Preforeclosure leads present a valuable opportunity for real estate agents seeking lucrative listings or for buyers and investors looking to purchase a home below market value. However, finding and converting these specific niche leads may get quite tricky. In this article, the team and I will present proven methods on how to find preforeclosures, including purchasing leads, searching through the MLS and local directories, and generating referrals. By learning these methods, you’ll be all set to dive into preforeclosure deals and make the most out of them.

One of the most effective and time-saving ways to find preforeclosure, FSBO (for sale by owner), and expired leads is with REDX. For $49.99 per month, REDX provides up-to-date preforeclosure property information in your county. It will include difficult-to-attain homeowner contact details and organize it in a database to give you a head start on the competition.

What Is a Preforeclosure?

Before going into the 10 ways to find preforeclosure houses, it’s important to clarify what a preforeclosure is and how they differ from foreclosures. When a homebuyer takes a loan or mortgage from a lending institution, they are required to make regular payments to pay back the loan. If the homeowner fails to make mortgage payments for three months or more, the lender can start legal proceedings to take possession of the property.

The preforeclosure phase is a warning period where the lending institution notifies the homeowner about their intention to take legal action by filing a Notice of Default or Lis Pendens. During this window, homeowners can bring their payments up to date, renegotiate a repayment plan with the lender, opt for a short sale, or sell the property to settle any overdue amounts and safeguard credit for future endeavors. An auction date is usually set after the notice of default has been filed, but the timing and scheduling of these dates can vary from state to state.

It’s important to note that preforeclosures are different from foreclosure properties. While preforeclosures are homes at the start of the foreclosure process, foreclosures are at the end, with the lending institution having already repossessed the property. Preforeclosure homeowners can still address payments or make a short sale, whereas foreclosures require them to vacate. Moreover, preforeclosures are accessible to homebuyers for negotiation and inspection, while foreclosures are exclusively available to investors through auctions. Selling a preforeclosure property can protect the homeowner’s credit score, whereas foreclosure has a negative impact.

10 Methods of How to Find Preforeclosure Properties

Now that you have a clearer and more comprehensive understanding of what preforeclosures are and how they are different from foreclosure properties, it’s time to learn how to find these preforeclosures, navigate the preforeclosure market, and tap into the investing opportunities they present. Here are 10 proven effective methods on how to find preforeclosure homes:

1. Purchase Online Preforeclosure Leads

One of the most direct paths to buying a house in preforeclosure is simply buying preforeclosure leads online. Although this is a paid method, it will result in instant leads that you can start working to convert. Many lead sources automatically send new leads to your inbox daily, enabling you to start marketing to leads immediately instead of spending hours or even days finding the lead before making contact. Also, several providers have built-in client relationship managers (CRMs), power dialers, and lead management tools.

Check out a few of my favorite picks below:

Providers | ||||

|---|---|---|---|---|

Key Features |

|

|

|

|

Starting Monthly Price | $49.99 | $39.80 | $39 | $87 |

Learn More |

2. The Local MLS

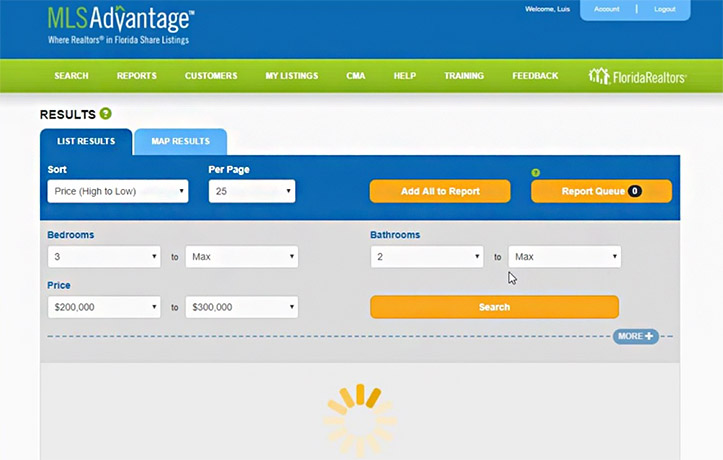

One of the most logical places to find preforeclosure homes and generate real estate leads is the Multiple Listing Service (MLS). The MLS is a local database of properties for sale, accessible only to real estate professionals. Your local MLS is often the most reliable data source, and it can help you discover active foreclosure, preforeclosure listings, and detailed property information.

Example MLS dashboard (Source: YouTube)

Since each MLS is operated and managed by real estate brokers and is specific to your state, it is not open to the public for the sake of security and operating costs. If you are not a licensed agent, you may be able to gain access by building relationships with agents, brokers, or the association that owns the MLS.

3. Online Directories

Online directories have extensive data on properties in your area, which can help you pinpoint preforeclosure listings. They also have filtering capabilities, making it easier to sort through potential listings to locate the most relevant details.

While directories are useful for real estate professionals, they are ideal for real estate investors starting the search process for preforeclosure listings because directories can be accessed instantly from any device with the least amount of legwork and without a real estate license. However, even the most accurate directories will inevitably have inaccurate or outdated information, so check multiple sources.

Here are some online directories where to find preforeclosure lists:

Providers | ||||

|---|---|---|---|---|

Key Features |

|

|

|

|

Starting Price | $119 per user, per month | $24.99 per month, if billed annually | Free to browse, ZPA costs about $20 to $60 per lead | $49 per month |

Learn More | Visit Zillow or read Zillow Our Premier Agent Review |

4. Public Records

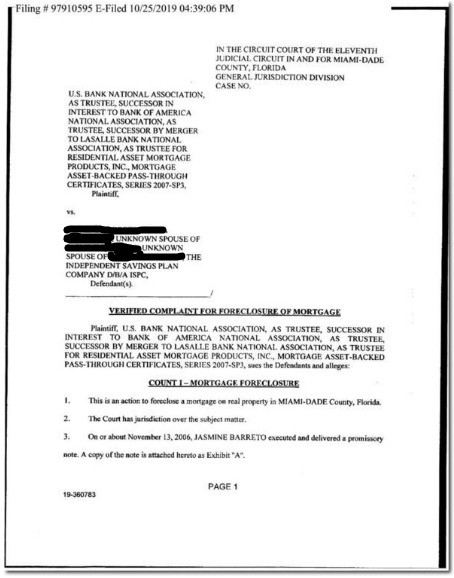

Searching public records is one of the most reliable ways to find accurate foreclosure listings. However, it can be time-consuming and only provides limited information. Preforeclosure listings can be found for free in the public records section at your county recorder’s office or online. Search for Notice of Default, Lis Pendens, and Notice of Sale. These notices are issued to the homeowner and publicly recorded during the foreclosure process.

Public records include the property address and the homeowner’s name. Generally, they also contain the name of the bank doing the foreclosure and how much is owed on the property. Still, a good amount of important data will be unavailable. For example, public records don’t reveal liens owned on the house (a title search is required), photos, and a detailed property description, so you might have to comb the internet or ask around to uncover this information.

Example preforeclosure notice (Source: Househeroes)

Understanding how to find preforeclosure properties through public records is only the first step of the process. You’ll need to visit the property and look for signs of distress, like overgrown grass, piles of newspapers, or other signs of abandonment. You may even want to talk to neighbors or mail delivery drivers to learn about anyone living in the home. If you can’t locate contact details, you can leave a handwritten note letting the owner know you are interested in assisting with the property.

5. Local Newspapers

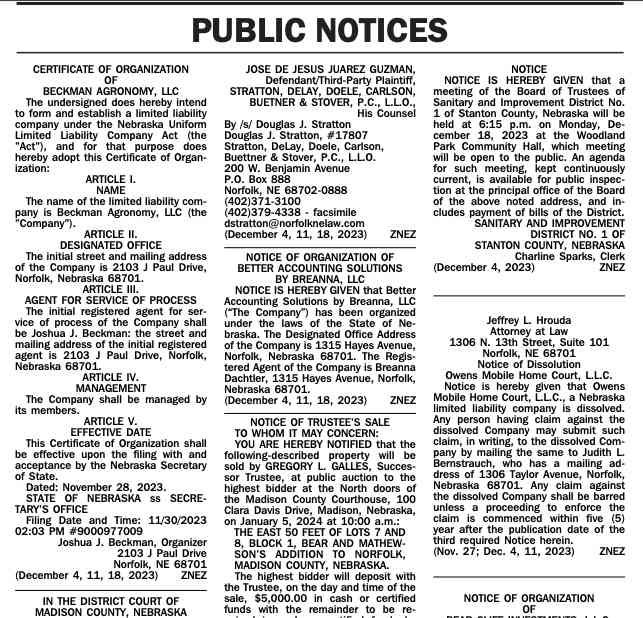

Local newspapers publish the addresses of homes at any stage of the foreclosure process. Once the preforeclosure process begins, the homeowner will receive notices of foreclosure, including “Lis Pendens,” published in the newspaper’s legal section.

Of course, most local newspapers also have an online edition where the same information is published. You’ll often have to pay for access to the newspaper for your county, but you can check out the legal section and note the addresses with pending litigation. Like the public records, the paper won’t include photos or descriptions of the preforeclosure listings, so you must do your own research.

Sample legal notices (Source: Norfolk Daily News)

Even though checking out local newspapers may seem archaic, it’s an extremely reliable source that provides information as soon as the property receives notices. It’s also easy to access, although there will often be a fee. This method is ideal for agents and investors who already know how to get listings since there will be competition for these leads as soon as the data is public.

6. Real Estate Wholesalers

Another way to locate preforeclosed homes is by searching through data yourself. You can make valuable connections with specialized professionals who are consistently in contact with preforeclosure leads, like wholesalers. Real estate wholesalers are entrepreneurs who use wholesaling as an investment strategy. They advertise to distressed homeowners to buy their home and connect it with a buyer or investor.

Example real estate wholesaler (Source: Patch)

For example, a wholesaler can find a homeowner in preforeclosure and make an offer at a certain price, depending on comparable properties and the home’s condition. Wholesalers create a contract with the homeowner but don’t actually pay the designated amount. Instead, they look for a real estate investor to buy the home for a fair price, and the wholesaler keeps the difference. By making connections with wholesalers, investors can get excellent deals on properties at a discounted price.

7. Real Estate Attorneys

Real estate attorneys are licensed professionals who can work with homeowners in various legal matters. For instance, attorneys are often hired to represent clients who inherit homes they can’t afford or who have defaulted on their loans and need legal assistance. This makes them a great source for knowing how to find preforeclosures.

Connect with real estate attorneys to find preforeclosure leads (Source: Adobe Stock)

The best way to connect with attorneys is by attending in-person events or making connections through personal and professional friendships. Seek them online or on social media and instantly connect. Attorneys can put you directly in the path of distressed owners and strong investment opportunities, making them valuable sources of preforeclosure listings. However, you will still need to do your own research on each property before making a deal.

8. Real Estate Referrals

In the real estate industry as a whole, networking is the best way to acquire leads and build a reputation. Whether you’re an investor or agent, you’ll be more successful in real estate with more connections. According to the National Association of Realtors (NAR), 65% of homesellers find their listing agent through a personal referral. You most likely have many other friends, family members, and acquaintances who can connect you with potential preforeclosure listings.

The owners of preforeclosures are often members of your community who likely went through an unexpectedly difficult time. You might be more connected to these potential leads than you think, so don’t miss an opportunity to open the door for referrals. Start by sharing your search for preforeclosure homes for sale with friends and family or on social media. Let them know that you want to invest in potentially distressed homes and that your business venture could be life-changing for others in need.

Custom landing page (Source: Placester)

Build a system to generate real estate referrals online, like creating a website, landing page, ads, and a social media account. With a real estate website creator like Placester, you can get a full website and custom landing pages up and running in a matter of hours. Tailor your website and landing pages to speak to homeowners of distressed and preforeclosure properties by giving them information about the process to let them know you’re an expert in that niche.

9. Prospecting Letters for Preforeclosure Listings

Writing letters can seem like a boring or old-fashioned way to make contact, but it can be a particularly effective strategy for preforeclosures. Since the recipients are often not in their situation by choice, they should be approached with sensitivity and compassion, which is very difficult to do through online ads or messages. Letters, on the other hand, can be personalized and handwritten to make the most significant impact.

Write your prospecting letter from a template, but include unique details about their neighborhood, interests, or local hot spots if you are familiar with them. Focus on communicating how you can benefit the owners as much as possible. Here is a preforeclosure letter template you can use as a guide.

I hope this letter finds you well despite the challenges posed by the economic recession. I understand that navigating the foreclosure process can be overwhelming, and I am reaching out to offer assistance during this difficult time.

I am [Your Name], a dedicated real estate agent with [Real Estate Company Name]. I specialize in assisting homesellers who find themselves underwater on their mortgage or are facing the prospect of foreclosure. I recognize that facing foreclosure can be an emotionally taxing experience, and I am here to provide a beacon of hope to guide you through this crisis.

One viable alternative to foreclosure is a short sale. In a short sale, the homeowner, real estate professional, and lender collaborate to reach an agreement to sell the home at its current market value, often below the existing mortgage balance. This process allows the property to transition to a new owner, alleviating the lender’s risk and releasing the current homeowner from the burden of an underwater mortgage.

Undoubtedly, the short sale process is challenging and time-consuming, requiring persistence and dedication. As a specialist in short sales and foreclosures, I possess the expertise to navigate this intricate process and guide transactions to completion. My goal is to empower my clients to break free from the strain of an underwater mortgage and move toward financial relief.

If you or someone you know is currently facing foreclosure, please don’t hesitate to contact me. I am here to provide support and explore potential solutions during this challenging time.

Best wishes,

[Your Signature]

[Your Contact Information]

10. Real Estate Agents

Real estate agents are excellent resources for investors to start their search for preforeclosed homes because they have access to the MLS. By finding a great real estate agent to work with, you’ll get qualified assistance and have all the labor-intensive tasks completed for you, like handling any paperwork.

In addition, real estate agents can locate a preforeclosure listing, arrange any necessary meetings, and competently negotiate on your behalf. However, you must pay your agent to cover their commission, making the preforeclosure listing more expensive. Plus, you will spend most of your time working to your agent’s schedule.

Pros & Cons of Preforeclosure Leads

Homes in foreclosure often cost less than market value, which presents an incredible opportunity for savvy real estate investors or agents. This profit potential is the most obvious reason to search for preforeclosures, but many hurdles also come with foreclosures. Before investing your time and resources, consider all the pros and cons of preforeclosure listings.

| PROS | CONS |

|---|---|

| Homeowners are often motivated and extremely eager to sell their homes quickly | Most foreclosure properties are in poor or distressed condition |

| This is an opportunity for homeowners to relieve themselves of significant financial and legal hardship | Foreclosures have a longer sale process, anywhere from 90 days to a number of years to complete, depending on many different factors |

| Less competition for agents | Significant research required |

| For investors, foreclosure homes often cost less than market value, providing profit potential | Foreclosure homeowners can be difficult to contact or have extenuating circumstances with additional legal or financial obstacles |

Frequently Asked Questions (FAQs)

While various preforeclosure sites offer online leads, our top recommendation is REDX for its unparalleled reliability in providing verified leads. REDX excels in compiling lists from diverse niche sources, making it the ideal choice for agents seeking preforeclosure leads, as well as those interested in FSBO, FRBO, and expired listings. Additionally, the platform provides a Power Dialer, enhancing your ability to optimize connections and streamline prospecting calls.

To find a free list of foreclosures in your area, explore the public records section at your county recorder’s office or browse online. These records typically include property addresses and homeowner names. Another effective method is leveraging referrals to discover foreclosed houses for sale nearby. Owners of homes in foreclosure are often part of your community, making potential leads more accessible than you might realize. Begin by sharing your search for preforeclosure listings with friends, family, or on your social media platforms.

To effectively wholesale preforeclosures, follow these steps:

- Search for preforeclosures near you.

- Contact the seller and find out when the foreclosure auction will occur. If possible, ask for a timeline of important dates and deadlines.

- Perform a thorough financial analysis of the preforeclosure home with the seller. Along with determining the payoff balance of the mortgage loan, check for any other charges like interest or late fees, the total monthly payment of the property, potential reinstatement fees, other liens against the property, or any other outstanding debts related to the property. This analysis will help you understand the actual equity of the property, avoid potential roadblocks, and assess the profit margin.

- Make an offer and secure a contract with the seller.

- Share the contract with your investor and cash buyer network and assign the purchase contract to a third-party buyer.

- Collect a wholesaling fee.

Bottom Line

There are many methods for how to find preforeclosure leads, such as the MLS, online directories, real estate referrals, and public records. Although it may be more work than a traditional property listing, there is potential to make a lot of profit, stand out from the competition, and specialize in a niche area of real estate.