Credit card fraud, the most common form of identity theft in the US, can happen to anyone. It’s a global issue that can cause major problems if you don’t take proper steps to protect yourself. To demonstrate the effects of credit card fraud and how it can impact you and your business, we’ve compiled a list of credit card theft statistics for you to keep in mind.

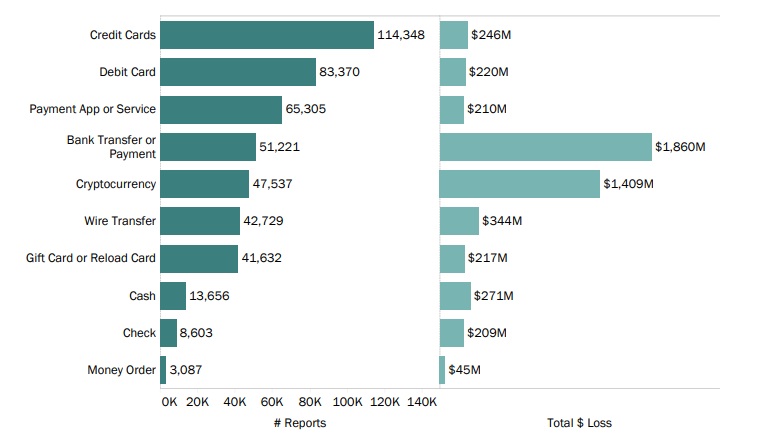

1. Credit Card Fraud Losses Reached $246 Million Nationwide

Chart representing categories of fraud reports and their monetary losses (Source: FTC)

According to the FTC, a total of 2,566,261 fraud reports were filed in 2023. Out of those reports, the FTC found that credit cards were the most common payment method impacted by fraud and had a total loss of $246 million nationwide. This is an increase of 7.3% from 2022, which reported $219 million in losses.

This goes to show that millions of people are increasingly affected by credit card fraud every year, as it’s the most common type of identity theft. It’s important to take as many precautions as you can to avoid being a victim of fraud, like signing the back of your card immediately and only using your card on secured and trusted platforms.

(FTC, Consumer Sentinel Network Data Books)

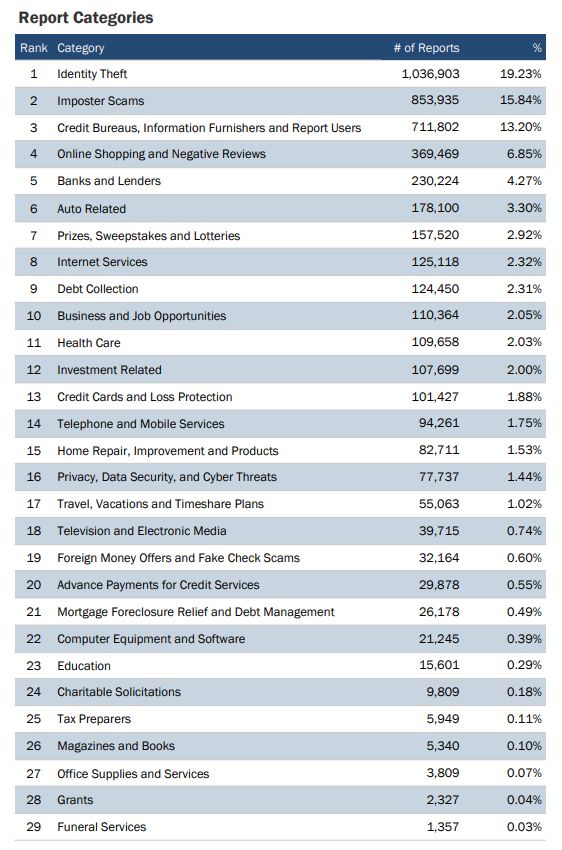

2. Identity Theft Reports Make Up the Majority of Fraudulent Complaints

Number of reports per fraud-related category (Source: FTC)

Out of all fraudulent report types, identity theft had the most in 2023, totaling 1,036,903 reports. That makes up 19.23% of 5,392,028 total fraud-related complaints.

Following identity theft, imposter scams had the second-highest number of complaints, making up 15.8% of all reports. Rounding out the top three reports with the highest number of complaints are credit bureaus, information furnishers, and report users, equating to 13.2% of total fraud reports filed with the Consumer Sentinel Network.

While fraud can take many forms, being a victim of small business credit card fraud can damage your credit history if left unchecked. It’s important to monitor your credit and affiliated reports often so that you can take swift action if you see fraudulent activity and avoid other forms of fraud altogether.

(FTC, Consumer Sentinel Network Data Book)

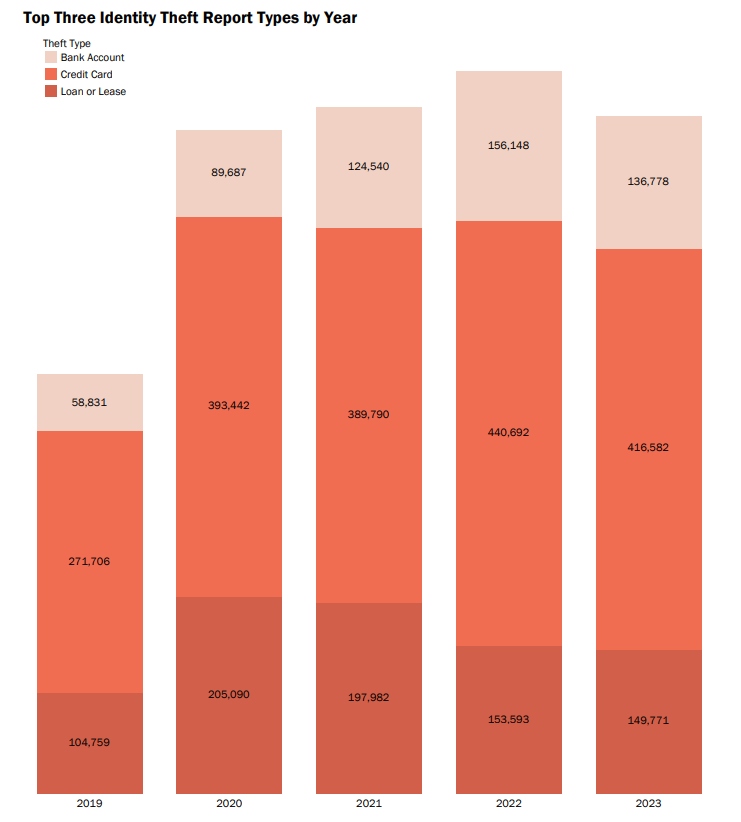

3. Total Credit Card Fraud Reports Have Decreased by 5.4% Since 2022

Chart of the top three identity theft report types by year (Source: FTC)

Compared with data from the 2022 identity theft reporting by the Consumer Sentinel Network, cases of credit card fraud decreased by 5.4% in 2023 from 440,692 to 416,582. Notably, the total number of identity theft reports also decreased from the past year. That said, there has been steady growth of overall credit card fraud over the past few years, with a major uptick in reports starting in 2020 surrounding the COVID-19 pandemic.

To help reduce your risk of credit card fraud, you should work toward keeping your credit cards safe—keeping them in a secure place, covering your information during transactions, and only carrying the ones you need are all steps you can take to help avoid being a victim of fraud.

(FTC, Consumer Sentinel Network Data Books)

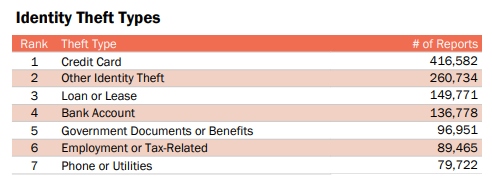

4. Credit Card Fraud Makes Up 40% of Identity Theft Reports

Number of identity theft report types by subcategory

Out of all types of identity theft that took place in 2023, credit card fraud ranked the highest. The FTC received 416,582 reports that represented misused information when applying for a new credit card or fraud on an existing one. This represents 40% of 1,036,903 total identity theft reports.

To avoid misused information and identity theft, you should aim to keep account details—such as login credentials and personal information—as secure as possible. This means updating your passwords regularly and taking other precautionary measures like setting up two-factor identification for additional security.

(FTC, Consumer Sentinel Network Data Book)

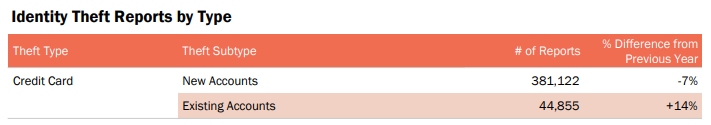

5. Credit Card Fraud on Existing Accounts Increased by 14% in 2023

Number of identity theft reports of new accounts vs existing accounts (Source: FTC)

Specific to statistics on credit card theft, new accounts saw a decrease in reports, whereas existing accounts saw an increase.

- The number of identity theft reports with fraudulent credit card activity decreased by 7% for new accounts (381,122 reports) when compared with 2022 reporting figures of 409,981.

- Fraud activity on existing accounts had 44,855 reports in 2023 and increased by 14% when compared with 2022 reporting figures of 39,593.

You can keep tabs on any suspicious activity across both new and existing accounts by setting up fraud alerts that are commonly offered by credit card companies. With this feature, you can be notified via text or email when suspicious transactions are made with your account information.

(FTC, Consumer Sentinel Network Data Books)

6. Younger People Report Fraud Losses More Often

Differences in fraud reporting and related monetary loss between age groups (Source: FTC)

Across age groups, younger people from the ages of 20 to 29 reported the most fraud in 2023, equating to 44% across the board. That said, the amount of fraud reports does not always equate to the amount of loss.

For the 20 to 29 age group, the average loss was $480. This group reported less loss in comparison with other age groups, with the 80+ group reporting the highest average loss of $1,450.

This data shows that credit card fraud can happen to anyone, regardless of age. Should this happen to you, contact the various credit bureaus to place a fraud alert or credit freeze on your accounts to avoid further fraudulent activity.

(FTC, Consumer Sentinel Network Data Book)

7. California Reported the Most Credit Card Fraud in 2023

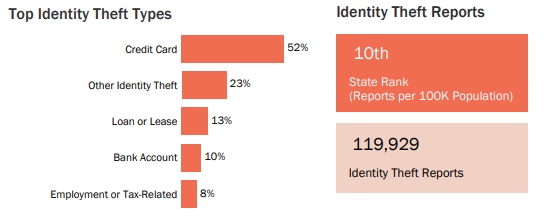

Identity theft statistics in California (Source: FTC)

California ranks #10 for national identity theft reports per 100,000 population. However, California had the highest number of total identity theft reports, amounting to 119,929. It also ranks as the highest percentage of credit card fraud nationwide, at 52%.

Notably, Florida is a close second, with 52% of credit card fraud reported out of 93,547 identity theft reports, and ranks #2 nationwide for total identity theft reports.

Regardless of where you live, victims of fraud should take immediate action to secure their information. In doing so, it’s important to contact the authorities and file an identity theft report with the FTC—which local law enforcement authorities can use as part of their investigation.

(FTC, Consumer Sentinel Network Data Book)

Frequently Asked Questions (FAQs)

Credit card fraud reporting fluctuates from year to year. However, credit card fraud reports decreased in 2023 in comparison with the total number of reports from 2022.

Credit card fraud makes up 40% of reported identity theft in the US. This represents 416,582 credit card fraud reports out of 1,036,903 total identity theft reports.

In 2023, credit card fraud statistics between new and existing accounts varied from the prior year. Existing accounts were the most affected and are considered the most common type of fraud in 2023, with an increase of 14%.

Bottom Line

Even the best small business credit cards can fall victim to fraud if you’re not careful. While credit card theft statistics can be a daunting topic, it’s important to understand why it happens and what you can do to prevent it. These statistics should offer some insight and allow you to take actionable steps to protect yourself and your business from credit card theft.

References: FTC, Consumer Sentinel Network Data Book (2022) and (2023)