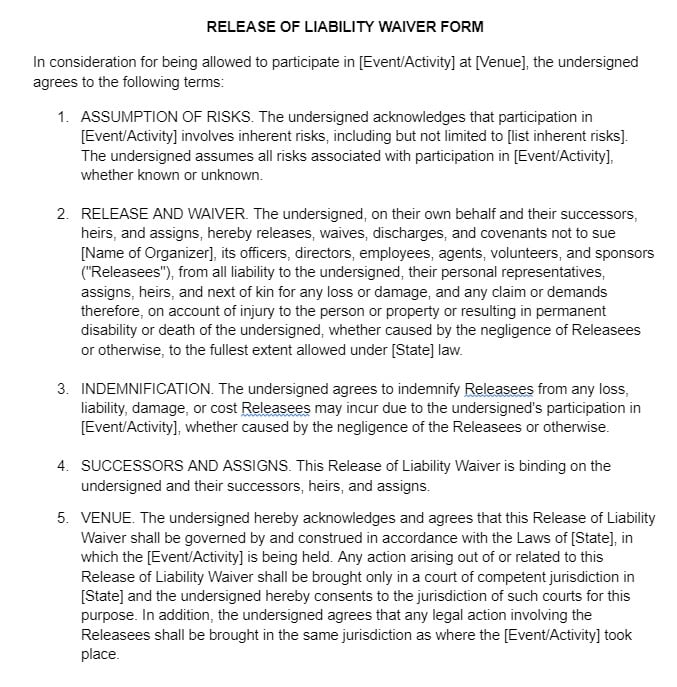

Download a free business liability waiver template for your business.

How Does a Business Liability Waiver Work?

A business liability waiver is signed at the onset of a relationship with a customer. Insurance companies may require certain types of businesses to obtain a liability waiver to reduce the number of claims made by a high-risk business.

The waiver protects the business from ordinary negligence (an act or omission that another reasonable person would not have committed in the same or similar circumstances). However, the waiver is irrelevant when there is gross negligence (an act that consciously disregards what is considered reasonable care for another).

Did you know? If a parent waives their child’s rights and the child is injured, many states have found that parental waivers are unenforceable. This is because it is unreasonable for a child, who cannot fully understand the risks, to have someone else waive their rights for compensation should they become injured.

What Should a Business Liability Waiver Include?

To be valid, a liability waiver must have key components included in its language and structure. Also, because people don’t usually have an attorney review the document, the language used must be easily understandable:

- Inherent risks: The waiver must declare that activities have risks involved and should include a comprehensive list of those risks.

- Assumption of risk: The waiver must include a statement to the effect that the consumer acknowledges the risk and voluntarily assumes the risk as their own.

- Release clause: This statement directly talks about how the business assumes no risk and the consumer will not hold the business liable in the event of injury.

- Indemnification clause: This is a statement saying that the consumer is responsible for the business’s legal costs if they are sued.

- Venue clause: The venue clause states what legal jurisdiction the waiver falls under; this is often the city or state in which the business is located.

- Successors and assigns: This protects anyone who might take over the company at a later date, ensuring that they are not subject to a lawsuit for the same liabilities.

- Signatures: The consumer must sign the waiver or have a parent or legal guardian sign for them.

Failure to include all components of the liability waiver could result in an unenforceable waiver if you are taken to court or if an insurance claim is filed.

When Does a Business Need a Liability Waiver?

A business needs a liability waiver when it has inherent risks associated with its services. Common examples of businesses needing liability waivers include:

- Personal trainers and gyms

- Event venues

- Conference organizers

- Theme parks

- Any business with high-risk activities like skydiving, scuba diving, trampoline houses, and rock climbing

If your industry has insurance claim statistics with high loss rates for certain types of injuries, this is a key indicator that you might need a liability waiver program. While general liability insurance is not always required, a business waiver is always a good idea. If you are unsure as to whether you need a liability waiver, then talk to your insurance agent. They can best advise you on the risks your business has and whether a liability waiver can help.

Can a Business Liability Waiver Replace General Liability Insurance?

While a liability waiver can reduce the chance of lawsuits and liability claims, it does not replace a general liability insurance policy and, in many cases, a general liability policy is required.

Even with the waiver, you can still be the subject of a claim or a lawsuit—the waiver becomes part of your defense if sued, but it’s no guarantee that a payout won’t happen. Insurance protects you in that case, so it’s important that you maintain adequate general liability coverage.

Because waivers require clear and specific language related to the risky activity, your business is still exposed to liability. For example, you have a liability waiver signed for a specific activity, such as personal training, but after the training session, the customer slips and falls in the bathroom. The waiver wouldn’t apply to the injury, and the claim resulting from this incident would fall under general liability insurance.

Did you know? While a waiver may help you in court, it doesn’t necessarily mean the insurance company will deny the claim. If your provider hasn’t expressly requested the use of waivers and the policy does not mention waivers, the carrier may still be required to handle the claim per the terms of the contract, such as policy, with your business.

Bottom Line

If you have a business where customers participate in risky activities, consider using liability waivers. Make sure that your waivers have all the required components to be legally enforceable, as this will reduce the chances of an insurance claim or lawsuit. However, nothing can replace implementing safety programs and risk assessments to reduce the number of injuries and liabilities as a whole.