CCH Axcess Tax, a cloud-based professional tax preparation software for accounting firms of any size, is a single component of the full firm management system offered by CCH. Having worked with small firms, my opinion is that those with fewer than 100 clients may find some of the firm management components to be cost-prohibitive. Pricing starts at $2,299 for 100 returns with five state filing options and $2,759 for 100 returns with unlimited state filing options. Unlimited returns cost $9,999.

With CCH Axcess Tax, users enjoy practical features like integrated field explanations and auto-flow for IRS forms like W-2s and 1099s, but periodic lags in responsiveness and occasional outages during peak filing times can compromise the user experience.

Pros

- Cloud-based system that eliminates IT headaches

- Integration with other CCH Axcess Tax modules for cloud-based firm management

- Strong customer support options

Cons

- Some features are paid add-ons

- No built-in integration with QuickBooks

- Limited free trial options

Pricing | |

Free Trial | Contact sales support for trial options |

Money-back Guarantee | None |

Supported Bookkeeping Software | None |

Standout Features |

|

Returns Supported | 1040, 1065, 1120, 1120S, 1041, 706, 709, 5500, and 990 |

Customer Support | Telephone, email, and live chat |

Average User Reviews | Has very limited reviews and is praised for its tax research service and ease of use; has complaints about the inability to import data from QuickBooks files and the lack of pricing transparency for certain return bundles. |

- Firms seeking a tax research service: CCH AnswerConnect provides practical answers to tax questions.

- Firms with remote employees: CCH Axcess Tax is cloud-based, allowing employees to work on sensitive client information from anywhere and 24/7.

- Firms seeking cryptocurrency solutions: CCH Axcess Tax integrates with CoinTracker and Ledgible, enabling you to address your clients’ cryptocurrency reporting needs.

CCH Axcess Tax Alternatives & Comparison

CCH Axcess Tax Reviews from Users

| Users Like | Users Dislike |

|---|---|

| Easy to access via the cloud | Lack of transparency with pricing for some services |

| User-friendly and intuitive navigation | Website doesn’t provide information about all package |

| Integrations streamline workflow | Hidden add-ons that cost additional money |

Clients who left a CCH Axcess Tax review shared that they like that the software is cloud-based and has an easily accessible presentation. They also said it’s user-friendly and easy to navigate. Integrations for practice management and workflow were also noted as appealing features.

User reviews are limited, but CCH Axcess Tax earned the following average score on this popular review site:

- TrustRadius[1]: 5.3 out of 10 based on around 15 reviews

It stands to reason that the lackluster rating stems from a lack of clarity around pricing, packages, and add-ons. While the reviews only represent the experience of about 15 users, I agree that CCH should offer transparency in its packages and pricing. Unfortunately, however, the lack of pricing transparency seems to be a consistent practice for competitors in the industry.

CCH Axcess Tax Pricing

The CCH Axcess Tax pricing scheme has multiple tiers for its Tax Essentials bundles, starting at $2,299 for 100 returns with five state filing options. Additional states are available for $49.95 each. Unlimited federal and state options are also available, and custom pricing may be available through a CCH Axcess Tax sales representative.

Number of Federal Returns Included | Federal Returns With Five States | Federal Returns With Unlimited State Filings |

|---|---|---|

100 | $2,299 | $2,759 |

200 | $3,299 | $3,959 |

400 | $4,299 | $5,159 |

Unlimited | $9,999 | $9,999 |

CCH Axcess Tax New Features

- Trial Balance Import Upgrade: Pre-formatting of import files has been simplified and import diagnostics have been clarified.

- Firm Permissions Access: Enhancements have been made to firm permissions so that specific administrative tasks like template management can be assigned to specific personnel.

- Trial Balance Report Remarks: Custom footnotes can be added next to trial balance accounts for internal notes that may be useful for the preparation and review process.

CCH Axcess Tax Features

CCH Axcess Tax has many useful features, such as tax research tools and the ability to create tax organizers for your clients. This is one of the reasons that we selected it as the best cloud-based software for comprehensive firm management in our ranking of top professional tax software.

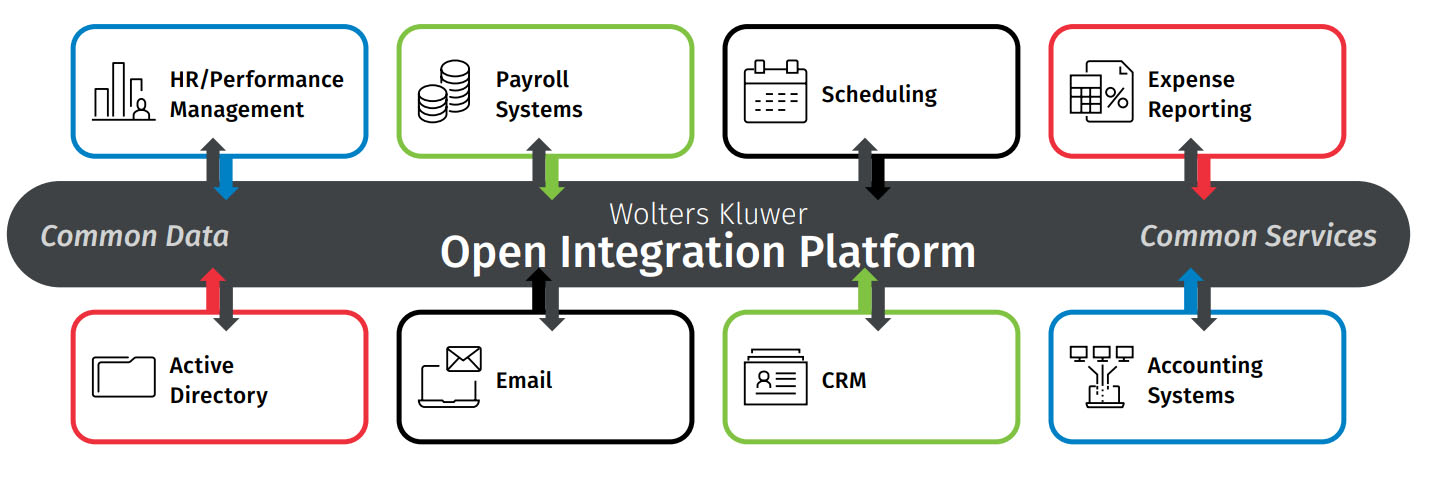

One of its biggest drawbacks is the lack of built-in integrations with QuickBooks and other accounting software. However, CCH Axcess Tax has an open integrations platform that can be used for many other software types. The integration will require most users to have background knowledge for implementation.

CCH Axcess Tax allows you to enhance your end-to-end digital tax workflow process by addressing your clients’ cryptocurrency reporting needs. It integrates with both CoinTracker and Ledgible, thus streamlining the process.

When utilizing the portal, you and your clients have access to a secure web-based portal, which allows you to view documents and files. You’ll be able to exchange, store, and organize files (e.g., a QuickBooks backup file) in one central location.

CCH Axcess Tax allows you to create tax organizers for your clients, which can be printed and sent or emailed. They can also be uploaded to the client portal, allowing clients to access them at their convenience. Clients can also upload documents that you requested to the CCH Axcess Tax Portal.

Axcess Tax has built-in integrations with CCH’s seven other Axcess modules, as listed below:

- Axcess Document: A cloud-based document management system, which allows you to store electronic copies of tax returns and file backups.

- Axcess Workstream: A project management integration with convenient links for status updates

- Axcess Portal: A secure document transfer portal for receipt and provision of confidential documents.

- Axcess Practice: A time tracking system for analyzing staff production metrics.

- Axcess Client Collaboration: A unified collaboration hub where you and your clients have access to a secure portal and an enhanced ability to move client work through the established workflow.

- Axcess iQ: A predictive intelligence integration that helps identify revenue opportunities within your existing client base.

- Axcess Financial Prep: A cloud-based trial balance solution that enables you to instantly produce accurate balances for preparing business tax returns.

Using application programming interfaces (APIs), Axcess customers can integrate their tax preparation with a wide array of other software to create a custom, comprehensive workflow. Basic knowledge of APIs is required.

Open Integration Platform (Source: Wolters Kluwer)

CCH Axcess Tax offers complete e-filing for all supported forms, and users can easily check their status, and view alerts and rejections. Digital tax workflow is also available, which helps further automate the tax preparation process.

The platform comes with a real-time link to CCH AnswerConnect, a powerful resource for comprehensive tax research. CCH research tools provide access to explanations of tax law and examples of application to real-world situations. It also includes the ability to research topics and find answers to compliance questions without leaving the tax preparation process.

Helpful alerts notify you of incomplete returns or tasks, changes that need to be reviewed, and outstanding conflicts. You can also speed up your on-screen reviews with features such as tick marks and preparer notes.

CCH can help you create professional correspondence and save them to libraries for reuse in any return. I have had great success in using its templates and customizing them using Microsoft Word. It allows me to have maximum control of client correspondence with minimal effort.

CCH Axcess Tax Ease of Use & Customer Support

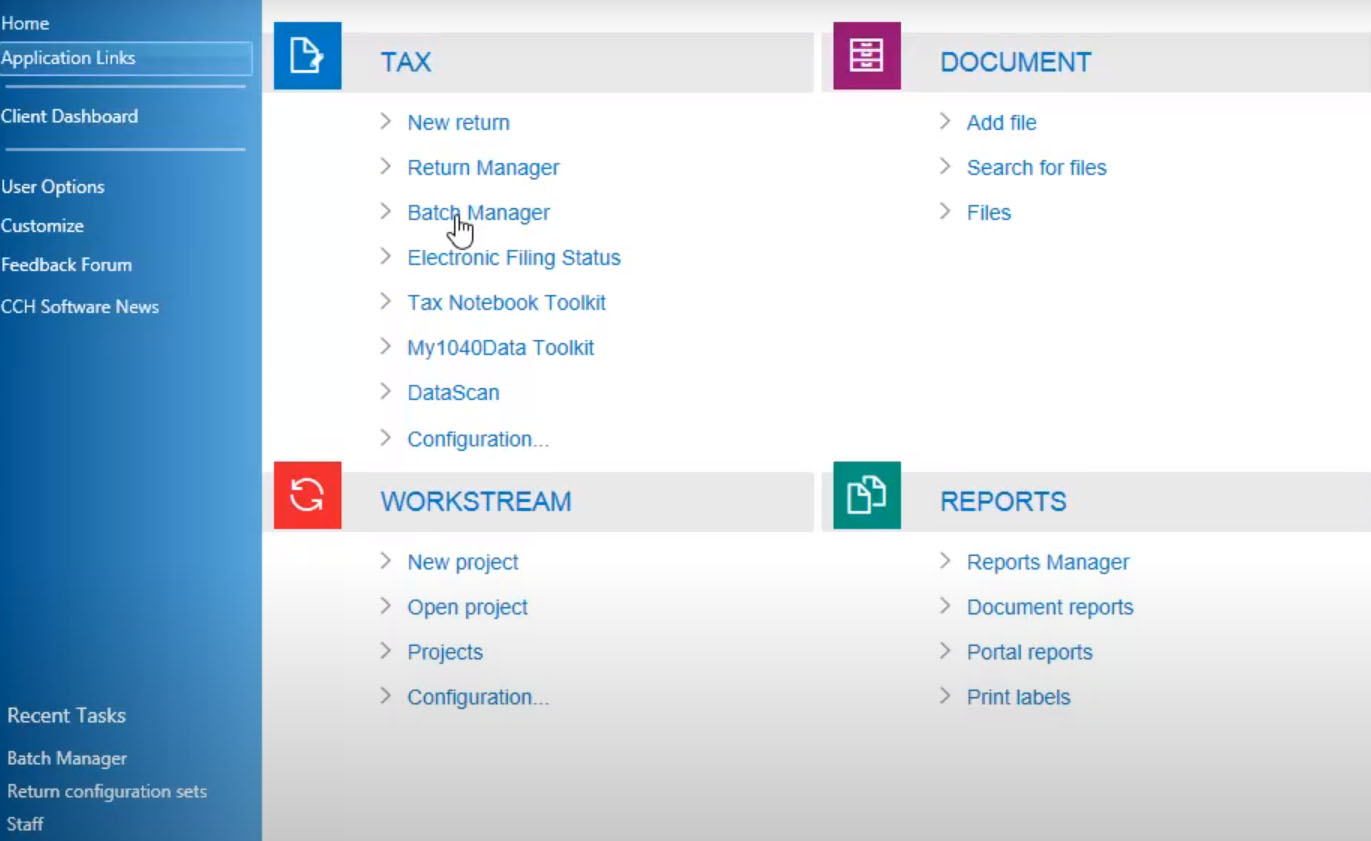

CCH Axcess Tax has the same familiar user-friendly interface as Microsoft 365, making CCH Axcess Tax easy to navigate.

The dashboard gives you quick access to all related projects, tasks, and client documents. Helpful tooltips provide useful information about each icon’s function, and you can customize the Quick Access Toolbar with your most-used tools. The enhanced Return Manager allows you to customize information based on what you need to see, and quick filters allow you to arrange tax returns in the desired order.

CCH Axcess Tax Dashboard

All registered users have access to support via telephone, email, and live chat. Additional help and support options include product guides, user videos, a searchable knowledge base, and a community user forum. You can also download product enhancements or updates from the website.

How I Evaluated CCH Axcess Tax

I evaluated CCH Axcess Tax by reviewing applicable requirements for small business tax preparers. My evaluation considered software cost, data import process, document management, software support, and ease of system operations. These characteristics were evaluated autonomously and compared with the offerings available from industry competitors.

Frequently Asked Questions (FAQs)

CCH Axcess Tax requires multiple methods of verification to access client data. Files uploaded to the CCH Axcess Tax Portal are scanned for viruses and encrypted and protected from unauthorized users through firewalls.

CCH Axcess Tax Portal will accept Microsoft Excel, Word, PowerPoint, and Visio, as well as web pages and hyperlinks.

Yes, CCH Axcess Tax supports client conversions from ATX, Drake, Go System Tax RS, Lacerte, ProSeries, TaxWise, and UltraTax CS.

Bottom Line

While its inability to sync with QuickBooks files is a disadvantage for QuickBooks users, CCH Axcess Tax has many robust features that make it a strong competitor in the field of tax software. This is mainly because of its integration with other CCH Axcess Tax modules that, together, create a cloud-based ecosystem for your entire firm. You can link to the CCH IntelliConnect tax research service without leaving the tax preparation program, and in an increasingly automated world, access to its strong customer support is a plus.

1 TrustRadius