A pay period is the recurring period of time during which employees work and are paid. Pay periods are fixed and most often occur on a biweekly or semimonthly basis (state laws may require a certain frequency). Some industries follow a specific pay period calendar for certain workers, such as weekly payroll for hourly employees in manufacturing companies.

Given that payroll impacts your business’s cash flow and financial reporting requirements, you must select the pay period that best fits your company’s needs and worker types. Continue reading for a better understanding of what a pay period is and what it means for your small business, and download our free pay period calendars that correspond with your business’s pay cycles.

Follow along with our pay period video below:

How Pay Periods Work

Employers set a regular pay period to ensure their employees receive consistent paychecks. While most companies base their pay schedule on the needs of the business, there are labor laws in place that govern the minimum consistency with which these schedules must comply.

Employers consider the minimum frequency at which they can legally process payroll—usually monthly—to set a regular pay schedule. Remember, every pay schedule includes start and end dates for time worked and a payday on which employees receive their paychecks. The payday varies depending on the employer; some designate the payday to be the last date of every pay period, while others may opt to pay a week after the pay period ends.

If you’re using a professional employer organization (PEO), your payday options may be limited (for instance, some larger payroll services only allow you to pay employees on Fridays).

Types of Pay Periods

Here are a few pay period examples and some of the most common pay schedules from which you can choose. Keep in mind that certain industries have norms, and you may need to follow your industry’s tradition to remain a competitive employer.

We recommend using a pay period calendar and/or chart to help you.

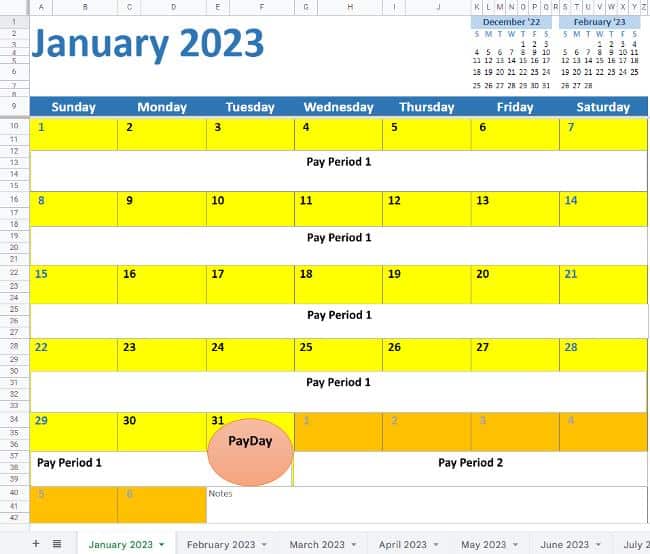

- A pay period calendar makes it easy to see each pay date because they’re highlighted. Post the calendar on your desk or wall for easy reference and write additional information or reminders to help you keep track of other important dates. Just follow along each day, and you’ll always know when payday is approaching. This really comes in handy if you process payroll manually.

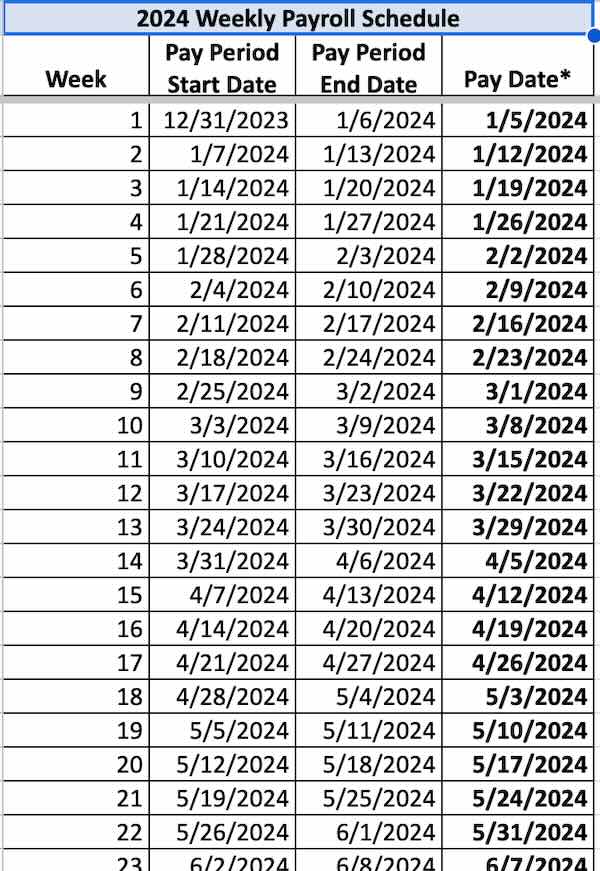

- Use a pay period chart when calculating your employees’ work hours. The chart lists the beginning and end dates you need to consider for each payroll, so you can easily ensure you’re only paying for time worked in the appropriate period. It’s a good idea to require your hourly employees to submit timesheets based on your set pay schedule.

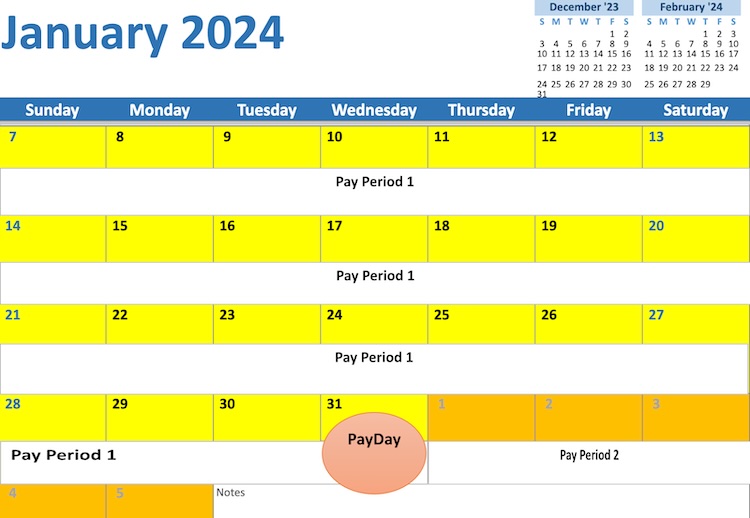

Monthly

With a monthly pay schedule, payroll is processed once a month. It’s not as common as the others and results in only 12 pay dates in the year. Some companies pay employees on the last Friday of each month, while others opt to pay on the last day of the month. If that happens to be on the weekend, they may pay on the last weekday before it. Monthly is used the least frequently of the pay schedules but is sometimes used by businesses that offer professional or business services.

Some states, like California, New York, and Massachusetts have laws against paying employees on a monthly basis; thus, it’s crucial to consult your state’s labor laws before committing to a monthly pay schedule. By confirming compliance with state regulations beforehand, you can avoid potential legal issues and ensure fair compensation practices for your employees.

To see what last year looked like in the monthly pay period formula, check our 2023 monthly pay period calendar. Reviewing last year’s pay period calendar gives you valuable insight and understanding of past patterns, which help in anticipating income fluctuations, budgeting, bill scheduling, and tax planning for the upcoming year.

Thank you for downloading!

If you want to avoid the hassle of manually tracking pay schedules and dates, consider using a small business payroll software like Gusto.

It automatically calculates employee pay and taxes and gives you the option to choose how to schedule your pay periods. And unlike some providers that limit you to a biweekly or semimonthly pay schedule, with Gusto, you can set any pay schedule you want.

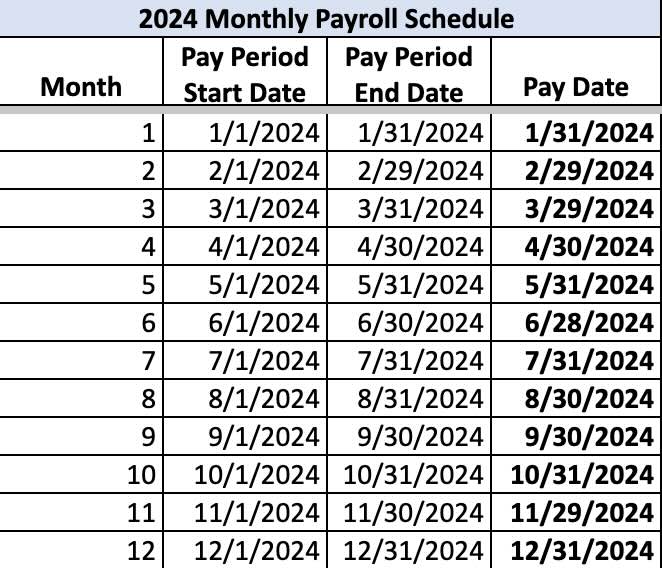

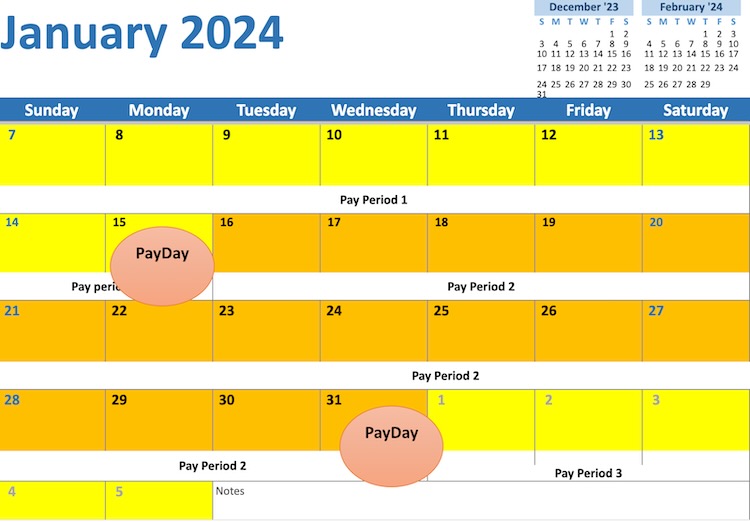

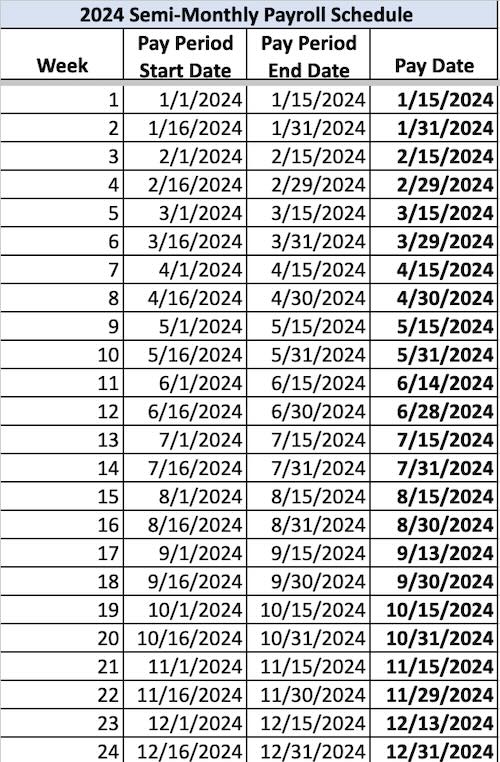

Semimonthly

Semimonthly, which is sometimes confused with biweekly, means twice a month. Many companies opt to pay on the 15th and last day of every month. If either of those days falls on a weekend, payroll is processed on the closest weekday before it. The pay period can include 14 to 16 days, depending on the number of days in the month. Typically, businesses in the financial, information technology, professional, and business service industries pay semimonthly—it’s the second least frequently used pay schedule.

Biweekly

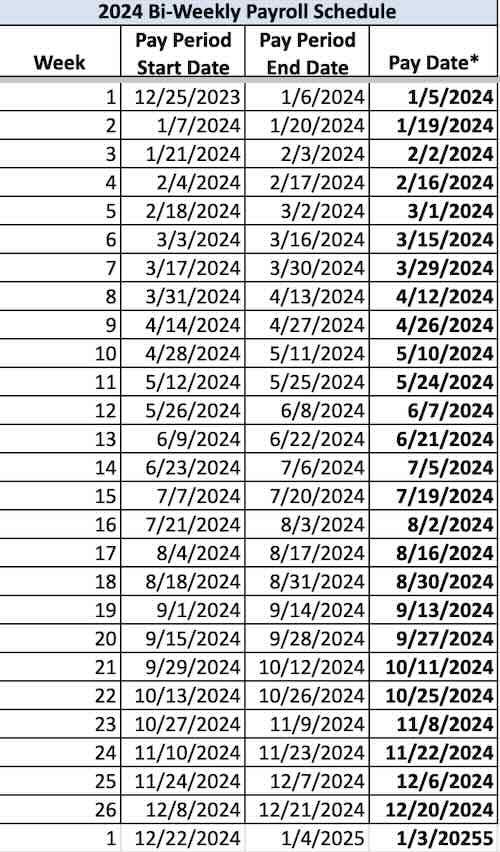

Biweekly means payroll is run once every two weeks or every other week, wherein employees are paid for two workweeks. For most months, this equates to two paydays, but three months in the year (that vary from year to year) have three biweekly paydays. The workweek for this pay period typically starts on a Sunday and ends on a Saturday.

One thing to note is that biweekly is the most common pay schedule overall, with more than a third of US private businesses historically paying their employees every two weeks. Many businesses in education, healthcare, leisure and hospitality, and information technology industries follow it.

Weekly

Employees are paid once a week; their paychecks include hours worked (or salary) for a workweek—for instance, Sunday through Saturday. Many companies choose Friday as their payday since it’s the last weekday, but it can be any day of the week. Many businesses in the construction, manufacturing, restaurant, and mining industries pay on this cycle.

Fixed-length

In a fixed-length pay period, employees are paid based on a number of days per pay period instead of a calendar date. Thus, the number of checks an employee receives every year may vary. This type of pay period is common in industries where hourly or salaried employees work on a consistent schedule. An example is the educational sector where public school teachers receive their salary bi-weekly or break their annual salary into 21 paychecks.

On-demand

Also known as instant pay, an on-demand pay period allows employees to access their earned wages whenever they need it, instead of waiting for the standard pay period. With on-demand pay, employees can request payment for the hours they worked before the scheduled pay.

Custom

A custom pay period allows employers to set a unique pay schedule that best suits their business needs. This could involve paying employees on specific dates each month, such as the 1st and 15th, or on a less conventional schedule tailored to the company’s workflow.

Tips for Choosing the Right Pay Period

A year can be divided into 52 weeks, 365 days, or 12 months, which means there are numerous schedules you can use for your payroll. Some businesses are more concerned with weekly payouts and opt to pay once a week or every other week. Others divide each month in half and choose to pay in the middle and at the end. Additionally, although not as frequent, a monthly pay schedule works better for some companies.

Here are some factors you should consider when determining your pay schedule.

- Labor laws and regulations: Ensure compliance with federal, state, and local labor laws regarding pay frequency, minimum wage, overtime, and payroll tax regulations. These laws may vary depending on the jurisdiction.

- Average wages: Restaurant employees who earn tipped minimum wage may be better suited for weekly paychecks. Forcing employees who receive low wages to wait two to three weeks for payday could damage morale.

- Company cash flow: Paying weekly means you must have enough cash available to pay more often. Some businesses have cash flow cycles that require more time before bank accounts are replenished—like stores that sell merchandise on credit.

- Profitability: Processing payroll more often usually costs more money ($50 to $100 per pay run for 10 employees), and some businesses, especially startups, have to manage their expenses more carefully. Using providers like Gusto allows employers to run unlimited monthly payrolls at no extra cost.

State Payroll Guides

Before choosing your pay schedule, it’s important to know how often your state requires employers to process payroll, which we detail in our state payroll guides. You also need to check each state’s requirements for pay periods. Click on the map below to see the guide for your respective state:

State Payroll Directory

Paying in Arrears vs Current

When you pay on a current schedule, you pay employees as soon as or before their pay cycle ends. Paying in arrears means there’s a delay between the time employees work and when they receive pay for that work. This delay could be a week or more, depending on state laws.

Jeff sets his pay period as Sunday through Saturday but opts to pay on Friday the following week (six days after the last workday). While this is sometimes a nuisance to new employees who may have to work a week “in the hole,” meaning they’re not paid at the end of their first week, it can be beneficial for some employers.

If you pay your employees for time that has not yet passed, there could be unexpected changes in their schedule for which you’ll need to make adjustments on the next pay period. This can become cumbersome, as you’ll have to keep track of pay cycles for which you’ve already processed payroll; it can also involve complying with federal overtime laws—paying time and a half (1.5 times regular hourly pay) for hours worked over 40 in a workweek.

Determining Whether to Pay in Arrears or Current

There is no hard rule guiding whether you should pay in arrears or current. You should consider the needs of your business and your employees. Paying in arrears gives you time to gather all timesheets, tip reports, and other information to ensure you process payroll correctly; there’s no need to forecast employee schedules.

Paying current is less confusing for some employees and works well in certain instances. Let’s assume a company has a Sunday through Saturday pay cycle, with Friday being the payday. If the employees only work weekdays, Monday through Friday, there would be less guesswork. Although Saturday is a part of the pay cycle, the employees don’t work on Saturdays. It also works for salaried employees who are paid the same amount every pay period, regardless of hours worked.

For a list of other payroll terms that small business owners need to know, check out our guide on payroll terminology. It’s also helpful to get a good grasp as to what payroll is and isn’t.

Frequently Asked Questions (FAQs)

A pay period refers to the timeframe over which an employee’s work hours are recorded, typically weekly, bi-weekly, or monthly. A pay date, on the other hand, is the specific day when employees receive their wages for that period. In essence, the pay date is when employees get paid for the work they’ve done during the pay period.

These are months where bi-weekly-paid employees receive three paychecks instead of two. If you get paid every two weeks, you’ll have 26 pay periods in one year because there are 52 weeks in a year (52/2 = 26).

A business can change its pay period, but it must comply with federal, state, and labor laws and regulations governing pay frequency. Employers typically need to provide advance notice to employees before changing the pay period, and the change should not result in any financial loss to the employees. It’s essential for businesses to communicate any changes clearly and ensure they comply with legal requirements.

Bottom Line

Choosing the pay period that best suits your business is essential, and following it consistently is even more important. Our payroll calendars and charts make it easy to track the beginning and end dates of your pay cycle along with your pay dates, so you never miss payday or run payroll for the wrong period.

However, if you want an easy way to pay your employees regardless of your pay schedule, consider Gusto. You can choose from the four major payroll schedules and even set up multiple and custom schedules if needed. Sign up today and get one month free when you run your first payroll. Offer will be applied to your Gusto invoice(s) while all applicable terms and conditions are met or fulfilled.