ProConnect Tax Online is a cloud-based professional tax preparation software designed specifically for firms centered on QuickBooks Online Accountant. It provides powerful features, such as missing data review and document management and is priced on a pay-per-return basis with no annual fee. It also has a K-1 package and a tax planner with the ability to project multiple case scenarios.

The pricing for ProConnect Tax Online’s pay-per-return ranges from $36.95 to $97.95 for individual returns and $40.95 to $117.95 for business returns, which is based on the quantity of returns. Those who gave a ProConnect Tax Online review had high praises, having said that they appreciate its integration with QuickBooks Online Accountant and strong customer support. However, while it can handle a large variety of different business and individual returns, it can’t prepare Form 5500 or Form 706 returns.

The Fit Small Business editorial policy is rooted in the company’s mission, which is to deliver the best answers to people’s questions. This serves as the foundation for all content, demonstrating a clear dedication to providing valuable and reliable information. Our team leverages its expertise and extensive research capabilities to identify and address the specific questions our audience has—and this ensures that our content is rooted in knowledge and accuracy.

In addition, we employ a comprehensive editorial process that involves expert writers. This process ensures that articles are well-researched and organized, offering in-depth insights and recommendations. Fit Small Business maintains stringent parameters for determining the “best” answers, including accuracy, clarity, authority, objectivity, and accessibility, and these see to it that our content is trustworthy, easy to understand, and unbiased.

ProConnect Tax Online Alternatives & Comparison

ProConnect Tax Online Pricing

Most ProConnect Tax Online users must pay per return on a sliding scale based on the total number of returns purchased. However, there is an unlimited option without any pricing information. It’s safe to assume that the unlimited option would at least exceed the cost of 499 business returns, which is over $20,000 (499 returns × $40.95).

Both individual (1040) and business (1041, 1065, 1120, 1120S, 709, and 990) returns include e-file for federal, state, multistate, and municipal returns.

As shown in our total cost table, ProConnect pricing becomes very expensive for high-volume preparers. We recommend high-volume preparers consider other options with lower-priced plans for unlimited returns. For example, ProSeries, a well-respected software from Intuit, is only $3,011 for unlimited individual returns as compared to ProConnect’s $18,438 for 499 individual returns. Read our review of ProSeries Professional for more information.

ProConnect Tax Online Reviews From Users

| Users Like | Users Dislike |

|---|---|

| Easy to set up and use | Pay-per-return pricing can be expensive for high-volume filers |

| Integration with QuickBooks Online | Doesn’t support Forms 5500 and 706 |

| Strong customer support including 24/7 support during tax time | Request a quote for unlimited returns |

Users who left a ProConnect Tax Online review gave the platform high praise for ease of use and the seamless integration with QuickBooks Online. Reviewers also love the vast customer support resources, including 24/7 support during tax time. However, we wholeheartedly agree with one of the complaints, which is that its pay-per-return pricing makes it expensive for users who file a large number of returns. Another drawback is the inability to file Forms 5500 and 706.

The software has earned the following average scores on popular review sites:

- TrustRadius[1]: 8.4 out of 10 based on around 20 reviews

- Capterra[2]: 4.2 out of 5 based on about 20 reviews

- G2.com[3]: 3.8 out of 5 based on around 20 reviews

ProConnect Tax Online New Features in 2023

ProConnect Tax Online has added new features and integrations, including the ability to customize client letters and access to firm performance insights.

- Unlimited returns package: ProConnect has introduced an unlimited returns package for the 2023 tax year. However, they don’t disclose the cost of this package on their website.

- IRS transcripts: ProConnect Tax now allows you direct access to everything the IRS has on file for your client with its IRS transcripts feature. You can pull all of the transcripts into ProConnect Tax, streamlining the filing process by eliminating back and forth with your clients.

- Customized client letters: The custom client letters feature allows you to customize letters to your clients to send along with their completed returns. They are only available for federal returns for all tax types starting in tax year 2022.

- Keyboard shortcuts: ProConnect Tax has compiled a list of shortcut key combinations to accelerate your productivity and streamline your workflow. You’ll be able to use them to navigate the three major sections of the software: client tax returns list, main navigation, and return navigation.

- Firm performance insights: ProConnect Tax gives you access to your firm’s performance insights via the dashboard, which reports annual client growth, time spent on returns for both the firm and by individual users and comparison reports based on specific time periods.

- Client reminders: You can now send clients reminders to complete their tax organizers by using the Link client request workflow. This will remind your client every seven days until they mark the task as done.

- Google Drive and Dropbox integration: Import your clients’ tax forms directly to their tax returns using ProConnect Tax Online’s Google Drive and Dropbox integrations.

- QuickBooks Billing integration: Create QuickBooks Online invoices from ProConnect Tax with your tax clients’ billing details auto-populated. This streamlines client invoicing and tracking A/R, without any separate logins or accounts required.

ProConnect Tax Online Features

In addition to the new features described above, ProConnect Tax Online offers several useful features that will add to your firm’s efficiency, including a tax planner, the ability to upload and store documents, a K-1 package, and a missing data review tool that ensures accuracy.

Use ProConnect Tax Online’s tax planner to plan ahead with your 1040 and Schedule C clients by playing around with comparative tax scenarios. These include making multiyear comparisons for up to three years and building multiple case scenarios. You can also calculate tax liability and import diagnostics.

ProConnect Tax Online tax planner (Source: ProConnect Tax)

With ProConnect Tax Online, you can upload and store documents and view them as you do the return. You also have the option to download forms and you can customize your requests for tax information, based on the previous year’s information.

ProConnect Tax Online will flag missing data fields as you’re working on a return so that you can identify any gaps or discrepancies prior to filing. This streamlines the process of identifying errors, creating a quicker review time.

With ProConnect Tax Online, you can upload and store documents and view them as you do the return. You also have the option to download forms, and you can customize your requests for tax information, based on the previous year’s information.

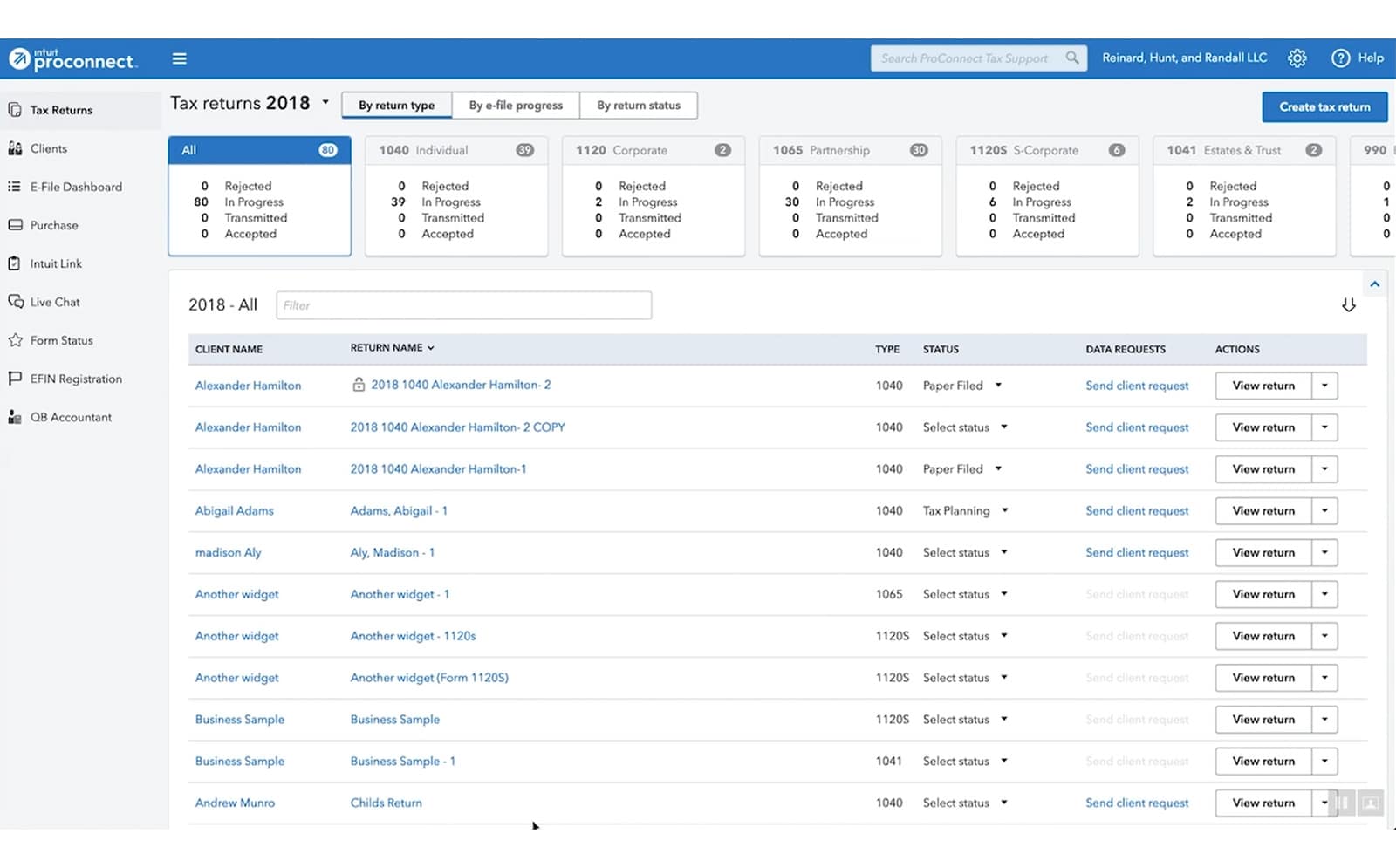

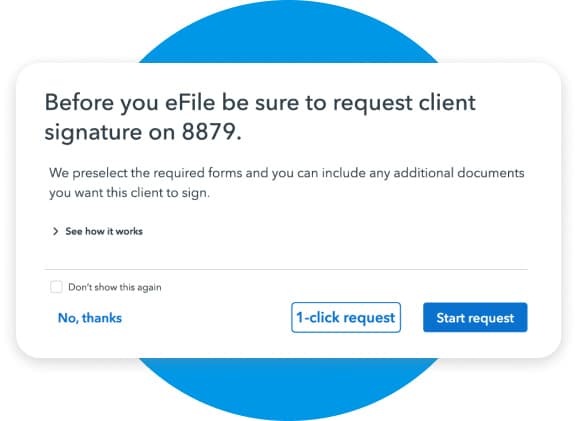

ProConnect Tax Online allows you to view the e-file status of all of your clients with a dashboard that allows you to sort, filter, and check for rejections. You can also offer e-signature, which lets your clients review and sign forms from anywhere, on any device.

ProConnect Tax Online e-filing feature (Source: ProConnect Tax)

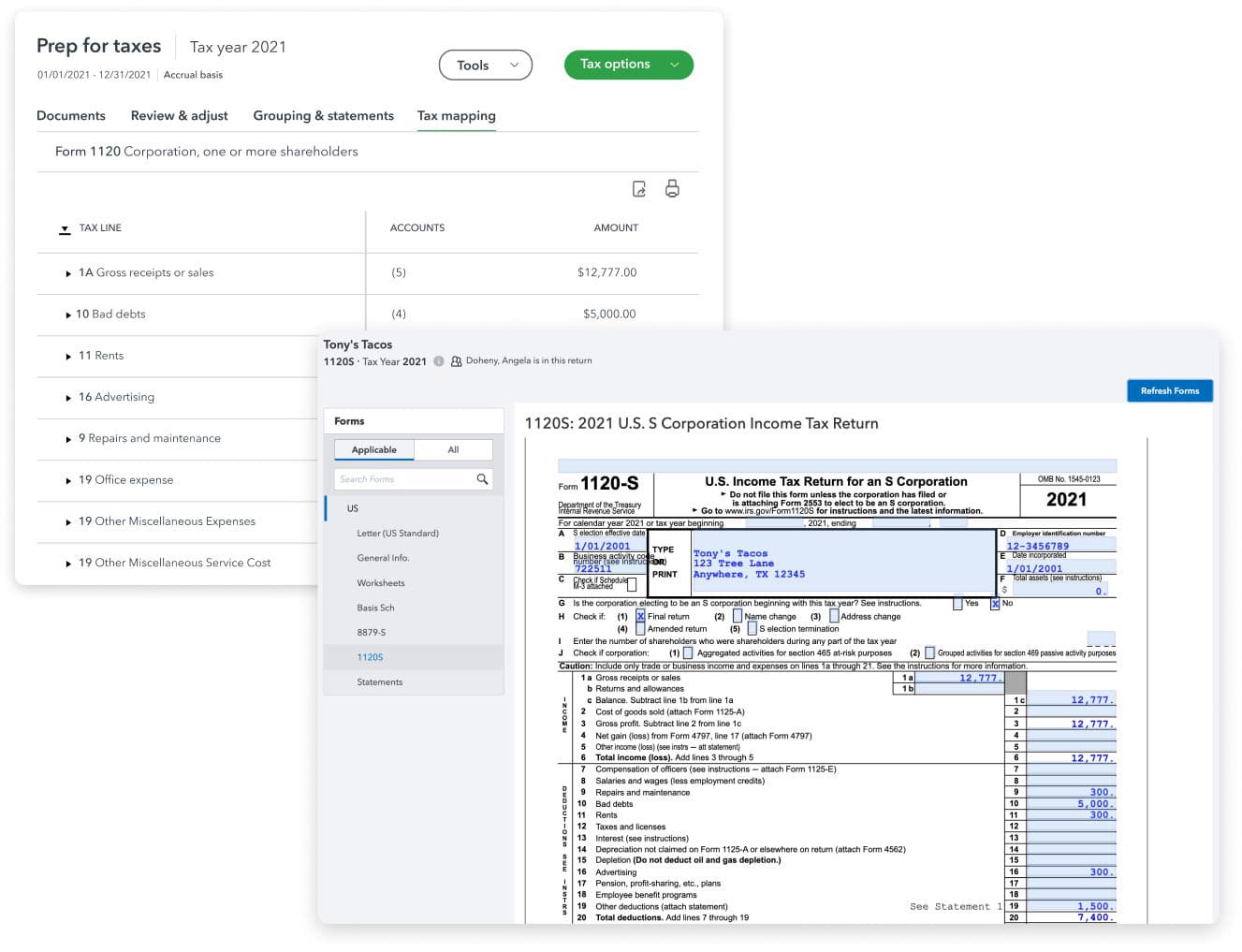

This lets you review, adjust, and transfer client data in less time. You can identify accounts that haven’t been mapped to tax lines and update tax lines more efficiently with predictive text entry. You can also view, modify, and approve any changes made to your clients’ books before exporting your prefiled form to tax returns.

ProConnect Tax Online’s Prep for Taxes feature (Source: ProConnect Tax)

ProConnect Tax Online Ease of Use & Customer Support

ProConnect Tax Online’s integration with QuickBooks Online Accountant makes it easy to access all of your data in one place. Equipped with an intuitive client portal, ProConnect Tax Online allows you to manage your accounting and tax clients from one dashboard.

You can make client information changes in QuickBooks Online Accountant—and those changes will be reflected automatically in ProConnect Tax Online. You can also take your client’s balance sheet and profit and loss statement and apply them to your year-end tax work with the Prep for Taxes feature.

ProConnect Tax Online has a variety of support resources that are available from the moment you sign up. The Easy Start onboarding program provides personalized customer support, automated data conversion, and a success guide to help ensure that you’re completely set up. By accessing the training portal in your software, you can earn free continuing professional education (CPE)/continuing education (CE) credits, join webinars, and participate in virtual conferences to learn from industry experts.

You can reach ProConnect Tax by phone Monday through Friday from the hours of 6 a.m. to 5 p.m. Pacific time. You’ll also have access to free 24/7 product support from ProConnect Tax Online’s agents during tax season. An online peer community and a searchable help widget are also available.

Frequently Asked Questions (FAQs)

Yes, ProConnect Tax Online requires all return preparers to be authorized by the IRS as an electronic return originator (ERO) and have a current electronic filing identification number (EFIN).

ProConnect is software used by paid tax professionals to prepare tax returns for their clients. For do-it-yourself (DIY) tax software, see our guide on the best small business tax software.

Yes, using ProConnect, you can provide your client with a tax organizer by selecting from several organizer templates and creating a customized document checklist for returns you plan to e-file for the year.

Bottom Line

ProConnect Tax Online is a great companion software for firms specializing in providing client services with QuickBooks Online. It integrates seamlessly with QuickBooks Online Accountant and can be managed from a single dashboard within the software. While it’s an ideal solution for firms that prepare a limited number of returns, it can get pricey if you anticipate filing a large quantity of them because of its pay-per-return pricing basis.