Fringe benefits are company-paid incentives you offer employees above and beyond their regular salary. They can include traditional employee benefits (such as health insurance and retirement benefits) as long as the employer is contributing to the costs, thereby saving the employee money. Fringe benefits also include less traditional benefits like moving expenses, adoption assistance, or commuter stipends. Fringe benefits are generally taxable, unless specifically exempted by the Internal Revenue Service (IRS).

Understanding these exemptions and how to distinguish taxable fringe benefits from non-taxable ones is key to making sure your business and employees are in compliance with federal tax laws.

Key Takeaways:

- Most fringe benefits are taxable, so make sure you understand the tax implications.

- Until 2026, all moving expense benefits are taxable to the employee.

- A strong benefits package will help you attract and retain top talent.

What are Taxable Fringe Benefits?

As stated, fringe benefits are any incentive offered as an addition to their regular pay—and according to the IRS, most fringe benefits are subject to taxes. So, you’ll need to deduct taxes for most benefits you offer to employees.

Here are a few examples of fringe benefits that are subject to taxes:

Bonuses | Awards and prizes |

Frequent flier miles converted to cash | Clothing |

Excessive mileage reimbursement | Education reimbursements unrelated to the employee’s job |

Excessive moving expenses | Gift cards |

The IRS guidelines for what is taxable and not are very precise. For example, the federal mileage reimbursement standard is 67 cents per mile, and it’s not taxable—but you can reimburse more. Any amount you’ve reimbursed over 67 cents per mile is taxable income to your employees. So, if you reimburse employees at 75 cents per mile, then eight cents per mile is taxable income.

The Tax Cuts and Jobs Act, passed in 2017, set moving expenses as taxable to the employee. This exclusion is set to lift in 2026. So until January 1, 2026, any moving expenses you provide to employees is fully taxable on their annual income tax return.

Calculating the Fair Market Value

Taxable fringe benefits must be valued so you know what tax rates employees or you need to pay. According to the IRS, the fair market value of a fringe benefit is determined by what a reasonable person would pay for that specific benefit.

For example, if your company offers country club memberships to employees, the fair market value would be whatever the country club charges a member annually. If that fee is $20,000, then that’s the fair market value.

If your company pays that entire fee, then $20,000 is taxable income to any employee who chooses this fringe benefit. For such a high cost, however, you may split that cost with employees. In that instance, only the amount your company pays ($10,000) would be taxable income to your employee.

When calculating the fair market value of a fringe benefit, you would use any publicly available information to determine that figure. Using the country club example, your company may be a corporate member that receives discounts on the dues for any of your employees, resulting in an actual membership cost of less than $20,000. However, you’re still able to use the $20,000 figure for taxation purposes, even if your actual cost is less.

Fringe Benefit Tax Rate

As the employer, it’s your job to withhold appropriate taxes for any benefits. But you and your employee have options on your withholdings. You can elect to tax fringe benefits at the employee’s income tax rate. Or you can choose to withhold a flat 22% of the benefit value.

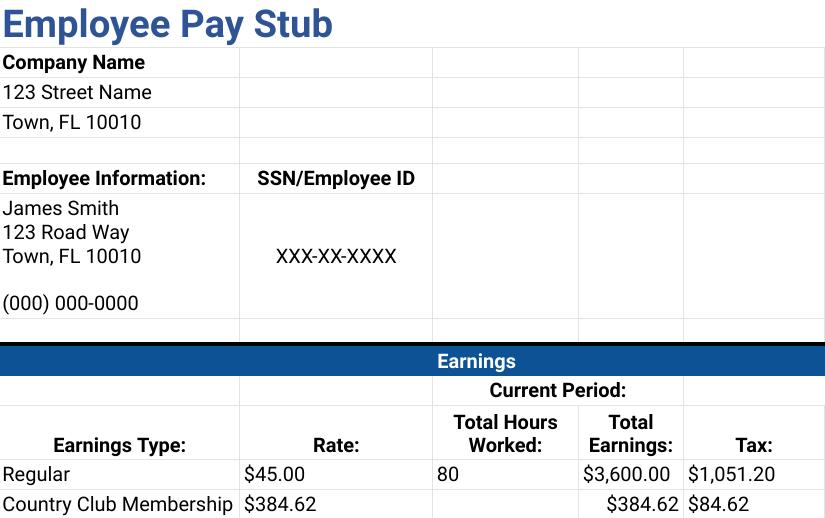

Sample pay stub showing a country club membership fringe benefit that’s been split between employer and employee. The amount was taxed at a flat rate of 22%.

Withholding at a flat rate may be simpler for your processing, but it could result in a higher tax due or tax refund for your employee at the end of the year. It’s recommended to consult with your employees to figure out what they would prefer.

What are Non-taxable Fringe Benefits?

The IRS includes a list of fringe benefits that are, in most cases, excluded from being subject to federal income tax withholding, social security tax, Medicare tax, federal unemployment (FUTA) tax, or Railroad Retirement Tax Act (RRTA) taxes.

These include the following:

Accident insurance | Employee discount programs |

Life insurance (unless over $50,000) | Employee stock options |

Adoption assistance | Employer-provided technology equipment (cell phone, laptop) |

Gym membership | Health savings account |

De minimis (minimal) benefits like free coffee or candy | Meals (if furnished on business premises) |

Child care assistance | Retirement planning services |

Education assistance (up to $5250 per year) | Birthday gift |

Tuition assistance | Commuter benefits |

For an overview of the rules, check out the IRS’ table on the employment tax treatment of these benefits.

Offering Fringe Benefits for Your Small Business

When considering fringe benefits to offer your employees, think about some of the traditional benefits that your company can contribute to (covering part or all of your employees’ healthcare premiums, for example). Also, use your imagination and get creative to offer your employees something unique to your company.

For instance, if you’re in the ice cream business, you could offer every employee a free pint of ice cream each week. Or if you provide elderly home care services, you could offer your employee’s elderly family members discounted rates.

Examples of Fringe Benefits to Offer

Beyond the standard tuition assistance, investing in your employees’ professional development through workshops, conferences, and training sessions can significantly enhance their skills and value to your business. This keeps your team up-to-date with the latest industry trends, boosts morale and job satisfaction, and shows that you have a commitment to your employees’ career skills and advancement.

Apart from gym memberships, comprehensive wellness programs that include mental health support, nutritional advice, and stress management workshops can play a crucial role in promoting employee’s overall well-being. These programs demonstrate an investment in your employees’ health beyond the physical, addressing the full spectrum of wellness.

Check out our employee wellness ideas guide for some ideas you can use.

Beyond traditional wellness programs, advanced stress management programs are becoming more common. These include access to meditation apps, on-site relaxation spaces, and workshops to help manage workplace stress. Adopting a comprehensive approach to mental health can help companies foster an environment where employees feel supported in managing stress, leading to improved productivity and overall job satisfaction.

Providing access to legal consultation for personal matters, such as estate planning, family law, or identity theft issues, can offer significant peace of mind to employees. Adopting this benefit shows you care about their well-being beyond the workplace, offering support in navigating complex personal challenges.

It’s also common in today’s work environment for employers to pay a portion or all of their employees’ mobile phone service costs. Companies can also partner with mobile phone providers to offer discounts and credits directly to employees. This benefit supports seamless communication and demonstrates a company’s commitment to investing in tools that empower employees both inside and outside the office.

Recognizing the integral role pets play in our lives, companies can offer a pet assistance program. This initiative covers various aspects of pet ownership, including veterinary insurance coverage and a pet bereavement leave policy. By supporting employees’ furry family members, businesses acknowledge the broad spectrum of family care, promoting a more inclusive and compassionate workplace culture.

One option to consider for offering your employees fringe benefits is a cafeteria plan, also called a section 125 plan. Allowed by the IRS, this is a written plan offering your employees a choice between cash compensation or a fringe benefit. You must allow employees the option to choose at least one taxable benefit (cash) and one qualified benefit (tax-free benefit). One of the most common qualified benefits offered by employers is a flexible spending account (FSA) used to cover medical expenses.

A cafeteria plan allows employees to make contributions toward a benefit tax-free, essentially reducing their taxable income while putting the deferred money into an account for their use—giving them more bang for their buck. These accounts allow employees to defer income to pay for healthcare with tax-free funds. It also saves your company money as any of your contributions are not taxed. To establish a cafeteria plan, you must:

- Adopt a written plan document governing the plan administration

- Make employee plan elections irrevocable

- Ensure nondiscrimination requirements are met

Cafeteria plans allow your employees to choose the benefits they want. But there are some benefits you can’t offer in a cafeteria plan, even though you could offer them separately as an additional fringe benefit.

Can Include in a Cafeteria Plan | Cannot Include in a Cafeteria Plan |

|---|---|

Accident, life, and health benefits | Meals, lodging, working condition benefits |

Adoption assistance | Employee discounts or memberships |

Dependent care assistance | Tuition and relocation assistance |

Health savings account | Commuter benefits |

Cafeteria plans are complex. We highly recommend seeking guidance from a qualified professional to help you determine the right plan options to include.

For a detailed look at employee benefits, check out our guide to the different types of benefits.

Can You Offer Fringe Benefits to Independent Contractors?

While we’d normally say that you can’t offer any benefits to non-employees, you can offer independent contractors access to some fringe benefits—both those that are traditionally taxable and non-taxable (although it won’t actually be subject to employment taxes). This isn’t a common practice, however, partly because it blurs the lines between employee and independent contractor. If you do offer taxable fringe benefits to independent contractors, you must report those on Form 1099-NEC.

Why Fringe Benefits are Important + Pros and Cons

| PROS | CONS |

|---|---|

| Provides extra compensation to employees besides increased salary | Many employees simply want a higher salary, not benefits |

| Certain benefits increase employee health and productivity (gym membership, mental health counseling) | Creates additional expense to the employer through increased tax |

| Pre-tax fringe benefits can reduce an employee’s tax liability | Some fringe benefits require administration, which increases costs |

There are many advantages of offering fringe benefits to your employees. While there can be tax implications to some, ultimately, offering more benefits and the right benefits will help you attract and retain top talent.

- Attract top talent. Top candidates look for benefits packages that offer more than the standard. This signals to potential hires that you value employee well-being and work-life balance, making your company a desirable place to work.

- Boost employee retention. The cost of losing an employee is substantial, not just financially but also in lost knowledge and decreased morale among remaining staff. Offering a comprehensive benefits package demonstrates your commitment to employee welfare, fostering loyalty and encouraging your team to stay longer with your company.

- Enhanced job satisfaction and improved productivity. Benefits tailored to meet your employees’ needs contribute significantly to job satisfaction. Offering remote and hybrid work options shows respect and trust for your employees. When employees feel taken care of and appreciated, they’re more likely to be productive.

According to the Bureau of Labor Statistics (BLS) private employers covered 78% of medical premiums for single coverage plans. This fringe benefit is quickly becoming commonplace, so if you’re not offering it, you could be losing ground.

Fringe Benefits Frequently Asked Questions (FAQs)

Yes. A 401(k) is a retirement plan sponsored by your company. It lets workers save and invest a piece of their paycheck, putting that toward retirement. Offering this fringe benefit is a powerful tool in attracting and retaining top talent, as the only way workers get access to a 401(k) is through an employer-sponsored plan.

Yes, you can. While some benefits, like health insurance, can be costly, there are cost-effective options available. Consider benefits that require minimal to no financial investment, such as flexible work hours, remote work options, and professional development opportunities. Tailoring your company’s benefits package to match your business’s budget and your employees’ needs is key.

Thinking outside the box, some fringe benefits can be unique to your company. You can offer pet adoption services or cost reimbursement. You can partner with other local businesses to offer employees free or discounted access to experiences like theme parks, theater tickets, or museum passes. Don’t forget to ask your employees what they want—they may have some great ideas that you can implement quickly and cost-effectively.

Bottom Line

Small businesses can up their recruitment and retention strategy by adding fringe benefits. It can help to increase an employee’s total compensation and reduce your company’s overall cost to employ. Offering fringe benefits is great, but make sure you understand the tax implications and how to attribute each benefit to all your employees.