Depreciation is a tax break that lets investors in income-producing property slowly deduct the cost of the property but not the cost of the land. The annual depreciation deduction is based on two factors:

- Your basis in the property; usually the purchase price.

- Whether the rental property is commercial or residential.

Depreciation is an important rental property deduction that can lower your tax bill and increase your overall cash flow. If you’re eligible, report your rental property’s depreciation on IRS Form 4562.

How To Calculate Rental Property Depreciation

Step 1: Determine the Adjusted Basis of the Property

The first step is to determine the adjusted basis of the property to be depreciated. You must separately determine the basis of the building vs the basis of the land since you can’t calculate depreciation on the land.

How to determine your adjusted basis in the rental property varies depending on how it was acquired:

- Purchased property: The adjusted basis of rental property you purchase is the cost. The cost includes both the purchase price and any closing costs but not points paid to a mortgage company.

- Inherited property: Your adjusted basis of property received by bequest is the fair market value (FMV) of the property on the date of death.

- Gifted property: If you received your rental property as a gift, your adjusted basis is equal to the adjusted basis that the donor had—you’ll need a copy of the donor’s depreciation records to determine this amount. It’s simply the original cost less the amount of depreciation they claimed. It rarely happens for real property, but if the FMV of the property is less than the donor’s adjusted basis, then your adjusted basis is equal to the FMV.

Regardless of how you acquired your rental property, you can add to the adjusted basis figured above the amount you spend on getting the rental property ready to rent for the first time.

Step 2: Determine If Your Rental Property Is Residential or Commercial

The depreciation deduction can be claimed for any property, regardless of location, as soon as it is put to use or is ready for rental. Under the modified accelerated cost recovery system (MACRS) general depreciation system (GDS), domestic rental property depreciation is calculated using 27.5 years for residential rental properties and 39 years for commercial rental properties. Any property you own outside of the United States is depreciated over a 30- or 40-year period, respectively. Depreciation stops when either the asset is no longer used or its cost or other basis has been fully recovered.

Types of Depreciable Real Estate

The IRS determines what types of properties you can claim depreciation on. Here are some typical examples of the property types that fall into residential or commercial rental property:

Residential Rental Property | Commercial Rental Property |

|---|---|

Single and multifamily homes | Warehouses |

Condominiums | Office buildings |

Apartment complexes | Manufacturing facilities |

Mobile homes | Shopping malls |

If you live in a property and sublet either all or part of it, then you cannot claim depreciation on it because you do not own it. However, if you own a house you’re renting out as an Airbnb or a factory you’re renting out as an industrial facility, you can claim depreciation.

Under MACRS, you can get bonus depreciation if the cost of some fixtures and furniture is accounted for separately from the cost of the building as a whole. You can have an engineer, an appraiser, or a contractor look at the furniture and fixtures to give you an estimate of their FMV. Read our guide to bonus depreciation for a comprehensive explanation and to find out whether your building’s components qualify.

Step 3: Calculate Depreciation Expense

Depreciation on real property is calculated using the straight-line method and the midmonth convention. With straight-line depreciation, the asset’s adjusted basis is steadily lowered over time, with each year allocated the same amount of depreciation. The midmonth convention means that depreciation in the year a property is placed in service or is disposed of is calculated for a half-month, rather than having to calculate depreciation to the exact day.

Your MACRS depreciation deduction can be calculated using one of two methods:

- The depreciation method and convention that apply over the recovery period of the property.

- The percentage from the MACRS percentage tables.

Both methods should result in the same depreciation amount with perhaps some rounding differences.

Calculating MACRS depreciation should be left to either tax preparation software or a tax specialist but it’s still a good idea to learn how this works. You can check our list of the best online tax preparation services for recommendations, and you might also find it helpful to read our MACRS depreciation guide, which has the MACRS tables and a calculator and a guide on how to use them.

Let’s discuss how to calculate rental property depreciation manually, and then you can compare it to depreciation from the tables.

1. Calculate Depreciation for Year Placed in Service

Depreciation in the first year is figured a little differently than in subsequent years. Let’s take a look at the formula you’ll use to calculate depreciation for the year the property was placed in service.

First year depreciation = (Depreciable Basis/ Recovery Period) x Convention

The convention is the percentage of the year the asset was placed in service, assuming it was placed in service during the middle of the month. For example, if an asset was placed in service anytime during the month of April you must calculate depreciation for 8.5 months (April 15–December 31).

Convention in the above equation would be:

Convention for April acquisition = 8.5/12

2. Calculate Annual Depreciation

Annual depreciation is equal to the cost of the asset divided by the MACRS life of the asset. Let’s take a look at that equation:

Annual depreciation = Depreciable Basis /Recovery Period

3. Calculate Depreciation for Year of Disposal

To calculate depreciation in the year of disposition, you can use the following formula:

Year of disposal = (Depreciable basis/Recovery Period) x Convention

As with the year placed in service, the convention is the percentage of the year the asset was in service, assuming it was disposed of in the middle of the month. For example, if the rental property was sold on April 2, you would calculate depreciation for 3.5 months (January 1–April 15).

Convention in disposal equation would be:

Convention for April disposal = 3.5/12

Step 4: Report Depreciation on Your Tax Return

Once you have figured out how much depreciation you can claim, you’ll need to report your depreciation deduction on IRS Form 4562. The line that you are required to report this information on depends on the type of property you own.

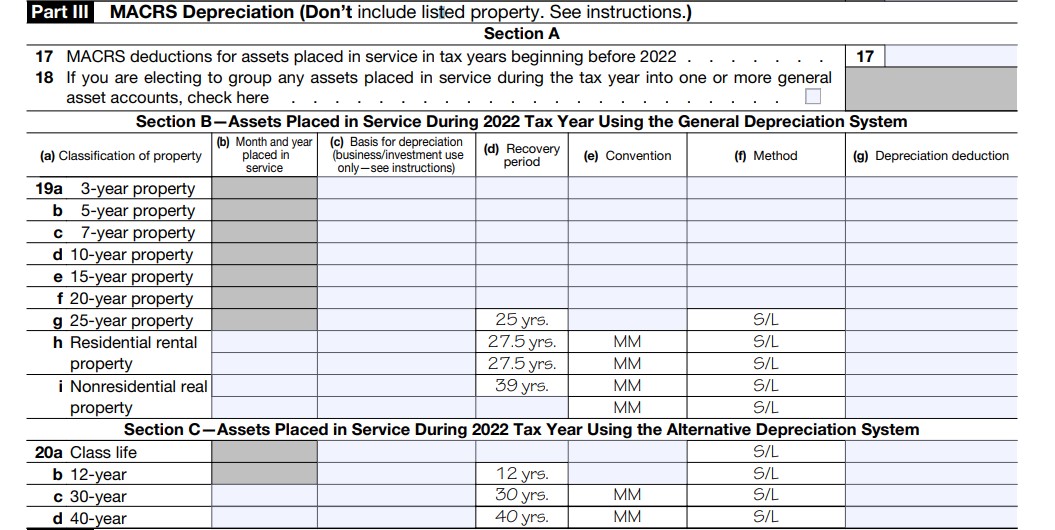

- Residential rental property: Part III, Section B, line h

- Commercial real estate: Part III, Section B, line i

IRS Form 4562 Part III

Then, depending on whether you are a real estate investor or real estate professional, you will report the deduction on Schedule E or Schedule C, respectively.

Depreciation reduces the adjusted basis of your rental property and, therefore, increases the gain—or decreases the loss—you recognize when you eventually sell the building. If you want to hold off on paying tax when you sell your rental property, you may want to consider a 1031 exchange.

Example of Residential Rental Property Depreciation

We’ll use the percentage table to work through an example to illustrate the process of depreciation.

On Jan. 1, 2022, Mr. X purchased a single-family home to operate an Airbnb for $250,000. The purchase price reflects the FMVs of the land ($100,000) and the structure ($150,000)

Because land is not subject to depreciation, only the value of the structure itself will be taken into account. Mr. X must also use the straight-line method and midmonth convention to calculate his depreciation deduction. Since he purchased the building on Jan. 1, 2022, depreciation began on Jan. 15, 2022, as per the rules of the midmonth convention.

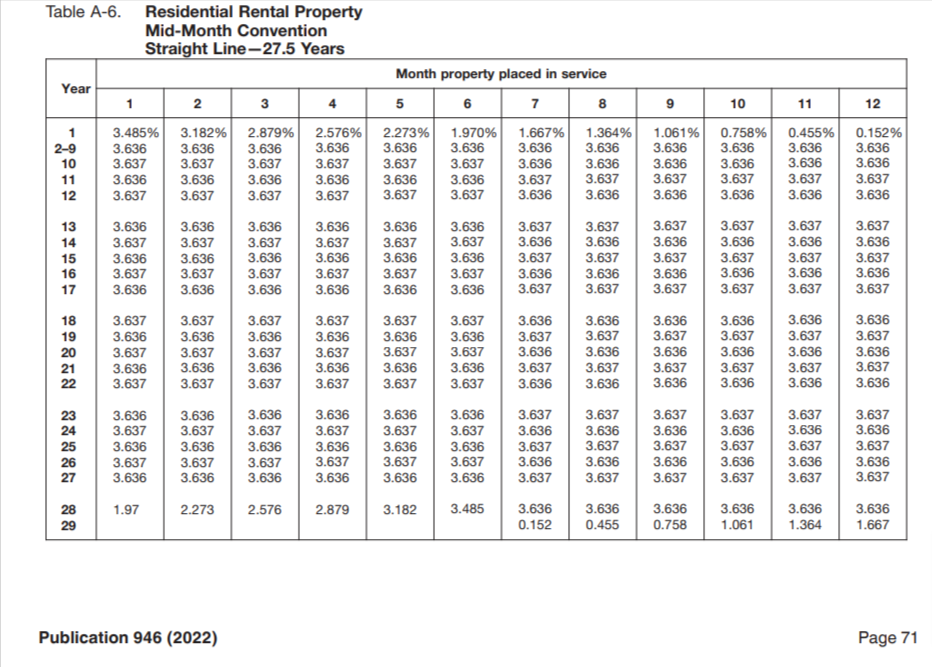

Let’s look at his depreciation schedule. For each year, we will multiply the basis by the depreciation rate. You can follow along using the facts above and Table A-6 from IRS Publication 946.

Table A-6 from IRS Publication 946

Let’s assume that Mr. X sells the property in June 2027 for $500,000. He would be allowed the following yearly depreciation:

Year | Method | Recovery Period | Basis | Rate | Depreciation |

|---|---|---|---|---|---|

2022 | SL | 27.5 years | $150,000 | 3.485% | $5,228 |

2023–2026 | SL | 27.5 years | $150,000 | 3.636% | $5,454 |

2027 | SL | 27.5 years | $150,000 | 1.667%* | $2,500 |

*The depreciation rate in the final year is the annual rate of 3.636% times 5.5/12 since he owned the building for 5.5 months.

The total depreciation claimed for years 2022 through 2027 is $29,544.

Step 1: Calculate the Adjusted Cost Basis of the Rental Property

Using the purchase price minus the annual depreciation calculated above, we can calculate the adjusted cost basis, which comes to $220,456:

Adjusted basis: $250,000 – $29,544 = $220,456

Step 2: Calculate the Gain on the sale of the Rental Property

The gain on the sale is the $500,000 sales price less the $220,456 adjusted basis:

Gain: $500,000 – $220,456 = $279,544

The entire gain of $279,544 is referred to as a Section 1231. Section 1231 gains are usually treated as capital gains unless you have other 1231 losses in excess of this gain.

Calculating tax on Section 1231 gains and losses is complicated and probably deserves the attention of a tax professional. However, the basic idea is that after netting all of your 1231 transactions, if you have an overall gain, then all 1231 transactions are treated as capital. If you have an overall 1231 loss, then you treat all 1231 transactions as ordinary income.

Example of Commercial Rental Property Depreciation

Let’s look at another example using the same facts as above, except Mr. X purchased a warehouse on June 1, 2022, that he plans to use for his business, Widgets ‘R’ Us.

Mr. X wants to sell his property in about seven years, so he went to his accountant, Ms. Y, to get tax projections for the coming years. Mr. X plans to sell the building for $800,000 Let’s learn what his potential gain will be.

Since land is not subject to depreciation, only the value of the building itself will be taken into account. Mr. X must also use the straight-line method and the midmonth convention to figure his depreciation deduction. Since he bought the building on June 1, 2022, depreciation began on June 15, 2022, as per the midmonth convention.

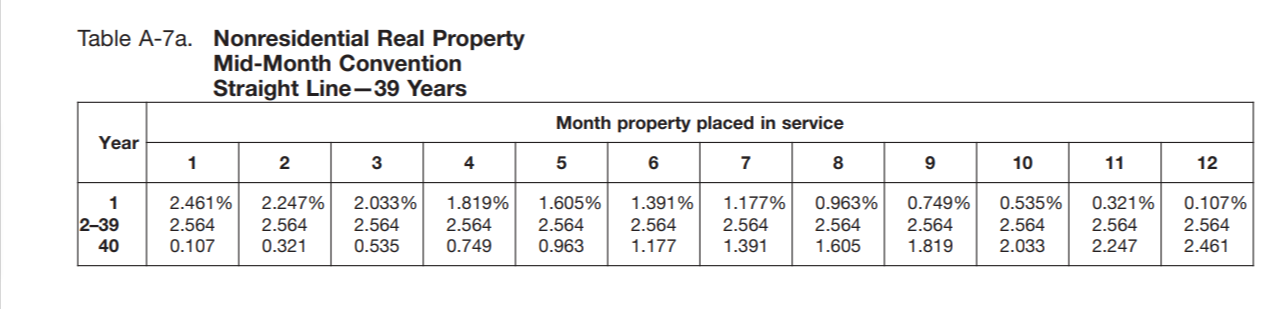

Let’s look at his depreciation schedule. For each year, we will multiply the basis by the depreciation rate. You can follow along using the facts above and Table A-7a from IRS Publication 946.

Table A-7a from IRS Publication 946

Let’s assume that Mr. X sells the property in June 2029 for $800,000. He would be allowed the following yearly deprecation:

Year | Method | Recovery Period | Basis | Rate | Depreciation |

|---|---|---|---|---|---|

2022 | SL | 39 years | $150,000 | 1.391% | $2,087 |

2023–2028 | SL | 39 years | $150,000 | 2.564% | $3,846 |

2029 | SL | 39 years | $150,000 | 1.177%* | $1,765 |

*The depreciation rate in the final year is the annual rate of 2.564% times 5.5/12 since he owned the building for 7.5 months.

The total depreciation claimed for years 2022 through 2029 is $26,928.

Step 1: Calculate the Adjusted Cost Basis of the Rental Property

Using the purchase price minus the annual depreciation, we can calculate the adjusted cost basis, which comes to $223,072:

Adjusted basis: $250,000 – $26,928 = $223,072

Step 2: Calculate the Gain on the sale of the Rental Property

The gain on the sale is the $800,000 sales price less the $223,072 adjusted basis:

Gain: $800,000 – $223,072 = $576,928

The entire gain of $576,928 is referred to as a Section 1231. Section 1231 gains are usually treated as capital gains unless you have other 1231 losses in excess of this gain.

Frequently Asked Questions (FAQs)

The depreciation method used for rental property is MACRS, which requires straight-line depreciation over 27.5 years for a residential property and 39 years for commercial property.

Depreciation adjustments, sometimes known as “catch-up,” are made when it turns out that no depreciation was claimed in prior years or you claimed more or less than the allowable amount of depreciation. If you need to make this adjustment, you can do so using IRS Form 3115.

No, you can’t, as land can never be depreciated. Since land is not depreciable, the cost basis for depreciation must be calculated by allocating a portion of the purchase price to the building.

Bottom Line

Depreciation is a powerful tool that can be used to reduce your tax liability and increase your cash flow. If you’re a real estate investor, you do not want to miss out on this deduction this tax season. If you’d like to learn more about additional deductions for rental property, read our article on the Top 12 Rental Property Tax Deductions & Benefits.