QuickBooks Online is a cloud-based accounting software that we find suitable for most small businesses, including those with inventory and projects. You can use it to track income and expenses, pay bills, invoice customers, and run reports like cash flow statements. It offers four plans ranging from $30 to $200 monthly, depending on the number of users and features you need.

We like that QuickBooks Online offers all of the accounting solutions needed by most businesses and that it has a vast network of QuickBooks ProAdvisors for easy access to professional help. While reviews are generally positive, some users find QuickBooks Online expensive for small businesses while others want to see an improvement in its customer support.

If you’re interested in this software after reading this detailed QuickBooks Online review, you can sign up for a 30-day free trial. You may also purchase right away to get a 50% discount for three months and receive a free one-time virtual session with a ProAdvisor to set up your company file.

The Fit Small Business editorial policy is rooted in the company’s mission, which is to deliver the best answers to people’s questions. This serves as the foundation for all content, demonstrating a clear dedication to providing valuable and reliable information. Our team leverages its expertise and extensive research capabilities to identify and address the specific questions our audience has—and this ensures that our content is rooted in knowledge and accuracy.

In addition, we employ a comprehensive editorial process that involves expert writers. This process ensures that articles are well-researched and organized, offering in-depth insights and recommendations. Fit Small Business maintains stringent parameters for determining the “best” answers, including accuracy, clarity, authority, objectivity, and accessibility, and these see to it that our content is trustworthy, easy to understand, and unbiased.

Pros

- Is the leading small business accounting software on the market

- Offers scalable plans priced depending on the number of users’ features included

- Has robust accounting features, including banking, project accounting, and inventory management

- Generates a wide selection of accounting and financial reports

- Calculates sales tax rates automatically to apply to an invoice automatically

- Has a vast network of QuickBooks Online ProAdvisors for easy access to professional support

Cons

- Is a bit expensive compared to other similar products

- Can’t enter bills and track time worked using the mobile app

- Requires Advanced to compare estimated to actual project costs and manage fixed assets

- Is more of a generalized solution; has no industry-specific features

- Doesn’t allow you to call phone support directly unless you upgrade to Advanced

QuickBooks Online Alternatives & Comparison

If you want to consider other options, check out our guide to the best QuickBooks Online alternatives or see our list of the leading small business accounting software.

- QuickBooks vs Wave

- QuickBooks vs Xero

- QuickBooks vs Zoho Books

- QuickBooks vs FreshBooks

- QuickBooks vs Sage 100 Contractor

- QuickBooks vs Sage 50cloud

- QuickBooks vs Sage Intacct

- QuickBooks vs BILL

- QuickBooks vs ZipBooks

- QuickBooks vs NetSuite

- QuickBooks vs Sage Business Cloud Accounting

- QuickBooks vs Quicken

QuickBooks Online Reviews From Users

| Users Like | Users Dislike |

|---|---|

| Easy to use | Expensive for small businesses |

| Professional-looking invoices | Difficult to contact customer support |

| Robust accounting features, including bank feeds, reporting, and a mobile app | |

Below are the common sentiments from users and our expert opinions:

- Is a terrific user-friendly tool for small businesses: Some mentioned that they switched to it because it’s easier to use than other similar software. For some, it may have an initial learning curve, but with time and minimal practice, it becomes user-friendly. Another thing I like is that QuickBooks continuously updates the software to make the user experience as smooth as possible.

- Has great features: One reviewer explained that it creates professional-looking invoices while another likes that they can use it to print checks. Some are also impressed with its bank feeds, reporting features, and its mobile app. With these and other powerful features, I believe that QuickBooks Online is the most robust accounting software.

- Is difficult to contact customer support: I understand their sentiments as I also sometimes encounter problems when contacting QuickBooks’ customer support. Most of the time, it’s easy to connect to an agent, but they would often pass me around different agents before I get an answer. Sometimes, I don’t even get a useful answer at all. That said, I’d like to see QuickBooks improve its support.

- Is not that affordable: Plus, QuickBooks’ plan with project accounting and inventory costs $90 while other similar software like Zoho Books has a more affordable plan at only $50 monthly.

Here are the average QuickBooks Online review scores from third-party sites:

- Capterra[1]: 4.4 out of 5 based on over 6,400 reviews

- G2.com[2]: 4.0 out of 5 based on around 3,200 reviews

Fit Small Business Case Study

To determine how QuickBooks Online stacks up against other similar software, we compared QuickBooks Online to Wave and Zoho Books using our internal case study. The chart below sums up the results.

The case study ratings are based on the features and capabilities of the QuickBooks Online Plus version, which is the most popular option for small businesses.

Touch the graph above to interact Click on the graphs above to interact

-

Zoho Books From $0; $24 as tested

-

QuickBooks Online From $30 per month; $90 as tested

-

Wave Starter Free

Our case study reveals that QuickBooks Online’s biggest strengths are general features, A/P and A/R management, reporting, integrations, and ease of setup. Zoho Books takes the lead for the mobile app category while Wave wins in pricing. Wave also is the easiest to use, but it falls short in nearly all the feature categories, which we anticipated since it’s free software.

QuickBooks Online Pricing

While QuickBooks Online isn’t the most inexpensive software, we awarded it an above-average score for pricing because it offers four scalable options, which can be ideal for growing businesses. It is available in four plans ranging from $30 to $200 per month. You can either get a 30-day free trial or purchase right away and receive a 50% discount for three months and a free online session with a QuickBooks ProAdvisor to set up your account.

All plans include basic features, such as income and expense tracking, invoicing, bank feeds, and reporting. However, the higher plans offer advanced features, as summarized in the QuickBooks Online pricing and feature comparison table below.

Pricing & Features | Simple Start | Essentials | Plus | Advanced |

|---|---|---|---|---|

Pricing (Cost per Month) | $30 | $60 | $90 | $200 |

Number of Users | 1 | 3 | 5 | 25 |

Manage & Pay Bills | ✕ | ✓ | ✓ | ✓ |

Track Employee Time | ✕ | ✓ | ✓ | ✓ |

Record Multicurrency Transactions | ✕ | ✓ | ✓ | ✓ |

Track Inventory & Cost of Goods | ✕ | ✕ | ✓ | ✓ |

Track Project Profitability | ✕ | ✕ | ✓ | ✓ |

Create & Send Invoices by Batch | ✕ | ✕ | ✕ | ✓ |

Manage & Track Fixed Assets | ✕ | ✕ | ✕ | ✓ |

Compare Estimated vs Actual Project Costs | ✕ | ✕ | ✕ | ✓ |

Set Up Custom User Permissions | ✕ | ✕ | ✕ | ✓ |

Access to Dedicated Success Manager | ✕ | ✕ | ✕ | ✓ |

Free Training for Staff ($3,000 Value) | ✕ | ✕ | ✕ | ✓ |

Don’t choose a QuickBooks Online plan based solely on the number of users you need. Let’s say you need to track inventory but only need three users, so you chose Essentials because it’s limited to three users—and is more affordable than Plus.

However, you’ll be disappointed when you find out that Essentials can’t track inventory and project profitability. If you need more help deciding which plan to choose, read our comparison of QuickBooks Online plans.

QuickBooks Notable New Features

- QuickBooks Bill Pay: You can now pay vendor bills directly from within QuickBooks with your bank or credit card through QuickBooks Bill Pay. This new solution has features similar to other online bill pay platforms like Melio and BILL, but it’s exclusively for QuickBooks Online and Desktop users. Its key features include automatic bill creation, 1099 filing, and approval workflows. We discuss this new solution in detail in our QuickBooks Bill Pay review.

- New Invoice and Estimate Experience: QuickBooks Online now has an improved invoicing and estimate management tool. As you create an invoice or an estimate, QuickBooks shows a real-time PDF version of the item so that you don’t have to click the preview button to see what it looks like.

- Project Estimate vs. Actual Reporting: When you subscribe to QuickBooks Online Advanced, you’ll now have the option to compare your estimated project costs and actual costs. This is useful for companies that need high-level profitability tracking features.

- Spreadsheet Sync: You can now sync your QuickBooks Online Advanced account with Microsoft Excel. This allows you to pull data in a spreadsheet format, edit it using Excel, and then sync it back to QuickBooks Online.

- Fixed Asset Management: Another new feature in QuickBooks Online Advanced, this tool allows you to record new fixed assets, set up and track depreciation, and generate depreciation schedules.

QuickBooks Online Features

QuickBooks Online aced our evaluation of general features because it offers everything you need to set up your company file and get started. You can enter your basic information like company name and contact details, set up additional users and customize user access, and import your chart of accounts from your existing software if needed. QuickBooks Online also allows you to close books at year-end, which is important to prevent changes in your financial data.

Furthermore, you can customize your accounting processes, such as setting up the fiscal year and tax year of your company, choosing the accounting method, and adding categories to track your income and expenses. One thing we like about QuickBooks is the ability to create classes and locations for tracking profit and loss (P&L). You can also modify your chart of accounts (COA), enter an additional user, and control how much access you want to give them.

Our QuickBooks Online General Features Video

QuickBooks Online excels at managing unpaid bills and expenses. You can view the list of your unpaid bills to track them effectively. You can create recurring transactions, record partial payments of an invoice, set up and track inventory items, and print checks instead of writing them manually. Also, QuickBooks has further improved its A/P management feature by incorporating the new QuickBooks Bill Pay discussed earlier.

Our QuickBooks Online A/P Video

We found QuickBooks Online’s ability to manage invoices equally terrific as its ability to manage payables, making it our overall best invoicing software. The good thing is that QuickBooks calculates sales taxes in every jurisdiction where you collect sales tax automatically.

In terms of invoicing, there are many reasons to love QuickBooks Online. You can choose from different templates, add your logo, change colors, and include personalized messages. You set up recurring invoices and print and email them to your customers.

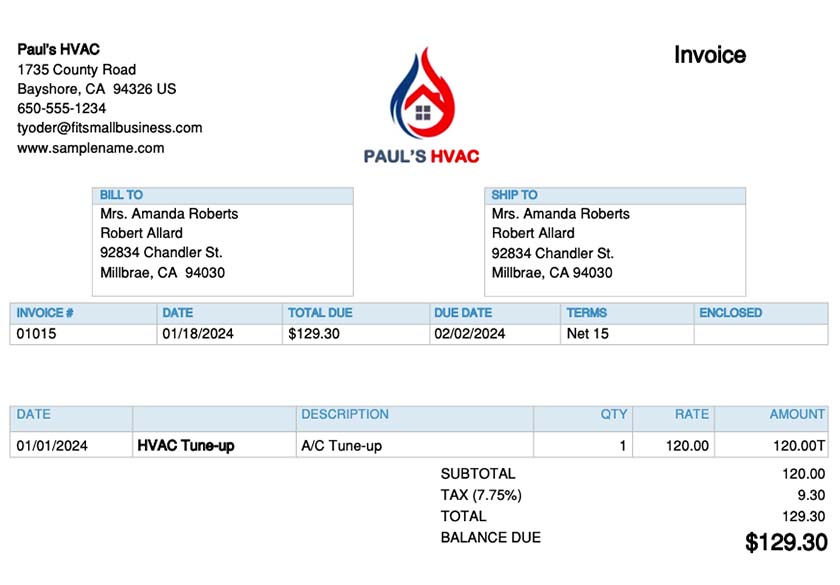

Sample invoice in QuickBooks Online

What’s more, we love that QuickBooks Online has further enhanced its invoicing feature by allowing you to view a live PDF version of your invoice as you complete the invoicing form. This helps you customize your invoices easily without repeatedly clicking the preview button.

Other great features include the ability to:

- View sales tax liability details

- View and track sales tax collected and remitted

- Pay sales tax liability with a check

- Accept short payments from customers

Our QuickBooks Online A/R Video

Just like most accounting software, you can connect your bank and credit card account to QuickBooks Online. If you’re uncomfortable connecting your bank account, you can upload your transactions in a QuickBooks Online format.

If you dread reconciling your bank account manually, you can use QuickBooks Online’s powerful bank reconciliation feature and generate reconciliation reports to see cleared and uncleared transactions. Unlike FreshBooks and Xero, QuickBooks allows you to reconcile your bank and credit card accounts, even if you choose to record all activity manually vs importing bank transactions.

Our QuickBooks Online Cash Management & Banking Video

We docked a few points for project accounting because you can only compare project estimates and actual costs in the highest plan, QuickBooks Online Advanced. However, the platform is good for project accounting. You can create projects and assign wages, income, and expenses to a project. You can also create project estimates and include inventories, sales taxes, and labor in those estimates.

Our QuickBooks Online Project Accounting Video

QuickBooks Online does a great job at sales and income tax tracking. It could’ve scored higher if the QuickBooks team had a service for filing sales tax returns on behalf of the client.

You can add sales taxes to your receipts, invoices, and estimates, and QuickBooks Online will calculate and track them automatically for easy tax filing. It also keeps track of your tax payment due dates to avoid late filing and late payment penalties.

One of its advantages over similar software is that you can e-file your taxes either through email or your agency’s website. If you’re working with independent contractors, QuickBooks Online lets you generate 1099 tax forms and either file them online or print and then mail them to the IRS.

We evaluated QuickBooks Online’s sales and income tax features across the other categories, so there’s no separate video.

QuickBooks Online could have earned a perfect mark for inventory if users could also compare actual and estimated inventory in the Plus Plan and not only in Advanced. Nevertheless, QuickBooks’ inventory accounting feature is excellent as it lets you track stock items and quantities, update inventory quantities automatically, create purchase orders and send them to vendors, and set up alerts to see when it’s best to replenish your stock.

There’s no separate video since QuickBooks Online’s inventory management is evaluated across the other categories.

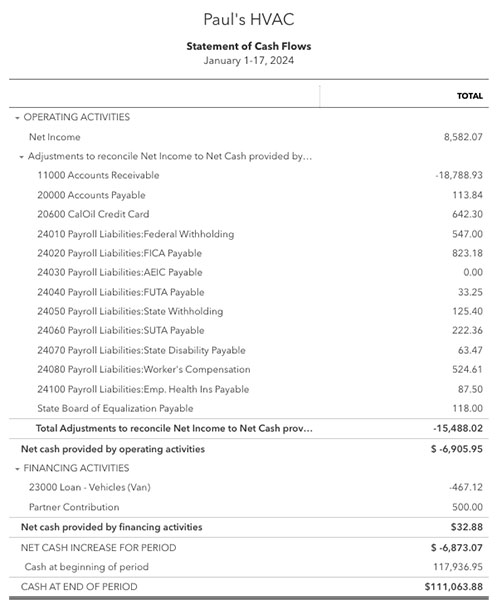

QuickBooks Online is arguably one of the best accounting software programs for reporting. It can generate more than 100 reports, depending on your subscription; in our case study, we generated 16 different types of reports successfully, which isn’t possible in most other accounting software.

Whether you need standard reports—such as balance sheets, P&L statements, and cash flow statements—or sales reports by customer, location, or class, you can do it all in QuickBooks Online.

Sample cash flow statement in QuickBooks Online

Our QuickBooks Online Reporting Video

QuickBooks’ mobile app is functional, but we hope to see more features in the future, such as the ability to enter bills and record time worked. Available for Android and iOS devices, it contains many features available in the browser-based desktop interface, making it one of our best mobile accounting apps. It also allows you to create and send invoices on the go, receive payments from customers, assign expenses to customers or projects, and view financial reports.

Our QuickBooks Online Mobile App Video

Other Features

- Free meeting with a ProAdvisor when to set up your company file: QuickBooks Online offers a one-time virtual session with a QuickBooks expert who will walk you through connecting your bank and credit card accounts, setting up your chart of accounts, customizing invoices, and setting up reminders. This offer is unavailable with the free trial and doesn’t include desktop migration, payroll setup, or services.

- Enhanced migration process: The export process includes a user ID automatically, allowing you to create an account easily. Also, the transaction limit has been raised from 350,000 to 750,000.

- Mobile check deposit: This lets you deposit checks from the mobile app. When you take a photo of your check and upload it to QuickBooks, the program generates a digital transaction automatically. QuickBooks says mobile deposits may take up to five business days. Note that this feature is only available to users with a QuickBooks Checking account. If you don’t have one, read our detailed QuickBooks Business Checking review to see how it can benefit your business.

QuickBooks Online Ease of Use

QuickBooks Online is relatively easy to use, but there will still be a learning curve for some users, especially since the platform has plenty of features to master. Fortunately, the interface is easy to navigate and has an organized dashboard where you can find the features you need easily.

You can set up your company easily and customize QuickBooks based on your needs. From the Accounts and Settings page, you can configure various settings, such as your company information, billing and subscription, sales transactions, expenses, and advanced settings.

You can learn QuickBooks even without an accounting background, but it becomes much easier to use if you have some knowledge of basic accounting concepts.

To help you better understand how to use QuickBooks Online’s features, you may check out our free QuickBooks Online tutorials.

QuickBooks Online Customer Support

QuickBooks offers plenty of customer support options, including phone, email, live chat, and chatbot. However, if you want to talk with a real person, you need to submit a form and wait for them to call you—unless you upgrade to QuickBooks Online Advanced, which gives you access to premium customer support.

If you have minor issues, you can check out QuickBooks’ vast self-help resources, such as blogs, setup guides, troubleshooting tips, and community forums. If you prefer getting support through email, then QuickBooks isn’t for you.

A huge advantage of choosing QuickBooks is the availability of local bookkeepers in your area who can provide assistance. QuickBooks dominates the market for small business accounting, and most professional bookkeepers use it for their small business clients. It’s almost certain you’ll be able to find a ProAdvisor to help you.

For guidance, see our step-by-step article on how to find a local QuickBooks ProAdvisor. It also covers the platforms or websites you can find a ProAdvisor on.

QuickBooks Online Integrations

QuickBooks Online integrates with a wide range of third-party software, including popular tools like PayPal, Square, Stripe, Gmail, Google Sheets, Salesforce, HubSpot, WooCommerce, and Shopify. It also connects with thousands of apps through Zapier. While it has vast integration options, we believe a few business apps stand out for specialized purposes, as highlighted in our list of the best QuickBooks Online integrations.

It also integrates with other QuickBooks solutions, such as QuickBooks Payroll, QuickBooks Time, QuickBooks Checking, and QuickBooks Payments.

For information on the QuickBooks products, see our articles:

How We Evaluated QuickBooks Online

We evaluated QuickBooks Online and other leading accounting software using an internal scoring rubric with 13 major categories.

5% of Overall Score

In evaluating pricing, we considered the billing cycle (monthly or annual) and the number of users.

5% of Overall Score

This section focuses more on first-time setup and software settings. The platform must be quick and easy to set up for new users. Even after initial setup, the software must also let users modify information like company name, address, entity type, fiscal year-end, and other company information.

5% of Overall Score

The banking section of this case study focuses on cash management, bank reconciliation, and bank feed connections. The software must have bank integrations to automatically feed bank or card transactions. The bank reconciliation module must also let users reconcile accounts with or without bank feeds for optimal ease of use. Lastly, the software must generate useful reports related to cash.

5% of Overall Score

The A/P section focuses on vendor management, bill management, bill payments, and other payable-related transactions. A/P features include creating vendors and bills, recording purchase orders and converting them to bills, creating service items, and recording full or partial bill payments.

5% of Overall Score

This takes into account customer management, revenue recognition, invoice management, and collections. The software must have A/R features that make it easy for users to collect payments from customers, remind customers of upcoming or overdue invoices, and manage customer obligations through analytic dashboards or reports.

10% of Overall Score

Businesses with inventory items should choose accounting software that can track inventory costs, manage COGS, and monitor inventory units.

10% of Overall Score

Service or project-based businesses should choose accounting software that can track project costs, revenues, and profits. The software must have tools to track time, record billable hours or expenses, send invoices for progress billings, or monitor project progress and performance.

4% of Overall Score

In this section, we’re looking at sales tax features. The software must have features that allow users to set sales tax rates, apply them to invoices, and enable users to pay sales tax liability.

4% of Overall Score

Reports are important for managers, owners, and decision-makers. The software must have enough reports that can be generated with a few clicks. Moreover, we’d also like to see customization options to enable users to generate reports based on what they want to see.

10% of Overall Score

Customer service is evaluated based on the number of communication channels available, such as phone, live chat, and email. Software providers also receive points based on other resources available, such as self-help articles and user communities. Finally, they are awarded points based on the ease with which users will find assistance from independent bookkeepers with expertise in the platform.

10% of Overall Score

This requires the software to allow users transitioning from other bookkeeping software to import their chart of accounts (COA), vendors, customers, service items, and inventory items. Ideally, there will be a wizard to walk the user through the import process.

10% of Overall Score

Ease of use includes the layout of the dashboard and whether new transactions can be initiated from the dashboard rather than having to navigate to a particular module. Other factors considered are user reviews specific to ease of use and a subjective evaluation by our experts of both the UI and general ease of use.

5% of Overall Score

This includes the availability of integrations for payroll, time tracking, and receiving e-payments. We also evaluated whether an electronic bill pay integration was available.

5% of Overall Score

The software must have a mobile app to enable users to perform accounting tasks even when away from their laptops or desktops. Some of the features we looked into include the ability to create and send invoices, accept online payments, enter and track bills, and view reports on the go.

7% of Overall Score

We went to user review websites to read first-hand reviews from actual software users. This user review score helps us give more credit to software products that deliver a consistent service to their customers.

Frequently Asked Questions (FAQs)

QuickBooks Online is great for most businesses, especially those that need inventory and project accounting and companies wanting to track activity by class and location.

Some of the top alternatives to QuickBooks Online are Zoho Books, Xero, FreshBooks, Wave, and Sage 50. These QuickBooks alternatives might save you money and provide a better solution for your business.

QuickBooks Online is very user-friendly, but you need to know the basics. Check out our series of free QuickBooks Online tutorials to get started.

The best plan depends on the size of your company and the features you need. We have an in-depth comparison guide of QuickBooks Online plans to help you choose the best one for your business.

No, they are two completely different products. QuickBooks Online is cloud-based, while QuickBooks Desktop is installed locally. Read our QuickBooks Online vs Desktop comparison to learn more about their differences.

Yes, it does. You may purchase the QuickBooks Live Bookkeeping add-on, which gives you access to a team of certified bookkeeping professionals who will provide you with live support through video chat.

Bottom Line

QuickBooks Online dominates the market for small business accounting software due to its extensive features and flexibility in meeting the needs of nearly any small business. It can track inventory costs, generate invoices, track unpaid bills, and calculate P&L separated by many factors, including user-defined classes and locations.