Lacerte Tax, Intuit’s top-of-the-line tax solution, offers a variety of tools to help streamline your practice. It can be used for preparing the most complicated tax returns, such as consolidated returns and returns for oil and gas companies. It can import balances from QuickBooks Desktop and integrates with Intuit Practice Management.

Although the Lacerte Tax software cost for its pay-per-return plan is available, you must contact a sales representative for other pricing information. In exchange for your email, you can try the Lacerte Tax version with no printing and e-filing capabilities for free. Most users rate the platform highly and comment on its ability to prepare virtually any complicated tax return. Learn if it’s right for your business through our in-depth Lacerte Tax review.

The Fit Small Business editorial policy is rooted in the company’s mission, which is to deliver the best answers to people’s questions. This serves as the foundation for all content, demonstrating a clear dedication to providing valuable and reliable information. Our team leverages its expertise and extensive research capabilities to identify and address the specific questions our audience has—and this ensures that our content is rooted in knowledge and accuracy.

In addition, we employ a comprehensive editorial process that involves expert writers. This process ensures that articles are well-researched and organized, offering in-depth insights and recommendations. Fit Small Business maintains stringent parameters for determining the “best” answers, including accuracy, clarity, authority, objectivity, and accessibility, and these see to it that our content is trustworthy, easy to understand, and unbiased.

Lacerte Tax Alternatives & Comparison

Lacerte Tax Reviews From Users

| Users Like | Users Dislike |

|---|---|

| Is good for complicated returns with special tax rules | Has input that is not set up like forms |

| Can watch actual forms change while adjusting input | Is for tax pros and expects you “know what you’re doing” |

| Can jump to relevant input line from output forms | Cannot override values on output forms |

| Is expensive | |

I tend to agree with users who have left a Lacerte Tax review online. Lacerte is incredibly powerful and can prepare pretty much any return. As one of the most powerful professional tax software, it is built for the very best tax pros, and as one reviewer said, it “expects you to know what you’re doing.” I’d agree with that assessment, but I don’t think it’s necessarily a weakness. Serious tax pros want to use the program differently than a part-time preparer working evenings on a few individual returns—and Lacerte gives the serious pro what they want.

One user noted that they wished you could override values on the final output forms. I have mixed emotions on this comment. While you can sometimes save some time with an override, most reviewers don’t want the staff preparing the return to be able to use overrides. It is sometimes difficult to detect overrides entered by staff and it can result in unforgivable return mistakes, like forms that don’t correctly foot.

The following Lacerte Tax’s ratings on third-party review sites:

Lacerte Tax Software Pricing

The provider offers three plans: Lacerte 200 Federal 1040, Lacerte Unlimited, and Lacerte REP (pay-per-return pricing). The Lacerte Tax software cost for the first two plans are only available by contacting a sales representative. While we don’t have access to specific pricing for most plans, many users commented that the program is expensive.

Pay-per-Return Pricing

Lacerte’s REP plan provides pay-per-return pricing for individual and business returns but also requires an annual license fee of $783.

1040 Federal + 1 State | $96 per return |

1040 Additional States | $73 per return |

Business/Exempt/Trust/Estate (Federal + 1 State) | $125 per return |

Business/Trust/Estate - Additional States | $81 per return |

Gift Tax/Employee Benefit - Federal | $83 per return |

Consolidated Corps | $124 per return |

Tax Scan and Import | $14 per return |

Lacerte Tax Features

Lacerte Tax has several useful features to help you save time with preparing your clients’ returns, including a missing client data tool and a trial balance utility. Its comprehensive tax analysis and planning tools enhance your service offerings.

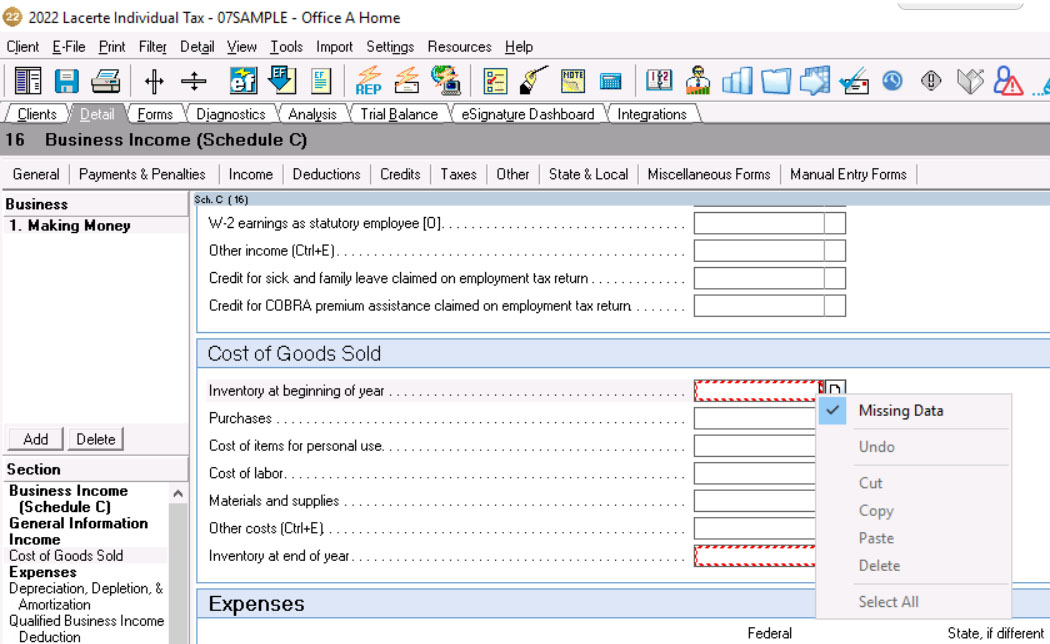

Missing Client Data Tool

This built-in tool allows you to flag missing information throughout a return and then prepare a report of all missing information to send to your client. For example, in the screenshot below, I’ve flagged beginning and ending inventory on a Schedule C as missing by simply right-clicking on the input field and selecting “Missing Data.” The missing field will have a red-checkered border until the flag is cleared or a value is input.

Input Fields Flagged as Missing in Lacerte Tax

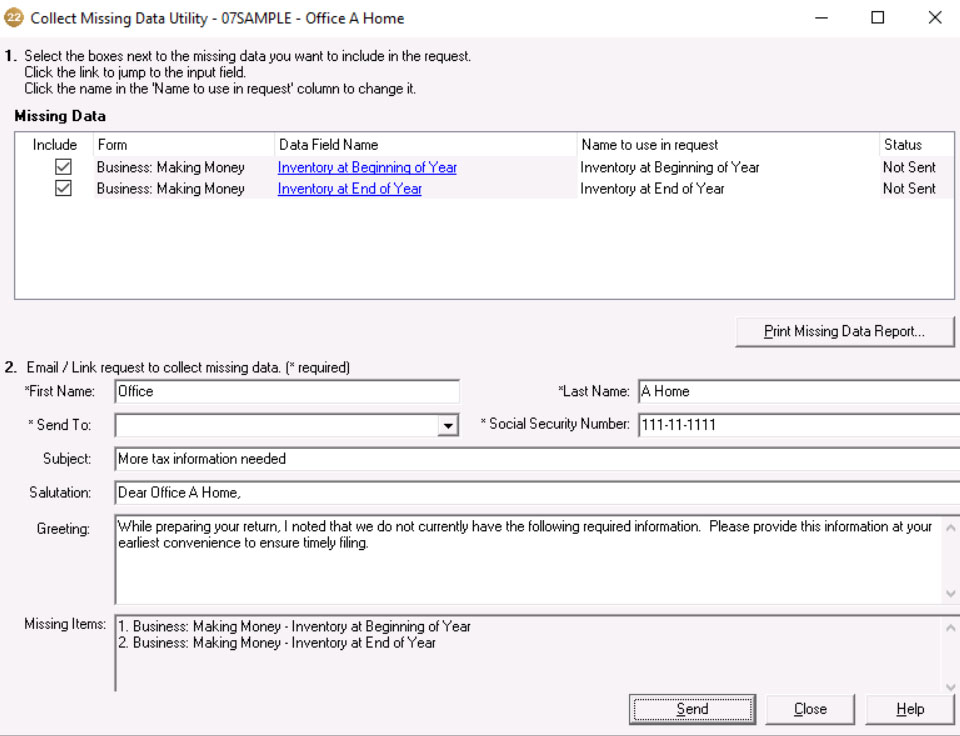

Once all the missing fields have been flagged within the return, you can email a missing data report automatically to your client as shown below. The Missing Data Utility keeps track of missing items you’ve already sent your client so you can send additional emails without duplicating the missing content.

Missing Data Utility in Lacerte Tax

E-organizer

This is a paperless option that assists with the organization and collection of information. You can send forms, questionnaires, and emails to clients, providing them with access to a customized, password-protected executable file. This file includes detailed information on how to use the organizer and frequently asked questions (FAQs).

Forms View

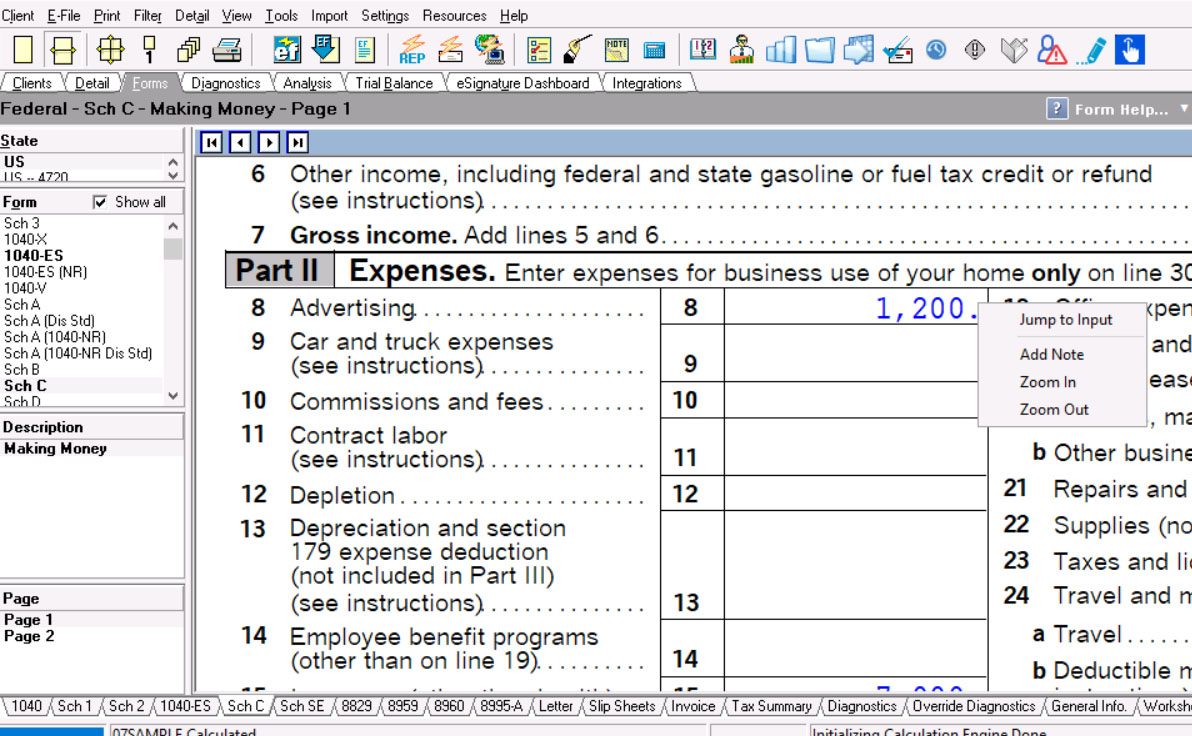

You can easily view the final forms prior to printing or filing. After selecting the “Forms” tab, the left menu bar lists the forms that have been added to this return. You can select any form to view it and then right-click on most lines to drill down to the input form where this line item originated.

In the screenshot below, I’ve right-clicked on advertising expenses on Schedule C. If I select “Jump to Input” on the popup menu, I’ll be taken to the business income and expense input screen where the $1,200 was input.

Jumping to the Input Screen from Schedule C

Drilling down from the tax forms is an extreme time saver when you’re reviewing returns, and it’s not always available with lower-end software.

Trial Balance Utility

The trial balance utility is useful for developing a chart of accounts, modifying journal entries, reviewing trial balance reports, and more. It can even import data from QuickBooks, Excel, and EasyACCT. You also have the option of setting up a chart of accounts directly in Lacerte Tax or copying a chart of accounts from a similar company.

- Comprehensive form library: Lacerte Tax gives you access to more than 5,700 forms, including multistate, K-1s, and 5500 benefit plan returns, which enable you to service a variety of clients and businesses.

- Tax analysis and planning tools: You have access to sophisticated tax analysis and planning tools.

- Tax Analyzer assists professionals with managing their clients’ liabilities and financial health, red-flagging amounts that are most likely to trigger an IRS audit.

- Tax Planner provides customized plans for each client’s future liability based on current and future state and federal tax rates.

Lacerte Tax Customer Support

Lacerte Tax’s technical support is included with purchase, and it is offered in the following ways:

- Toll-free phone support from Monday to Friday, 9 a.m. to 8 p.m. Eastern time

- Email support

- Website support

- In-program help

- Help Me option with screen-specific topics

- IRS instructions per form

It also offers various levels of training courses and how-to video tutorials to help get you up to speed quickly. There is also a searchable knowledge base and community user forum.

Lacerte Tax Ease of Use

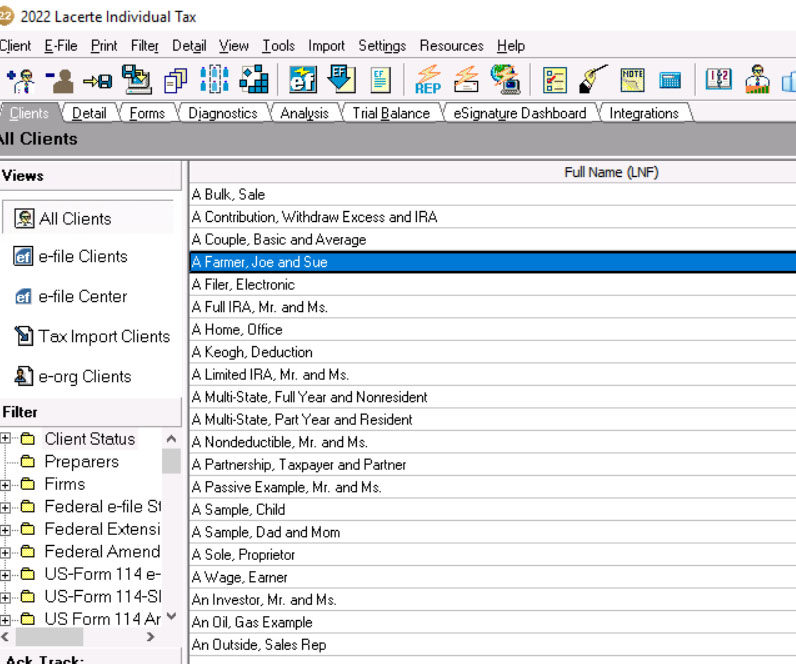

Lacerte’s dashboard is very cluttered and a little hard to read. However, after using it for a few returns, I think it becomes fairly easy to navigate. First. you select a client while viewing the “Client” tab. In the screenshot below, I’ve selected a client named Joe and Sue Farmer.

Client Return List in Lacerte

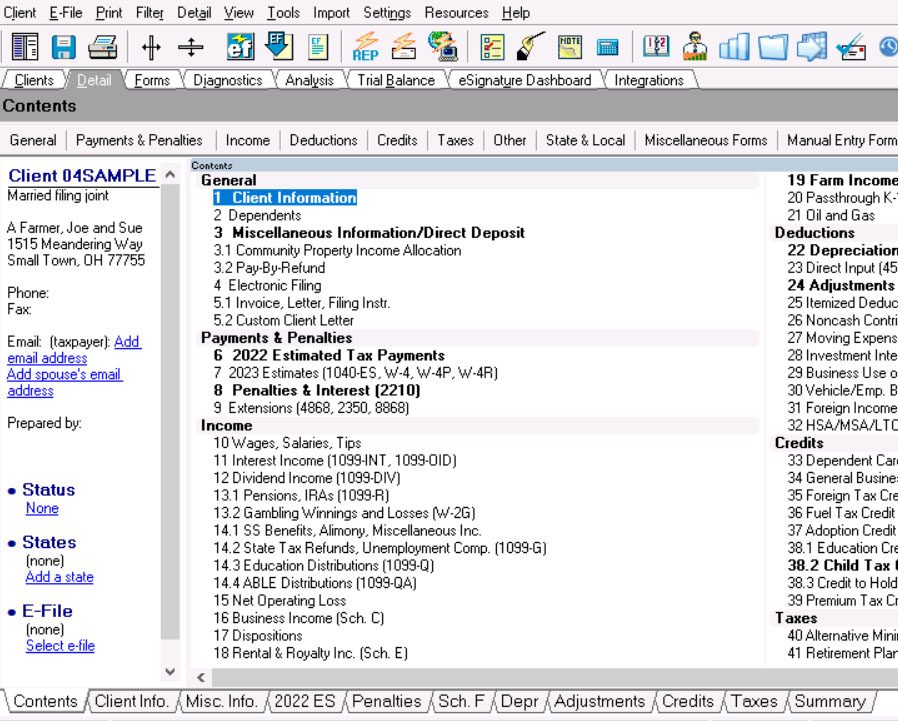

After selecting Joe and Sue Farmer, I can move to the input forms by selecting the next tab, which is “Detail.” This is unintuitive, as most programs would expect you to double-click on the client name to open the return, but not so with Lacerte.

Return input detail in Lacerte

The screenshot above shows the “Contents” tab, which lists all the available input forms for that type of tax return. You can scroll to the right in the program to browse all the forms. A quicker way to navigate is to click on the lower tab related to the area of the return you are working on to see just those input forms.

FAQs

Lacerte’s pay-per-return plan’s prices vary depending on the type of return—ranging from $14 to $125 per return, plus an annual license fee of $783. For information about the platform’s other plans, Lacerte 200 Federal 1040 and Lacerte Unlimited, you must contact a sales representative.

Yes, Lacerte Tax is easy to use for experienced tax professionals preparing complex returns.

Yes, Lacerte Tax is Intuit’s top-of-the-line tax preparation software.

Yes, Lacerte Tax offers a pay-per-return option, which is referred to as the Lacerte REP plan.

Bottom Line

Lacerte Tax is quality tax preparation software that’s right for any firm that prepares complicated tax returns regularly. Its range of useful tools includes an expansive form library, a paperless option for organizing and collecting tax information, and a variety of tax analysis and planning tools. The platform includes time-saving features as well, such as QuickBooks Desktop integration.

[1]TrustRadius

[2]G2.com