In this article, we explain how to fill out Schedule F for reporting farming and agricultural income and expenses. In accordance with the IRS’s Schedule F instructions, the information below includes details on document assembly, form completion, and filing. As an additional resource, we’ve provided a sample completed form.

Key Takeaways:

- Schedule F is used by owners of farm and agricultural businesses to report income and expenses.

- Farm income includes cash payments and the fair market value of goods received from bartered goods and services.

- Farming expenses include rent, soil supplies, and labor.

- Schedule F should accompany Form 1040.

Step 1: Assemble Supporting Workpapers

It is recommended that you maintain your Schedule F support through accounting software, as that is the best way to stay organized. Compile any of the items below that apply to your farming operation, and include any ordinary and necessary expenses Ordinary and necessary farming expenses are ones that are appropriate, helpful, and commonly accepted in the industry. incurred in the course of your business.

- Cost of soil supplies (e.g., fertilizer, commercial compost, and seeds)

- Animal feed

- Details for equipment purchased during the year:

- Type of equipment purchased (e.g., backhoe, seeder, and sprayer)

- Date of equipment purchased

- Cost of equipment purchased

- Records of any appropriate expenses that are standard for the farming industry

- Records of cash and credit income received

- Records of bartering income

Our related resources:

Step 2: Access the Form

Schedule F should be a part of the individual tax package provided in your tax software program. You can also find Schedule F on the IRS website.

Step 3: Complete Identifying Information

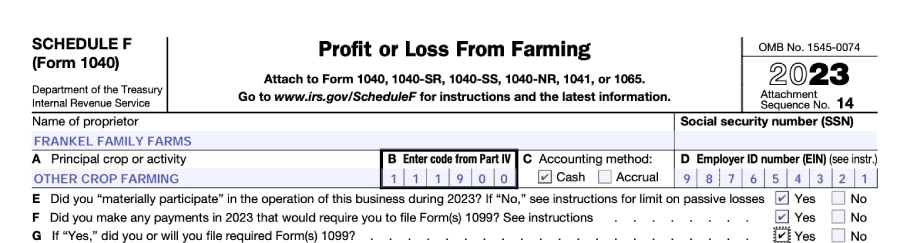

The top of Schedule F should be completed with the following information:

- Name of proprietor: Indicate the business name if there is another name besides the taxpayer’s personal name.

- Social Security Number (SSN): Input your SSN. Trusts and partnerships should not provide an SSN. Instead, enter an Employer ID Number (EIN) in section D; see our guide on how to get an EIN.

- Line A – Principal Crop of Activity: Enter the main activity performed on your farm. You may use the description for the code entered on line B, shown next.

- Line B – Activity Code: Select the correct activity code from Part IV of Schedule F contains a list of Principal Agricultural Activity Codes

- Line C – Accounting Method: Check the correct box to indicate the cash or accrual basis accounting method.

- Line D – Employer ID Number: Enter the business ID number issued on your IRS Determination Letter

- Line E – Material Participation: Check “yes” or “no” if you materially participated in the business.

- Line F – 1099 Payments: Check “yes” or “no” if you paid any contractor $600 or more for services.

- Line G: 1099 Reporting Confirmation: Check “yes” or “no” if you issued Form 1099s for the contractors referenced on line F.

Sample Input for Schedule F Identifying Information

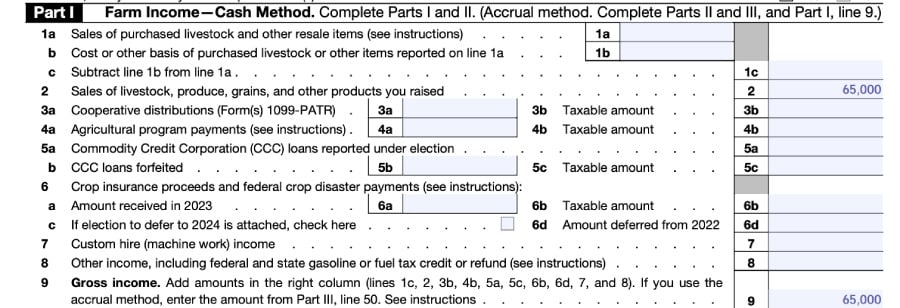

Step 4: Complete Part I: Farm Income – Cash Method

This section is primarily for farm operators keeping their books on the cash method of accounting—but if the accrual basis of accounting is used, complete only line 9 of Part I, then proceed to Part II.

For users of the cash method, lines 1 to 8 should be completed, showing each applicable type of income. Frankel Family Farms only grows and sells produce, so its income is reported on line 2. If the farming operation had income from additional farming sources listed on other lines in Part I, then all income sources would be totaled on line 9.

Reporting for income reported under the accrual method is explained in Part III.

Sample Input for Schedule F, Part I

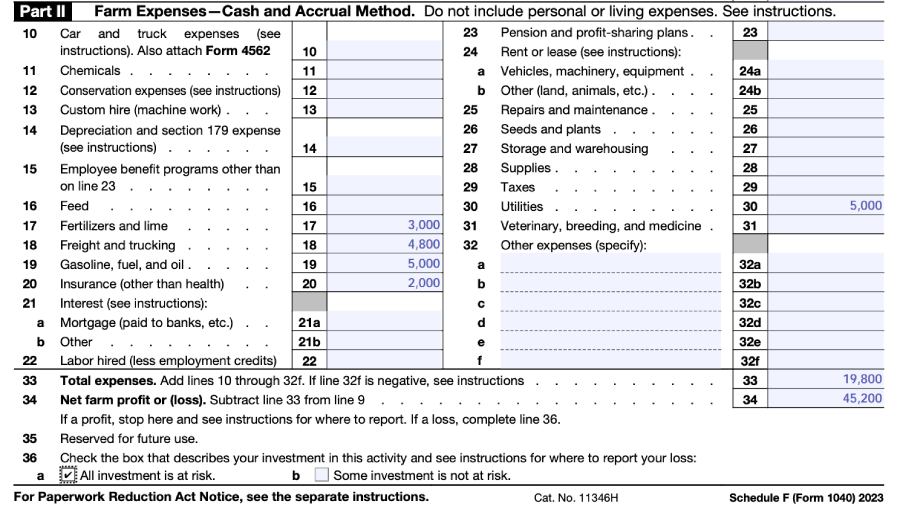

Step 5: Complete Part II: Farm Expenses – Accrual and Cash Method

Lines 10-34 should be completed showing each expense for farm businesses using either the cash or accrual method—whichever you selected in part C of the header. Current year expenses for Frankel Family Farms are shown below and totaled on line 33. Net income of $45,200 ($65,000 to $19,800) is shown on line 34.

At the bottom of Part II, you’ll want to check the box indicating whether or not your investment is “at-risk.” Investments that are “at-risk” create a personal liability for the investors if the investment goes bad.

Sample Input, Schedule F, Part II

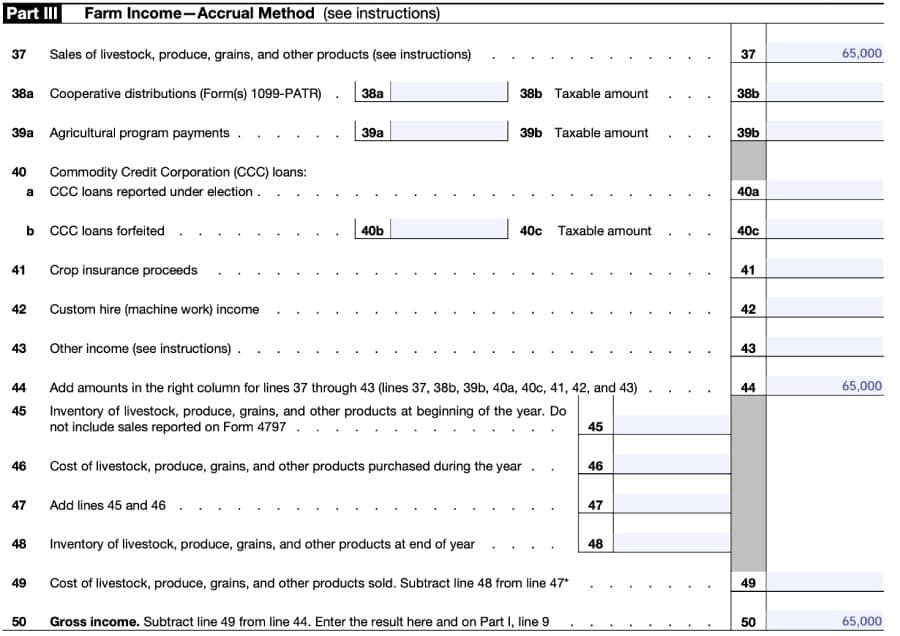

Step 6: Complete Part III: Farm Income – Accrual Method

You may skip this step if you report your income in Part I under the cash method. If applicable, Part III should be completed in the following order:

- Lines 37 to 43 should be completed showing each type of income for farming and agriculture businesses that use the accrual method. If Frankel Family Farms’ produce business operated on the accrual method, income from produce sales would be reported on line 37. If the farming operation had income from additional farming sources listed on other lines in Part III, then all income sources would be totaled on line 44.

- Since inventory-based businesses are more likely to use the accrual method of accounting, cost of inventory is reported on lines 45, 46, 48, and 49.

- Cost of inventory should be subtracted from gross income and reported on line 50.

- The line 50 amount is then transferred to Part 1, line 9.

Sample Input, Schedule F, Part III

Step 7: File the Completed Form

Schedule F should be included with your timely filed tax return, including extensions. The form is due with your personal tax return, and subject to the same filing date.

Who Should Not File Schedule F

The following farm-related businesses should not use Schedule F to report income and expenses:

- Veterinary services

- Pet breeding or care

- Contractual farm management

- Sales of livestock held for draft, breeding, sport, or dairy purposes

- Soil preparation, veterinary, farm labor, or horticultural services if your principal source of income is from the provision of these services

- Farm rentals reporting on Form 4835

Frequently Asked Questions (FAQs)

Schedule F should be completed by owners of farm and agricultural businesses.

Any ordinary and necessary expenses that are required to operate the farming or agricultural business are generally deductible. Examples of deductible expenses include fertilizer, compost, seeds, labor, freight and shipping, and animal feed.

Schedule F works by taking either the cash basis gross income (calculated in Part I) or accrual basis gross income (calculated in Part III) and subtracting out farming expenses (calculated in Part II) to arrive at taxable income. For best practices on how to fill out schedule F, consult the form instructions.

Bottom Line

Schedule F is used to report income and expenses from farming and agriculture business operations. Farm-related activities such as veterinary or boarding services and contractual farm management are excluded from income calculation on this form and should instead use Schedule C.