In this tutorial, you’ll learn how to void a check in QuickBooks Desktop for bill payment checks and payroll checks already issued but not yet cashed or deposited. We’ll also cover the instances when you should void a check.

This tutorial is more useful if you follow along in your QuickBooks Desktop account. If you don’t have one, you can purchase QuickBooks Desktop, one of our best small business accounting software, with a 60-day money-back guarantee.

Tip:

The process of voiding a check is the same in all QuickBooks Desktop variants, whether it’s Pro, Premier, Enterprise, or Accountant. To help you determine which is right for you, read our comparison of QuickBooks Desktop products.

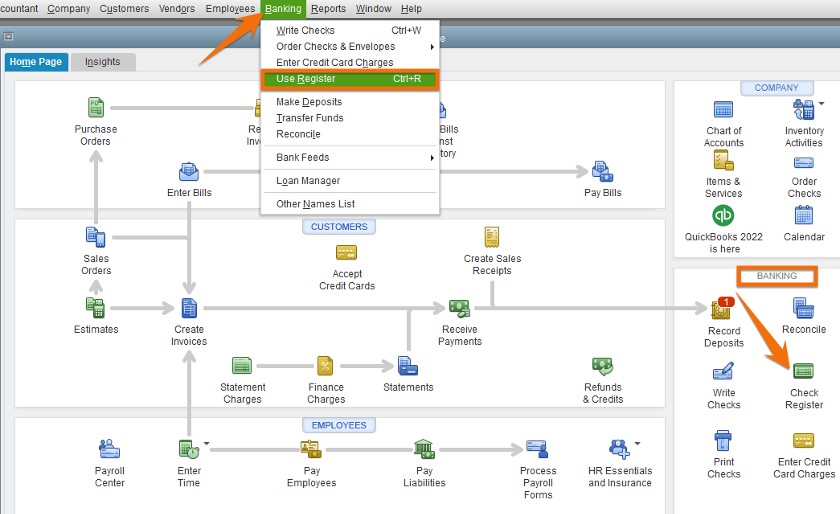

How To Void a Bill Payment Check in QuickBooks Desktop

Choose the bank account from which the check that you want to void was issued. In our example below, we used Company Checking Account.

Select the bank account from which the checks were issued

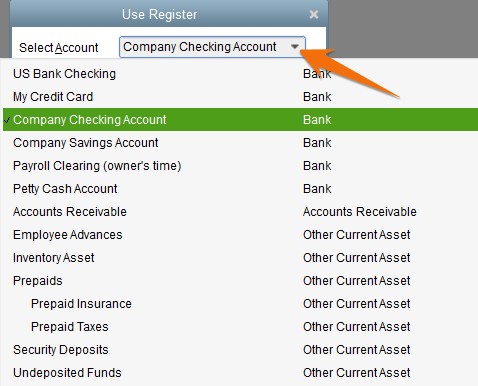

A window displaying all the checks that have been created will open. Select the check you want to void by double-clicking anywhere on the line. In our example below, we want to void a bill payment check (check #5314) issued to “Printing Shop” worth $340.

Select the check to void

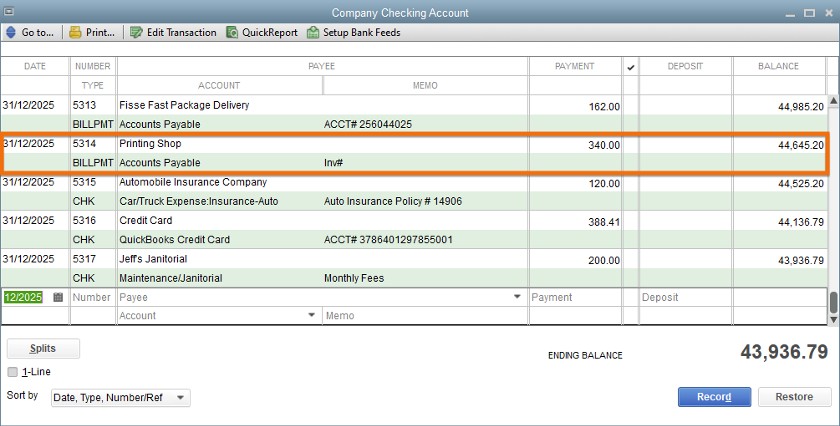

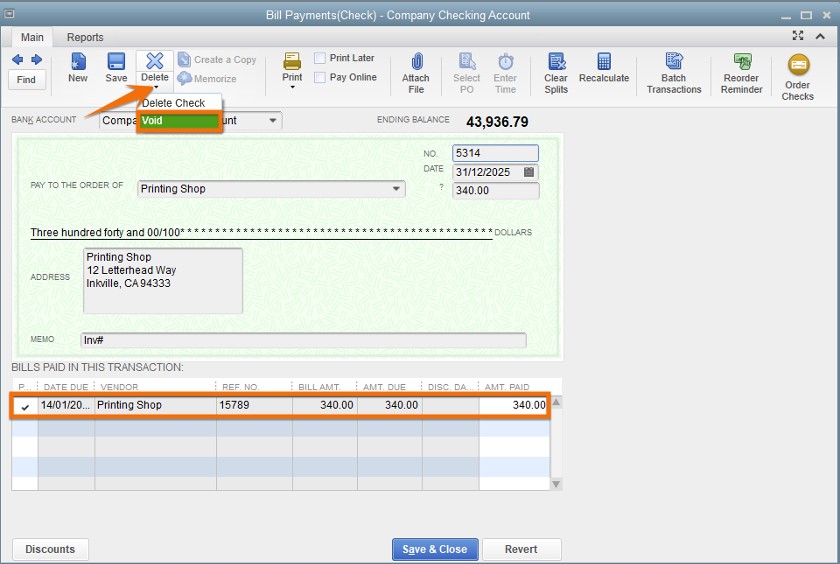

After selecting the check from the list, your check will appear, as shown below. You’ll notice that the list also includes the outstanding bills owed to the vendor you’re issuing the check to. Click on the small drop-down under the Delete button on top of the check screen, and then select Void.

Tip:

Voiding and deleting a check are two different things. Voiding a check means turning the balance to zero while deleting a check means removing the transaction completely from QuickBooks.

Voiding a check in QuickBooks Desktop

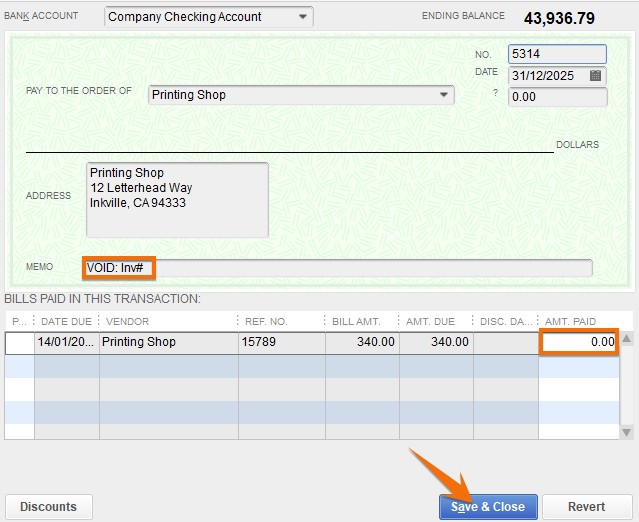

After clicking on Void, you’ll notice that the amount turns to zero, which is an indication that the bill was reverted to open. You’ll also see “VOID” in the memo field. Click the Save & Close button to void the check.

Check about to be voided in QuickBooks Desktop

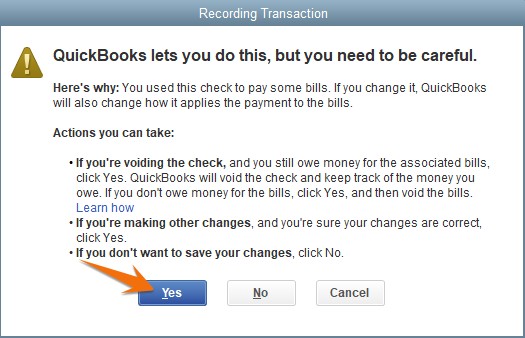

When you click Save & Close, you’ll be prompted with a message asking whether you want QuickBooks to record the changes. Click Yes to proceed.

Click Yes to save your changes

If you need to reissue and reprint the check, follow the instructions on how to pay bills as discussed in our tutorial on printing checks on QuickBooks Desktop.

How To Void a Payroll Check in QuickBooks Desktop

Voiding a payroll check is a bit more complicated than voiding general checks, especially if all payroll tax returns have been filed. Doing this can have a significant effect on your books and payroll records. The best way to reissue a payroll check isn’t to void it but to reprint it with a new check number. You can then create a new check, assign it the old check number, and void it to leave a paper trail.

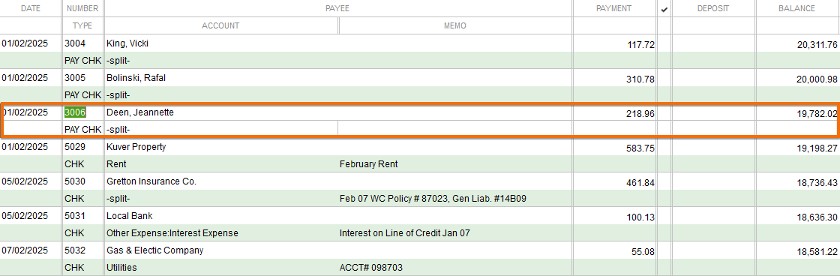

From the check register, select the payroll check you want to void. To illustrate the next steps, let’s void the paycheck (check #3006) issued to Jeannette Deen.

Select the payroll check to void in QuickBooks Desktop

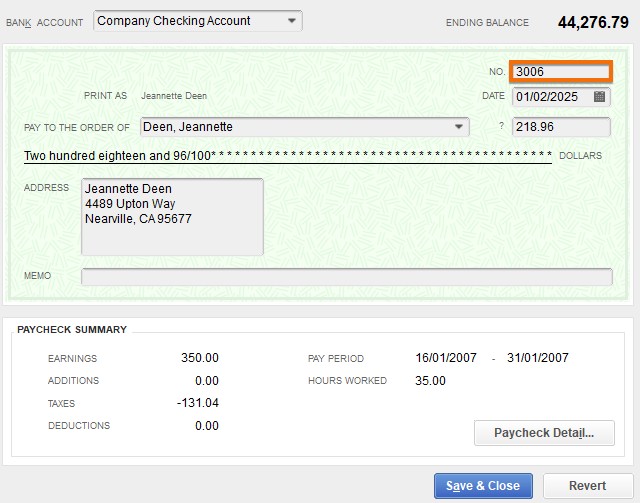

Double-click anywhere on the entry line to display your paycheck. Take note of the existing check number of the check you want to void. In our example, the check number is 3006.

Prepare to void a check in QuickBooks Desktop

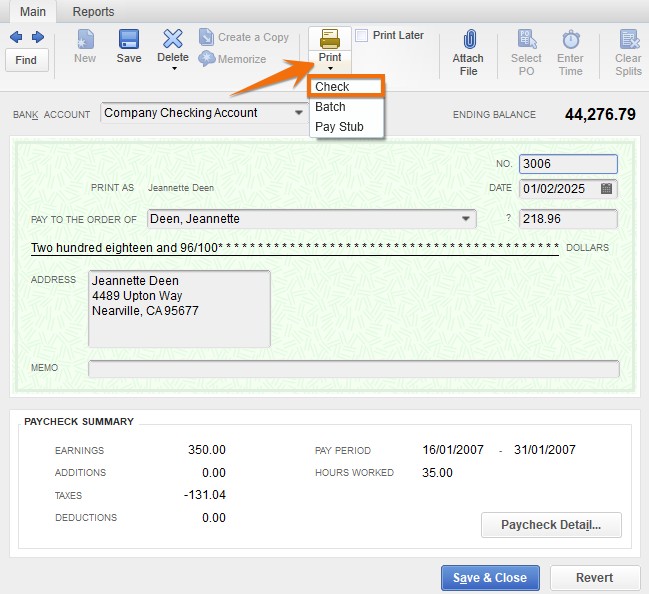

To change the check number, click on the Print menu on top of the payroll check window, and then choose Check from the drop-down list, as shown below.

Reprint the check with a new check number

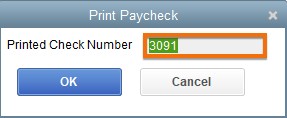

QuickBooks Desktop will then generate a new check number automatically. Make sure to verify that this number matches the check in your printer—or change the number, if needed—and then print the new check.

New check number

Once the check with the new number is printed, it’ll be recorded in the check register automatically. As shown below, the old check number 3006 is now listed as check number 3091. You can find the new check in the register, and you won’t see the old check.

This step isn’t absolutely necessary, but it’s a good idea to show the old check number as voided in your check register. To do this, click on the bottom-most line in the register, enter the old check number, and then set the details.

For instance, in the animation below, we entered check number 3006 (the old check number), selected “Jeannette Deen” as the Payee, and left a note in the memo field saying it was voided. Click Record to save the changes.

Recording the old check in the check register

Then, you will want to find the old check in the register and then follow the steps for voiding a check.

Tip:

It’s good practice to ensure that all check numbers appear in the check register so that you know no blank checks are missing. That’s why many companies will go through the trouble of creating a check and voiding it in QuickBooks.

When To Void a Check in QuickBooks Desktop

You’ll need to void a check in QuickBooks Desktop when

- A check was issued to the wrong person

- A check is lost or stolen

- Incorrect details, like in the amount or date, were entered

- Incorrect work locations (tax jurisdiction) for paychecks were input

- There are duplicate checks

Other than for duplicate checks, you’ll generally want to void checks and then issue a corrected replacement. As stated above, doing this can be straightforward for regular checks, but reissuing paychecks can be tricky.

Wrap Up

You now know the process for voiding a bill payment check, as well as how to void and reissue a payroll check in QuickBooks Desktop. If you’re considering a switch to QuickBooks Online, check out our tutorial on how to convert QuickBooks Desktop to QuickBooks Online.