When sending a payment reminder to a client, you should include the amount owed, payment due date, and the acceptable payment methods like check or credit card. Sending payment reminders is an important part of successfully extending credit to customers and a best practice for managing accounts receivable. We recommend that you email the initial payment request along with an invoice within one to two days of completing the job. Most importantly, maintain a professional yet friendly tone in all communications with your customer.

For your convenience, we have included three templates that you can download, customize, and cut and paste into an email:

- Asking for a payment before you start a job: Download template.

- Asking for a payment when work is complete: Download template.

- Asking for a payment that’s past due: Download template.

Typically, when you need to ask for money from your customers, you fall into one of three different scenarios above—all of which require a different way of asking. We explore each scenario further below.

1. Asking for Payment in an Email Before You Start a Job

If you’re a service provider, it’s best practice to ask for an upfront deposit of 20 to 50% of the total agreed amount.

Before sending an invoice and payment request, make sure that you have communicated to the customer that you require a deposit upfront. That way, they aren’t caught off guard by the email. This conversation should take place at the time they agreed to have you provide the goods or services. Typically, if you send customers a quote or proposal, the upfront deposit should also be outlined in those documents.

This email should be sent immediately after your customer has approved the estimate or quote and the start date for the project has been determined.

This email should include the following information:

- Total cost of the job

- Required deposit amount

- Date the deposit is due

- Projected start and end date of the job

- Date that the remaining balance is due

- Specific language that says, “Work will begin once the deposit has been received or when full payment is received,” depending on your situation

- Acceptable payment methods like check or credit card

- Instructions on how to submit payment

- Your contact information if there are questions

- A copy of the invoice attached

Download the How To Ask for Payment in an Email Before You Start a Job template and customize it.

2. Asking for Payment When Work Is Complete

Once you have completed a job, you should send a payment reminder within one to two days. The longer you wait, the longer it’ll take for you to get paid. If you don’t make it a priority, then neither will your customers.

This email should include the following information:

- Amount due

- Due date

- Acceptable payment methods like check or credit card

- Instructions on how to submit payment

- Your contact information if there are questions

- Specific language that says, “Thank you for your business, I look forward to working with you in the future.”

- A copy of the invoice attached

Download the How To Ask for Payment in an Email When Work Is Complete template and customize it.

3. Asking for Payment That Is Past Due Politely

Out of the three types of emails we have discussed, this is probably the toughest one to send. However, keep in mind that your customers are busy like you and, most of the time, have simply overlooked sending payment. While it’s easy to fly off the handle, the number one rule is to keep your head if you want to get paid.

This email should include the following information:

- Amount due

- Due date

- Acceptable payment methods like check or credit card

- Instructions on how to submit payment

- Your contact information if there are questions

- Specific language that references previous attempts to collect payment; for example, “We did not receive a response to our email date 05/24/20xx.”

- A copy of the previous email(s) sent

- A copy of the invoice attached

Download the How To Follow Up on Payments That Are Past Due template and customize it.

If you don’t receive a response from your customer after sending a couple of emails, it’s time to give them a call. Always give your customer the benefit of the doubt and be polite. There’s a chance that you have the wrong email address or that your emails are sitting in a spam folder. It’s important to keep the lines of communication open.

If you’re able to reach your customer and they’re unable to pay you, give them the option of a payment plan. Document the agreed-upon plan and have your customer acknowledge it via email or with a signature. Stay on top of the due dates of the payment plan to ensure that your customer is living up to the agreement.

Customers who are not paying on time can be difficult situation to handle, especially if they’re not keen on replying. If you want to avoid these scenarios, you should tighten up your credit granting policy to filter out customers who have a high chance of default. Learn more about this in our article about extending credit to customers.

When sending a payment reminder email, it’s important that you look professional. If your email address starts with an old nickname or ends with @hotmail.com, you should create a business email address. Check out our guide to how to create a professional email address.

The Collections Process

If all of your attempts to collect payments via email fail, your last resort is to implement a more formal collection process. This will require you to send written collection letters via mail. If you haven’t received payments after the fourth collection letter, we suggest you contact a collection agency. Be sure to check out our free guide on how to write a collection letter with free templates and tips on how to avoid payment collection issues in the future.

Sending Payment Reminders Using QuickBooks Online

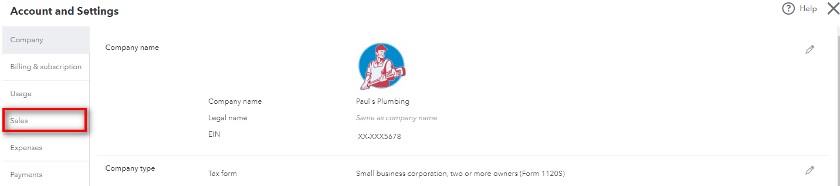

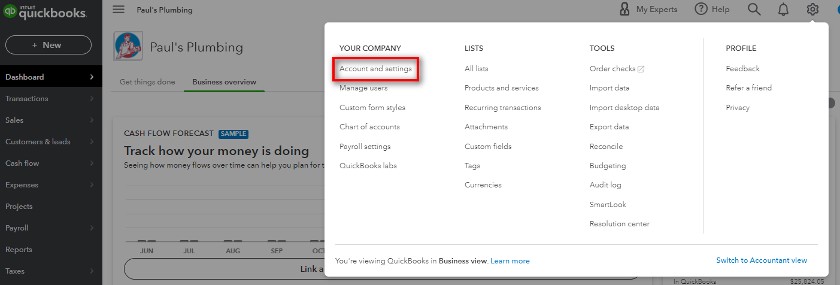

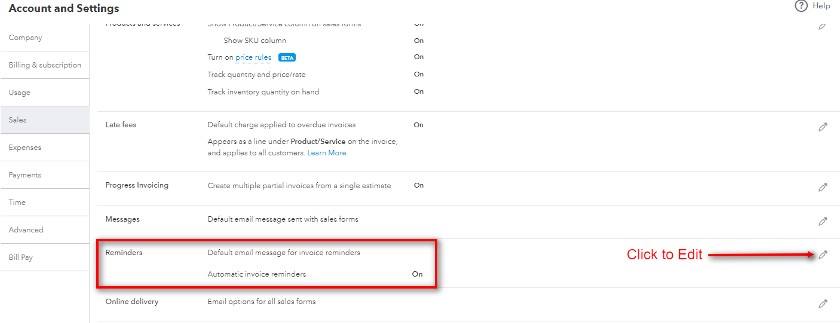

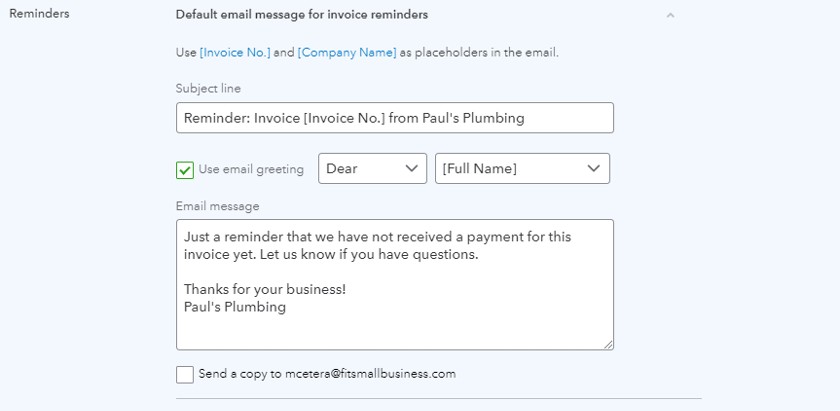

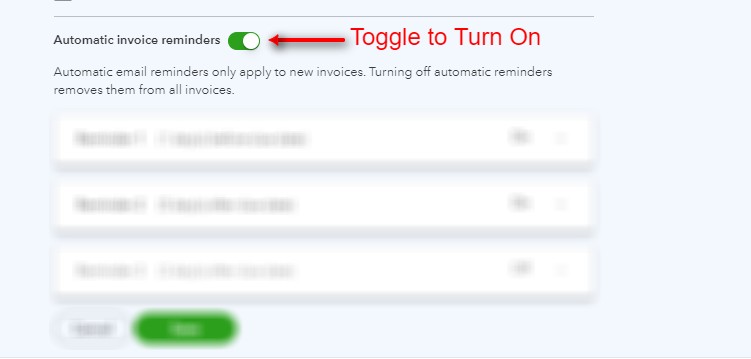

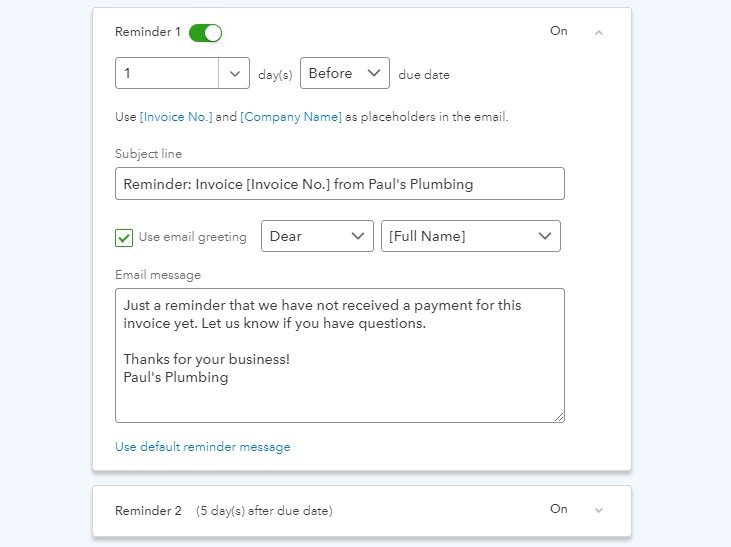

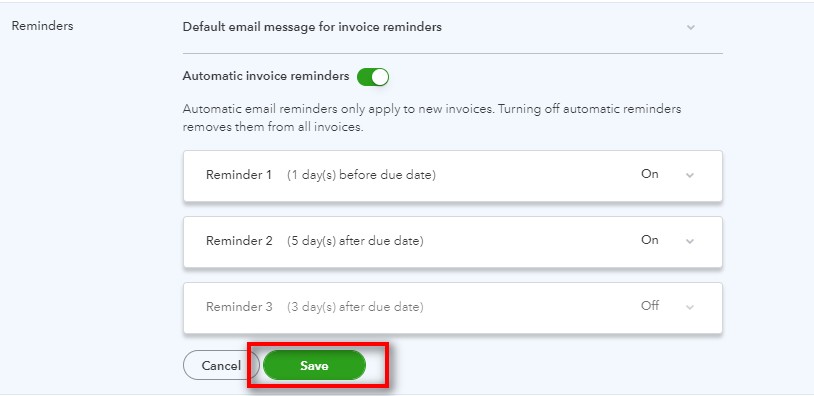

QuickBooks Online can send automatic payment reminders based on the criteria you set. To do this on QuickBooks Online, follow these steps:

QuickBooks Online will automatically send these reminders via email once the conditions have been met, such as one day before due date. We recommend maximizing the three reminders so that you can reduce the administrative work of your accounts receivable staff.

Bottom Line

We’ve shared several best practices and provided you with templates to address the three primary stages of asking for payment in an email. Now, it’s time to implement the information that we have shared with you into your customer billing process.