Form 944 is an IRS form that very small businesses use to file their employer taxes on an annual basis. It is specifically for businesses that have at least one employee and owe less than $1,000 annually in federal taxes (income tax withholdings plus Social Security and Medicare taxes). This article covers the when and how to use Form 944, as well as how to fill it out.

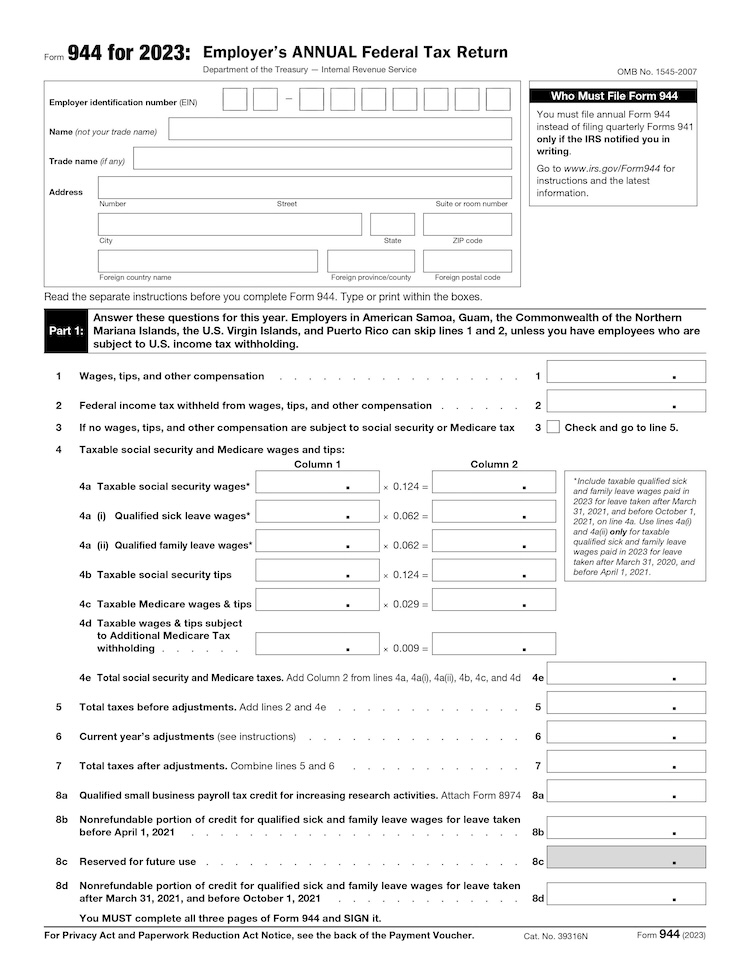

You can download Form 944 by clicking the image below—or do so directly from the IRS Website. The IRS also allows you to fill it out directly on their site. Read on to find out how to fill out each part of the form.

Key Takeaways:

- Form 944 requires IRS permission to file.

- It must be filed by Jan. 31 each year.

- This is a time-consuming process, so you consider using software to help with filling and filing.

Contact Information

- Enter your Employer Identification Number (EIN).

- Name: Use your legal business name. This is the name of the person or entity that owns the company. In the case of most very small businesses, it will be the owner’s name or the LLC name.

- Trade name: This is the name you do business under. They may be different.

- Address: If you have more than one location, use the address of your headquarters.

Part 1

Special Instructions on Numbers

- The form provides decimal points. Put dollars to the left of the decimal point. Put cents to the right, even if it is 00.

- Do not use dollar signs.

- If the entire amount is zero, leave it blank.

- Use a minus sign for negative amounts when possible. Otherwise use parentheses, e.g., -1.00 or (1.00).

- Line 1: This is the annual total from box 1 of your employees’ Form W-2.

- Include sick pay from a third party if you were given timely notice and have liability for the taxes. If you were the third party and transferred liability, do not include sick-pay payments.

- Line 2: Enter income taxes you withheld or were required to withhold on earnings. This does not include third-party sick pay.

- Line 3: Check this box if none of the wages, tips, or compensation is subject to Social Security or Medicare taxes. Jump to line 5.

- Line 4a: Enter total wages, sick pay, and taxable fringe benefits that are subject to social security tax. Do not include tips. If an employee’s taxable wages (including tips) reach $160,200 for the year, use that as their total wages in your calculations. Then multiply by 0.124 to get column 2.

- Line 4b: Enter all tips your employees reported to you during the year until the total of the tips and wages for an employee reaches $160,200 for the year. Then multiply by 0.124 to get column 2.

- Line 4c: Enter all wages, tips, sick pay, and taxable fringe benefits that are subject to Medicare tax. Unlike line 4a and 4b, use the full amount even if it exceeds $160,200. Multiply by 0.029 to get column 2.

- Line 4d: If you paid an employee more than $200,000, then you are subject to additional Medicare tax withholding. For any employees that earned over $200,000, you need to enter the amount paid over that $200,000. For example, if Employee A earned $210,000 and Employee B earned $215,000, you will enter $25,000. Multiply this by 0.09 for column 2.

- Line 4e: Add columns 2 inline 4a through 4d and put it here.

- Line 5: Add Lines 2 and 4e.

- Line 6: There are many reasons to have adjustments, such as previously filed Form 944s, fractions of cents, sick pay, and group life insurance. Refer to the instructions on the IRS website. Enter this as a negative number if needed.

- Line 7: Combine lines 5 and 6.

- Line 8a: If you qualify for a payroll tax credit, enter the amount of credit from Form 8974 line 12. Leave this line blank if this credit does not apply to you.

- Line 8b: If you paid qualified sick leave or family leave wages in 2023 for leave taken after March 31, 2020, and before April 1, 2021, enter it here.

- Line 8c: Leave this blank.

- Line 8d: If you paid qualified sick leave or family leave wages in 2023 for leave taken after March 31, 2021, and before Oct. 1, 2021, enter the non-refundable portion here.

- Lines 8e and 8f: Leave this blank.

- Line 8g: Add all lines 8 together and enter the total here.

- Line 9: Subtract line 8g from line 7.

- Line 10a: Enter your total deposits for the year and include overpayments applied from a previous year, plus overpayments applied from Forms 944-X, 944-X(SP), 941-X, or 941-X(PR).

- Line 10b and 10c: Leave this blank.

- Line 10d: If you paid qualified sick leave or family leave wages in 2023 for leave taken before April 1, 2021, enter that amount here.

- Line 10e: Leave this blank.

- Line 10f: If you paid qualified sick leave or family leave wages in 2023 for leave taken after March 31, 2021, and before Oct.1, 2021, enter the amount here.

- Line 10g: Leave this blank.

- Line 10h: Add all lines 10 together and enter the total here.

- Line 11: If line 9 is more than 10h, enter the difference here. Do not enter on both lines 11 and 12.

- Line 12: If line 10h is more than line 9, enter the difference here. Do not enter on both lines 11 and 12.

Part 2

Line 13: If line 9 is less than $2,500, check the box and go to Part 3. If line 9 is more than $2,500, fill out lines 13a through 13l with your monthly tax liabilities. Then, add them up and put the total in 13m.

- If your tax liability is negative, enter zero and subtract that amount from the following month’s liability.

- If 13m does not equal line 9, check your math and your records. If it still does not match, payments may not be counted as timely.

- If you are a semiweekly depositor, then you need to fill out Form 945-A instead.

Part 3

Lines 14 through 26 ask questions about your business. Answer them completely and be sure to leave any lines that don’t apply to your business, as well as those marked “Reserved for future use,” blank.

- Line 14: If your business has closed or stopped paying wages, mark this line.

- Line 15: Enter any qualified health plan expenses for qualified sick leave wages taken before April 1, 2021.

- Line 16: Enter any qualified health plan expenses for qualified family leave wages taken before April 1, 2021.

- Line 17 and 18: Leave this blank.

- Line 19: Enter any qualified health plan expenses for qualified sick leave wages taken after March 31, 2021 and before Oct. 1, 2021.

- Line 20: Enter line 19 amount.

- Line 21: Enter any amount from line 19 under collective bargaining agreements.

- Line 22: Enter any qualified health plan expenses for qualified family leave wages taken after March 31, 2021 and before Oct. 1, 2021.

- Line 23: Enter line 22 amount.

- Line 24: Enter any amount from line 22 under collective bargaining agreements.

- Line 25 and 26: Leave this blank.

Part 4

If you have someone else handling your accounts, like an employee or tax preparer, and want to allow the IRS to contact them for questions, fill out this section. This has to be the name of a specific person, not the name of an organization or a person’s job title. Either you or your designee must choose a five-digit PIN that the IRS will use to confirm the person’s identity when talking to them.

Part 5

Use your legal name and title, plus the best daytime number where you can be reached. Only the following people are authorized to sign Form 944:

- Sole proprietorship owner

- Corporation president, vice president, or another principal officer

- A partner, member, or other partnership officer

- A fiduciary of a trust or estate

Special Instructions for Additional Sheets and Attachments

- Write your EIN, “Form 944,” and the tax year on any attachments.

- Staple attachments to the upper left corner of the form if filing paper forms.

This is specifically for small businesses that have no employees or very few employees. If you withhold less than $1,000 per year in federal payroll taxes, then you may qualify to use this form instead of Form 941. That translates into roughly less than $5,000 in wages paid out during a calendar year.

Wages include salary and hourly employees plus commissions, tips, and other taxable earnings. It does not include payments made to contractors.

You must have IRS permission to file a Form 944. New business owners are told when they receive their Employer Identification Number (EIN) if they can file a 944. Existing businesses who have previously filed Form 941 need to request permission to file a 944.

Most employers are familiar with Form 941. Form 941 is used for employers who report wages and taxes four times a year (at the end of each quarter), while Form 944 is for those who can report once a year instead. Both forms report wages, tips, withholdings, and employment tax adjustments.

You should use Form 941 if you have employees and don’t receive notice from the IRS to file a 944 (or if you do not qualify to file a Form 944). Do not use Form 941 if:

- You filed a final return

- You are a seasonal employer

- You handle farm or household employee payroll

To learn about more payroll forms, check out our guide to employer payroll forms.

If you are an established business that currently files Form 941 but think you qualify to file Form 944, you may write to the IRS to get permission to use this form instead. You need to make this request in writing between Jan. 1 and March 1 of the year. Alternatively, you can call the IRS between Jan. 1 and April 1.

You must file Form 944 by Jan. 31 of the year following the year being reported.

Thus for the 2023 tax year, you must file by Jan. 31, 2024. If you have been making deposits on time and in full, you can file as late as February 10. If the deadline falls on a Saturday, Sunday, or holiday, you can file by the next business day.

Pro Tip: It’s important to work Form 944 into your payroll process. Set your own deadline each year to have it prepared, verified, and filed.

You can fill out the 944 online, download and print it, or e-file it. If you choose to mail your form in, you need to use the US Postal Service, as many postal delivery services cannot deliver to P.O. boxes. Where you send the form depends on where you are filing and if you are including a payment. E-filing requires IRS-approved software. There may be charges, and you need an electronic signature.

Finally, some tax accountants and payroll services may file Form 944 for you. Check with your payroll service if interested.

If you need a payroll provider that will prepare, file, and fill out Form 944—as well as pay your taxes—for you, consider Gusto. It performs all payroll tax calculations automatically and doesn’t charge extra to file the forms. Try it free for 30 days.

Form 944 allows you to pay taxes only once a year. However, you should be depositing withholdings on a monthly or semimonthly basis. The IRS determines this with a lookback period: How much you paid in taxes in a prior year.

If you previously used Form 941 but qualified for a Form 944 in 2023, you would need to look at the taxes you paid in 2022. If you reported $50,000 or less of taxes for the lookback period, you must deposit monthly; if you reported more than $50,000, then you should deposit semiweekly.

See the IRS Publication 15 for details. Form 944 helps you calculate how much you must pay in excess of the already scheduled deposits. To learn about more taxes you may be responsible for paying, check out our guide on employer taxes.

If you owe less than a dollar, you do not need to pay.

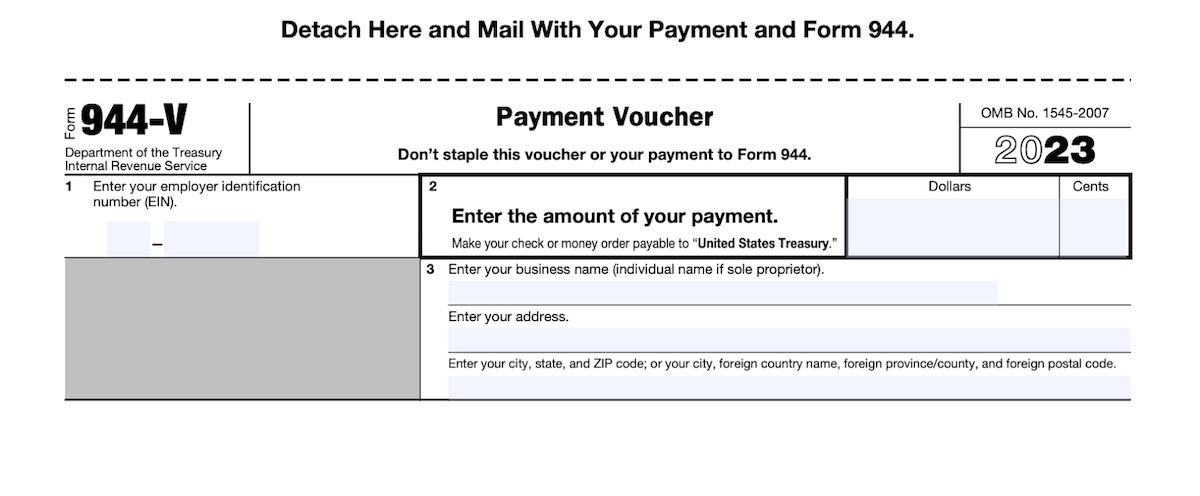

Page 3 of Form 944 contains 944-V, which is a voucher you can use to send in payment via check or money order with your form. The IRS uses the 944-V to credit the payment more quickly. However, you can only use this form if:

- You are filing and paying on time.

- Your net taxes are less than $2,500 and you are paying in full.

- Your net taxes are over $2,500 but you have already deposited taxes owed for the first three quarters of the year, then you may use the 944 to pay the remaining taxes if they are less than $2,500 and you are paying in full.

- You have scheduled monthly deposits in accordance with the Accuracy of Deposits rule. In this case, your payment may be over $2,500.

If you do not qualify for the 944-V, then you must make deposits using the IRS Electronic Federal Tax Payment System (EFTPS). Using a 944-V to make a deposit that should be electronically deposited will result in a penalty. Deposits must be made by 8 p.m. Eastern time the day before the date the deposit is due.

Detachable Form 944-V contained within the Form 944 document

- Line 1: Enter your EIN.

- Line 2: Enter the amount due. Note that the dollars and cents have different sections. Be sure it is less than $2,500 unless you’ve been making monthly deposits.

- Line 3: Enter your business name and address.

- Make checks or money orders to “United States Treasury”: Write “Form 944,” the tax year, and your EIN on the check or money order. Do not staple the check to the form.

Frequently Asked Questions (FAQs) About Form 944

What is the main difference between Form 944 and Form 941?

Form 944 is designed for small employers whose annual liability for Social Security, Medicare, and withheld federal income tax is $1,000 or less. This form allows your business to report taxes annually instead of quarterly, as required with Form 941.

When do I have to file Form 944?

Form 944 is due to the IRS each Jan. 31 of the year following the reported tax year. If the due date falls on a weekend or government holiday, the deadline is the following business day. You may be eligible for an extension to Feb. 10, but don’t assume this is the case unless the IRS notifies you.

How do I make a payment when filing Form 944?

Payments are made via the IRS EFTPS. You can pay by credit card, debit card, or with a check or money order if accompanied by Form 944-V. If you’re paying with a check or money order, make sure it’s made payable to the United States Treasury and includes your EIN, Form 944, and the tax period.

Bottom Line

IRS Form 944 is an annual federal tax return for very small businesses that either have no employees or are liable for less than $1,000 taxes in a calendar year. You need IRS permission to file this form instead of Form 941, which is for quarterly tax filing. Be sure to fill it out correctly to avoid penalties. Even if you use this form, you need to make payments electronically according to your monthly or semiweekly schedule; check payments can be made with the form in specific circumstances.