Creating a business budget is an important step in planning. A small business budget starts with creating the budgeting process, the operating budgets, such as sales, inventory and purchases, cost of goods sold (COGS), and sales and administrative, and ends with the financial budgets, such as cash, capital, and proforma financial statements.

To help you get started, we’ve provided a very simplified version of a budget spreadsheet to illustrate how information from each area of your business is combined to form an annual budget. We’ll discuss how to use this spreadsheet throughout our article.

Budgeting is an important subset of managerial accounting. Read our small business guide to managerial accounting and learn how managerial accounting concepts can be applied in a small business setup.

Step 1: Create a Budget Process

The budget process shows how the different departments of the business create a budget. Without a process, budgeting would be chaotic, and it would result in inefficiencies. In the budget process, you need to consider the following:

- Budget period: When are budgets created, reviewed, implemented, and evaluated against actual performance?

- Budgeting method: How are budgets created? Is it created from scratch (zero-based budgeting)? Is it based on actual results with adjustments (incremental budgeting)?

- Budget involvement: Who creates the budgets?

- Budget committee: Who oversees and approves the budgets?

- Budget manual: What are the guidelines for creating budgets?

The first thing to consider in the budget process is the budget period. How long should budgets be prepared? When will it be implemented? The budget period can be any time before the next business year begins. Hence, you can create next year’s budget three months prior to the end of the current year.

The crucial periods for budget planning are as follows:

- Budget preparation: The time at which managers and heads create a budget for their department.

- Budget review and approval: The time at which top management will review and approve all lower-level budgets.

- Budget implementation: The time at which all concerned parties will act upon planned activities stated in the budget. This phase runs until the effectiveness of the budget lasts.

- Budget accountability: The time at which top management will assess if the business is meeting its budgetary goals. This phase runs intermittently during the year, such as monthly, quarterly, or semiannually, especially during performance evaluation and review.

As a small business, you need not be particular about the phases. You can modify the phases depending on small business needs.

There are four different types of budgeting methods, but for small businesses, we picked only two, as they are the most appropriate for the setup:

- Zero-based budgeting: This is a budgeting technique that starts from scratch. It doesn’t use information from past budgets. Instead, departments and managers need to justify every dollar in the budget without referring to past performance or past budgeting practices.

- Incremental budgeting: This is a budgeting technique that uses actual figures from the past years and adjusts with a certain percentage. For example, if actual sales last year is $20,000, the incremental budgeted sales could be 10 percent more or $22,000.

Small businesses must consider what kind of involvement is needed during the budgeting process, given that budgets can be used to measure the performance of departments and managers. There are two kinds of budget involvement—for small businesses, authoritative budgeting is suitable if the small business owner is heavily involved in daily operations. Alternatively, participatory budgeting applies if the owner delegates decision-making to managers.

1. Authoritative budgeting

Also known as top-down budgeting, this budget involvement strategy only includes top management in the budgeting process, where operating personnel and lower-level employees have little to no say in the budget. It takes less time to create since there are fewer employees involved.

However, some operating personnel and lower-level employees may disagree with top management’s estimates in the budget. At the least, this strategy creates discord between top management and operating personnel due to conflicting views. But if prepared appropriately, authoritative budgeting reflects the business’ vision, mission, and goals better.

2. Participatory budgeting

This is also called bottom-up budgeting, and this budget involvement strategy includes operating personnel and lower-level employees in creating a budget. It is a budget co-created by everyone involved or affected by the budget being created.

It enhances the relationship between top management and operating personnel since everyone has a say in the budget. However, this strategy can take time since more employees are involved in the budgeting process. Also, some lower-level managers can use this opportunity to insert some budgetary slack so that they look good during performance.

The budget committee is responsible for compiling all lower-level budgets and assembling them into one package called the master budget and reviewing and approving budgets from different departments. For small businesses, the composition of the budget committee can be the small business owners, chief executive officer (CEO), treasurer, budget coordinator, and chief accountant.

The role of the budget coordinator is to reach out to lower-level managers and communicate the wishes of the budget committee. If you’re a family-grown small business, family members, including the small business accountant or finance officer, can be committee members.

The first order of business of the budget committee is to create a budget manual, which outlines the budgeting process. Lower-level managers and department heads will use the budget manual when creating lower-level budgets. The budget committee may also set specific budget formats and deadlines.

A budget manual standardizes the budgeting process—it ensures fairness and comparability among departments and managers. With this manual in place, you can prevent the instance of inserting unfamiliar line items in the budget or using different sources in forecasting budgeted figures.

The budget manual should include the following:

- Statements of budgetary purpose

- Budgetary activities, such as budget preparation, budget hearing and evaluation, budget approval, budget execution, and budget accountability

- Schedule of budgetary activities and deadlines

- Sample budgets

- Key assumptions used in budgeting

You can create a budget easily using QuickBooks Online. Its budgeting functions create budgets per account in the chart of accounts. Read our QuickBooks Online review for detailed information on our recommendation.

Step 2: Determine Key Assumptions in Budgeting

After performing the groundwork for budgeting, the next step is determining the key assumptions. These assumptions make it easy to prepare budgets since not all information is readily available until it happens. These assumptions are not arbitrary because they must be based on past experience and good business practices.

Examples of assumptions are:

- Sales forecast

- Selling price per unit

- Cost per unit

- Estimated discounts given to customers

- Estimated sales returns

- Desired ending inventory per month or quarter

- Number of raw materials used to produce one good unit

- Number of labor hours needed to produce one good unit

- Number of overhead hours (if any) needed to produce one good unit

- Inventory cost flow method used, such as first-in, first-out (FIFO), last-in, first-out (LIFO), or average cost

- Cash collection patterns

- Cash payments patterns

- Cash retention policies

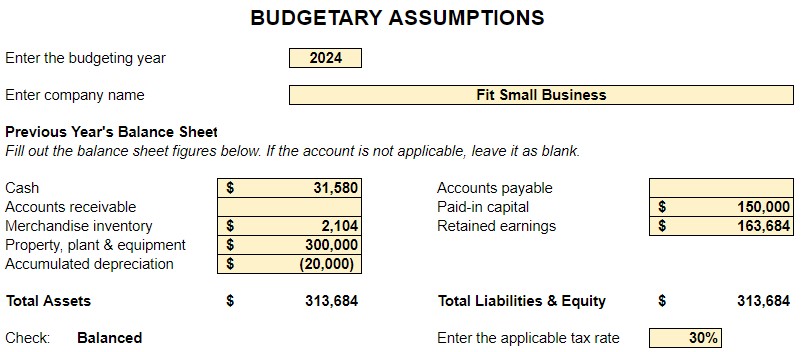

Input your assumptions in the second tab of our downloadable spreadsheet. When done, all of the reports will automatically populate. It’s the quality of your assumptions that will determine if your budget is realistic. As you improve your budgeting process, you’ll come up with additional assumptions to include in the process.

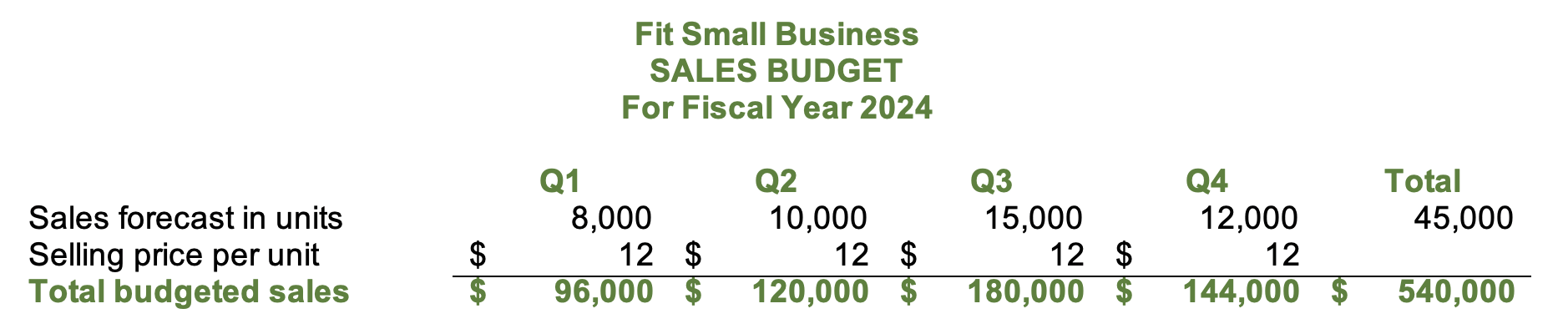

Step 3: Create the Sales Budget

The sales budget is the first budget that should be prepared because almost all budgets will depend on the information in it. It is the responsibility of the sales department to forecast and create the sales budget of the company, and it is crucial that the department forecast sales reasonably using the appropriate forecasting method. Our article about sales forecasting discusses the method of sales forecasting and shows how CRM software can help.

Below is an example of the sales budget taken from our small business master budget template.

Sales budget

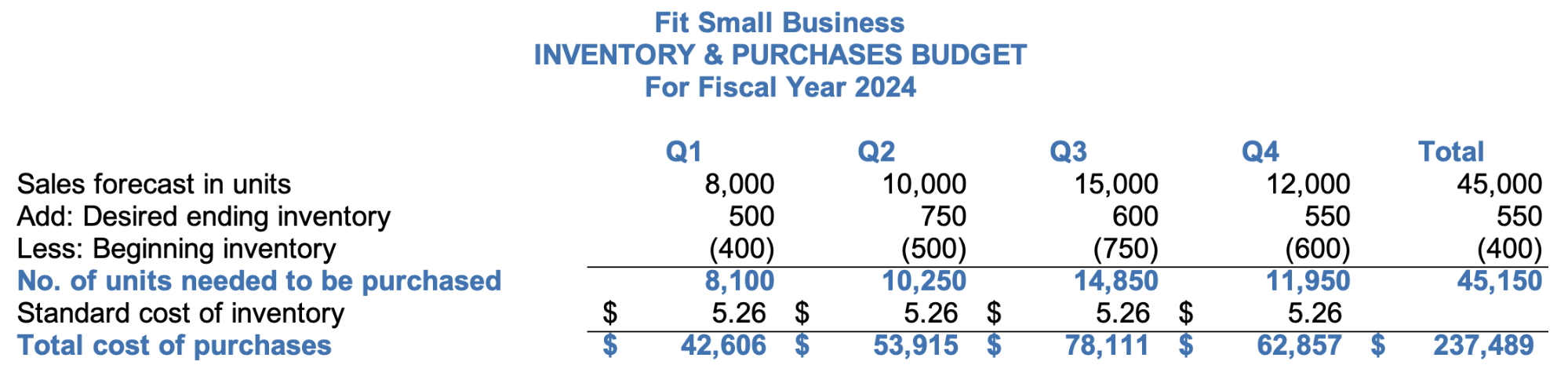

Step 4: Create the Inventory & Purchases Budget

There are two ways to call this budget: merchandising companies can call it inventory and purchases budget while manufacturing companies can call it production budget. However, the information shown in this budget remains the same. The inventory or production budget shows the number of units needed to meet the sales demand.

Inventory budget

The image above shows the sample inventory budget in our free template. One of our assumptions is that the business intends to keep 5% of next quarter’s sales forecast as current quarter’s ending inventory. In Q1, desired ending inventory is 500 units, which is 5% of 10,000 units of Q2’s sales forecast.

After determining the number of units needed, multiply them to the standard cost of inventory to get the total cost of inventory. The standard inventory cost is also the budgeted cost of inventory. Since some inventory prices fluctuate, setting standard costs makes it easy for us to budget.

When adding values in the total column, do not sum up the values in the beginning and desired ending inventory rows. Instead, the total beginning inventory in the total column should be the Q1 beginning inventory, while the total ending inventory should be the Q4 ending inventory.

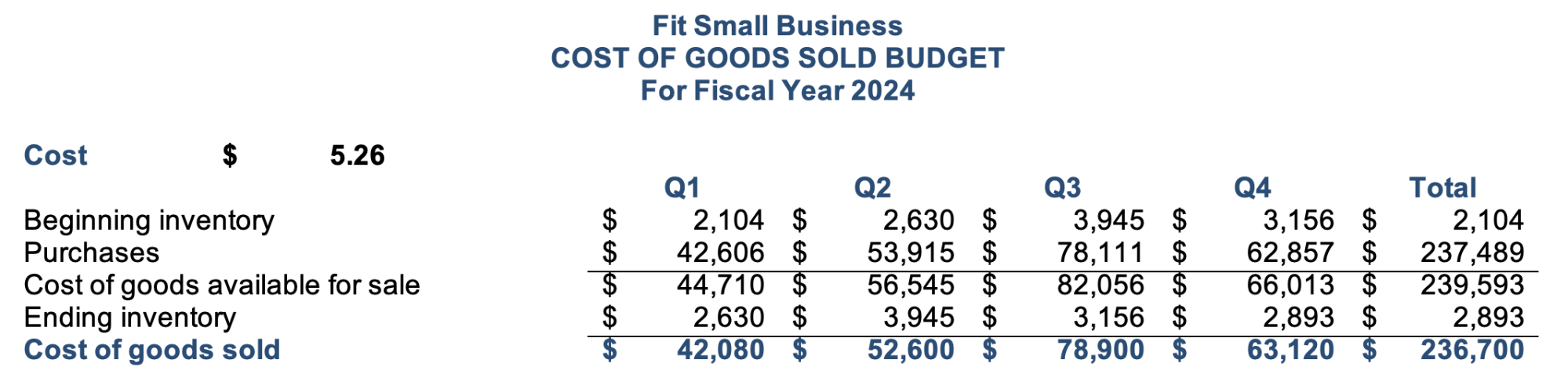

Step 5: Create the COGS Budget

The next logical step after budgeting inventory and purchases is to determine the COGS. Through the COGS budget, we can estimate the level of COGS per quarter. This budget is necessary for preparing the proforma income statement.

Below is the COGS budget from our small business budget template:

COGS budget

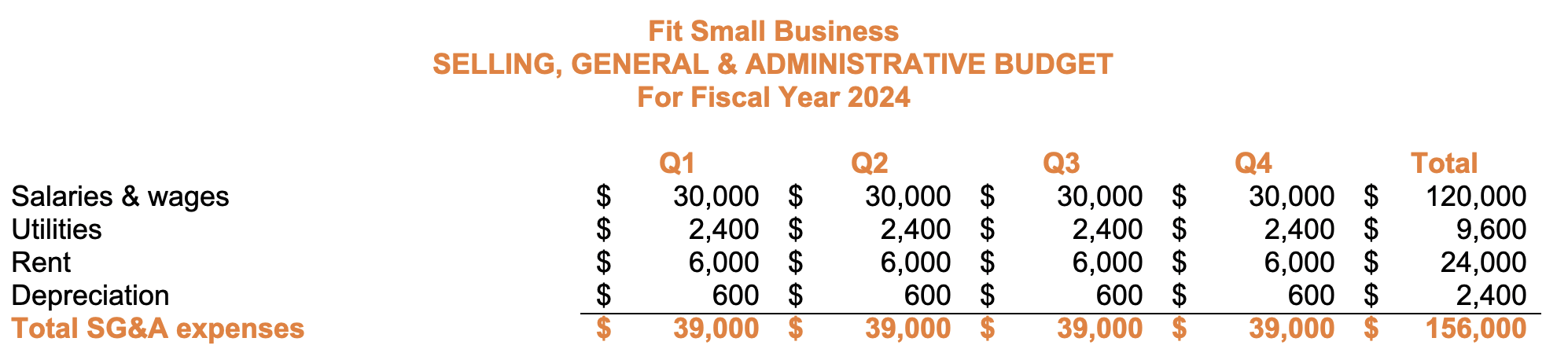

Step 6: Create the Sales & Administrative Budget

The sales and administrative (S&A) budget presents the budgeted costs for sales expenses, office expenses, and administrative expenses. This is necessary for budgeting the salaries of employees and other fixed expenses. The image below shows the sales and administrative budget from our template:

S&A budget

Most expenses in this budget are fixed costs. That’s why the amounts are the same for every quarter. Manufacturing companies may also call this budget a “fixed overhead budget.”

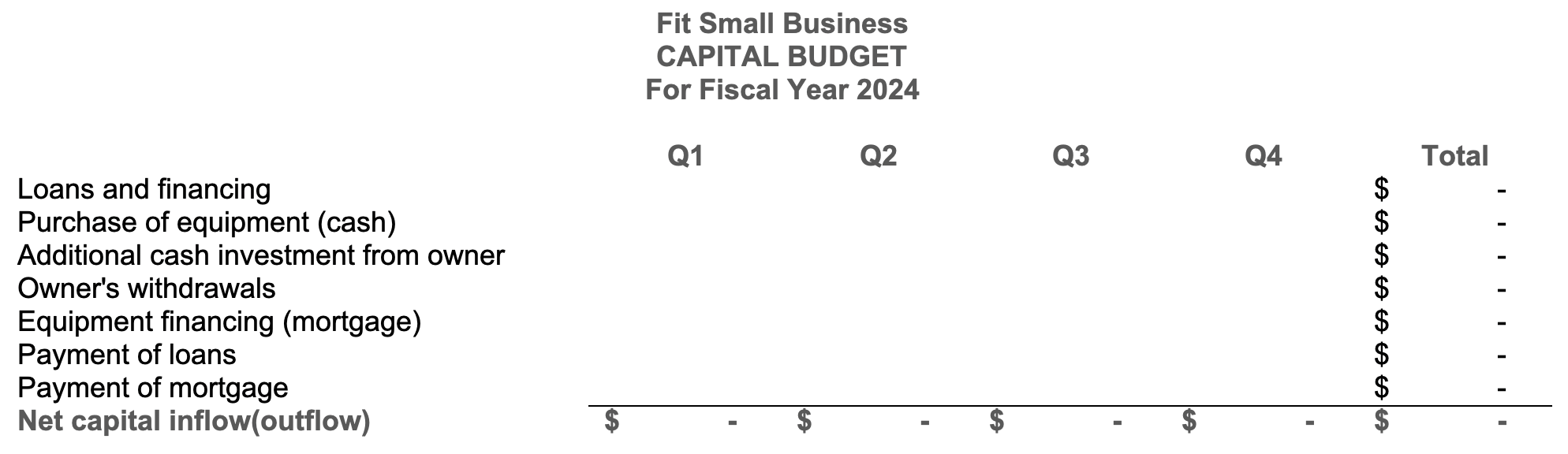

Step 7: Create the Capital Budget

A capital budget shows all the planned capital expenditures during the year. In our capital budget example below, there are no figures because the sample company didn’t plan any capital decisions for 2024. However, we’ve included common capital decisions for you to fill out when you use our template. For instance, a bank loan is a capital inflow while the purchase of equipment is a capital outflow.

Capital budget

The capital budget in our downloadable spreadsheet does not auto-populate from the assumptions tab. Instead, enter your budgeted loans and purchases directly in the report.

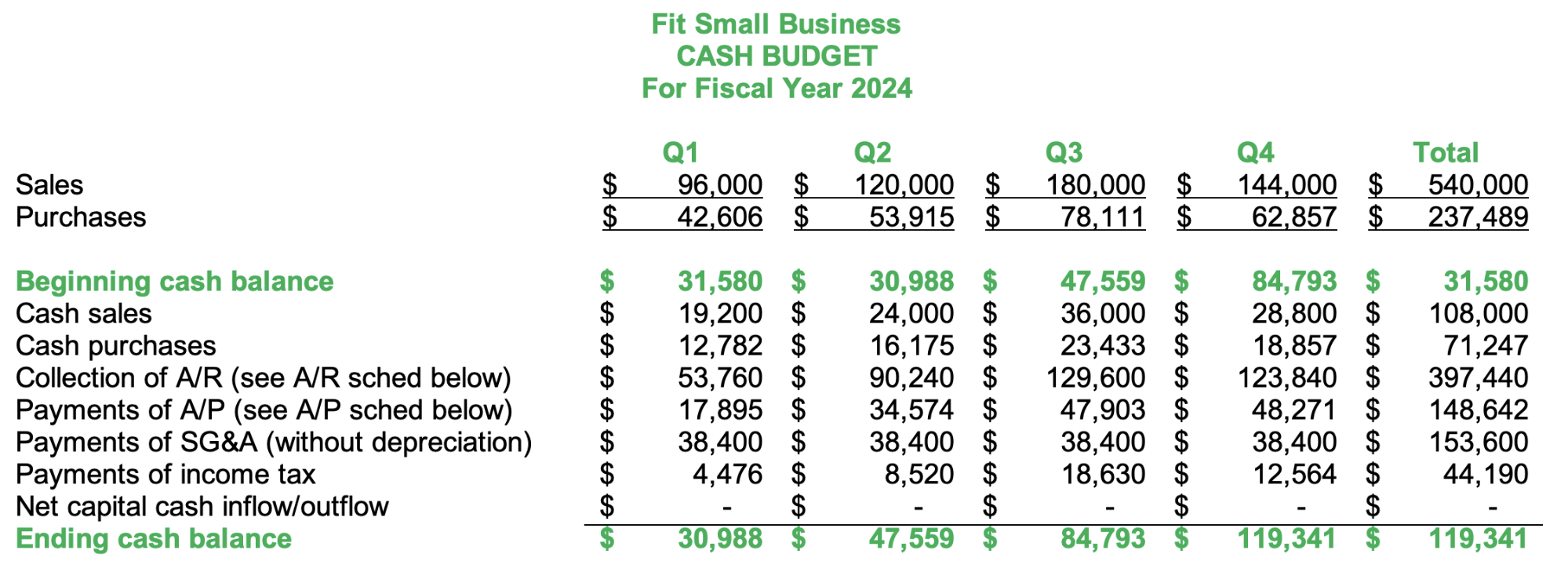

Step 8: Create the Cash Budget

The last budget that you need to prepare is the cash budget, which shows all the cash inflows and outflows from all budgets. Almost all budgets above affect cash flow. For example, the sales budget can show all cash inflows from cash sales and subsequent cash collections from credit sales.

Cash budget

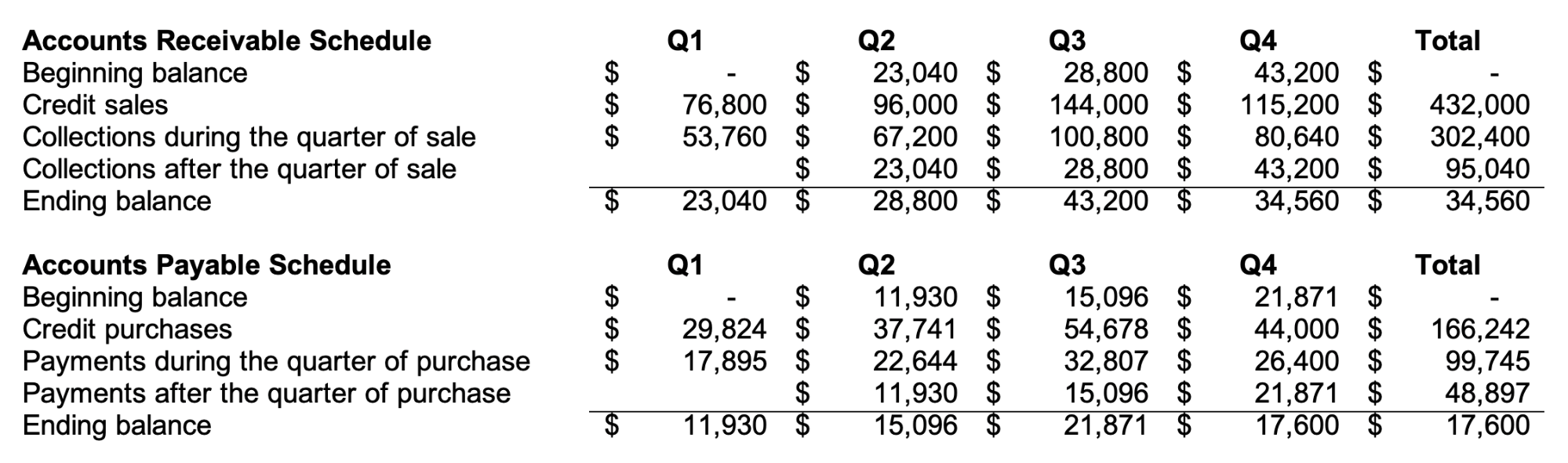

Accounts Receivable & Accounts Payable Schedule

Collections from accounts receivables (A/R) and payments of accounts payable (A/P) are integral parts of the cash budget. Creating the A/R and A/P schedules helps in computing the ending balance of A/R and A/P and the amount of cash collections and payments per quarter. Below are the supporting A/R and A/P schedules for our cash budget above:

A/R and A/P schedules

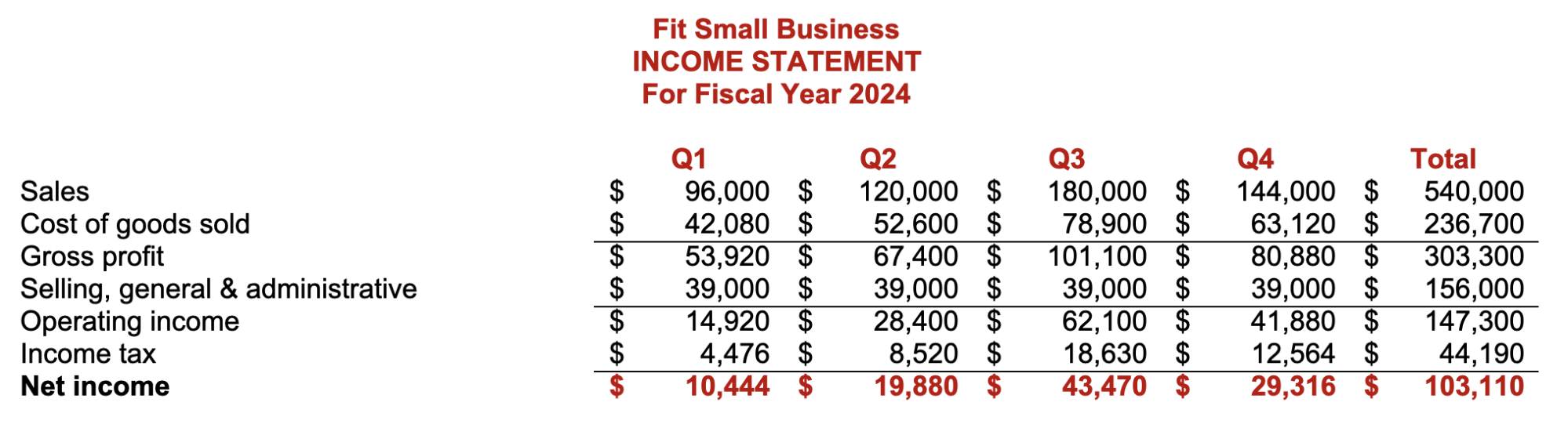

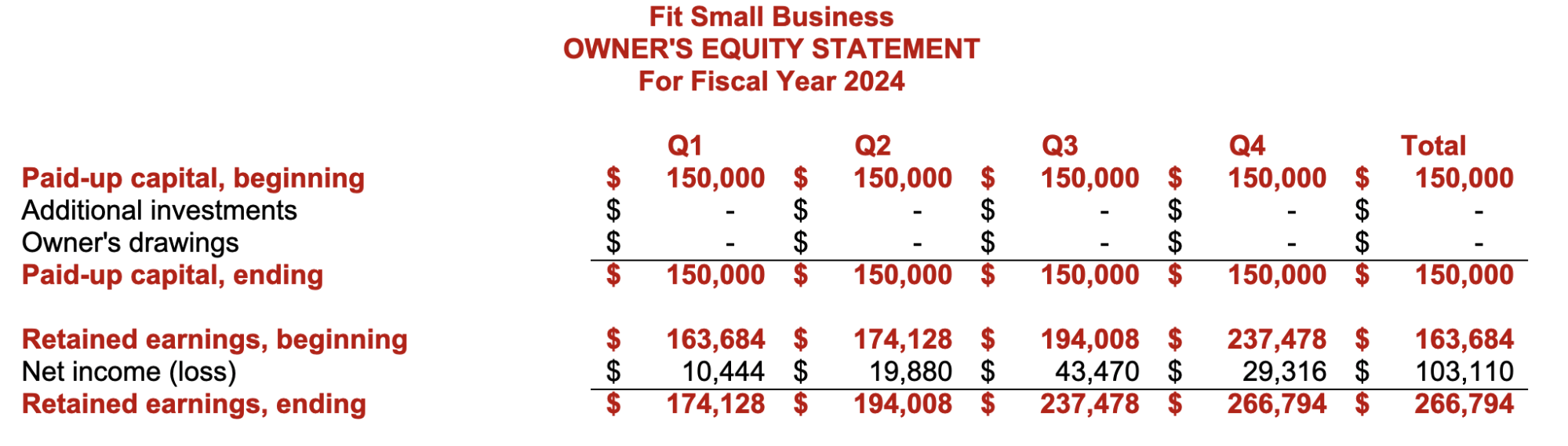

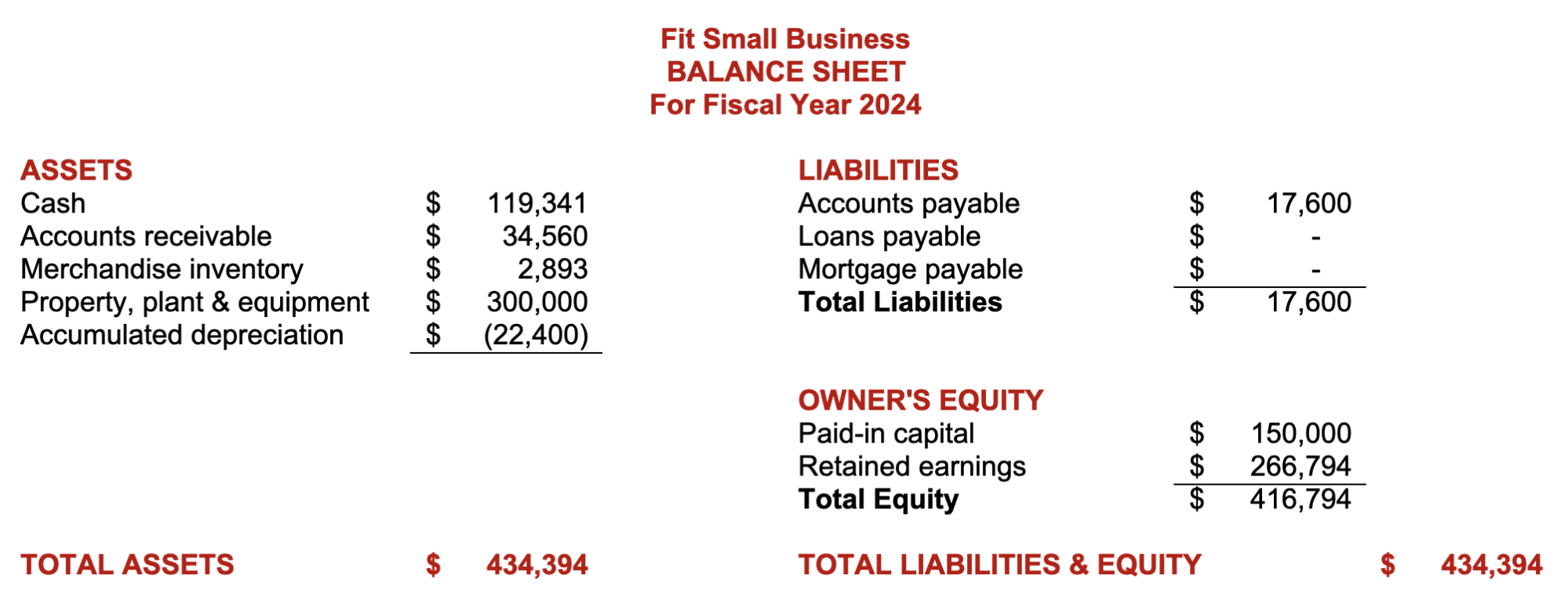

Step 9: Assemble the Proforma Financial Statements Based on Budgeted Figures

The ultimate result of the budgeting process is the proforma financial statements, which are the budgeted or projected results of planned activities. If the budget goes as planned, the actual financial statements should be near the proforma financial statements. Below are the proforma income statement and balance sheet in our small business budget template.

Common Problems in Budgeting

Budgeting helps businesses plan on future events and meet company goals. However, it is likely that you will experience difficulties and problems during the budgeting process. The four problems we’ll discuss are budgetary slack, goal incongruence, budget myopia, and standard setting.

Budgetary slack and goal incongruence occur when managers are not aligned with the business’s overall goals and objectives, while budget myopia happens when the business forgets to consider the impact of short-term decisions in the long run. Lastly, standard setting often poses a problem when standards are too high or ideal. Let’s discuss each of them in greater detail below.

Sometimes, managers and heads can use budgets to preempt results to their favor. This unethical practice is called budgetary slack or budget padding. Budget slacks occur when managers underestimate revenue goals and overestimate expense goals and when the business follows the participatory budget involvement strategy.

When time for evaluation arrives, budget slacks will make the manager’s performance as exemplary. Managers tend to include budgetary slacks when top management is too strict and punitive whenever budgets aren’t met.

For example, the sales manager underestimates the sales forecast at $50,000 for the first quarter, knowing that they can achieve actual sales of $70,000. This example shows how budgetary slack can affect performance evaluation and create a false reflection of the company’s ability to generate revenue.

Budgets are goals. When goals of management and employees don’t meet, the budget will not reflect the results that’s best for the business as a whole. Preventing goal incongruence enhances the quality of the budget. The goal of employees should be aligned with the business’s goals, and top management should provide opportunities for employees to pursue their career growth within the business.

Improper communication of business goals and ineffective leadership are the common causes of goal incongruence. As a small business owner or manager, you should show employees that you are committed to them with respect to their professional goals and that you expect them to align themselves with the business’s overall goals.

Budget myopia occurs when budgeting focuses only on short-term goals without considering how these goals will affect the company in the future. Managers become “myopic” in budgeting when they see budgets as measures for performance—they forget that the main objective of budgeting is to plan, organize, and manage the firm’s resources. As a result, budget realignments occur because there is a failure to plan future events.

Another hurdle in budgeting is setting standards, which are tools for planning and controlling. If used inappropriately, they can cause problems in the budgeting process. It is important that you have to set your standards at a practical level.

Practical standards allow room for error or inefficiencies. It gives employees a chance to learn and improve their outputs without affecting performance. Unwise managers often impose ideal standards or standards that require optimum performance and perfection.

As a result, imposing ideal standards results in employee burnout, decreased productivity, and negative employee morale. Discouraged employees might also result in dysfunctional behavior that might be detrimental to the company.

Frequently Asked Questions (FAQs)

Budgets help in planning and managing business resources. Since plans and goals require an outflow of resources, budgets help the business determine the right amount of resources needed to achieve the goal.

The small business owner should have an active role in helping managers and supervisors craft their budgets. As the owner, you should guide your employees to align their goals with the business’ overall goals.

Bottom Line

With our small business budget guide and template, you can create a small business master budget. We hope that the template will help you understand why budgeting is crucial to the planning, organizing, and controlling business operations.