IRS Form 1099 is a series of forms used to report certain types of income that don’t come from a direct employer in the form of wages, salaries, tips, etc. Form 1099-NEC (nonemployee compensation) is the most common version, frequently used by small business owners.

If businesses pay $600 or more in compensation throughout the year to contractors, freelancers, or other nonemployees, they are required to send copies of Form 1099-NEC to the IRS and payees (before 2020, this was reported on 1099-MISC). Form 1099-NEC is typically issued to individuals, sole proprietors, partnerships, and LLCs treated as either sole proprietorships or partnerships.

Form 1099-NEC is due Jan. 31, 2024, to report 2023 calendar year payments. You can print blank 1099-NEC form copies from the web or fully completed forms from your payroll software—many offer it for free.

What Is a Form 1099-NEC & When Is It Due?

Form 1099-NEC is an information return. Its primary purpose is to give nonemployees a record of the total annual payments they received and need to report during tax time (you won’t withhold or pay any employer taxes on the money you pay contractors). 1099-NEC forms also alert the IRS to who received untaxed payments throughout the year, just in case those individuals don’t self-report and pay their tax bill.

As noted earlier, in prior years, contractor payments were included in Form 1099-MISC. If you need to file a 1099 for nonemployee income paid in 2019, you would use the 2019 1099-MISC. We cover 1099-MISC and other types of 1099 forms in more detail later in this article.

The due date for furnishing a copy to your contractors and vendors and filing a copy with the IRS is Jan. 31 for most businesses; however, when that date falls on a weekend, it’s due the following Monday.

When Are You Not Required to File

You are not required to file a Form 1099 if you meet any of the following conditions:

- You are not engaged in a trade or business.

- The payment was made to another business that is incorporated, but was not for medical or legal services, or the sum of all payments made to the person or unincorporated business is less than $600 in one tax year.

- You paid for physical products or goods, not services. The business you paid is a C corporation or S corporation, unless you paid the business for medical or health care payments or attorney services.

- You made a payment that is not considered to be income, such as a loan repayment or a reimbursement for expenses.

- You made a payment that is not subject to federal income tax, such as a payment made to a foreign person.

Here are some additional things to keep in mind:

- The $600 threshold applies to the total amount of payments made to a single payee during the year, not to each individual payment.

- If you make a payment to a payee who is not a US citizen or resident, you may still be required to file a Form 1099 if the payment is considered to be income for US tax purposes.

- There are some other exceptions to the Form 1099 filing requirements, such as for payments made to certain government agencies or for payments made for gambling winnings.

- If you are required to file a Form 1099, you must do so by the deadline, which is usually Jan. 31st of the year following the year in which the payments were made. Failure to file a Form 1099 on time can result in penalties from the IRS.

If you are unsure whether you are required to file a Form 1099, you should consult with a tax adviser.

How to Prepare & File Form 1099-NEC in 4 Steps

Preparing and filing a Form 1099-NEC is relatively simple, as long as you’ve kept good records. The form itself is brief.

Step 1: Have All Independent Contractors Complete a Form W-9

Before paying a contractor for any work, it is important to have them complete and sign a Form W-9. Form W-9 shows information you will need for preparing Form 1099-NEC, such as the contractor’s name, address, and taxpayer identification number.

Go through your records and find out if you need to request Form W-9. Store them with your other payroll forms.

The links for downloading Form W-9 are:

- Form W-9: This is the blank Form W-9; have your contractors fill this out, sign it, and send you a copy.

- Instructions for the requester of Form W-9: These instructions are for businesses and cover issues such as when to ask for a Form W-9 from a contractor.

If you don’t want to worry about handling paper tax forms and also have W-2 employees, then you can use payroll software like Gusto to do it for you. Contractors enter their personal information on electronic W-9 forms that automatically transfer to year-end 1099 forms, so you don’t have to fill out anything—you can also use it to prepare W-2s for employees. These automations make it much easier to do payroll.

Gusto even lets you pay independent contractors via direct deposit or check, all for $6 per worker each month they’re paid. Learn more about it in our Gusto review or visit Gusto’s website.

Need more help on how to handle your payroll efficiently? Read our How to Do Payroll guide for expert tips and strategies.

Step 2: Track Payments Made to Independent Contractors Throughout the Year

Businesses can monitor payments made to contractors and vendors manually or by using software. At the end of the year, compile a report showing the total amount of payments to each contractor. Analyze this report to determine which contractors you need to send a Form 1099-NEC to.

If you’re tracking payments manually, use Microsoft Excel or Google Sheets. You can enter formulas to automatically sum the payments, so you always have a running year-to-date total.

Step 3: Complete Form 1099-NEC at the End of the Year

Once you have a report showing total amounts paid to each contractor and the Form W-9, you are in a position to prepare the Form 1099-NEC. Fill out the form for each contractor or vendor as required.

The different ways a business can prepare Form 1099-NEC include:

- Filling out paper forms: Order blank forms from the IRS for free; be sure to get Form 1096 in addition to Form 1099-NEC (Form 1096 is a summary of all the 1099 forms you issue and should be sent to the IRS alongside the 1099 copies). It’s important to note that all forms sent to the IRS must be machine-readable forms in red ink. Note: forms cannot be filled out digitally and printed already filled in.

- Downloading PDF forms: Use the downloadable Form 1099-NEC to prepare the copy you send to contractors and vendors. Download the 2022 version of Form 1099-NEC from the IRS website (or click the download link below), and then type in information on-screen and print.

- Using payroll software: If you prefer to file your Forms 1099, you will need to use software that can e-file the forms or work with someone who has access to tax software. Many payroll software have a feature contractors can use to print the completed form themselves, making doing payroll that much simpler.

- Using accounting software: Some accounting software programs can prepare, print, and e-file Form 1099-NEC.

- Using Form 1099 software: There are a handful of desktop and web-based software programs for preparing and e-filing Form 1099.

- Hiring an accountant: You can hire an accountant or tax preparer to prepare and e-file your 1099 forms in addition to your income tax return.

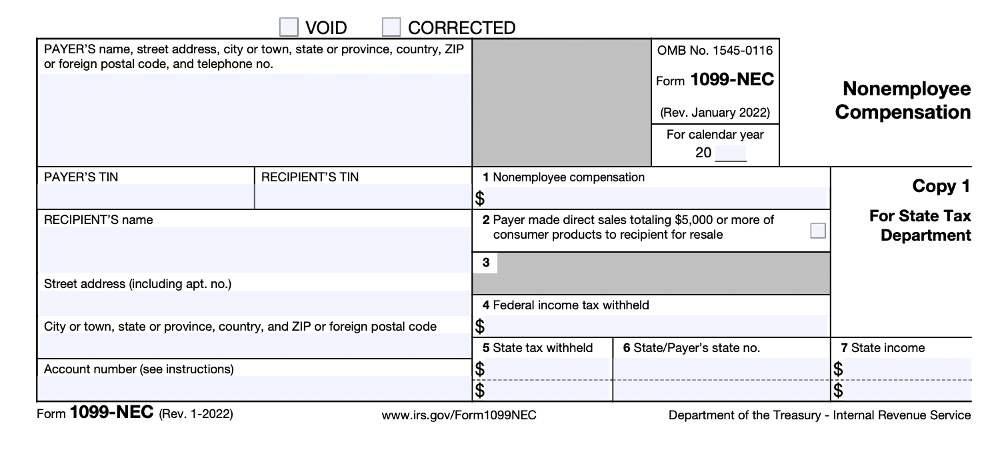

Here is what Form 1099-NEC looks like, along with a brief description of what type of payments are reported in each box:

Box 1. Nonemployee compensation

Report payments of $600 or more made to a nonemployee. Normally, you can report nonemployee compensation paid to individuals and partnerships.

Boxes 2 & 3. Direct sales totaling $5,000 or more of consumer products to recipient for resale

No information is required in this box, so leave it blank if it’s not relevant for you.

Box 4. Federal income tax withheld

Enter backup withholding. For example, persons who have not furnished their TINs to you are subject to withholding on payments required to be reported in box 1.

A contractor might be subject to back up withholding if, for example, they did not provide you with their federal taxpayer identification number or Social Security number. This is why it’s important to ask your contractors to give you a signed Form W-9 before paying them.

Boxes 5–7. State information

These boxes are provided for your convenience only and need not be completed for the IRS. Use the state information boxes to report payments for up to two states.

Keep the information for each state separated by the dash line. If you withheld state income tax on this payment, you may enter it in box 5. In box 6, enter the abbreviated name of the state and the payer’s state identification number. In box 7, you may enter the amount of the state payment.

Step 4: Provide Form 1099 to Independent Contractors & File With IRS

Provide one copy of Form 1099-NEC to each contractor or vendor and file all Forms 1099-NEC with the IRS. You will also have a copy you can send to your state tax department, if required. Send out these 1099 forms after you review them for accuracy and completeness.

Businesses hand-deliver, mail, or electronically send Form 1099-NEC to their contractors. When filing with the IRS, either mail in paper forms or electronically file them.

Penalties for Missing the Deadline

The penalties for missing the deadline for filing Form 1099 vary depending on how late the forms are filed and whether the taxpayer acted with reasonable cause. Here’s a summary:

- $50 per form if filed late but within 30 days of the deadline.

- $100 per form if filed late but within 60 days of the deadline.

- $250 per form if filed more than 60 days late.

In addition to the monetary penalties, the IRS may also impose a civil fraud penalty of up to 75% of the tax due if the taxpayer intentionally disregards the requirement to file Form 1099s.

There are a few exceptions to the penalties for late filing or providing incorrect Form 1099s. For example, there is no penalty if the taxpayer can show that the failure to file or provide correct forms was due to reasonable cause. Reasonable causes can include things like illness, natural disasters, or computer problems.

If you are a taxpayer who has missed the deadline for filing Form 1099s, you should contact the IRS as soon as possible to discuss your options. The IRS may be willing to waive the penalties if you can show that you had reasonable cause for the late filing.

Here are some tips for avoiding penalties for late filing or providing incorrect Form 1099s:

- Start preparing your Form 1099s early.

- Make sure you have all of the necessary information, such as the taxpayer’s name, address, and taxpayer identification number (TIN).

- Review your Form 1099s carefully before filing them.

- File your Form 1099s by the deadline.

Form 1099-NEC Filing Examples

We provide two examples of how to prepare Form 1099-NEC. Our first example is a 1099 for an outside consultant. In our second example, we describe a situation where a Form 1099-NEC is not required because the amount paid is less than the reporting threshold.

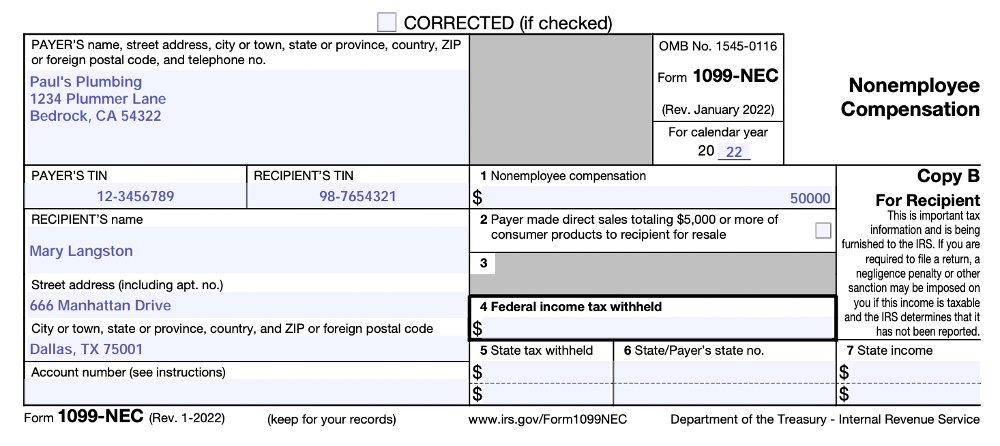

Mary is a human resources (HR) consultant. Your firm contracted Mary to set up your HR information system and provide training on the system. She is an independent contractor.

In 2022, your business paid Mary a total of $50,000 for nonemployee compensation. Since $50,000 exceeds the $600 threshold for nonemployee compensation, your business is required to file a Form 1099-NEC.

You show nonemployee compensation of $50,000 in Box 1. This means that Mary will have to claim $50,000 of taxable earnings on her tax return.

Below is a sample Form 1099-NEC that you would issue to Mary:

Chris is an independent QuickBooks ProAdvisor. Your firm hired Chris to set up your QuickBooks files and train you on how to use the system. Chris also reviews your financial statements every quarter to make sure that you are doing things correctly. Chris is an independent contractor.

In 2022, your business paid Chris a total of $550 of nonemployee compensation. Since $550 is less than the $600 threshold for nonemployee compensation, your business is not required to file a Form 1099-NEC for Chris.

Other Common 1099 Forms

There are several varieties of Form 1099. Form 1099-NEC is the most common for small and midsize businesses because this is the form used to report payments to independent contractors. However, before 2020, 1099-MISC was the most common.

Other varieties of Form 1099 for small and midsize businesses are:

- Form 1099-MISC: Issued by businesses to report miscellaneous nonemployee payments other than those to contractors, like those to attorneys, for rents, awards, etc.

- Form 1099-CAP: Issued by corporations to report changes in corporate control and capital structure

- Form 1099-DIV: Issued by corporations and financial institutions to report dividends paid to shareholders; C-corps may need to issue this form to their shareholders

- Form 1099-INT: Issued by businesses and financial institutions to report interest payments; businesses may need to use this form to report interest paid to individuals or partnerships

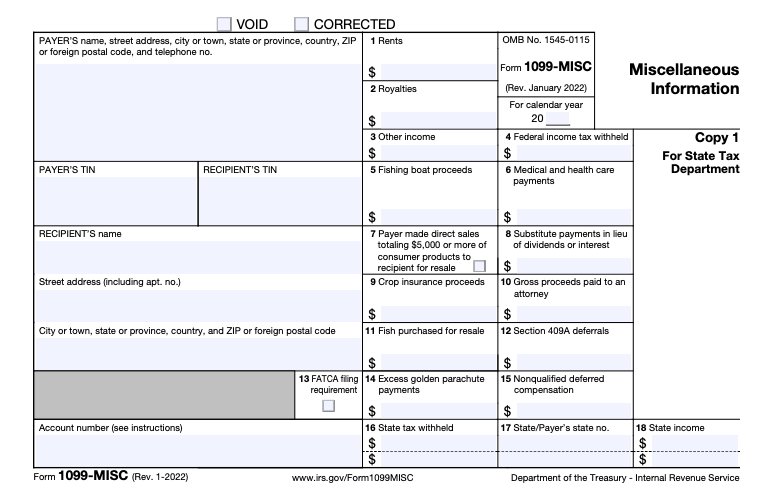

When to File IRS Form 1099-MISC

Since Form 1099-MISC was the primary 1099 used by businesses before the 2020 changes, let’s go over when you would need to file it, along with the new instructions and layout.

Form 1099-MISC must be filed by Feb. 28 if you file by mail and March 31 if you file electronically.

The minimum thresholds at which businesses are required to form 1099-MISC are:

Reason for Payment | Minimum Amount Paid by Your Business |

|---|---|

Rents | $600 |

Royalties | $10 |

Prizes and awards | $600 |

Withholding of federal income tax under the backup withholding rules | Any Amount |

Fishing boat proceeds | $600 |

Medical and healthcare payments | $600 |

Direct sales of consumer products for resale anywhere other than retail stores | $5,000 |

Substitute payments in lieu of dividends or interest | $10 |

Crop insurance proceeds | $600 |

Attorneys and lawyers | $600 |

Cash payments for fish or other aquatic life | $600 |

Box 1. Rents

Report all types of rent payments of $600 or more during the calendar year. This includes rent for office space, warehouse space, machines, or equipment.

Box 2. Royalties

Report total gross royalty payments of $10 or more during the calendar year. Royalties include payments to license intangible property like patents, copyrights, or trademarks. Royalties also include fees paid by a publisher to an author or literary agent.

Box 3. Other income

Report payments of $600 or more for prizes, awards, and certain other types of payments that do not fit into any other box on Form 1099-MISC.

Other types of payments reported in Box 3 include (see Instructions for Form 1099-MISC for details):

- Prizes and awards, including the fair market value of noncash items

- Payments made to a deceased employee

- Payments of Indian gaming profits to tribal members

- Payments for participating in a medical research study

- Termination payments to former self-employed insurance salespeople

- Punitive damages, damages for nonphysical injuries and illnesses

Box 4. Federal income tax withheld

Enter backup withholding in this box. If you withheld any federal tax from a nonemployee payment, you are required to file a Form 1099-MISC, even if the payment amount is less than the threshold.

Box 5. Fishing boat proceeds

Enter the individual’s share of all proceeds from the sale of a fishing catch in excess of $600. Also, report cash payments of up to $100 per trip that are contingent on a minimum catch and paid for other duties performed such as mate, engineer, or cook. Do not report any wages that belong on Form W-2.

Box 6. Medical and healthcare payments

Report payments of $600 or more made in the course of business to physicians, dentists, and other providers of medical or healthcare services. 1099-MISC forms with payments of this nature aren’t only sent to individuals and partnerships but also corporations and LLCs.

This box also includes payments from medical and health care insurers issued to health care providers. You are not required to include payments to pharmacies for prescription drugs.

Box 7. Payer made direct sales of $5,000 or more

Place a tick mark in box 7 if your business sold $5,000 or more of consumer products to an individual or partnership for resale in a nonretail environment. Typically, this is for Amway distributors and similar direct sales networks.

Box 8. Substitute payments in lieu of dividends or interest

Report payments of $10 or more that are substitute payments in lieu of dividends or tax-exempt interest. Stockbrokers and financial institutions report substitute payments when dividends or tax-exempt interest is received on a security while those securities are on loan.

Box 9. Crop insurance proceeds

Insurance companies use Box 9 to report crop insurance proceeds of $600 or more paid to farmers. However, this amount does not need to be reported if farmers informed the insurance company that expenses have been capitalized for tax purposes.

Box 10. Gross proceeds paid to an attorney

Report payments of $600 or more made to an attorney or lawyer. These are reportable even if the amount is paid to a law firm organized as a corporation and even if the services were performed on someone else’s behalf.

Box 11. Fish purchased for resale

If you purchase fish for resale, you must report total cash payments of $600 or more made to people in the business of catching fish.

Box 12. Section 409A deferrals

In general, businesses do not have to complete Box 12. Section 409A refers to certain types of nonqualified deferred compensation plans. For more details, please refer to the Instructions for Form 1099-MISC.

Box 13. FATCA filing requirement

FATCA requires certain US taxpayers who hold foreign financial assets with an aggregate value of more than the reporting threshold (at least $50,000) to report information about those assets on Form 8938, which must be attached to the taxpayer’s annual income tax return.

Box 14. Excess golden parachute payment

Enter any excess golden parachute payments in this box. In general, an excess parachute payment is any amount that exceeds the average compensation for services in the individual’s gross income over the most recent five years. For more details, refer to the Instructions for Form 1099-MISC.

Box 15. Nonqualified deferred compensation

Report amounts deferred as part of a nonqualified deferred compensation plan that are includible in the taxable income of a nonemployee. Do not use this for deferred compensation for employees: that goes on Form W-2 instead. See the IRS’s Instructions for Form 1099-MISC for more details.

Boxes 16–18. State information

These boxes need to be completed for those businesses that are required to file copies of Form 1099-MISC with state tax departments.

Bottom Line

Businesses may need to file Form 1099 to report various types of payments. If they paid $600 or more in compensation to contractors, freelancers, and other nonemployees, they must send copies of Form 1099-NEC to the IRS and the payees by Jan. 31 following the year in which the payments were made.

If you need help preparing and sending 1099 forms to your independent contractors, consider using a payroll software like Gusto. For just $6 monthly per contractor, you can automate payments and tax form preparation (both W-9 and 1099 forms). And during the months you don’t need to pay your contractor, you won’t owe Gusto either. Sign up today and get one month free when you run your first payroll. Offer will be applied to your Gusto invoice(s) while all applicable terms and conditions are met or fulfilled.

.