MileIQ is a cloud-based mileage tracking software that tracks your drive and mileage automatically and then classifies your trips as personal or business. It is accessible through a mobile app and web dashboard. For individuals, the platform is free for the first 40 drives each month, and you can upgrade to the Unlimited plan ($7.50 monthly) if you need to go beyond 40 trips. For businesses, MileIQ pricing runs from $8 to $10 per user, per month.

I like that it’s easy to use and that it provides reliable automatic tracking via the mobile app. However, it lacks other essential tools like bank connections and built-in accounting. See if it’s worth considering in my detailed MileIQ review.

Pros

- Is a simple mileage tracking solution

- Has the most affordable paid tier among all the software I’ve reviewed

- Lets you customize trip purposes with various categories

- Can learn recurring trips and automatically classify them after repeated usage

- Can track miles offline

- Offers mileage reports that are compliant with IRS standards

Cons

- Doesn’t integrate with bank or credit card accounts to import actual vehicle expenses

- Doesn’t display a real-time map while driving

- Has no route planning features

- Lacks telephone support

Monthly Pricing | For Teams:

For Individuals:

|

|---|---|

Free Trial (Paid Plans) | ✕ |

Discounts | ✕ |

Customer Support | Live chat, email support, and a help center |

Average User Review Rating |

- Individuals who only need to log mileage for taxes or expense reimbursements: MileIQ is one of our best mileage tracking apps, particularly for those wanting a simple solution to log their drives. Its focus is automatic mileage tracking, making it a great fit for self-employed individuals wanting to save money on their taxes by accurately tracking and deducting their business miles. It is also ideal for expense reimbursement when integrated with SAP Concur, a travel and expense management tool.

- Drivers with the same routes: The app recognizes frequent trips, which is a useful feature for drivers with frequently driven routes.

- Company drivers with irregular working hours: MileIQ’s Work Shifts feature allows you to set multiple working shifts for a single day or across multiple days.

MileIQ Alternatives & Comparison

There aren’t many MileIQ reviews online, but based on recent feedback, the software allows users to easily track drives automatically using the app. One user likes that they are able to create teams and track multiple vehicles within the app; I also love this feature, and I believe this is great for those needing to track mileage across multiple employees. Another reviewer appreciates that they could add drives offline, which isn’t available in all mileage tracking software.

Here’s how MileIQ is rated by third-party sites as of this writing:

Fit Small Business Case Study

I compared MileIQ with Everlance, TripLog, and QuickBooks Online across six major categories and summed up the results in the chart below.

MileIQ vs Competitors

Touch the graph above to interact Click on the graphs above to interact

-

MileIQ $0 to $10 per month

-

Everlance Free, 10 per month, or $33 per month per user

-

TripLog $0 to $15 per month

-

QuickBooks Online $35 to $235 per month

MileIQ outclassed its competitors because it offers more affordable paid plans. However, it falls behind in mileage tracking, where TripLog takes the lead because it contains all the features I’d like to see in mileage trackers, including those missing in MileIQ, such as bank connections and route planning tools.

In terms of related app features, MileIQ needs third-party integrations to work with accounting software or expense trackers. QuickBooks Online leads in the area because it’s a complete bookkeeping solution.

I gave MileIQ an excellent score because it offers more affordable paid plans than most similar software. I deducted a few points because the free plan supports only up to 40 drives.

MileIQ offers separate packages for personal and team use. With the Individuals package, you can get MileIQ for free for 40 drives a month and upgrade to the Unlimited plan at $7.50 monthly per user if you need unlimited mileage tracking. Those interested in the Teams package can choose from three paid plans with prices ranging from $8 to $10 monthly per user.

MileIQ took a hit in my evaluation of mileage tracking features because it lacks several important tools, including bank connections to import actual vehicle expenses, route planning, and a clock-in/clock-out timesheet. However, it still offers many useful features that can help you automate your mileage tracking workflows. Below is a list of some of MileIQ’s most notable features.

You can track mileage automatically using the MileIQ mobile app, which you can download on Google Play and the App Store. The app uses GPS to track mileage, eliminating the need to start and stop recording manually. It allows you to classify your drive with a single swipe—right for business and left for personal. After tracking your drives, you can obtain the results you need quickly for taxes or expense claims.

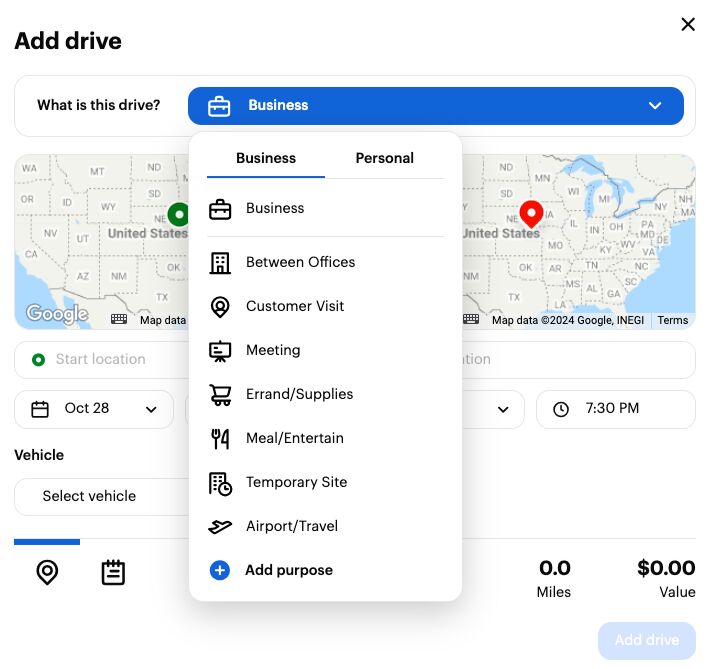

Classifying drives is an essential feature for a mileage tracker, as you wouldn’t want a business trip classified as a personal trip. In MileIQ, you can classify trips via the mobile app or through the web dashboard. There are three ways to classify drives on the app.

- Business or personal classification: Swipe right for business or swipe left for personal.

- Custom purpose classification: You can add a custom purpose based on the category with either a long swipe to the left or right. You can assign business-related categories, such as “between offices”, “customer visit”, and “meeting”. For personal trips, you’ll see options like “commute,” “medical ($),” “charity ($),” and “moving.”

- Phone and iPad exclusive: For iOS users, MileIQ has an exclusive widget that can help you classify drives without even opening the app. Users of iPhone 7 and above can classify drives from their notifications.

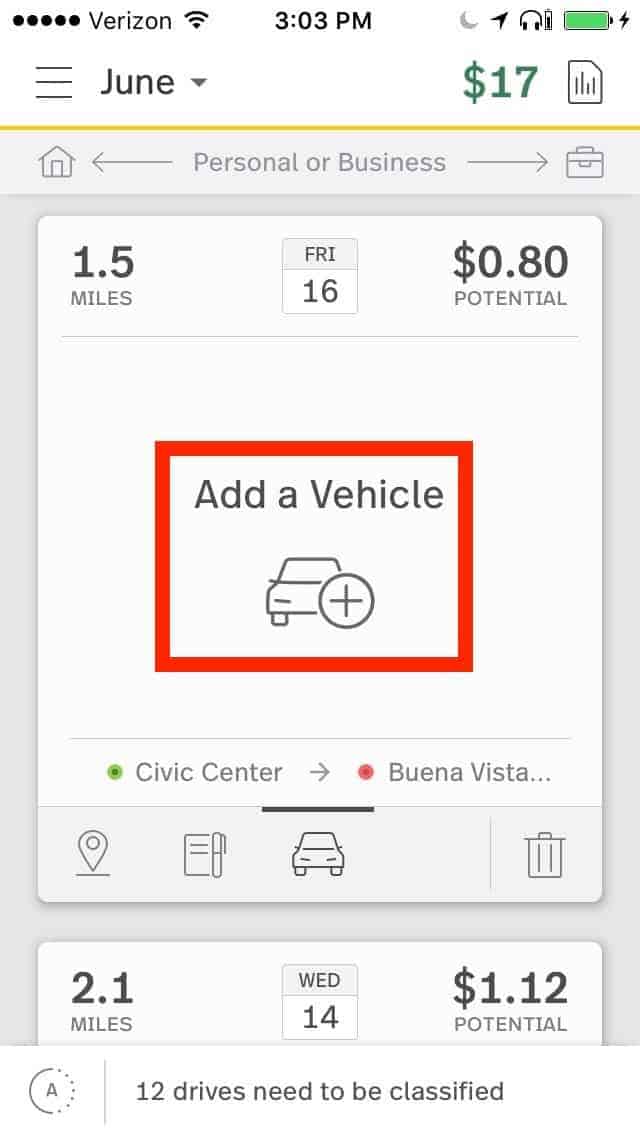

You can personalize MileIQ in many ways, including vehicles, drive detection, and stuck in traffic. You can add several vehicles in MileIQ, whether the vehicle is personal or company-owned. Additionally, you can add information to help you identify the vehicle, such as the make, model, and year, and assign it a nickname.

Adding a Vehicle through the MileIQ Mobile App (Source: MileIQ)

MileIQ reports and recognizes a new trip if you travel at least a half-mile from your current location. The variance for drive detection is less than a mile. MileIQ may occasionally disregard drives shorter than a mile, depending on your last known location.

MileIQ has a 15-minute grace period before it stops tracking your trip. If you’re stuck in traffic, MileIQ will continue recording your trip unless you’ve been idle for more than 15 minutes. In that case, the system will record a new trip once you start moving again.

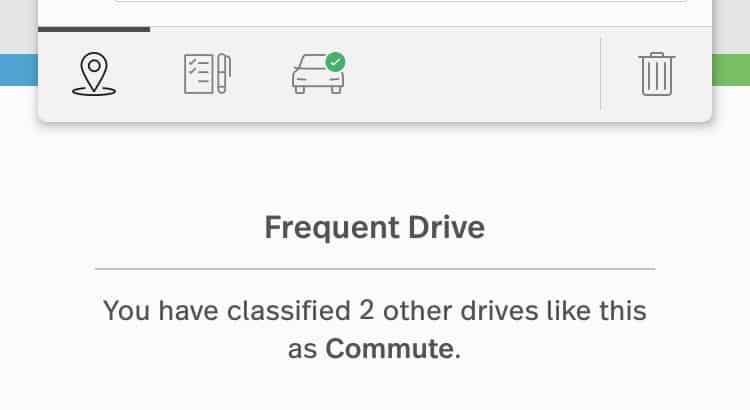

MileIQ classifies your trips automatically with its Frequent Drives feature. This feature is useful for drivers who take the same route or locations for their commute. The app will detect and remember the routes you take frequently and assign the same tag in the future on your behalf. You can view the details or reclassify a trip if needed from the web dashboard.

When you classify a drive, and MileIQ offers to classify it for the second time in the future, you’ll receive a notification on your app noting its potential to be a frequent drive.

Notification of Potential Frequent Drive in MileIQ (Source: MileIQ)

With the Work Hours feature, MileIQ will classify those hours outside of your working shift as personal automatically. All you need to do is to set your normal business hours, and only trips within those hours will be recorded in the app as business. The rest of the drives are classified as personal automatically. You can always review your drives from the web dashboard and reclassify them if needed.

For those who have irregular working schedules, Work Shifts allows you to set multiple working hours for the same day or multiple days. For instance, if you’re a rideshare driver in the morning and evening, simply turn on Work Shifts, and your personal drives will be classified automatically. You can add shifts when setting your schedules with the Working Hours feature.

MileIQ lacks additional built-in tools like accounting, invoicing, and a dedicated reimbursement system, which cost it points in my assessment. These are helpful for users needing more than just mileage tracking—though those can be added through third-party integrations.

For example, if you need expense reimbursement, you can connect MileIQ to SAP Concur. If you require accounting and invoicing features, you can integrate MileIQ with Xero; the integration allows you to automatically log and import mileage data from MileIQ into Xero. From here, you can categorize it as a reimbursable expense or add it to client invoices.

I find MileIQ easy to use and like its minimalistic dashboard. You can automatically track mileage using the MileIQ mobile app, but you can also manually enter a drive if needed. From the desktop interface, I was able to easily add a drive by clicking the Add drive button.

Adding a new drive manually in MileIQ

I couldn’t award MileIQ a higher mark primarily due to its limited customer support, which is a huge part of my evaluation for ease of use. You can access support via live chat and browse some online self-help guides, but there’s no option to talk to an agent over the phone.

I gave MileIQ a fairly good score in my subjective evaluation. It isn’t that comprehensive, but I like that it provides reliable and easy automatic tracking. I could have given it a higher mark if it had additional built-in features like accounting and invoicing. Adding these features would make it more flexible for those needing more comprehensive support within a single app.

How I Evaluated MileIQ

I evaluated MileIQ based on six major categories, as outlined in the scoring rubric below.

20% of Overall Score

All the mileage tracker apps (except QuickBooks) offer a free plan or version, so we evaluated pricing based on the affordability of the paid plans, taking into account the number of users included and the number of trips you can track per month.

30% of Overall Score

The ideal mileage tracking app should have the essential features needed to track business mileage and expenses, such as automatic tracking, route planning, bank and credit card integration, and a clock-in/clock-out timesheet for employees.

20% of Overall Score

The best mileage tracker app should have an intuitive user interface and good customer service.

10% of Overall Score

We added user review scores from third-party review sites to include customer ratings in our evaluation. By reading competent and legitimate reviews, we also used this information to add more insights to our evaluation and analysis.

10% of Overall Score

We conducted a subjective analysis of each mileage tracker app based on features, accessibility, ease of use, available reports, and popularity.

Frequently Asked Questions (FAQs)

Yes, MileIQ is free to download and use. It offers 40 free drives each month, and if you go beyond that, you can get a premium subscription or wait for the next month’s free drives.

Yes, you can customize trip classifications and add specific notes to each trip to explain its purpose.

MileIQ simplifies mileage tracking for tax deductions and expense reimbursement, saving you time and potentially increasing your tax savings.

Bottom Line

If you are looking for an automatic mileage tracker for mileage reimbursement or tax purposes and don’t need accounting or expense tracking, then MileIQ is right for you. It can be easy to forget to log your business drives from time to time, so it’s nice to have a simple automatic mileage tracker.

With a single swipe, you can classify your trips instantly as personal or business.

The free version tracks up to 40 trips a month, which should be enough if you make one trip per day. If you’re concerned that you might go beyond that, then I recommend signing up for any of the paid plans, which are generally more affordable than those from similar providers.