Understanding pre-tax and post-tax deductions is a crucial part of running a small business. Deductions play a crucial role in both employee benefits and garnishments, impacting net pay for your employees.

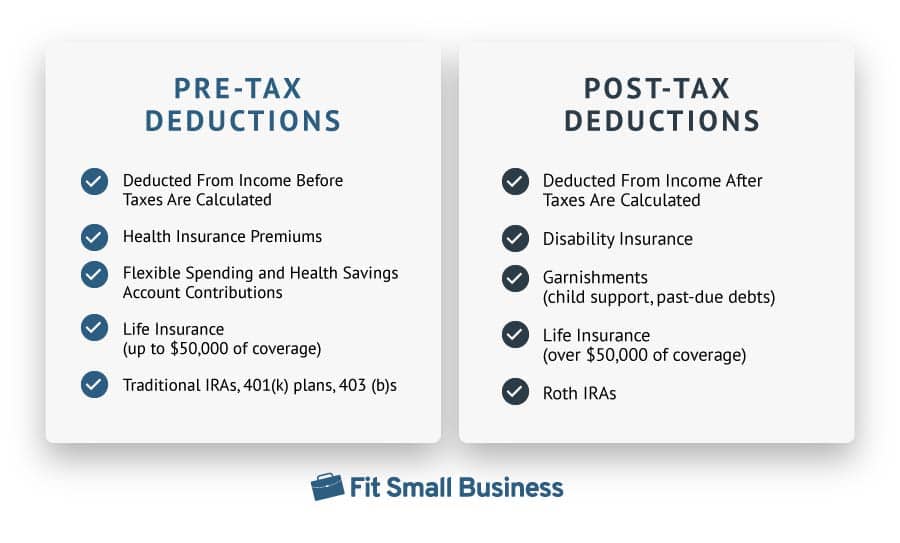

- Pre-tax deductions are those deductions subtracted from an employee’s pay before taxes are withheld (including health plan and life insurance contributions).

- Post-tax deductions refer to deductions taken from an employee’s pay after taxes have been withheld (including wage garnishments and union dues).

Tax deductions are set by the government, so you can’t choose whether a benefit is pre- or post-tax. You simply choose the benefit you want to offer and then follow the rules for taxation. In this guide, we walk you through both types of deductions.

Types of Pre-tax Deductions

While many pre-tax deductions have been approved for years, the federal government may change the rules for what qualifies as a pre-tax deduction. So, make sure you stay up to date on the requirements. You can find a full list of pre-tax deductions directly from the Internal Revenue Service (IRS).

Common pre-tax deductions include:

Certain employee contributions to health, vision, and dental insurance plans are pre-tax, including Health Savings Accounts (HSA) and Flexible Savings Accounts (FSA). Employer-paid healthcare is not income to the employee, so it’s not a pre-tax deduction. However, you can deduct employer-paid health plan costs, including administration fees, from your business taxes.

Employees’ 401(k) contributions are pre-tax, reducing their taxable income. However, if your company offers a Roth version and employees contribute, this is not a pre-tax deduction—Roth retirement contributions are post-tax. Many employers match 401(k) contributions up to a certain amount. These contributions don’t qualify as a pre-tax deduction for the employee, but your business can write off the contributions on your business taxes.

401(k) contributions get tricky because, even though they’re pre-tax for your employees, the amount still counts toward you and your employees’ FICA taxes. Also, the annual contribution amount is limited to $23,000 for contributions made in 2024. Except for self-employed individuals, employees cannot contribute more than this amount, limiting the amount of tax liability reduction they can achieve each year.

In the News: Traditionally, employers can make an optional matching contribution to employees’ 401(k) plans but those matching contributions had to go into the pre-tax, traditional 401(k). Under the SECURE Act 2.0, employers can choose to make matching contributions into an employee’s Roth (post-tax) 401(k). This is entirely optional and at the discretion of the employer.

What isn’t optional is a different provision of the SECURE Act 2.0, which requires most employers to enroll eligible employees into the company’s retirement plan automatically. Starting January 1, 2025, any employer who starts a new 401(k) plan must automatically enroll eligible employees at a contribution rate of at least 3%. Companies in business for under three years and those with 10 or fewer employees are exempt.

Especially in large metropolitan areas, commuter benefits are a great benefit that employers can offer to their employees. An added bonus is that they’re a pre-tax deduction. However, there’s currently no tax benefit to employers, except if you offer bicycle commuting benefits.

Regular commuting is not a tax deductible fringe benefit. However, these commuter benefits may qualify as pre-tax for your employees:

- A public transportation pass

- Parking garage or lot fees

- A commuter vehicle provided by the company to transport employees

There are limits on these deductions. You can only provide pre-tax commuter benefits of up to $315 per month. These contributions must also be recorded under an employer reimbursement plan, requiring you to verify the expense before you provide employees with a pre-tax reimbursement.

Employee contributions to life insurance are pre-tax. The contributions don’t count toward an employee or employer’s FICA or FUTA. However, only the first $50,000 of coverage is counted for FICA—anything beyond that is taxable.

Types of Post-tax Deductions

Except for wage garnishments, which are court-ordered, employees can decline to participate in post-tax deductions. Common post-tax deductions include:

The most common type of post-tax deduction is wage garnishment. Courts, the IRS, or other regulatory agencies may send an earnings withholding order to deduct a certain amount of money from an employee’s paycheck. This often occurs if an employee is behind on:

- Back taxes

- Child support

- Alimony

- Loans

When you receive a garnishment order, it will detail the amount to withhold and give you instructions on where to send payments. Most garnishment orders also allow you to deduct a small administrative fee for your time.

Because garnishments are legal orders, make sure you read them closely, adhere to them accurately, and ask questions if you’re unsure of something. If you deduct incorrect amounts, your company could be liable for underpayments.

Roth retirement plans can be great for employees who want to contribute post-tax dollars toward their future. This lets them have money grow tax-free and lets them take the money out in retirement without paying taxes on it because they’re paying taxes now.

A Roth 401(k) allows for post-tax employee contributions. If your company offers a 401(k) retirement plan, you can add a Roth option, which is an attractive benefit to employees.

Employers can offer remote workers benefits, just like offering commuter benefits. The difference is that remote worker benefits are post-tax and in the form of a stipend.

Sometimes included in each paycheck and other times included monthly or quarterly, a stipend provides your employees with a fixed sum of money above and beyond their regular wage. They can use this money to pay for remote work costs, like a standing desk, ergonomic chair, faster internet, and upgraded equipment. However, stipends are taxable, so both you and your employees will pay taxes on this money.

Union dues may be required if you have employees who are part of a union. But union dues are post-tax, so you’ll need to calculate taxes before taking the union dues out of an employee’s net pay.

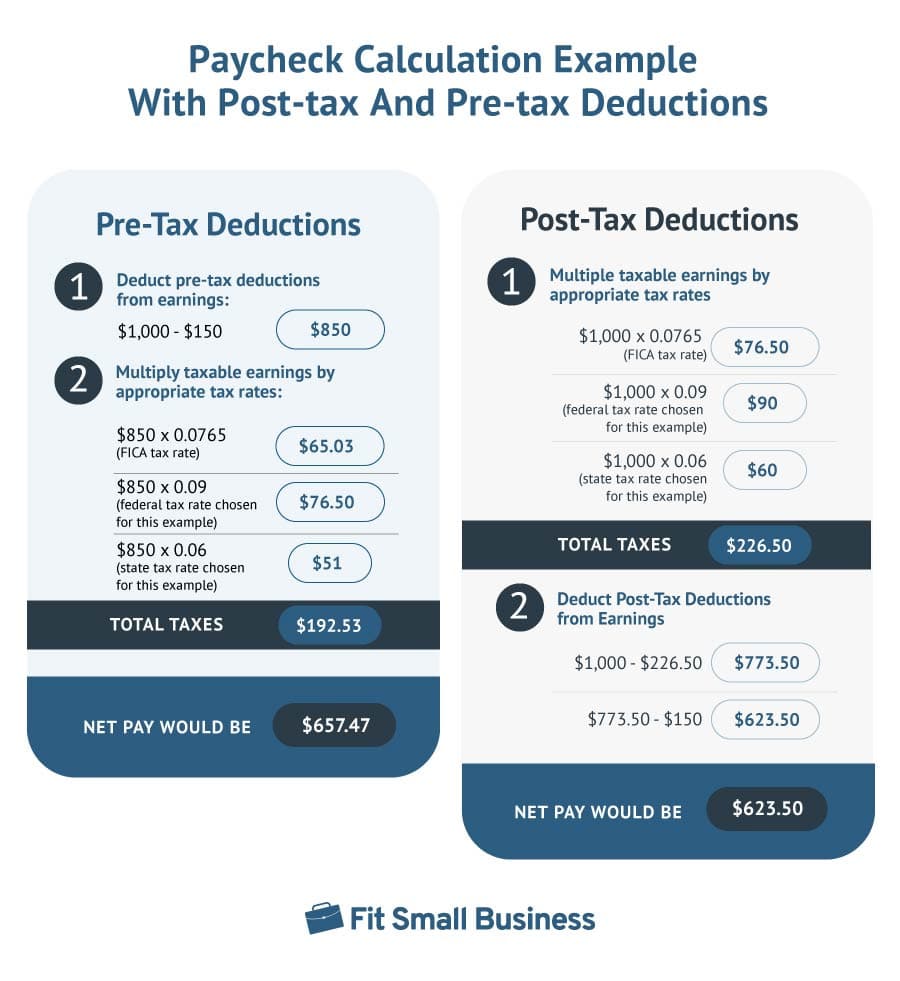

Pre-tax vs Post-tax Deduction Calculation Example

Let’s look at how pre-tax and post-tax deductions work in practice.

Say Anna earns $1,000 per pay period in gross wages. She contributes $150 per pay period toward health insurance (pre-tax deduction), reducing the taxable income to $850. This saves her taxes on the $150 per pay period because the tax burden is calculated on $850, not $1,000—meaning she will only be taxed $192.53, resulting in a net pay of $657.47.

On the other hand, say Anna instead has a wage garnishment of $150 for an unpaid bill. Because this is a post-tax deduction, it doesn’t affect the payroll tax calculation or reduce Anna’s income tax burden—meaning her $1,000 pay would be taxed by $226.50, and then the $150 garnishment gets deducted, resulting in a net pay of $623.50.

Statutory vs Voluntary Deductions

Pre-tax and post-tax deductions aren’t the only consideration for you. Some deductions fall under statutory, or required, and others are voluntary. Understanding the difference between them will ensure compliance.

Statutory Deductions | Voluntary Deductions |

|---|---|

Mandated by law and deducted without employee approval required | Requires employee approval to deduct |

|

|

Knowing the difference between statutory and voluntary deductions sets your business up to be legally compliant, avoiding costly fines and penalties. Accurate understanding of these deductions also allows for more complete financial planning and reporting for your business.

By clearly categorizing deductions, you can better forecast your budgets, manage cash flow, and prepare financial reports. It aids in transparent communication with employees about their salaries, benefits, deductions, and net pay, building trust and clarity within the organization.

Pre- & Post-tax Deductions Frequently Asked Questions (FAQs)

Pre-tax deductions reduce an employee’s taxable income, which means they’ll often see a decrease in the taxes withheld and an increase in their take-home pay. Post-tax deductions do not affect an employee’s taxable income, so they will take home a little less pay compared to a pre-tax deduction.

Pre-tax disability insurance premiums are paid with money that hasn’t been taxed, which can lower an employee’s taxable income but could result in any benefits received being taxable. With post-tax disability insurance, employees pay premiums with money that’s already been taxed, so any benefits received are typically tax-free.

Yes, employees can choose between pre-tax and post-tax contributions when they’re voluntary, especially retirement options like 401(k). However, the ability to change and the specific process will depend on the plan provider and the rules governing the plan.

Bottom Line

Pre- and post-tax deductions are just one of many parts of running payroll. Following this guide is a great start to ensuring you pay your employees correctly and on time. To help you eliminate mistakes, consider partnering with a trusted payroll software that can do these calculations for you automatically.