The past decade has seen an increase in credit card debt, and it’s easy to see why. Using credit cards as a form of payment has made it easier for consumers and companies to conduct business. Many credit cards also offer consumers benefits that they otherwise would not get by paying with cash, such as purchase protections, extended warranties, and rewards programs.

While credit cards can be useful financial tools, they can be detrimental to consumers if used irresponsibly. For example, credit cards carry high interest rates, making it expensive to carry a balance month over month. Additionally, due to the profitability of the industry, credit card fraud has also continued on an upward trend. Left unchecked, this fraud can result in a high financial cost to both consumers and businesses.

The Significance of Credit Card Debt Stats & Fraud

Given the widespread use of credit cards, credit card debt stats provide insight into the financial well-being of businesses and consumers. Businesses, for instance, may increase the prices of their products and services to cover merchant processing fees or added costs associated with accepting this additional form of payment. Fraud costs can also indirectly be passed onto consumers as a cost of conducting business.

Consumers who carry a balance may also be at risk of paying hefty interest charges due to the higher rates on these cards. Missing payments could also lead to late fees and lower credit scores, something that could impact rates and approvals on subsequent loan applications.

Credit Card Debt Statistics

1. Most Americans carry at least one credit card

US consumers are no strangers to using plastic to pay for goods and services, and as a business owner, accepting credit card payments can help facilitate and simplify the payment process. As reported by the US Government Accountability Office, the vast majority of adults in the US have at least one credit card in their name. These accounts are also used regularly, with nearly half carrying a balance into the following month.

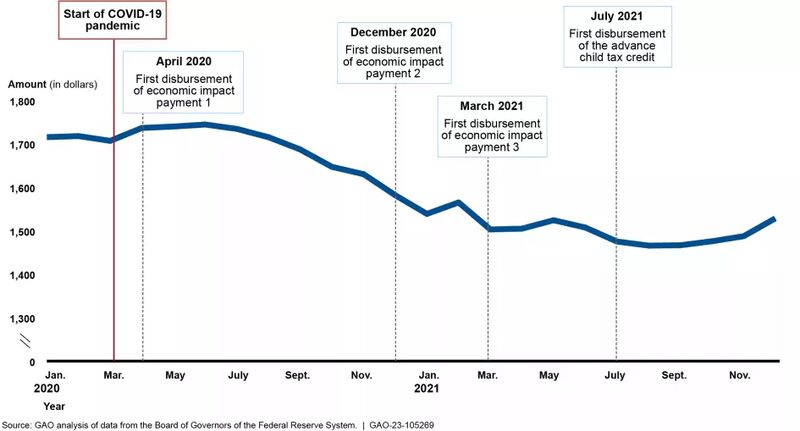

This trend changed slightly with the COVID-19 pandemic and changes in monetary policy that put money back into consumer’s pockets. Stimulus checks, tax credits, and extended unemployment insurance benefits are just several examples. Those policy changes saw consumers paying down their credit card debt, in addition to a reduction in the delinquency rate. However, once the pandemic-related changes expired, credit card debt has once again begun to rise.

Chart showing outstanding historical credit card balances of consumers (Source: US Government Accountability Office)

(US Government Accountability Office)

2. Credit card balances have continued to rise, reaching nearly $1 billion

Credit cards have continued to play a large role in financing the lifestyle for many consumers. With balances continuing to rise, they don’t appear to be going away any time soon, so business owners who accept credit card payments may also see a rise in sales.

This is largely because credit cards allow users to carry a balance from one month to the next, making it easier to purchase goods and services instantly. A large number of consumers have elected to go this route, purchasing items they are unable to pay for in cash.

Data from the Federal Reserve Bank of Philadelphia shows that the total outstanding balance of credit cards from select large banks has been trending upwards since 2013, rising from approximately $578 billion to a high of $911 billion as of the end of 2023.

Data showing the increasing trend in credit card balances over the past decade (Source: Federal Reserve Bank of Philadelphia)

(Federal Reserve Bank of Philadelphia)

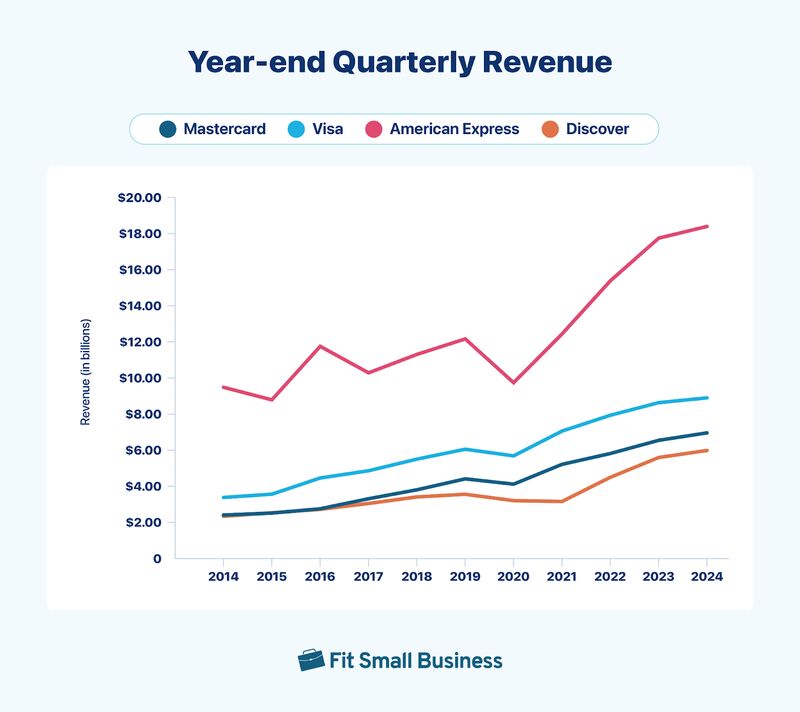

3. Credit card issuers continue to report rising profitability

Mastercard, Visa, American Express, and Discover are four of the major credit card networks within the US. Looking at revenues for the past 10 years, each of these companies has continued to report increasing profits and revenues. As a result, we expect that this financial tool will continue being widely used.

Based on the data beginning in December 2014 through July 2024, the following quarter-end revenues were reported:

- Mastercard’s revenues increased from $2.4 billion to $6.9 billion

- Visa’s revenues increased from $3.3 billion to $8.9 billion

- Revenue for American Express increased from $9.4 billion to $18.39 billion

- Discover reported revenue of $2.3 billion to nearly $6 billion

(Macrotrends, Mastercard Revenue 2010-2024 | MA; Visa Revenue 2010-2024 | V; American Express Revenue 2010-2024 | AXP; and Discover Financial Services Revenue 2010-2024 | DFS)

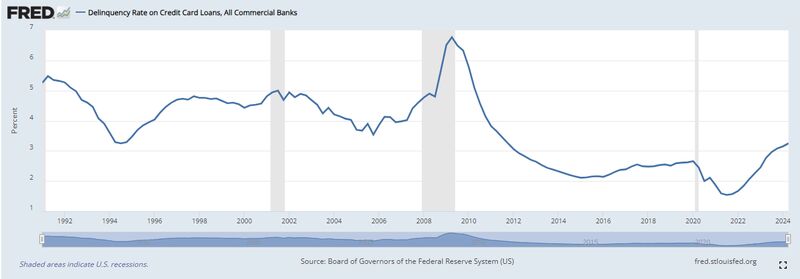

4. Credit card delinquency rates have been trending down

Despite the rising popularity of credit cards and the increase in average credit card balances, consumers have continued to make their payments promptly. For credit card companies, this combination only serves as further motivation to seek additional revenue by continuing to push consumers to use their cards as a form of payment.

As reported by the Federal Reserve Bank of St. Louis, data gathered from the Board of Governors of the Federal Reserve System shows a peak credit card delinquency rate of 6.77% in 2009. The overall trend going back as far as 1992, however, has shown a decrease in late payments. The most recent data as of the end of Q2 2024 shows a current credit card delinquency rate of 3.25%, with a low of 1.54% in Q3 2021.

Consumers, however, should be aware that although delinquency rates may be down, they may not necessarily be an indicator of financial health. Meeting the minimum required payment but still carrying a balance, for instance, requires consumers to pay hefty interest rates, often higher than 20%. Doing this long-term can put a strain on a consumer’s budget and limit their opportunities to invest in other areas of their personal and professional lives.

Chart illustrating the historical delinquency rates on credit cards (Source: Board of Governors of the Federal Reserve System)

(Federal Reserve Bank of St. Louis)

Credit Card Fraud Trends

1. Financial losses due to fraud have grown

According to the Federal Trade Commission (FTC), 2023 saw 5.39 million fraud reports. That’s a significant increase from the 325,519 reports it took in 2001. While an increase in fraud may be associated with the rising popularity of credit card usage, the disproportionate rate at which fraud has increased over the years can indicate how profitable this is for fraudsters.

Consumers should take note of this and be aware of how it may impact them. In total, the FTC reported $10 billion total fraud losses. Taking an expanded look globally, credit card issuers reported over $33 billion in losses in 2022 alone. Financial losses due to fraud can also impact consumers indirectly if they force companies to raise prices to remain profitable.

(FTC, Consumer Sentinel Network Data Book 2023; and Statista)

2. Credit card fraud continues to evolve, coming in many different forms

Fraud comes in many different forms, making it difficult to catch sometimes. It’s also continually evolved with advancements and changes in technology. For example, the increasing use of social media provided fraudsters with access to more information about individuals, making them more susceptible to phishing attempts and social engineering.

Below are some common forms of credit card fraud and how they’re carried out:

- Identity theft: This occurs when another individual obtains your personally identifiable information and poses as you without your knowledge. Personally identifiable information can include things like your Social Security number, date of birth, and address. Some examples of identity theft can involve circumstances when someone applies for a loan in your name, uses your identity to gain employment, or provides your information in requesting medical services.

- Credit card skimming/cloning: Credit card skimming occurs when another device is added to a merchant’s legitimate card reader. This secondary device captures your card’s information when it is swiped and is often camouflaged, appearing identical to the original card reader. Once the fraudster has this information, they can use it to conduct their own online purchases or copy it onto another card, a process that’s called cloning.

- Social engineering: This occurs when a fraudulent party contacts the potential victim to manipulate them into providing access to the victim’s accounts or to steal financial information. Fraudsters may accomplish this by posing as a legitimate third party and establishing rapport or trust with the victim, before finally trying to pressure or trick them into providing sensitive financial data.

3. Credit card fraud varies by location

While it’s never recommended to become complacent when it comes to protecting yourself from fraud, certain geographic areas are less prone to these types of activities. The Federal Trade Commission has published data from 2023 showing the states with the largest number of reports of fraud. Taking into account each state’s population, the most reports per 100,000 had Georgia, Florida, and Nevada topping the list. Iowa, North Dakota, and South Dakota had the least number of fraud reports.

(FTC, Consumer Sentinel Network Data Book 2023)

4. Consumers have legal rights to minimize losses

When fraud occurs, the federal government provides certain protections to limit the direct financial loss to consumers. For example, the Fair Credit Billing Act (FCBA) reduces a consumer’s liability to no more than $50 in cases of identity theft or fraud. The FCBA also affords consumers the right to dispute billing errors and inaccurate charges and have them eliminated if successful, prohibiting lenders from taking any action that may damage your credit until the dispute is resolved.

The Electronic Fund Transfer Act (EFTA) is another example of a regulatory requirement designed to protect consumers who engage in electronic funds transfers. The EFTA states that unauthorized transfers reported within two days will have the consumer responsible for no more than $50 and $500 if reported within 60 days.

5. Banks & lenders have taken actions to lower fraud

In an effort to reduce losses due to fraud, banks have continuously enhanced the identity verification methods being used. For instance, Mastercard provides identity verification platforms designed to more quickly and accurately verify the identity of a user to ensure a legitimate transaction. Its ID Verification portfolio includes a wide range of services, including the following:

- Mobile verification verifies that a consumer is in possession of their mobile phone number.

- Document source verification verifies the legitimacy of government-issued IDs against the government issuer of the document.

- Document verification, combined with a real-time selfie, can verify the authenticity of a government-issued ID.

- Attribute verification ensures that the consumer is in possession of their phone, after which the user’s personal data is also verified.

What You Can Do About Credit Card Debt & Fraud

Manage Credit Card Debt

Interest rates on credit cards are typically anywhere from 20% to 30%, making it very expensive to carry a balance. If you let your spending get out of control, you could quickly find yourself struggling financially. If you’re currently in debt, however, there are several approaches you can take to begin tackling your credit card balances.

- Create a monthly budget. An important first step to prevent falling into additional debt is to know where all of your money is currently going. You can review bank statements from the past 12 months to identify all of your recurring and non-recurring expenses.

- Refinance to a lower interest rate loan. Many other types of loans have lower interest rates than credit cards. Many of our best personal loans for business funding, for instance, have rates under 9%. You can use the funds from these financing options to pay off your credit card balances to lower your monthly payments and reduce the amount of interest expenses you’ll pay in the long run.

- Use the debt snowball method. The method works by having you pay the credit card with the smallest balance first. You’ll make minimum payments on all of your other cards, and any extra funds you have remaining at the end of the month are allocated toward the credit card with the smallest balance.

- Use the debt avalanche method. This works similarly to the debt snowball method. However, it works by having you pay the credit card with the highest interest rate first. You’ll make minimum payments on all other accounts, and any excess funds in your budget will be allocated toward paying down the balance on the card with the highest rate.

Protect Yourself Against Credit Card Fraud

Although there are federal regulations in place to protect you by limiting your financial losses, it can still be time-consuming and frustrating to deal with the aftermath of being a victim of fraud. Additionally, while banks may continue to enhance identity verification procedures to minimize fraud, they are not foolproof and you should still be proactive in protecting yourself.

- Monitor your credit. The three major credit bureaus all have products and services that allow you to monitor your credit reports. These products can also notify you via email or phone whenever new activity is detected, allowing you to quickly be made aware of potential fraudulent activity. Visit Equifax, Experian, and Transunion for information on each company’s respective products and services.

- Use strong passwords for online banking. To avoid unauthorized access to your accounts, ensure you use strong passwords for your online accounts. Your accounts with each bank should have unique passwords, use a combination of letters, special characters, and numbers, and be at least 15 characters in length. It’s also recommended to change your passwords periodically and to enable multi-factor authentication as an additional layer of security.

- Avoid using public WiFi. Public Wifi is not secure, and it’s possible that your information could be stolen.

- Avoid giving out sensitive information on incoming phone calls. Caller IDs can be spoofed. If you’re contacted by an individual claiming to be from a bank or other organization, we recommend hanging up and calling the bank directly by verifying its number on the company’s website.

- Set up activity notifications for your accounts. Many banks and lenders allow users to set preferences with regard to the type and frequency of notifications sent to emails or mobile phones. You can set your preferences to alert you whenever certain transactions are made, something that can quickly make you aware of unauthorized activity on your account.

Frequently Asked Questions

If you carry a balance, it can be expensive as interest rates usually run anywhere from 20% to 30%. Our list of the best small business credit cards, however, has cards that carry rewards programs and purchase protections that can reduce your total cost of conducting business.

Unfortunately, credit card fraud is very common. The FTC reports that in 2023, the Consumer Sentinel Network took in over 5.39 million reports of fraud in all of its various forms such as identity theft and imposter scams.

Monitor your credit reports, and set alerts for each of your individual accounts to notify you in the event of high-risk activity—such as purchases or transfers of money that exceed a certain dollar amount. You can also use safe internet practices, such as avoiding public WiFi, using strong passwords, and enabling multi-factor authentication when available.

Bottom Line

While credit cards can be a useful financial tool, it’s important to use them responsibly due to the high interest rates many carry. With the increasing popularity of credit cards, fraud has also risen, with financial losses relating to credit cards exceeding $33 billion in 2022. Left unchecked, this increase in the cost of doing business could result in higher prices for goods and services.

References: US Government Accountability Office, Federal Reserve Bank of Philadelphia, Macrotrends, Mastercard Revenue 2010-2024 | MA; Visa Revenue 2010-2024 | V; American Express Revenue 2010-2024 | AXP; and Discover Financial Services Revenue 2010-2024 | DFS, Federal Reserve Bank of St. Louis, FTC, Consumer Sentinel Network Data Book 2023, Statista