There are two main components of a bank statement reconciliation. First, you need to ensure that all transactions on your bank statement appear on your check register. Then, see to it that the remaining transactions in your check register are recorded properly, even though they haven’t cleared the bank. We’ll break these two components into five easy steps to illustrate how to do bank reconciliation manually plus how you can do it easily using QuickBooks Online. Regular bank reconciliations are a crucial element of cash management for small businesses and generally are a duty of the bookkeeper.

Many free or low-priced accounting software doesn’t offer an adequate bank reconciliation feature. While they claim to perform bank reconciliations, they don’t allow for any timing differences between when a check is written and when it clears the bank. All they do is match your book transactions to your bank transactions and require that they be recorded in the same period. QuickBooks Online offers true reconciliations and is our best small business bank reconciliation software.

Summer Savings: Get 70% off QuickBooks for 3 months. Ends July 31th. |

|

Your reconciliation period must always start from the last time the account was reconciled or opened if it has never been reconciled. Reconciling bank balances monthly is an important internal control over cash. Before you start reconciling bank accounts, get your bank statement, check register, and previous bank reconciliation statement first.

For illustration purposes, here is a bank statement from a fictitious bank called First Capital Bank.

New York, NY 10003-1502 1-800-555-5555 PO BOX 4000 | CHECKING ACCOUNT STATEMENT 355 Lexington Ave., 18th Floor New York, NY 10017 Statement Period: June 1, 2022 to June 30, 2022 | ||||

Date | Description | Ref. | Withdrawals | Deposits | Balance |

06-01-2022 | Bank statement beginning bal. | $ 10,000 | |||

06-03-2022 | Local Phone Company - Visa | 9655 | 250 | 9,750 | |

06-08-2022 | Check No. 100 | 1,000 | 8,750 | ||

06-09-2022 | Check No. 101 | 350 | 8,400 | ||

06-15-2022 | Cash Deposit | 2297 | 5,400 | 13,800 | |

06-17-2022 | Check No. 103 | 2,100 | 11,700 | ||

06-18-2022 | ATM Withdrawal | 1112 | 3,000 | 8,700 | |

06-20-2022 | Cash Deposit | 2298 | 1,500 | 10,200 | |

06-24-2022 | Check No. 105 | 800 | |||

06-28-2022 | NYC Electric - Visa | 8655 | 120 | 9,280 | |

06-29-2022 | Kristen Berman - Payment | 3332 | 700 | 9,980 | |

06-30-2022 | Bank service charges | 10 | 9,970 | ||

BANK STATEMENT ENDING BALANCE | $ 9,970 | ||||

Below is the check register of the First Capital Bank checking account in the books of Paul’s Plumbing:

CHECK REGISTER - FIRST CAPITAL BANK Account No.: 321-0000-9874 From June 1, 2022, to June 30, 2022 | |||||

|---|---|---|---|---|---|

Date | Description | Ref. | Debit | Credit | Balance |

06-01-2022 | Beginning balance | $ 9,000 | |||

06-03-2022 | Local Phone Company Payment - Visa | 9655 | 250 | 8,750 | |

06-06-2022 | Check # 101 - Business Supply Center | 350 | 8,400 | ||

06-08-2022 | Check # 102 - Cecil’s Lockworks | 200 | 8,200 | ||

06-10-2022 | Check # 103 - Foster Lighting | 2,100 | 6,100 | ||

06-14-2022 | Cash collections deposited | 2297 | 5,400 | 11,500 | |

06-16-2022 | Check # 104 - Novello Lights Magazine | 1,800 | 9,700 | ||

06-18-2022 | ATM Withdrawal | 1112 | 3,000 | 6,700 | |

06-19-2022 | Cash collections deposited | 2298 | 1,500 | 8,200 | |

06-21-2022 | Check # 105 - 123 Plumbing Supply | 800 | 7,400 | ||

06-24-2022 | Check # 106 - Joe Plumber | 200 | 7,200 | ||

06-26-2022 | Check # 107 - Office Supply Store | 500 | 6,700 | ||

06-28-2022 | NYC Electric - Visa | 8655 | 120 | 6,580 | |

06-30-2022 | Cash collections deposited | 2299 | 5,220 | 11,800 | |

CHECK REGISTER BALANCE | $ 11,800 | ||||

At first glance, you can see that the June ending bank statement balance and check register balance don’t agree. The bank reported a balance of $9,970 and yet the records of Paul’s Plumbing show a balance of $11,800. Since there are timing differences in book and bank recording, you need to perform a bank reconciliation to reflect the effect of unrecorded transactions in the book and bank records.

Before we start the June bank reconciliation, we need to review the May reconciliation, shown below. We see that check #100 for $1,000 was a reconciling item. If this check doesn’t clear the bank in June, it will continue to be a reconciling item on the June reconciliation. This is why it’s important to review the prior month’s reconciliation.

PAUL’S PLUMBING BANK RECONCILIATION FIRST CAPITAL BANK, MAY 31, 2022 | ||

|---|---|---|

Balance per bank statement as of May 31, 2022 Add: Deposits in transit Deduct: Outstanding Checks

Balance per Check Register | - (1,000) | $ 10,000 (1,000) $ 9,000 |

Deposits must appear both in the bank statement and check register, and those that appear only in either the bank statement or check register must be addressed. Here’s how you analyze deposit items properly:

- Deposits in the register but not on the bank statement: These are probably timing differences if they were deposited at the very end of the month. Otherwise, they need to be investigated as an error by the bank or in the check register.

- Deposits on the bank statement but not on the check register: These are most likely omissions from the check register that need to be added, but you should verify the bank deposits are valid before adding them.

Let’s use the sample information below:

New York, NY 10003-1502 1-800-555-5555 PO BOX 4000 | CHECKING ACCOUNT STATEMENT 355 Lexington Ave., 18th Floor New York, NY 10017 Statement Period: June 1, 2022 to June 30, 2022 | ||||

Date | Description | Ref. | Withdrawals | Deposits | Balance |

06-01-2022 | Bank statement beginning bal. | $ 10,000 | |||

06-03-2022 | Local Phone Company - Visa | 9655 | 250 | 9,750 | |

06-08-2022 | Check No. 100 | 1,000 | 8,750 | ||

06-09-2022 | Check No. 101 | 350 | 8,400 | ||

06-15-2022 | Cash Deposit | 2297 | 5,400 | 13,800 | |

06-17-2022 | Check No. 103 | 2,100 | 11,700 | ||

06-18-2022 | ATM Withdrawal | 1112 | 3,000 | 8,700 | |

06-20-2022 | Cash Deposit | 2298 | 1,500 | 10,200 | |

06-24-2022 | Check No. 105 | 800 | 9,400 | ||

06-28-2022 | NYC Electric - Visa | 8655 | 120 | 9,280 | |

06-29-2022 | Kristen Berman - Payment | 3332 | 700 | 9,980 | |

06-30-2022 | Bank service charges | 10 | 9,970 | ||

BANK STATEMENT ENDING BALANCE | $ 9,970 | ||||

Take note of the items highlighted in green. The first procedure in reconciling is tracing the bank statement line items to the check register. On June 15, we had a cash deposit of $5,400 with reference number 2297. If you look at the check register below, we see the same deposit recorded on June 14. Now, let’s do the same process for the cash deposit of $1,500 and the $700 deposit by Kristen Berman.

CHECK REGISTER - FIRST CAPITAL BANK Account No.: 321-0000-9874 From June 1, 2022, to June 30, 2022 | |||||

|---|---|---|---|---|---|

Date | Description | Ref. | Debit | Credit | Balance |

06-01-2022 | Beginning balance | $ 9,000 | |||

06-03-2022 | Local Phone Company Payment - Visa | 9655 | 250 | 8,750 | |

06-06-2022 | Check # 101 - Business Supply Center | 350 | 8,400 | ||

06-08-2022 | Check # 102 - Cecil’s Lockworks | 200 | 8,200 | ||

06-10-2022 | Check # 103 - Foster Lighting | 2,100 | 6,100 | ||

06-14-2022 | Cash collections deposited | 2297 | 5,400 | 11,500 | |

06-16-2022 | Check # 104 - Novello Lights Magazine | 1,800 | 9,700 | ||

06-18-2022 | ATM Withdrawal | 1112 | 3,000 | 6,700 | |

06-19-2022 | Cash collections deposited | 2298 | 1,500 | 8,200 | |

06-21-2022 | Check # 105 - 123 Plumbing Supply | 800 | 7,400 | ||

06-24-2022 | Check # 106 - Joe Plumber | 200 | 7,200 | ||

06-26-2022 | Check # 107 - Office Supply Store | 500 | 6,700 | ||

06-28-2022 | NYC Electric - Visa | 8655 | 120 | 6,580 | |

06-30-2022 | Cash collections deposited | 2299 | 5,220 | 11,800 | |

CHECK REGISTER BALANCE | $ 11,800 | ||||

The cash deposit of $1,500 with reference number 2298 is present in our cash register. However, there are a couple of items in the bank statement and check register that need to be addressed. First, we see a deposit of $700 from Kristen Berman in the bank statement that isn’t recorded in the check register. Second, the check register reported a deposit of $5,220 with reference number 2299 that doesn’t appear in the bank statement.

We need to make adjustments for these two items:

- Deposit by Kristen Berman not recorded in the books: The deposit appears in the bank statement so we don’t need to adjust the bank statement balance. After verifying the deposit shown on the bank statement is correct, we add the $700 deposit to the check register.

- Cash deposit by Paul’s Plumbing not reported in the bank statement: The cash deposit of $5,220 appears in the check register, but not the bank statement, so this will be a reconciling item on the reconciliation report. This reconciling item is called a deposit in transit or deposits made that haven’t yet been recorded by the bank.

The same concept from Step 2 applies here. If a withdrawal appears on the bank statement but not on the check register, it’s a book or bank error that needs investigation. Otherwise, it’s a reconciling item if it appears on the check register but not on the bank statement.

New York, NY 10003-1502 1-800-555-5555 PO BOX 4000 | CHECKING ACCOUNT STATEMENT 355 Lexington Ave., 18th Floor New York, NY 10017 Statement Period: June 1, 2022 to June 30, 2022 | ||||

Date | Description | Ref. | Withdrawals | Deposits | Balance |

06-01-2022 | Bank statement beginning bal. | $ 10,000 | |||

06-03-2022 | Local Phone Company - Visa | 9655 | 250 | 9,750 | |

06-08-2022 | Check No. 100 | 1,000 | 8,750 | ||

06-09-2022 | Check No. 101 | 350 | 8,400 | ||

06-15-2022 | Cash Deposit | 2297 | 5,400 | 13,800 | |

06-17-2022 | Check No. 103 | 2,100 | 11,700 | ||

06-18-2022 | ATM Withdrawal | 1112 | 3,000 | 8,700 | |

06-20-2022 | Cash Deposit | 2298 | 1,500 | 10,200 | |

06-24-2022 | Check No. 105 | 800 | 9,400 | ||

06-28-2022 | NYC Electric - Visa | 8655 | 120 | 9,280 | |

06-29-2022 | Kristen Berman - Payment | 3332 | 700 | 9,980 | |

06-30-2022 | Bank service charges | 10 | 9,970 | ||

BANK STATEMENT ENDING BALANCE | $ 9,970 | ||||

The checks reported in the bank statement above pertain to vendor checks that Paul’s Plumbing issued. The vendors deposited the checks to the bank, which resulted in a deduction in the bank statement beginning balance.

Matching Checks in the Check Register and Bank Statement

Now, our goal is to match the checks in the check register with those in the bank statements. So far, the checks in the bank statement are check numbers 100, 101, 103, and 105. At an initial glance, you should notice that check numbers 102 and 104 are missing in the sequence. Moreover, we should also trace if Paul’s Plumbing issued checks beyond check number 105. We can determine that by looking at the check register.

CHECK REGISTER - FIRST CAPITAL BANK Account No.: 321-0000-9874 From June 1, 2022, to June 30, 2022 | |||||

|---|---|---|---|---|---|

Date | Description | Ref. | Debit | Credit | Balance |

06-01-2022 | Beginning balance | $ 9,000 | |||

06-03-2022 | Local Phone Company Payment - Visa | 9655 | 250 | 8,750 | |

06-06-2022 | Check # 101 - Business Supply Center | 350 | 8,400 | ||

06-08-2022 | Check # 102 - Cecil’s Lockworks | 200 | 8,200 | ||

06-10-2022 | Check # 103 - Foster Lighting | 2,100 | 6,100 | ||

06-14-2022 | Cash collections deposited | 2297 | 5,400 | 11,500 | |

06-16-2022 | Check # 104 - Novello Lights Magazine | 1,800 | 9,700 | ||

06-18-2022 | ATM Withdrawal | 1112 | 3,000 | 6,700 | |

06-19-2022 | Cash collections deposited | 2298 | 1,500 | 8,200 | |

06-21-2022 | Check # 105 - 123 Plumbing Supply | 800 | 7,400 | ||

06-24-2022 | Check # 106 - Joe Plumber | 200 | 7,200 | ||

06-26-2022 | Check # 107 - Office Supply Store | 500 | 6,700 | ||

06-28-2022 | NYC Electric - Visa | 8655 | 120 | 6,580 | |

06-30-2022 | Cash collections deposited | 2299 | 5,220 | 11,800 | |

CHECK REGISTER BALANCE | $ 11,800 | ||||

The check register above shows that Paul’s Plumbing issued seven checks to vendors (101, 102, 103, 104, 105, 106, and 107). The only checks that appear in both the check register and bank statement are check numbers 101, 103, and 105. Hence, we can tick them off as cleared. However, we don’t see check numbers 102, 104, 106, and 107 in the bank statement, meaning that these checks haven’t yet cleared our bank.

We see check 100 in the bank statement but not on the check register. Recall that this check was on the May reconciliation. Since it has now cleared the bank, it will no longer be a reconciling item on the bank reconciliation report for June.

Direct Debits and Bank Service Charges

Aside from outstanding checks, we see direct charges to the bank account. These are bank service charges and direct debits. The direct debits via Visa pertain to Paul’s Plumbing’s payment of telephone bill (Local Phone Company) and electric bill (NYC Electric). Since we have these two items in both records, we can tick them off as cleared.

However, the bank service charge of $10 in our bank statement doesn’t appear in our check register. The bank service charge is erroneously omitted from the books, so it should be added to the check register.

In reconciling, here’s how we treat them:

- Outstanding checks: These checks appear in the check register but not in the bank statement. Hence, we should deduct them from the bank statement balance. The outstanding checks in our example are check numbers 102, 104, 106, and 107.

- Bank service charges: These are minimal fees that banks bill for using their bank services. Since these charges don’t appear in the check register, we should deduct them from the check register balance.

In performing bank reconciliations, always remember that adjustments for missing transactions only pertain to items on the bank statement not in the check register. Hence, we don’t make journal entries for deposits in transit and outstanding checks.

Below are common book errors that are often discovered during the reconciliation process. These errors should be corrected in the accounting records before the reconciliation is completed. Reconciling items that need adjustment:

- Customer payments made to the bank

- Collection of customer notes made through the bank

- Interest earned in the bank account

- Bank service charges

- NSF (nonsufficient funds) checks deposited

An NSF check is a check from your customer that “bounced” because they didn’t have sufficient funds in their checking account to pay the check. It’s a good idea to give all of your deposited checks a few days to clear before spending the money in case any of them bounce. Otherwise, a bad check from your customer could result in your own check bouncing.

In our example above, the only error corrections needing book adjustment would be the deposit by Kristen Berman and the bank service charge. We record the adjustments in the check register as follows:

CHECK REGISTER - FIRST CAPITAL BANK Account No.: 321-0000-9874 From June 1, 2022, to June 30, 2022 | |||||

|---|---|---|---|---|---|

Date | Description | Ref. | Debit | Credit | Balance |

06-01-2022 | Beginning balance | $ 9,000 | |||

06-03-2022 | Local Phone Company Payment - Visa | 9655 | 250 | 8,750 | |

06-06-2022 | Check # 101 - Business Supply Center | 350 | 8,400 | ||

06-08-2022 | Check # 102 - Cecil’s Lockworks | 200 | 8,200 | ||

06-10-2022 | Check # 103 - Foster Lighting | 2,100 | 6,100 | ||

06-14-2022 | Cash collections deposited | 2297 | 5,400 | 11,500 | |

06-16-2022 | Check # 104 - Novello Lights Magazine | 1,800 | 9,700 | ||

06-18-2022 | ATM Withdrawal | 1112 | 3,000 | 6,700 | |

06-19-2022 | Cash collections deposited | 2298 | 1,500 | 8,200 | |

06-21-2022 | Check # 105 - 123 Plumbing Supply | 800 | 7,400 | ||

06-24-2022 | Check # 106 - Joe Plumber | 200 | 7,200 | ||

06-26-2022 | Check # 107 - Office Supply Store | 500 | 6,700 | ||

06-28-2022 | NYC Electric - Visa | 8655 | 120 | 6,580 | |

06-30-2022 | Cash collections deposited | 2299 | 5,220 | 11,800 | |

06-30-2022 | ADJ: Payment from Kristen Berman via bank | 3332 | 700 | 12,500 | |

06-30-2022 | ADJ: Bank service charges | 10 | 12,490 | ||

CHECK REGISTER BALANCE | $ 12,490 | ||||

A bank reconciliation statement is a schedule showing the differences between the bank statement balance and checking account. The most common format of a bank reconciliation statement is the adjusted balances format. It reconciles both the bank and book accounts

An alternative format would be the bank-to-book format. Here, you only need to adjust the bank statement balance to arrive at the check register balance. While this format is easy, the bank-to-book format won’t show the equality of bank balances.

For illustration purposes, we’ll use the adjusted balances format.

PAUL’S PLUMBING BANK RECONCILIATION FIRST CAPITAL BANK, JUNE 30, 2022 | |||

|---|---|---|---|

Balance per bank statement (Step 1) Add: Deposits in transit (Step 2) Deduct: Outstanding Checks (Step 3)

Balance per Check Register | 200 1,800 200 500 | 5,220 (2,700) | $ 9,970 2,520 $ 12,490 |

After reconciling the bank accounts, the true cash balance available to spend is $12,490.

Bank Reconciliation Using QuickBooks Online

Reconciling bank accounts in QuickBooks Online follows a similar process. However, it will be a little bit easier since QuickBooks Online will pull up your check register automatically. Read our QuickBooks Online bank reconciliation article or watch the free tutorial video that shows you the hands-on process of reconciling bank accounts.

As a QuickBooks Online example, let’s reconcile accounts using the data from First Capital Bank on QuickBooks Online.

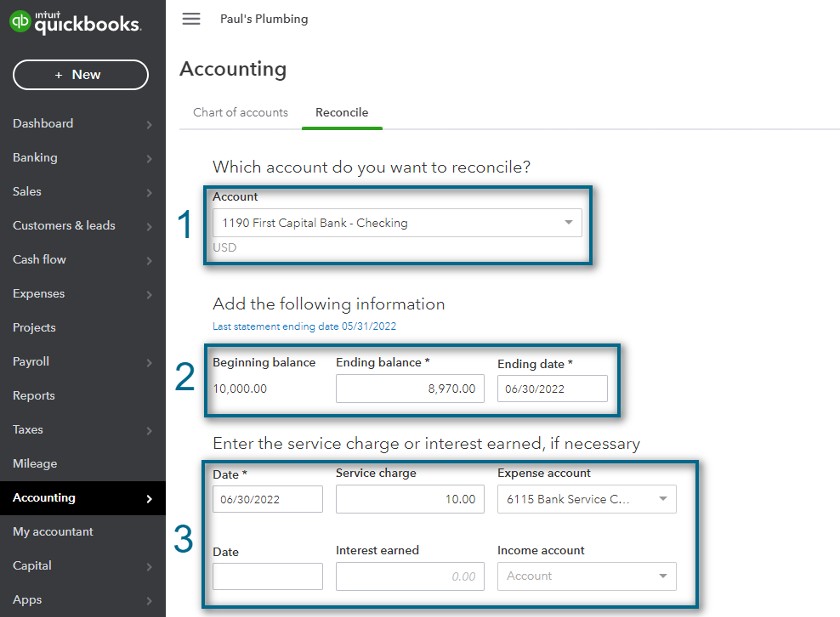

Entering Data Needed Before Reconciliation

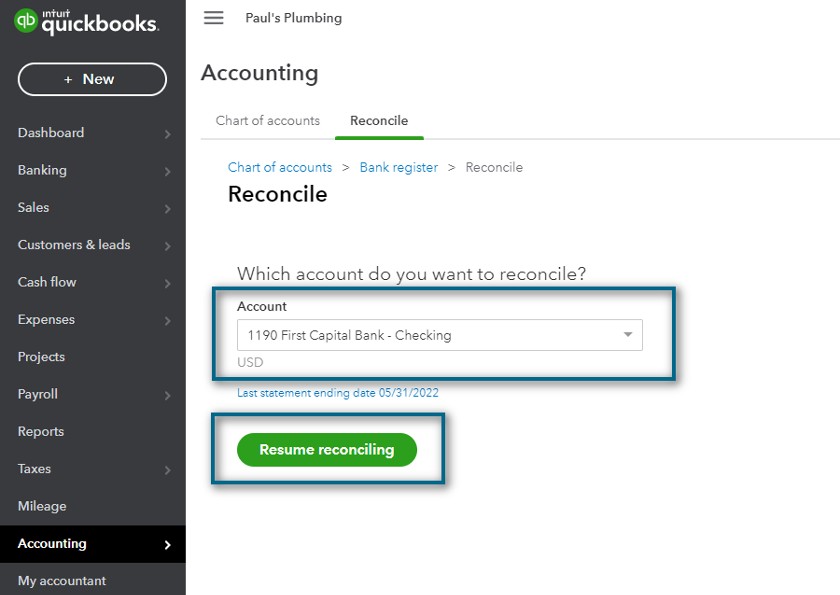

- Step 1.1: Choose the account you want to reconcile. For this article, we used First Capital Bank. But in your small business, choose your checking account.

- Step 1.2: Enter the ending balance in the bank statement. The ending balance is $9,970 in the example above.

- Step 1.3: Enter the bank service charges and interest earned. In the books of Paul’s Plumbing, the appropriate expense account is Bank Service Charges. However, you may use other account titles as you deem appropriate. By allowing us to enter the bank statement charges here, QuickBooks Online saves us the step of correcting for this omission in Step 4 above.

We don’t have any interest earned, so we’re skipping that part. But if you encounter interest revenue in your business’ bank statement, include the amount as interest earned and choose the appropriate account. Click Start Reconciling when you’re done.

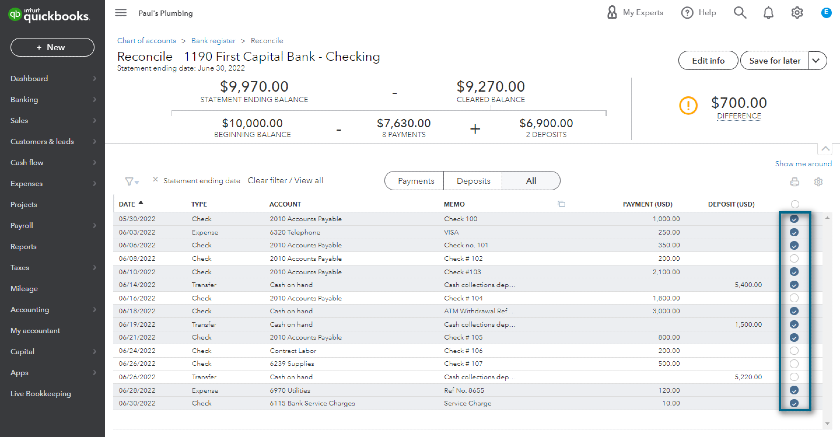

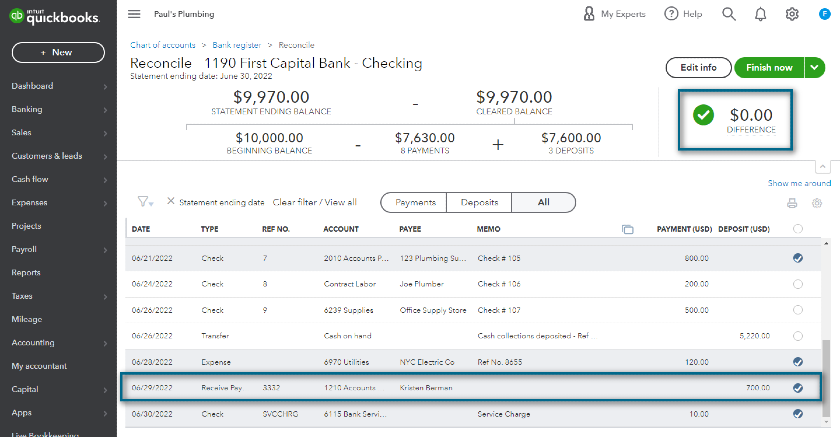

Reconciling Transactions

If a transaction is both in QuickBooks Online and the bank statement, tick its entry to clear it. QuickBooks Online will add or deduct automatically in the cleared balance. Otherwise, leave it be. Notice that unticked transactions are the items that we only see in the QuickBooks Online check register but not on the bank statement.

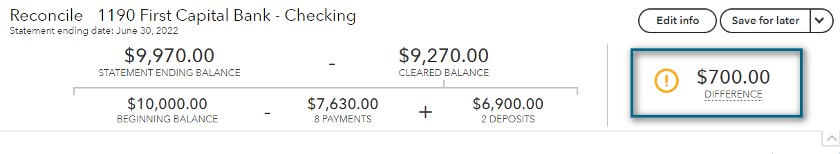

Reconciling a Missing Difference

In Step 2, we ticked all the transactions we see in both the bank statement and QuickBooks Online’s check register. However, there’s still a $700 difference. If you review the bank statement, remember that Kristen Berman paid us $700 directly through the bank, which means that we still need to record the transaction before we complete our reconciliation.

You can safely exit the reconciliation screen without losing your progress by clicking the Save for later button at the top. After recording the $700 payment from Kristen, you can go back to the reconciliation screen and tick the payment.

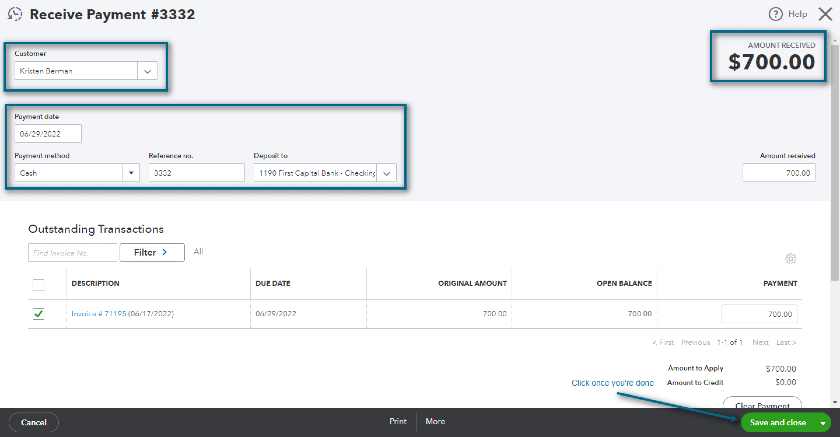

Receiving Payment Made Directly to the Bank by Customer

Fill in the details and don’t forget to select the appropriate bank account where the customer deposited it. In our example, Kristen deposited it to First Capital Bank, so we should select the First Capital Bank – Checking Account. Hit the green Save and close button once you’re done.

Resuming Reconciliation

Navigate to Accounting in the left side menu bar. Click Reconcile to bring you the reconciliation screen. Choose the account you want to reconcile, then click Resume reconciling. Once you’re in the reconciliation screen, find the adjustment you made and tick it. Notice that the difference is already $0 and the cleared balance is equal to the statement ending balance.

Completed Bank Reconciliation Process in QuickBooks Online

Click the green Finish now button to complete the bank reconciliation. This notification will appear: “You reconciled this account.” Click Done, and you’ll arrive back at the bank register.

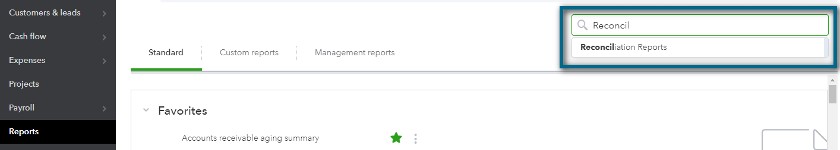

Navigate to Reports in the left side menu. Use the search bar and search for Reconciliation Reports.

Searching for Reconciliation Reports

Generating a Bank Reconciliation Statement

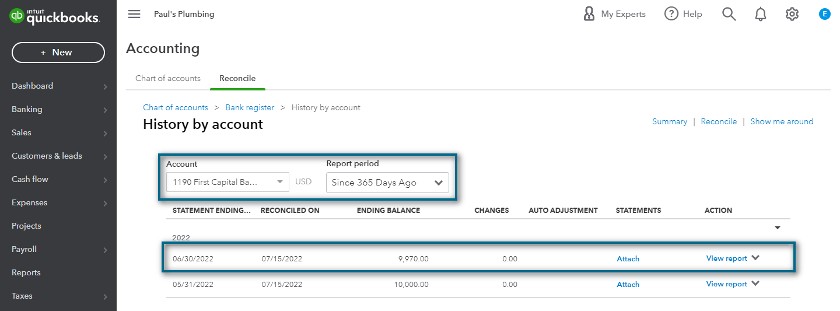

QuickBooks Online will bring you to the History by account screen. Make sure to choose the checking account you want to see and set the report period. Click View Report to generate the bank reconciliation statement.

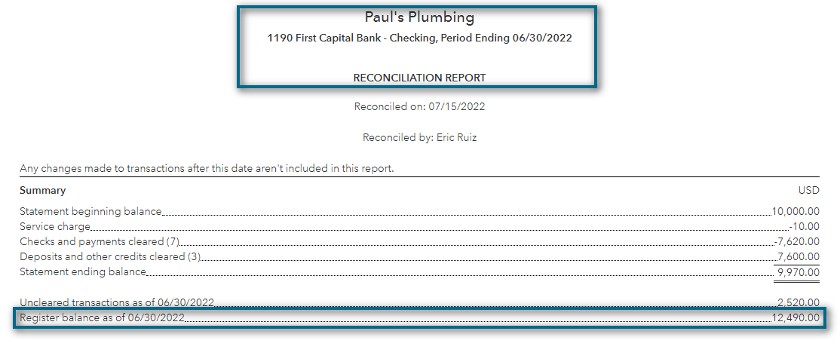

Bank Reconciliation Statement

QuickBooks Online reconciled the bank statement items to arrive at the bank statement ending balance. If you add all uncleared transactions to the statement ending balance, you’ll arrive at the register balance or the adjusted cash balance.

The Importance of Reconciling a Bank Statement

- Ensures the availability of cash: Timely bank reconciliations help your business know the amount of cash in the bank. It helps reduce the occurrence of bouncing checks and failed payments due to insufficient funds.

- Catches fraud and manipulations: If one of your employees withdraws money from your bank account or a supplier forges a check you issued, you’ll certainly see them in the bank statement. In large businesses, accountants, and internal auditors sometimes use the proof of cash or the two-date bank reconciliation. The proof of cash not only reconciles the ending balances of the checking account but the current period receipts and disbursements.

- Detects errors and fees: If you recorded checks in the books by mistake, you can correct them by looking at the amount stated in the bank statement. Moreover, you can look at the actual check that comes with the bank statement. The bank statement will also reveal fees and penalties that they charged to your account.

- Explains differences in bank statements and check registers: A bank reconciliation shows (a) items that should be recorded in the check register and (b) items that are yet to be recorded by the bank. By considering these reconciling items, you can verify that the check register and bank account have the same balance.

Bottom Line

Reconciling bank accounts is an important control over cash. It ensures that all cash transactions are accounted for and justified. Without preparing a timely bank reconciliation, you risk your business losing cash without you knowing. With QuickBooks Online, it’s even easier to reconcile bank accounts because you only need to tick transactions until the cleared balance matches the statement balance.