Sales forecasting is the process of calculating an estimated future sales revenue within a given time, usually every week, month, quarter, and year. While it is not an exact prediction, it is an excellent basis for your sales team’s performance and can enable you to make more informed sales and marketing decisions. Learn what sales forecasting is and how it can improve your team’s short-term and long-term performance below.

Key Objectives of Sales Forecasting

As discussed in the sales forecast definition above, the goal of forecasting is to have an accurate estimate of your sales performance. Ideally, sales professionals aim to either achieve their expected sales target or exceed it. Sales forecasts also help organizations make better decisions based on a realistic prediction of future revenue, which helps them achieve the following objectives:

- Forecast estimated profit or loss within a given sales period

- Align hiring and staffing levels with predicted revenue

- Set a required level of production needed to meet forecasted demand for a product

- Provide sales leaders with accurate insights into their prospects and industry

- Help the financial department make quarterly and annual investment decisions

5 Important Benefits of Sales Forecasting

Sales forecasting is beyond predicting figures. It is a core business activity for leaders to capture relevant data for strategic decision-making with the help of the best sales forecasting software. Sales leaders use forecasts to plan sales quotas for reps across all territories and to properly budget and minimize unnecessary spending. Here are the benefits of accurate sales forecasting discussed in detail.

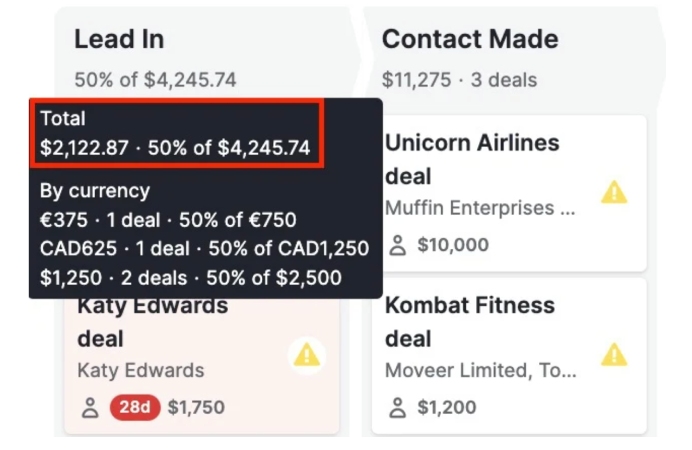

The concept of sales forecasting aims to maintain a good cash flow plan, which estimates future cash inflows and outflows. Optimizing sales forecasts using customer relationship management (CRM) powered by artificial intelligence (AI) ensures the accuracy and reliability of your cash flow plan. A good example is Pipedrive’s AI sales assistant, which recommends high-win probability deals that sales reps can focus their efforts on.

Pipedrive deal probability showing a lead 50% of the target value (Source: Pipedrive)

One of the core foundations of predicting business budget allocation is having accurate sales forecast data. With data-driven insights, startups and businesses can allocate resources efficiently. This ensures your sales team receives excellent support to meet their quotas while safeguarding the business’ financial health.

Sales forecasting can help estimate expenses and revenue based on short-term and long-term sales performance. Hence, sales leaders can use sales forecasts to discover high-revenue sales opportunities by targeting repeat customers and finding ways to broaden geographic reach.

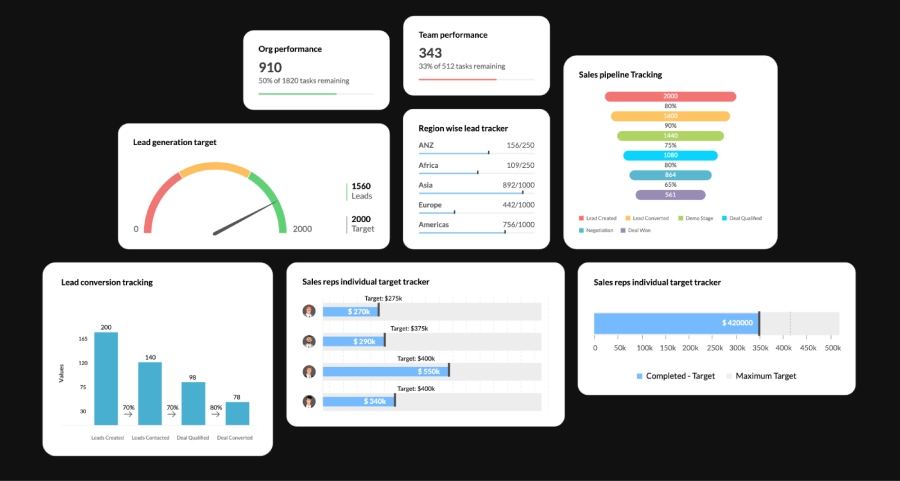

One of the aspects of sales management is performance monitoring. Sales leaders use forecast data to track salespeople’s performance, such as in terms of win rates and identify potential challenges early. Moreover, sales forecasting can be used to promote healthy competition by keeping sales reps informed about how they are performing compared to their peers. This also motivates them to apply the best practices of top performers to improve their performance.

Sales Forecasting Methods & Techniques

Forecasting entails inputting factors into an equation to output a sales estimate. Depending on which sales forecasting method you use, internal factors, such as past sales, current opportunities, and marketing campaigns, influence the estimates produced. There are also external factors to consider, like the economic climate, market competition, and seasonality. Below are the primary types of sales forecasting methods.

This projected sales forecast method takes data from previous time periods, accounts for new factors, such as growth or increased demand, and calculates estimated sales revenue. While this method is ideal for businesses at least a few years old, new businesses could also use historical trends by evaluating information from similar businesses. Let’s look at a sales forecast example created using historical trends.

Sample 1: Sales Forecast Estimate Based on Web Traffic Conversion

Last year, the ABC Online Store made $90,000 in revenue, had 2,000 customers, and 60,000 website visits. Based on their marketing plan for the new year, they expect to increase web traffic to around 80,000 visits, which in turn would be converted into new customers. Assuming each new customer spends the same average amount of $50 per purchase and the conversion rate of 3% remains consistent, ABC Online Store can expect a revenue of $120,000.

Sales Forecast = [(No. of website visits x Conversion rate)] x (Price per unit)

(80,000 x 0.03) x 50 = 120,000

Use our calculator below for a quick sales projection based on historical trends:

Let’s switch it up and say the business wants to predict how well it will do in terms of revenue during the busy season. In past years, the Q4 holiday season (October to December) accounted for 40% of its revenue. Through September, it had made $80,000. Based on the consistent proportion of revenue generated in Q4, the business can expect total revenue for the year to be $133,333, with $53,333 done in Q4 alone.

Now let’s switch the factors of the known historical information. Imagine, after five years in business, ABC Online consistently makes 15% more than the previous year. There’s also a demand increase in the total market of 10%. If ABC generated $150,000 last year, they could expect an increase of $22,500 (150,000 x 15%) due to standard growth and an additional increase of $17,250 due to new demand, for a total of $189,750.

Pipedrive cumulative revenue forecast (Source: Pipedrive)

A sales process that follows conversion rates of a sales pipeline or funnel can use conversion-based forecasting to estimate anticipated revenue. This is the best way to forecast sales in business-to-business (B2B) companies, which are usually finalized as deals.

Business-to-consumer (B2C) organizations can also use this method if they follow a typical sales cycle for closing deals. Ecommerce businesses can use it if they track website traffic, browsing, and purchasing rates.

Sample 2: Sales Forecast Estimate Based on Sales Pipeline Conversion

Let’s take the example of ABC Management Consulting. The leadership team wants to estimate revenue based on deals, deal values, and the conversion rates of its sales funnel. Going into the new year, it currently has 200 leads in the funnel and expects to generate 50 new leads throughout next year’s campaigns. There’s a total potential deal value of $6 million and the following conversion rates:

Aware of the brand to interested in more information → 16%

Interested in information to interested in receiving an offer → 50%

Received an offer to considering/negotiating that offer → 60%

Considered to offer accepted/deal closed → 75%

Based on the data above, ABC estimates that of the 250 total leads, 40 (16% of them) will be interested in more information. Of those interested, 20 (50%) will want to receive an offer through a proposal, and 12 of them (60%) will strongly consider the offer by negotiating some of the terms. In the end, nine of the leads are expected to become clients of ABC, which translates into a total deal value and sales prediction of $216,000.

Next, let’s look at conversion-based forecasting for a B2C ecommerce company. Using industry averages and their internal marketing knowledge, ABC Online believes its digital campaigns will reach 2 million views (awareness) over the next 12 months. It also anticipates 10% to click and view the online store (interested). From the website, 30% will likely browse for a solid amount of time (consideration), and 5% of those will actually make a purchase (decision).

Let’s assume each purchase is for one unit of what’s being sold for $100 each. Based on this, 3,000 purchases will be made for a total projected revenue of $300,000.

Zoho CRM pipeline and funnel conversion metrics (Source: Zoho CRM)

Of the sales forecasting methods, this is the least accurate because it doesn’t rely on actual historical data or conversion rates. Instead, you depend on your sales team’s performance expectations, market intelligence, and confidence to project the number of deals they expect to close or leads they anticipate generating.

That said, sales rep knowledge is instrumental in interpreting or reviewing sales projections generated from historical data or forecasted conversions. This is to see if it’s aligned with your typical business performance.

Sample 3: Sales Forecast Estimate Based on Sales Rep Knowledge

A simple example of how this method would be used is if XYZ Company is having a sales meeting with their sales reps. The manager goes through a list of new business opportunities and asks a rep responsible for a lead to provide a confidence level of closing the deal and how much they expect the deal to be worth. The following responses are given:

Opportunities | Forecasted Conversion | Expected Deal Value |

|---|---|---|

Deal 1 | 30% chance for $50,000 | $15,000 |

Deal 2 | 50% chance for $20,000 | $10,000 |

Deal 3 | 90% chance for $5,000 | $4,500 |

Deal 4 | 40% chance for $60,000 | $24,000 |

Deal 5 | 30% chance for $40,000 | $12,000 |

Deal 6 | 20% chance for $70,000 | $14,000 |

Total Expected Deal Value | $79,500 | |

This makes the total sales prediction for new business in this scenario $79,500. It’s the total of the expected deal values ($15,000 + $10,000 + $4,500 + $24,000 + $12,000 + $14,000).

This method could also be less probability-based and go exclusively on a “close” or “will not close” basis. For example, rather than asking for confidence levels, a manager could just ask for the estimated value and whether or not the rep thinks it will be closed within the time frame. The benefit of this method is that you can motivate your sales reps to prioritize closing deals, especially ones where they expressed a high confidence level that it would close.

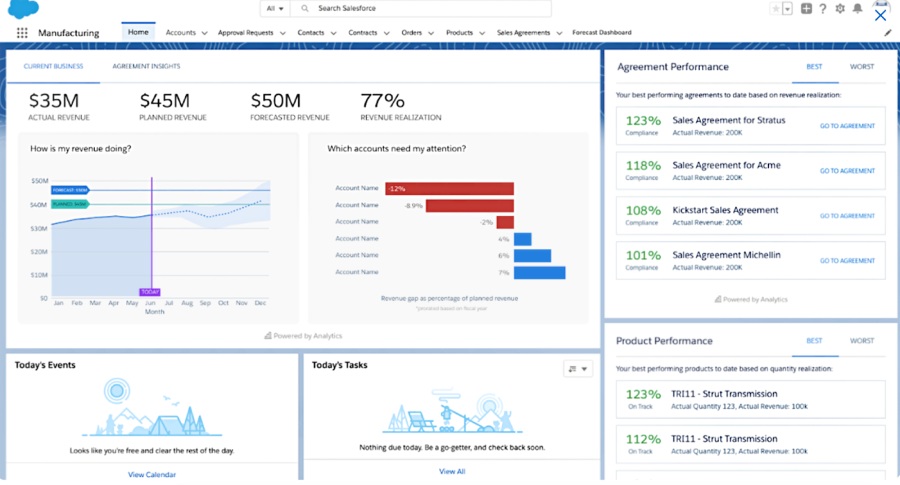

Salesforce for accurate forecasts and better pipeline visibility (Source: Salesforce)

Team Members Responsible for Sales Forecasts

While sales projections generally affect the whole company, taking the lead in generating them is part of the key aspects of sales management. However, each member involved in the sales and revenue chain must submit individual forecasts. These are the team members responsible for sales forecasts and their corresponding roles in the process:

Top Challenges of Sales Forecasting

Salespeople commonly encounter hurdles or challenges that affect the accuracy of their sales forecasting process. These can range from a subjective factor like seller bias to a broader category like economic issues. We have outlined the most common sales forecasting challenges below so that you can anticipate them and deal with them proactively.

This is a classic challenge rooted in salespeople who rely more on their gut feeling rather than objective data when it comes to deal probabilities. Some reps have good instincts, but it is best to use objective data as the source of truth for forecasts rather than just gut feelings.

Newly established businesses often lack sufficient historical data to base their forecasts on. In this situation, you can rely on market and competitive research when creating estimates. Also, you can generate two revenue projections based on both optimistic and pessimistic numbers, then update them with actual data as time progresses.

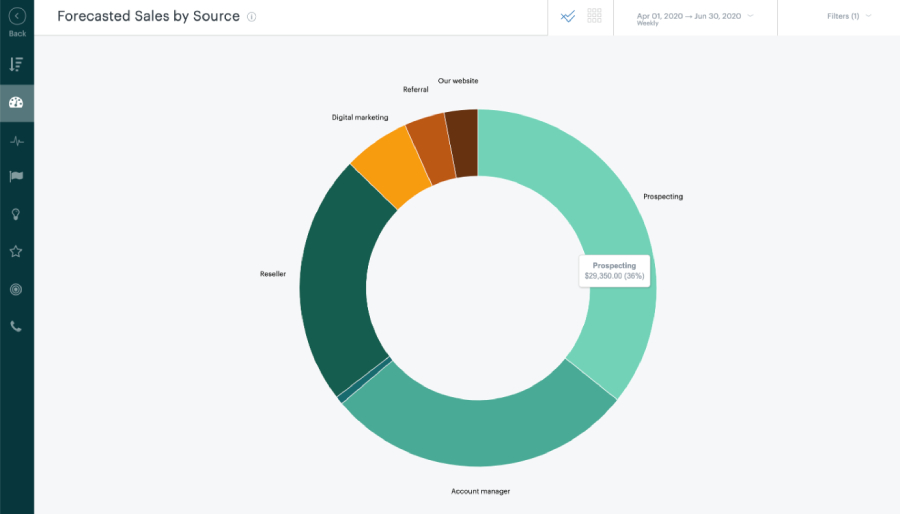

Zendesk forecast sales by source report (Source: Zendesk)

Building a sales forecast takes time, especially if you do it manually. Using sales forecasting software like Zoho Analytics, you can easily generate comprehensive sales reports and analytics. For sales organizations already using several tools for sales management, the main challenge here lies in the seamless integration between the apps your team is using. This ensures that these tools become an asset supporting reps’ work rather than a nuisance.

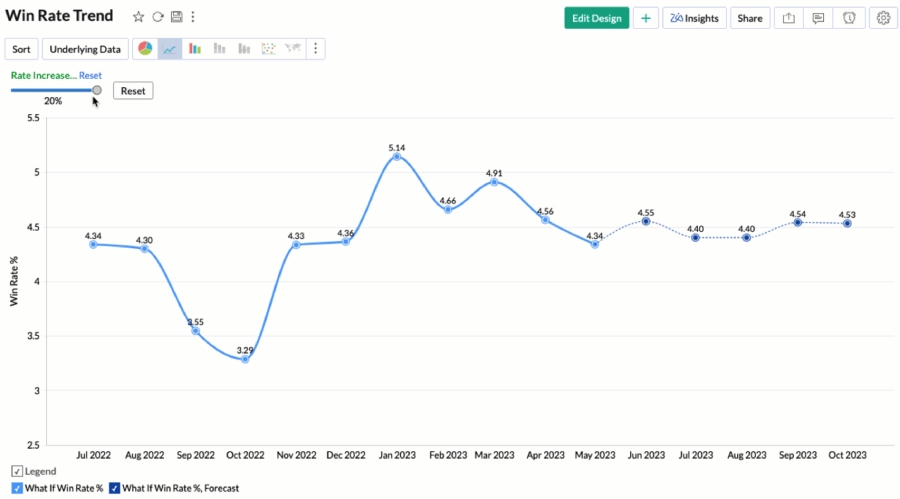

Zoho Analytics What-If Analysis feature for sales forecasting (Source: Zoho Analytics)

Any industry could be affected by general changes in the economy, such as those involving inflation, supply chain, and labor supply. Sometimes, forecasts could be affected by seasonality and the trend of buyer behavior during specific time periods. It is important to consider these factors and understand how they impact your profitability when you make your revenue estimates.

Sales Forecasting Best Practices

Forecasting sales offers many advantages—especially in providing businesses with accurate visibility of their upcoming business performance. However, it must be done correctly to reap the benefits. Below we share some of the best practices that sales teams should observe when doing sales forecasts.

Having an established system in place ensures you process the correct data while using the same system consistently, which will help provide more accurate forecasts.

Ensure you use only the most updated data. For example, regularly updating your pipeline and opportunities lessens the instances of overestimating your incoming revenue. Investing in a robust CRM system can help you ensure you have current sales data at all times.

Team collaboration is always ideal when doing forecasts, as there are areas one team member can spot that others may not. Having the sales team manager review forecasts also increases the chances of correctness and accuracy.

While forecasting sales lowers instances of inaccuracy, having an actual sales agent review and interpret the data gives businesses a more holistic and realistic view of their sales forecasts. Plus, you can leave the high-level tasks to your sales teams and let your CRM and other tech tools take care of the mundane, repetitive tasks.

However, take note that sales reps forget about 84% of sales training knowledge in the first three months. So, we highly recommend sales reps undergo continuous sales training in sales forecasting. Aside from regular coaching sessions, sales leaders must dedicate themselves to finding training opportunities for reps, either through virtual or in-person training.

Frequently Asked Questions

Sales forecasts serve as the basis for making business decisions, business plans, budgets, and risk management efforts. They allow organizations to properly allocate their resources and manage cash flow. They also indicate whether a sales team could achieve set short-term and long-term goals.

Small businesses must forecast sales as soon as they begin projecting their revenue. Without a sales forecasting model, startup businesses cannot fully maximize their sales talents and visualize their potential sales, which means missing plenty of sales opportunities.

The top common mistake in forecasting is relying on gut feeling instead of basing important decisions on realistic data. Others include ignoring historical patterns and failing to be flexible, which could be costly for your business. When creating your sales plan and budget, be prepared to make any changes if there are sudden declines in your sales trend caused by seasonal factors.

Bottom Line

Sales forecasting predicts future sales to provide valuable insights for more informed decision-making. This foundational sales activity is important in resource allocation, lead assignment, and sales territory management. It is interconnected with the supply chain and other core business operations. Understanding the different methods, best practices, and tools for sales forecasting streamlines the sales process and strengthens sales management for attaining revenue goals.