Commercial tenant improvements (TI), also known as commercial leasehold improvements or buildouts, are changes or repairs a landlord makes to their property as part of the lease agreement. These changes are needed to fit specific business needs. The landlord will either pay for the changes directly, reimburse the tenant for the changes, or offer reduced rent.

To help you understand this process, I’ve listed the tenant improvement definition, different types of improvement options, their pros and cons, and what to consider when negotiating effectively.

What Is a Commercial Tenant Improvement (TI)?

Commercial tenant improvements refer to the modifications or alterations made by a landlord to a rental space to meet a tenant’s specific needs and requirements. These renovations can range from minor cosmetic changes, such as painting the space a new color or installing new flooring, to significant upgrades, like installing new electrical or plumbing systems or building new walls. The primary purpose of a TI is to create a customized and functional space that is tailored to the tenant’s business needs and operations.

Why Are Commercial TIs Important?

Commercial leasehold improvements help landlords attract high-quality tenants, increase occupancy rates, and lead to higher rental yields. For tenants, a well-designed and equipped space can positively impact operations, boost employee productivity, and attract more customers.

However, the consequences of commercial properties failing to meet the specific needs of businesses can be severe. For instance, landlords may experience lower occupancy rates and decreased rental income if they don’t implement tenant improvements. For tenants, a space that isn’t tailored to their operations can lead to inefficiencies and dissatisfaction, emphasizing the urgency of tenant improvement.

4 Types of Commercial Tenant Improvements

Although they are relatively standard, there is much confusion about how commercial tenant improvements work. Like any real estate transaction, there are many different ways a landlord and tenant may reach an agreement. However, the four types of tenant improvements found below are the most common:

Types of TI | Explanation |

|---|---|

Tenant Improvement Allowance (TIA) | The landlord gives the tenant a certain amount of money to make the improvements. This is the most common type of commercial improvement agreement; in these cases, the tenant oversees the work. |

Rent Discounts | The landlord offers the tenant free or reduced rent for a certain number of months equal to the cost of the work completed. The tenant oversees the work. |

Building Standard Allowance (Buildout) | The landlord offers each tenant a package of improvements, and the tenants choose which improvements are made. The tenant pays for any improvements beyond the buildout, and the landlord oversees the work. |

Turnkey | The tenant submits a design plan showing potential improvements and their estimated costs. The landlord pays for the improvements and oversees the work. |

Many other details can vary within these improvement agreements. For example, the landlord may pay for the TIs directly or offer a tenant reimbursement for improvements. Getting a business or tenant improvement loan might be your best choice if you have to pay for the renovations before getting reimbursed.

Pros & Cons of Each Improvement Type

Each type of commercial tenant improvement has pros and cons, depending on who is overseeing the project, who is paying for it, and the possible side effects of renovations to your space. Check out the table below to know the pros and cons of each type of commercial tenant improvement:

Type of Payment Model | Who Oversees the Work? | Pros | Cons |

|---|---|---|---|

Tenant Improvement Allowance (TIA) | Tenant (usually) | Tenant has control of renovations and is less likely to have quality issues or cost overruns | Tenants must manage the renovations, which requires a significant amount of time and money |

Rent Discounts | Tenant (usually) | Tenant has control of renovations, and is less likely to have quality issues or cost overruns | Risk of the landlord increasing rent after the improvements to make up for the discount |

Building Standard Allowance (Buildout) | Landlord | Tenants don’t have to find a contractor or manage the renovation | Customizations can be limited, and you have limited input in the renovation |

Turnkey | Landlord | Tenants can request customizations and don’t have to oversee the work | Tenants have limited input on the renovation process |

Consider tax benefits as you weigh the pros and cons of each commercial tenant improvement agreement. Whoever does the work on a tenant improvement can depreciate it on their business taxes. If the landlord does the job, the landlord gets the depreciation.

If the tenant does the work, the tenant receives the tax benefit. Of course, consult with your tax professional before taking any depreciation on commercial leasehold improvements.

Inclusions & Examples

In commercial real estate, tenant renovations are extremely common. Business owners frequently need to renovate a building to fit their needs, whether it’s food service, office space, retail, or medical space. It’s easy to find these improvements when a popular chain retail store or restaurant opens in a new location.

Commercial improvements made to a Taco Bell restaurant (Source: Derrick Building Solutions)

Notably, commercial tenant improvements only include some adjustments or upgrades made to a property. Renovations like building or removing walls, heating, ventilation, and air conditioning (HVAC), electric, plumbing, paint, carpet, doors, windows, or other construction generally qualify as tenant improvement. However, any removable items or changes that don’t provide value to the landlord are not considered part of TI. This would include decorations, furniture, or electronics.

A few examples of commercial real estate tenant improvements include the following:

- Interior or exterior repainting

- Adding partitions or rooms (e.g., dental offices, doctor offices, or office spaces)

- Adding a drive-thru or changing the parking lot (e.g., food service)

- Changing or adding lighting

- Electrical work

- Flooring or carpeting

Example of commercial tenant improvement (Source: ScoCon)

Top Improvements Landlords or Tenants Want

If you’re a commercial landlord or a tenant seeking to rent a space, it’s essential to know the most in-demand improvements that landlords and tenants desire for their rental properties. These could include features like energy-efficient lighting or modern security systems. Consider these top improvements for your rental space to attract and retain high-quality tenants and maximize your investment returns.

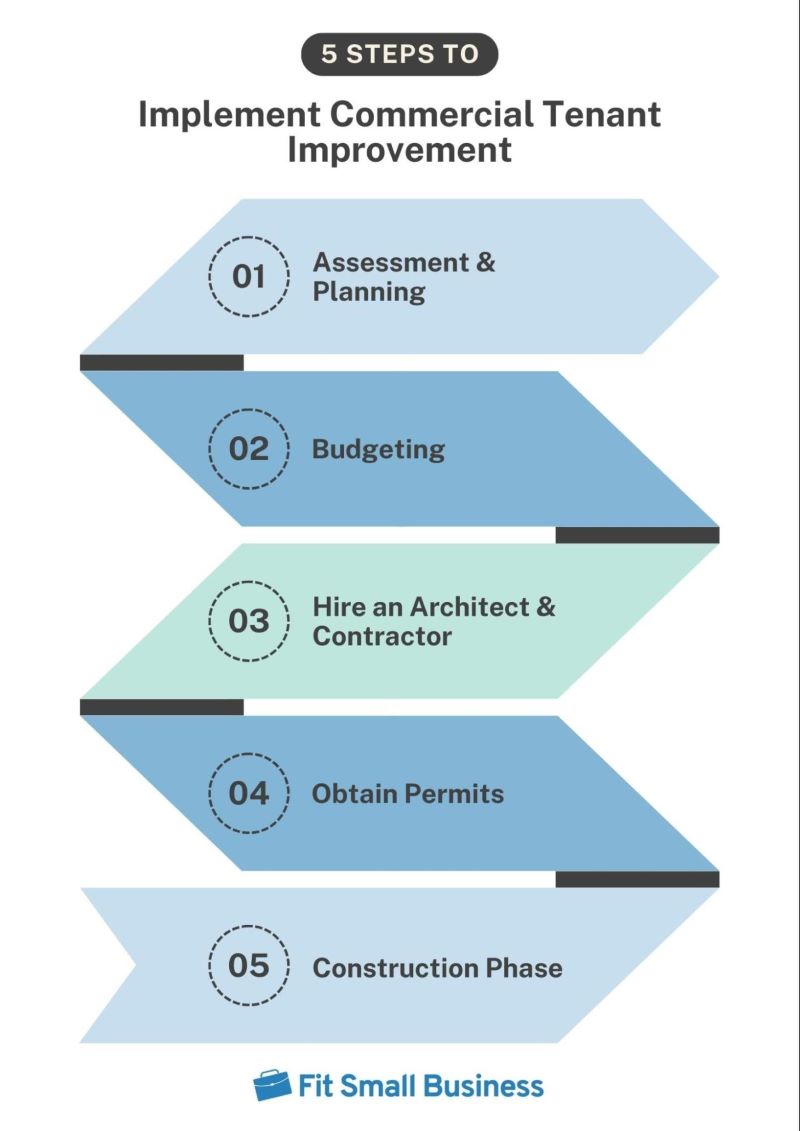

How to Implement Commercial Improvements

If you plan to improve a commercial space, follow the steps below to ensure a successful outcome. The process typically involves identifying what improvements are needed, setting a budget, obtaining necessary permits, and finally completing the construction work.

Step 1: Assessment & Planning

As a landlord or tenant, it’s essential to carefully evaluate your needs and requirements before embarking on any improvement projects. This involves creating a clear plan that outlines the changes you wish to make, including determining the optimal layout and design for the space.

You’ll need to consider various factors, such as the functionality of the space, the materials and equipment required, and any budgetary constraints. By thoroughly assessing your needs and creating a comprehensive plan, you can ensure that your commercial tenant improvements will be effective, efficient, and tailored to your or your business’ unique requirements.

Step 2: Budgeting

When planning for commercial lease tenant improvements, it is crucial to establish a realistic budget that incorporates all the necessary costs involved. You should understand the expenses of various project components, including construction, materials, permits, and design fees. To avoid any unexpected costs down the road, it is essential to work with contractors and designers to create a thorough plan that outlines all the expenses involved in the tenant improvement project.

Additionally, it is advisable to allocate some extra funds in case of unforeseen costs or delays. By establishing a realistic budget and clearly understanding the expenditures involved, you can ensure that your tenant improvement project is completed within your financial means and meets your expectations.

Step 3: Hire an Architect & Contractor

If you are planning to renovate your commercial space, you must hire an architect to ensure that the design and construction meet your business needs and comply with local regulations. Architects are experts in design, building codes, accessibility, and project management, and they play a vital role in bringing your vision to life. Working with an architect guarantees that your space is functional, secure, and visually appealing, creating an atmosphere that reflects your brand and supports your business operations.

In addition, hiring a skilled general contractor is essential to ensure that any upgrades or renovations to your property are completed with the utmost professionalism and efficiency. These experts can manage all aspects of your tenant improvement project, from its initial architectural planning to the final touches of the building process, ensuring that everything is completed to the highest possible standards.

Step 4: Obtain Permits

Before making any improvements to a rental property, it is necessary to understand the extent of the work required and whether permits from local authorities are necessary. Landlords or tenants may need to obtain permits for structural changes, electrical or plumbing work, or other modifications depending on the nature and scope of the project. Failure to comply with local building rules can result in penalties, legal consequences, and potential liability for any damages or injuries that may occur due to the work.

Step 5: Construction Phase

During the construction phase, the actual tenant improvements are carried out. This is a crucial stage in the project and requires effective management to ensure everything runs smoothly. The timeline for this phase may vary depending on the project’s complexity, but the entire project’s success depends on keeping everything on track.

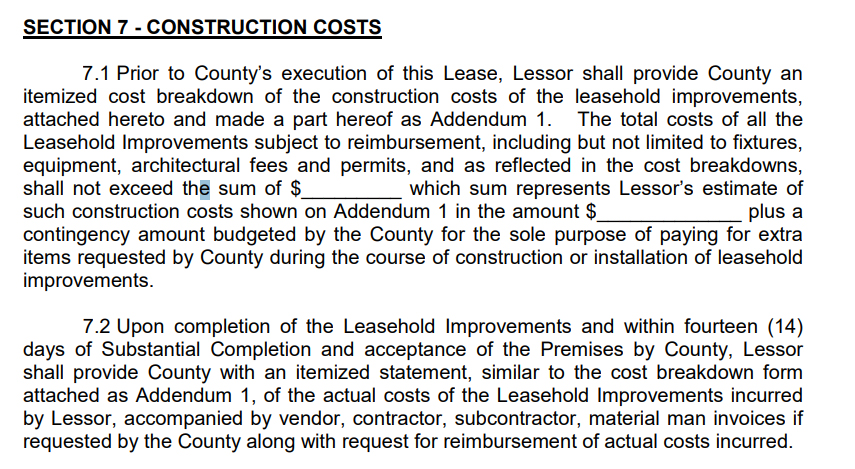

Who Pays for Improvements?

The most common question about commercial property improvements is, “Who pays for tenant improvements?” A few different types of tenant improvement agreements affect this answer. In general, however, tenants and landlords agree on an amount for TI, and landlords pay the cost.

Sample cost section from leasehold improvement agreement (Source: Bidnet)

Keep in mind that landlords and property owners are not required to offer a tenant improvement allowance. If there is a high demand for their property, they may not offer one at all. However, these allowances are generally customary.

Negotiating Commercial Improvements

Since tenant improvements are not required or restricted by law, they are negotiable for landlords and tenants. The portion of your lease covering improvements is usually called the “improvements and alterations clause,” and tenants should start by reviewing that carefully. If you find elements of the buildout allowance on a commercial lease you want to negotiate, here are some things to consider:

- State of the real estate lease market: Does the current market favor tenants or landlords? If you have many options for commercial space, this could give you more leverage in negotiations.

- Length of your lease: The longer you commit to staying in the building, the more likely the landlord will pay for improvements.

- Cost of rent: The higher your rent, the more likely the landlord will pay for improvements.

- Your business history and value to the landlord: If your business has historically drawn many customers, the landlord will be more inclined to pay for repairs.

- Timeline: Delays on large projects are inevitable, so ensure the projected timeline has a margin. Planning for this upfront can prevent obstacles to running your business efficiently.

- Type of agreement: Although the landlord usually pays for a commercial buildout, both parties should agree on the payment method.

- Management of the renovation: When landlords manage a renovation, there is more opportunity for mistakes and delays. When tenants manage a renovation for their business, they are typically more involved and can prevent increased fees and timeline delays.

- Payment requirements: Landlords typically want tenants to use the allowance for labor, materials, and construction, but there are other additional costs. Remember to budget for design consultation fees, legal fees, and material delivery costs.

Once you’ve read and understood your lease and considered all the factors, you can create a strategy to negotiate effectively. It’s better to negotiate before the renovations begin to set you, your business, and the landlord up for success. However, if the tenant improvements exceed the allowances, you can negotiate with your landlord to increase the amount or adjust your rent price.

Frequently Asked Questions (FAQs)

A tenant cannot remove improvements if they were paid for by the TI fund, as these improvements technically belong to the landlord.

Tenant improvements are typically not considered operating expenses—they are usually considered capital expenses.

Improvements the landlord does not cover include anything that caters only to the tenant’s specific needs. This includes improvements the tenant can remove, such as furniture, decor, and electronic equipment.

Bottom Line

In commercial real estate, tenant improvements are common, especially in the office, retail, and medical industries. Ensure you know the types of improvement agreements, the pros and cons of each, and how to negotiate the best deal that will help your business and the landlord-tenant relationship succeed.