A business would need a merchant account to securely accept electronic payments, such as credit and debit cards, and streamline the payment process, ultimately expanding customer payment options and improving financial transactions.

What Is a Merchant Account? A Guide for Small Businesses

This article is part of a larger series on Payments.

What Is a Merchant Account?

A merchant account is a bank account where payment processors temporarily store a merchant’s sales proceeds until the funds are deposited to the merchant’s elected bank account. Merchant accounts are used in conjunction with a payment processor, which facilitates the transaction. Most merchant account providers also offer payment processing services and are broadly referred to as merchant services or merchant account services.

Key Takeaways

- Merchant accounts are essential for businesses looking to accept electronic payments, providing a secure way to process credit and debit card transactions.

- To reduce credit card processing fees, businesses can shop around, negotiate with providers, and implement anti-fraud measures, ensuring cost-effective payment processing.

- Staying informed about payment trends is crucial for businesses to remain competitive in the evolving world of merchant services.

How Merchant Accounts Work

A merchant account works as a middle account between your customer’s bank account and your business bank account. You would need to sign up for a merchant account and payment processor. Then, you can start accepting payments, whether by having the customer put in their card information, having them swipe, dip, or tap their card, or having them pay with the click of a button online.

The merchant account services provider then handles the work of requesting the money from your customer’s card issuer and bank, which, in many cases, includes fraud checks and authenticating the account. Then, the money is transferred to the merchant account.

It’s held in the merchant account until the transaction is completely cleared and is then forwarded to your personal bank account. Usually, this is the last step, with payouts being done on a daily or weekly schedule.

Our article on how payment processing works describes the process in greater detail.

There are two kinds of merchant accounts provided by merchant services providers—dedicated merchant accounts and aggregated merchant accounts.

A dedicated merchant account is an individual account that is unique to the business. On the other hand, an aggregated merchant account is a shared account for multiple businesses under a single merchant account held by a payment facilitator.

A dedicated merchant account is a safer and more stable solution for businesses but usually involves a more stringent application and underwriting process. It is often much easier to open aggregated merchant accounts, although they are prone to account freezes and fund holds.

Do I Need a Merchant Account?

Whether or not a merchant account is necessary for your business largely depends on the nature of your operations and your customers’ payment preferences. If you have no plans of accepting credit and debit cards, then you may skip applying for a merchant account.

For brick-and-mortar shops, having a merchant account can boost sales by helping you capture customers who prefer to pay using credit and debit cards. Even microbusinesses, such as solopreneurs making casual sales and freelancers, can benefit from a merchant account, as customer payment behavior is shifting away from cash, even for modest transactions.

Additionally, if your business operates online or plans to expand its online presence, a merchant account is practically indispensable. In today’s digital age, customers expect a variety of payment options, and not having a merchant account can limit your ability to cater to those preferences. Ultimately, whether your business requires a merchant account hinges on your sales strategies, customer base, and the convenience you want to offer to your clients.

Learn more about new payment options in our roundup of payment trends.

While merchant accounts are essential for many businesses, they might not be the best fit for everyone. Small businesses or sole proprietors with infrequent card transactions may find alternatives more cost-effective.

Some of these alternatives include payment service providers (PSPs) like PayPal, Stripe, or Square, which only provide aggregated merchant accounts. These platforms provide easy integration and allow you to accept card payments without the need for a dedicated merchant account. However, be aware that they often come with slightly higher transaction fees.

Another alternative to credit card payments is Automated Clearing House (ACH) payments. ACH payments are secure and cost-effective. These transactions involve the electronic transfer of funds directly between bank accounts, bypassing the need for credit card networks. Learn more in our guides to ACH payments and accepting ACH payments for small businesses.

Additionally, mobile payment solutions, such as mobile wallets (Apple Pay, Google Wallet) or QR code payments, are gaining popularity and can serve as alternatives in certain scenarios. It’s crucial to evaluate your business model, transaction volume, and the preferences of your customer base when deciding whether a merchant account or an alternative payment method better suits your needs.

How to Get a Merchant Account

Getting a merchant account can be as easy as filling out a form—but that does not guarantee you get the best account for your business. Before you pick the first one you see or even the cheapest credit card processing provider, do a little research. For instance, if you make high-risk or high-volume sales, you may need a more specialized merchant account. These sometimes require a more in-depth application and approval process.

You would need to gather your business information, such as your employer identification number (EIN), to proceed with your application. Finally, order any equipment you need, and then you’re ready to process your first payment.

Download our free step-by-step guide to applying for a merchant account (including tips for getting the best rates). Continue reading for an overview of what to look for in a merchant account and how to apply.

Merchant services cost between 2% and 4% of your sales, and some services require a commitment of a year or more. These considerations can help you avoid costly mistakes and get you the best plan for your business.

- Step 1: Determine what you need. At Fit Small Business, we’ve evaluated hundreds of payment processors, from all-in-one payment and point-of-sale (POS) systems like Square to high-risk providers like PaymentCloud. We know that a good fit is as important as the quality of service. Therefore, you should know what you want out of payment processing.

- Know your business: Are you in a high-risk industry? Do you have a history of chargebacks? Will you be online, in-store, or taking mobile payments?

- Know your processing history: How much do you process in a month? How often do you need payment processing? What kind of processing do you handle most (online, keyed-in, card swipe or chip, non-contact payments?) Do you have high- or low-ticket sales?

- Know your needs: Do you also need a POS system? If you have one, how easy is it to integrate the merchant service? Are you planning to grow your online presence? Do you need to integrate payments with other business software like Salesforce?

- What do your peers use? Ask friends in your industry (or check out competitors) and see what they use and if they’re satisfied.

Merchant accounts often come with other services like PCI compliance and encryption to increase security, and additional payment processing tools like ACH transfers, gift cards, customer loyalty programs, a payment gateway, and merchant cash advances. Some even have point-of-sale (POS) systems with software for managing your business.

- Step 2: Look for providers. Here are a few things to consider:

- Fees: Some offer a simple flat rate per transaction; others offer interchange-plus. Some have monthly membership fees. Others charge additional small fees. Be careful, as one of the most common user complaints is being nickel-and-dimed to death with hidden fees. Ask to see a contract and follow up on any fees you don’t understand.

- Fee structure: Is the transaction fee by percentage, by cents, or a combination? If you do mostly small-ticket sales, then a percentage fee may be cheaper than a straight cents-added fee.

- Contract length: Ideally, your merchant service has month-to-month plans. However, if you are purchasing or renting equipment, high-risk, or getting a really low rate, they may require a contract. These are notoriously hard to get out of, and expensive to forfeit.

- Services: Some merchant services include POS, virtual terminals, and more for free. Others charge for specific tools. There are even some that require a separate payment gateway, which then adds its own charge to your processing fees. Know exactly what solutions you need ahead of time so you can get specific estimates.

- Quality of its apps: If you plan to use its POS system or app, check out the user reviews. Look for ease of use, complaints about downtime, and reports of withheld funds. For mobile apps, pay attention to whether it supports your version of Android or iOS.

- Ease of use: Merchant services should be easy to integrate and use, with intuitive software and an online system that makes it easy to see how much you spend on fees. Customer support should be available when you need them, especially if they supply you with your POS system.

- Complaints: It pays to check the experience of other users. We recommend the Better Business Bureau and Capterra when it comes to user review research. Keep in mind that the bigger the business, the more numerous the complaints; for example, there are thousands of complaints about Square and PayPal withholding funds, yet they serve millions of customers and are highly rated. (For a good source for reports on withheld funds, check out Card Payment Options.)

- Step 3: Compare your top choices. Some make it easy because they list their prices and features right on the website. For those that don’t, you’ll need to call and give some basic information about your business. In those cases, always ask to see a sample contract and check the contract length along with fees you don’t understand.

The good news is many merchant services don’t have a long approval process while PSPs only require you to fill out an application form—no approval required. In most cases, if they charge a flat rate, you can sign up for them right away.

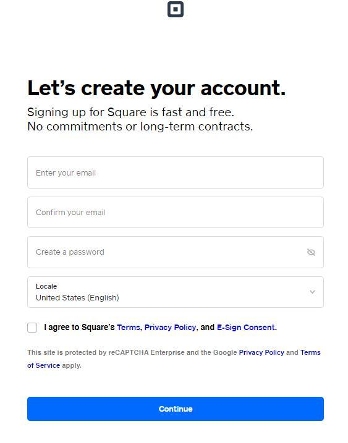

Some merchant accounts require just basic information to get you started. (Source: Square)

Merchant services that offer interchange-plus pricing usually have a larger application and an approval process. Here’s how the process works:

- Step 1: Prep your materials. To make it faster, gather your information:

- Business contact information, including name, addresses, and DBAs

- How long you’ve been in business and your sales history (to help you get the best rates and plans)

- If you’ve used a credit card processor before and the information around it

- Financial information like tax ID, financial statements, bank accounts, and routing numbers

- Credit card to pay the application fee

- Step 2: Contact the credit card processor. Some let you apply online; others have you talk to a sales associate who can take your information, discuss your needs, and give you a quote. Once you submit the information, the merchant service will run a check on your personal and business credit history.

- Step 3: Wait for approval. This can take up to two weeks, though usually less if you don’t have a high-risk account.

Brick-and-mortar shops can see an increase in purchases by having a merchant account, as most people use cash only for small tickets. However, even solopreneurs making casual sales should consider it, as customers usually only pay cash when it’s under $25—and even those instances are declining. Learn more payment trends and statistics.

Best Merchant Accounts

Now that you’ve decided on the kind of merchant account you need, here are some recommendations from our own research:

Best Merchant Accounts At a Glance

Best for | Type | Monthly fees | In-person fees | Online transaction fees | Contract required? | ||

|---|---|---|---|---|---|---|---|

All-around, retail | Aggregated | $0 | 2.6% + 10 cents | 2.9% + 30 cents | No | ||

Online sales and integrations | Aggregated | $0 | 2.7% + 5 cents | 2.9% + 30 cents | No | ||

Social sales, casual sales | Aggregated | $0 | 2.29% + 9 cents (through Zettle) | 3.49% + 49 cents | No | ||

Retail | Dedicated | $0 | From Interchange + 0.40% + 8 cents | From Interchange + 0.50% + 25 cents | No | ||

High-risk merchants | Dedicated | $10–$45 | 2%–4.3%, depending on risk | 2%–4.3%, depending on risk | At least 2-years (for high-risk) | ||

| High-volume sales | Dedicated | $99–$199+ | Interchange plus 8 cents* | Interchange plus 18 cents | No | |

| Restaurants | Dedicated | $0–$199 | From Interchange + 5 cents* | From 2.9% + 30 cents* | No | No Review Yet |

*Varies by subscription type

Still shopping for more options? If none of these satisfy your needs, check out the following articles:

- Best merchant services

- Best retail credit card companies

- Best payment processors for restaurants

- Best high-risk merchant services

- Best international merchant accounts

- Best mobile payment processors

- Best payment gateways

What’s a payment gateway? Payment gateway providers (like Authorize.net) may provide only the tool to connect with your merchant account or may provide merchant services as well.

Understanding Merchant Service Fees

Credit card processing fees can get complicated because there are so many entities involved, and because the fees are not standardized between different merchant service providers. So, the types of fees you pay with one company might be completely different from the structure another merchant service provider uses.

If you want to avoid a complex and potentially confusing fee structure, look for merchant accounts that provide flat rates, like Square or Stripe. This kind of payment provider is what-you-see-is-what-you-get. Usually, the only additional fees are for chargebacks or extra services.

Essentially, processing fees include the following:

One-time Fees

- Application fee: To open a merchant account, you first need to apply. In some instances, there are fees associated with the application process that the merchant account provider passes on to the merchant. (None of the merchant accounts on our best-of lists charge this fee.)

- Setup/installation fee: When you get started with a new merchant services provider, it may have setup costs. These expenses can apply both for assisted on-site and self-installations.

Monthly Fees

- Monthly fee: Some merchant services, like Payment Depot, are upfront about their monthly fee and what you get in return. If this fee is not posted on the website but they charge it, then negotiate to get it removed or lowered.

- Assessment fee: Calculated as a percentage of your total monthly sales, the assessment goes to the card associations. It’s non-negotiable.

- Credit card payment processing rates: Merchantcostconsulting.com estimates the average card processing fees to be anywhere from 1.7% to 2.5% per transaction. Processing fees make up the bulk of the fees that you will pay to accept credit cards. Interchange and assessment fees are typically bundled into this rate.

- Markup: Merchant services providers add an extra fee to what the card associations charge for processing. These are always negotiable.

- Batch fees: This may apply each time you settle your terminal. Inquire about the details of the batch fees and consider how frequently you batch your transactions (often daily).

- Account/service fee: Similar to a statement fee, this is a hidden cost companies add to cover their administrative expenses. It’s a good idea to try and avoid providers that charge these fees.

- Statement fee: Again, this is a hidden cost similar to account and monthly fees. The best merchant service providers do not charge statement fees.

- Equipment costs: You might already own compatible hardware. If you don’t, you’ll either need to purchase it on your own or from the merchant account provider. Many providers also offer the option to rent equipment, which may come with upfront and ongoing costs.

Incidental Fees

- Chargeback fees: Chargebacks happen when a cardholder has been a victim of fraud. Merchant services providers will charge a fee for each instance. Multiple instances may also result in fines. According to a Chargebacks911 report, 74% of merchants experienced an increase in chargebacks from 2022 to 2023, with a 19% average reported increase.

- Minimum processing fee: Depending on your provider and selected plan, you may have to process a minimum amount in transactions. If you don’t hit this minimum, you may have to pay a fee.

- NSF fee: The not-sufficient-funds fee happens when a cardholder doesn’t have enough balance in their account to cover the amount of the transaction. The issuing bank will typically apply this fee to the cardholder, so this does not impact merchants.

- PCI compliance fees: Some providers charge a fee to remain PCI-compliant, though it’s advised to find one that includes PCI compliance with their cost. Non-compliance could also result in fees of around $19.95 per month plus additional fines should there be a breach.

To learn more about different types of merchant service markups and what to expect for average processing rates, read our full guide on credit card processing fees.

How to Lower Credit Card Processing Fees

Here are some ways to get lower processing rates:

- Shop around. Do your research to find out who charges the lowest rates and which fee structure works for your average transactions.

- Ask. Sometimes your current business tools can negotiate their rates for you. This works especially well if you have a long and good relationship with your merchant services provider.

- Fight payment fraud. Look for ways to prevent chargebacks and other fraudulent activity so you don’t waste time and money on recovery. Many merchant services offer fraud protection tools, some free, some with an additional charge.

- Avoid chargeback fees. Not all chargebacks are because of fraud. Some are legitimate mistakes. Learn more in our article on how to prevent chargebacks.

- Implement surcharging. Credit card surcharging is the process of passing transaction fees on to customers. Learn more about it in our guide to credit card surcharging.

- Swipe when possible. Card-present transaction fees (swipe, chip, and NFC payments) are lower than online transaction fees because there is a reduced fraud risk. You can lower your fees by opting for these payment methods whenever possible.

Merchant Account & Payment Trends to Look Out for in 2024

The landscape of merchant accounts and payment processing continues to evolve at a rapid pace. Staying informed about trends is essential for maintaining a competitive edge in the world of merchant services. Here are some trends you can look out for in 2024:

- Increased Personalization: In 2024, expect to see a deeper focus on personalizing the payment experience. Merchant account providers will provide more tools for businesses to use data-driven insights to tailor payment options, offers, and rewards to individual customer preferences, enhancing overall satisfaction and loyalty. According to a report, 71% of consumers expect personalization in their shopping experience, another report shows that retailers that invested in personalization efforts saw a 45% increase in their conversion rate. Learn more about personalization in retail.

- Increased Use of AI: Artificial intelligence (AI) will play an even larger role in payment processing, offering enhanced fraud detection, predictive analytics, and customer support. AI-driven chatbots and virtual assistants will become more prevalent, providing instant assistance to customers. Learn more about the use of AI in retail.

- More Advanced Security Measures: As cyber threats continue to evolve, 2024 will bring heightened emphasis on advanced security measures. The payment security market is expected to grow at a compound annual growth rate (CAGR) of 13.9% from 2023 to 2030. Expect to witness the implementation of cutting-edge encryption technologies and multi-factor authentication to protect sensitive financial data.

- Heavier Emphasis on Data Security: An estimated 83% of organizations have experienced more than one data breach in 2022. With data breaches on the rise, 2024 will see a stronger emphasis on data security. Stricter compliance with data protection regulations and increased investment in secure payment technologies will be crucial for businesses.

- Wider Acceptance of Crypto: Cryptocurrencies will continue their journey toward mainstream acceptance. It is expected to grow at a CAGR of 14.1% from 2023 to 2033. More businesses will embrace digital currencies as a payment option, and consumers may enjoy greater flexibility when making purchases with crypto assets. Buying with bitcoin and other cryptocurrencies has started to move into the mainstream, and many payment processors, like PayPal, have been quick to adopt this new currency.

- Continued Growth of BNPL: The buy now, pay later (BNPL) trend is expected to persist in 2024 and beyond. The global market size is expected to hit $39.41 billion by 2030, which is equivalent to a CAGR of 26.1% from 2022 to 2030. Consumers will continue to seek flexible payment options, and more merchant service providers will offer seamless installment payment plans. More customers will be looking for this payment option so consider looking for a provider that offers BNPL.

- Increased Focus on Lower Costs, Better Transparency, and Faster Transactions: In an increasingly competitive market, more businesses will prioritize cost-efficiency, transparency, and faster payment processing—and merchant service providers will respond to maintain their competitiveness. This means lower fees for merchants, clearer pricing structures, and quicker settlement times, all contributing to improved customer satisfaction.

- Continued Growth in Volume and Efficiency of ACH Transactions: According to Nacha, consumers are increasingly looking for ACH, or bank-to-bank, transactions as a way to pay for items, including online. By the third quarter of 2022, a total of $19.3 trillion of ACH payments have been processed. Not all merchant services offer this, so look for this feature, especially if you do B2B sales.

- Further growth in contactless payments: The use of this payment method continues to rise, and is becoming a standard. Contactless payments are projected to increase by 221% between 2022 and 2026. Many card readers, like Square and PayPal, already have NFC payment capabilities. Contactless payments are also more secure than traditional swipe or chip payments because of the encrypted microchips in mobile apps.

Check out these other sources to help you plan for the future:

- Payments trends and statistics gathered by industry.

- Our payment report on the state of payment processing for retail and ecommerce.

- Online shopping statistics for how consumers prefer to buy online.

- Buy Now, Pay Later statistics and how it impacts consumer purchasing decisions.

Bottom Line

If you are selling in today’s world, you need a merchant account. Getting one is pretty easy, but choosing the right merchant services provider for your small business takes some work if you want the best fit. It may be tempting to go with the first one recommended to you or the one with the lowest rates, but it’s important to think about security features, tech integrations, and chargeback management. Start by identifying your unique business needs and challenges, and then rank each option against your qualifications to make an informed, strategic decision.