Chargebacks cost merchants nearly $80 billion annually. Providing the right supporting documents is one of the best ways to win that revenue back.

How to Dispute a Chargeback: Small Business Guide

This article is part of a larger series on Payments.

Chargebacks can have a significant impact on the revenue, profitability, and reputation of small businesses. Knowing how to dispute and ultimately win a chargeback will help keep the impact on your business to a minimum. Prompt response to a chargeback notice, compelling evidence, and a well-drafted rebuttal letter are some of the things that will help a small business win a chargeback.

A chargeback is a reversal of a card transaction because of a dispute filed by the customer, commonly because of merchant error, friendly fraud, or true fraud. Learn more in our small business guide to chargebacks.

Follow along with the steps we’ve laid out in this guide, plus learn why a business should dispute a chargeback, the different types of chargebacks, and tips for winning a chargeback.

Step 1: Understand the Chargeback Process

The process of disputing a chargeback begins when you receive the dispute notice from your merchant account provider. To carry out the next steps, you want to make sure that you have a good understanding of the chargeback process.

Step 2: Review the Chargeback Notice

It is important to attend to the chargeback notice as soon as you receive it, as it often includes a deadline for your response. You will need to make sure that you submit your evidence and rebuttal before the deadline. Otherwise, you will lose the dispute.

Step 3: Check the Reason for the Chargeback

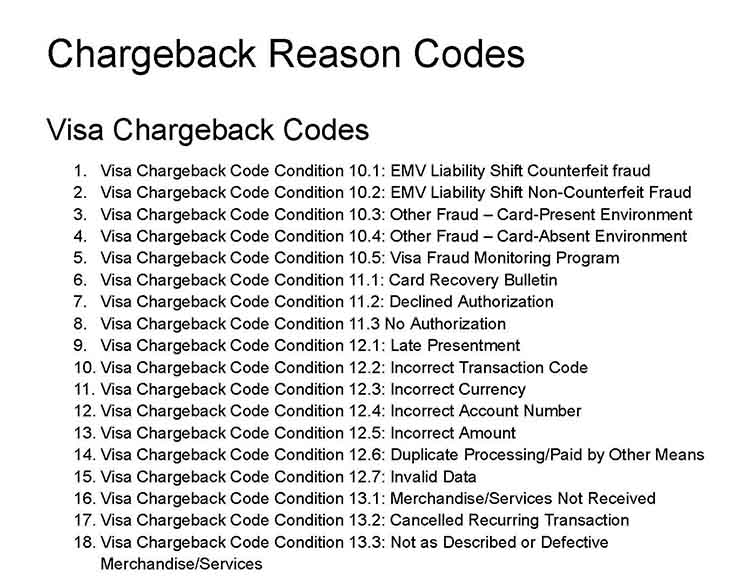

The chargeback notice will include a code indicating the reason for the chargeback (such as invalid data or disputed amount). This will also help you determine the compelling evidence you need to prepare to dispute the chargeback.

Download the list of chargeback reason codes for Visa, Mastercard, American Express, and Discover:

Step 4: Prepare Compelling Evidence

You will need to compile evidence to support your claim that the transaction is valid. The exact evidence you need will depend on the specific reason codes for the chargeback and the other details of the transaction, such as the payment channel and the type of product or service.

Chargeback Evidence

In-person Purchases | Online Purchases |

|---|---|

|

|

|

|

|

|

|

|

|

|

| |

|

Step 5: Craft a Rebuttal Letter

After collecting the evidence, you will need to craft a well-written rebuttal letter that will serve as the cover letter of your evidence. It should give a clear introduction of your chargeback response and an overview of the attached evidence. The letter should contain the following information:

- Chargeback number (or any other unique identifier that your processor uses for each chargeback)

- Reason code

- Order history

- Transaction details

- Narration of what happened when the purchase was made

Remember to make a copy of everything you submit to keep as your record.

Step 6: Wait for the Results

After submitting your rebuttal letter and evidence, it can take up to 75 days for the review to be completed. The exact length of time will depend on the reason code, the card network, and the bank that issued the card.

If the result is in favor of the customer, the transaction amount will be returned to the customer’s card, and aside from not getting paid for the transaction, the merchant will need to pay any chargeback fees that their processor imposes. On the other hand, if the result is in favor of the merchant, the transaction will remain valid.

Why Dispute a Chargeback

The impact of chargebacks on a business’ bottom line is significant. According to a chargeback report, the projected costs of chargeback for 2023 are estimated at $117 billion, with around $79 billion as merchant losses. It is estimated that every dollar lost (transaction amount) to a chargeback costs the business an estimated $2.40.

Other than financial losses, businesses that frequently receive chargebacks risk their reputation, as it could suggest poor customer service, fraudulent practices, or low-quality products or services.

Additionally, high chargeback ratios can lead to penalties from payment processors and card networks, higher overall processing fees, or even account termination. Businesses that have a chargeback ratio higher than 1% may be considered a high-risk merchant and included in the Member Alert to Control High-Risk Merchants (MATCH)/Terminated Merchant File (TMF) list.

Disputing chargebacks is crucial for minimizing unwarranted losses and maintaining customer trust. Some three-fourths of businesses have reported choosing to challenge chargebacks.

Different Types of Chargebacks

The types of chargebacks you will receive may be broadly categorized into three types. Each type of chargeback requires specific strategies for prevention and resolution. It is important to carefully examine the nature of the chargeback, gather appropriate evidence, and respond accordingly to dispute the chargeback.

Effective chargeback management also involves keeping track of the most common types of chargebacks that your business gets so you can implement procedures to address them.

Merchant Error

Merchant error chargebacks are due to mistakes by the merchant in the transaction process. Some examples are duplicate charges, incorrect amounts charged, and canceled orders still being charged.

Most merchant error chargebacks are resolved in favor of the customer. To help you minimize these kinds of chargebacks, it is important to train your employees well in your processes when processing card payments.

Friendly Fraud

Friendly fraud occurs when a customer initiates a chargeback on a valid transaction. Some examples include claims of non-receipt of a product despite having received them, denying making the purchase even if they did, and seeking refunds after using or consuming a product.

Around 44% of chargebacks received by merchants are due to friendly fraud. These chargebacks should be the focus of dispute efforts of merchants because these are legitimate charges by the customers. A large number of customers that file for chargebacks do not understand how and when chargebacks should be used.

True Fraud

Some chargebacks may be due to unauthorized or fraudulent transactions where a third party uses stolen card information to make purchases without the cardholder’s knowledge. For chargebacks due to true fraud, the issuer may immediately rule in favor of the customer.

Unfortunately, it is best not to dispute chargebacks due to true fraud because the burden of preventing this kind of fraud falls on merchants. The best way to address chargebacks due to true fraud is to invest in fraud protection tools.

Learn more in our guide on payment fraud.

Tips on How to Win a Chargeback Dispute

Winning a chargeback requires a strategic approach and compelling evidence. Here are some essential tips to increase your chances of winning a chargeback dispute:

- Meet the deadline: Respond to the chargeback within the timeframe specified by your payment processor. In most cases, missing the deadline means an automatic win for the customer.

- Follow the formats: Each acquirer has different preferences when it comes to file types and submission methods. Make sure you comply with what your acquirer is asking for and submit the documents according to the instructions.

- Document transactions: Make it a business practice to diligently document transactions and communications with customers. This will help ensure that you have adequate documents to provide as evidence in case of any chargebacks.

- Have a distinguishable billing descriptor: Avoid the situation where your customer files a chargeback because of an unrecognizable transaction. Some payment processors will let you set the business name that appears on your customer’s credit card statements.

- Use chargeback management tools: Chargeback management tools help you address and manage chargebacks more effectively and efficiently. There are merchant service providers that include built-in chargeback management and protection tools. These services help to manage fraud risk, address chargebacks as they come, and protect your business from chargeback losses. Check our list of payment services with chargeback protection.

How to Prevent Chargebacks

The best way to deal with chargebacks is to prevent them. Aside from minimizing financial losses, it can help maintain healthy relationships with your customers. To prevent chargebacks, ensure that you set clear expectations for your products or services, provide responsive customer support, and implement an easy refund process.

You should also avoid errors from the backend by keeping detailed records. Finally, protect your business from fraud with payment technology, such as a secure payment processing platform and fraud detection tools.

Read our guide on how to prevent chargebacks to get more in-depth information.

Bottom Line

Chargebacks are part of running a small business, and, unfortunately, these can cause significant negative financial effects on businesses. To minimize the impact of chargebacks when they happen, it is important to understand the chargeback process, respond to the chargeback notice in a timely manner, and compile evidence to address the specific reason codes that came with the chargeback.

While the chargeback process takes time, businesses need to address each step appropriately to win the dispute.