QuickBooks Live offers an affordable solution to basic bookkeeping tasks for QuickBooks Online users while Pilot Bookkeeping is more expensive but provides a large array of more sophisticated services targeting startup and high-growth companies. When comparing QuickBooks Live vs Pilot Bookkeeping, we believe that while QuickBooks Live excels in its wider range of customer support options that include video calls, Pilot is the stronger solution if you require a variety of bookkeeping services and access to tax consulting and filing.

- QuickBooks Live: Best for QuickBooks Online users seeking a QuickBooks ProAdvisor to complete basic bookkeeping tasks

- Pilot Bookkeeping: Best for venture-backed startups and fast-growing businesses seeking chief financial officer (CFO) services and tax management

| ||

|---|---|---|

3.70 ★ | 3.42 ★ | |

Pricing | Starts at $300 monthly, plus a QuickBooks Online subscription that starts at $30 a month | Starts at $499 per month, plus a QuickBooks Online subscription that starts at $30 monthly |

Pay-as-You-Go Option | N/A | N/A |

Service Frequency | Monthly | Monthly |

Free Trial | ✕ | ✕ |

100% Accurate Books Guarantee | ✓ | ✕ |

Accounting Software Supported | QuickBooks Online (required) | QuickBooks Online (required) |

Dedicated Bookkeeper | ✓ | ✓ |

Catch-up Bookkeeping | Back to last tax return with customized pricing | Custom quote |

Invoicing & Bill Pay | ✕ | Custom quote |

CFO Services | ✕ | Starts at $2,250 per month, billed annually |

Tax Advisory & Filing | ✕ | Starts at $2,450 per year |

Key Features |

|

|

What’s Missing | Invoicing, bill pay, and tax services | Video meetings and payroll |

Mobile App | iOS and Android (QuickBooks Online) | iOS and Android (QuickBooks Online) |

Ease of Use | Easy | Easy |

Average Rating on Third-party Sites | ||

Use Cases and Pros & Cons

User Reviews: Pilot Wins

| ||

|---|---|---|

Average Rating on Third-party Sites | ||

Users Like |

|

|

Users Dislike |

|

|

Both have mostly positive reviews, though Pilot Bookkeeping takes the lead in this category based on its higher scores. Reviewers of QuickBooks Live praised its responsiveness and affordable fees, and Pilot users appreciated its ease of use and additional services available.

Users appreciated the responsiveness and knowledge of the customer support team. They also described the fees as affordable and the dashboard itself as easy to navigate. Two complaints are that there aren’t any bill pay or invoicing and income tax filing or advisory services available. Also, reviewers wished that QuickBooks Live offered a free trial so that they could try the service before committing. We agree that a free trial would be nice, although only about half of the bookkeeping services we’ve reviewed offer one.

QuickBooks Live earned the following average scores on popular review sites:

Pilot Bookkeeping received the highest user review scores among the providers we have reviewed, and users praised the responsive team as well as an easy-to-use platform that allows for communication about transactions and vendors. They also appreciated the variety of additional services such as invoicing and paying bills. Complaints about the service are that it is more expensive than some of its competitors and that it lacks payroll services.

Pilot Bookkeeping earned the following average scores on popular review sites:

Pricing: QuickBooks Live Wins

| ||

|---|---|---|

Pricing | $300 to $700 per month (depending on monthly expenses), plus 30 to $200 monthly for a QuickBooks Online subscription | $499 to $699 monthly, billed annually, plus $30 to $200 a month for a QuickBooks Online subscription |

Onboarding Fee | Custom priced | Equal to one month of bookkeeping |

Catch-up Bookkeeping | Back to last tax return with customized pricing | Custom quote |

Invoicing | ✕ | Custom quote |

Bill Pay | ✕ | Custom quote |

Tax Services | ✕ | Starts at $2,450 per year |

CFO Services | ✕ | Starts at $2,250 per month, billed annually |

Free Trial | ✕ | ✕ |

When we compare QuickBooks Live and Pilot Bookkeeping in terms of pricing, QuickBooks Live is the clear winner because it charges a more affordable price for the available services. QuickBooks Live’s services are provided monthly, and after an initial custom-priced onboarding fee, you’ll be responsible for the monthly fee that applies to your business. Pilot also charges an onboarding fee that’s equal to one month of bookkeeping.

Both providers have a similar approach to the pricing of their basic bookkeeping services—QuickBooks Live and Pilot offer three subscription levels that vary in price based on the monthly expense cap. However, while QuickBooks Live is a “lightweight” assisted bookkeeping service, Pilot allows you to add on services like invoicing customers and bill pay for an hourly rate. Since QuickBooks Live and Pilot both require a subscription to QuickBooks Online, the price for the software must be factored in as well.

QuickBooks Live varies its subscription price depending on the amount of monthly expenses. QuickBooks Live has no monthly expense cap for its High Volume plan, whereas Pilot requires a custom quote for companies with over $200,000 in monthly expenses. We awarded QuickBooks Live 4 out of 5 points for pricing since it offers affordable and upfront pricing with no add-ons.

Low Volume | Medium Volume | High Volume | |

|---|---|---|---|

First Month (Onboarding) | Custom priced for all plans | ||

Monthly Cost | $300 | $500 | $700 |

Monthly Expense Cap | Up to $10,000 | $10,000 to $50,000 | Over $50,000 |

Annual Gross Revenue Cap | None | ||

Pilot Bookkeeping also offers a choice of three subscription levels, and fees are billed on an annual basis. We awarded Pilot 2 out of 5 points for pricing because its basic bookkeeping services and add-ons are more expensive than other online bookkeepers we’ve reviewed. We also dislike that many of its prices are undisclosed up-front, though that’s not to say that Pilot can’t provide value to the right company that can benefit from its advanced offerings, like CFO and Controller services.

Starter | Core | Plus | |

|---|---|---|---|

First Month (Onboarding) | $499 to $1,039, depending on expenses | $499 to $1,039, depending on expenses | Custom pricing |

Monthly Cost | $499 to $839 | $699 to $1,039 | Custom pricing |

Monthly QuickBooks Subscription | Starts at $30 | ||

Monthly Expense Cap | $0 to $199,000 | $0 to $199,000 | $200,000 and higher |

Annual Gross Revenue Cap | None | ||

Features: Pilot Wins

| ||

|---|---|---|

Pay Bills & Invoicing | ✕ | ✓ |

Fractional CFO Services | ✕ | ✓ |

Tax Consulting | ✕ | ✓ |

Tax Preparation & Filing | ✕ | ✓ |

Dedicated Bookkeeper | ✓ | ✓ |

Connect Bank Accounts | ✓ | ✓ |

Reconcile Accounts | ✓ | ✓ |

Categorize Transactions | ✓ | ✓ |

Catch-up Bookkeeping | ✓ | ✓ |

Provide Monthly Financial Statements | ✓ | ✓ |

Cash-basis Accounting | ✓ | ✕ |

Payroll Integration | ✓ | ✕ |

Enhanced Communication | ✓ | ✕ |

100% Accurate Books Guarantee | ✓ | ✕ |

QuickBooks Live and Pilot Bookkeeping are quite different in the services that they provide. While QuickBooks Live focuses on basic bookkeeping services like reconciling accounts and generating financial reports, Pilot offers several add-ons that will appeal to venture-backed startups and businesses that are growing quickly.

Diverse Service Offerings: Pilot Wins

Besides Pilot’s virtual bookkeeping, it offers a menu of services that will serve businesses looking for CFO and tax services or rapidly growing businesses like high-growth technology startups. You also have the option of adding services, such as invoicing customers and paying bills.

Accrual-basis Accounting: Pilot Wins

With Pilot, accrual-basis accounting is included with all plans, but it doesn’t have cash-basis accounting. QuickBooks Live, on the other hand, offers only cash-basis accounting.

100% Accurate Books Guarantee: QuickBooks Live Wins

QuickBooks Live offers something that Pilot doesn’t—a 100% Accurate Books Guarantee that lets you request a free audit if you suspect potential errors with your books.

It also has many attractive features, such as a dedicated bookkeeper who is a certified expert with QuickBooks Online, the ability to analyze reports with your bookkeeper, and assistance with setting up your accounts and customizing them. These features may not be as sophisticated as Pilot’s, but they’re a good fit for a business that doesn’t require additional services like payroll, invoicing, and bill pay.

Ease of Use: QuickBooks Live Wins

| ||

|---|---|---|

Overall Ease of Use | Easy | Easy |

Accessibility | Cloud | Cloud |

Online Help Section | ✓ | ✓ |

User-friendly Dashboard | ✓ | ✓ |

One-way Video Conferencing | ✓ | ✕ |

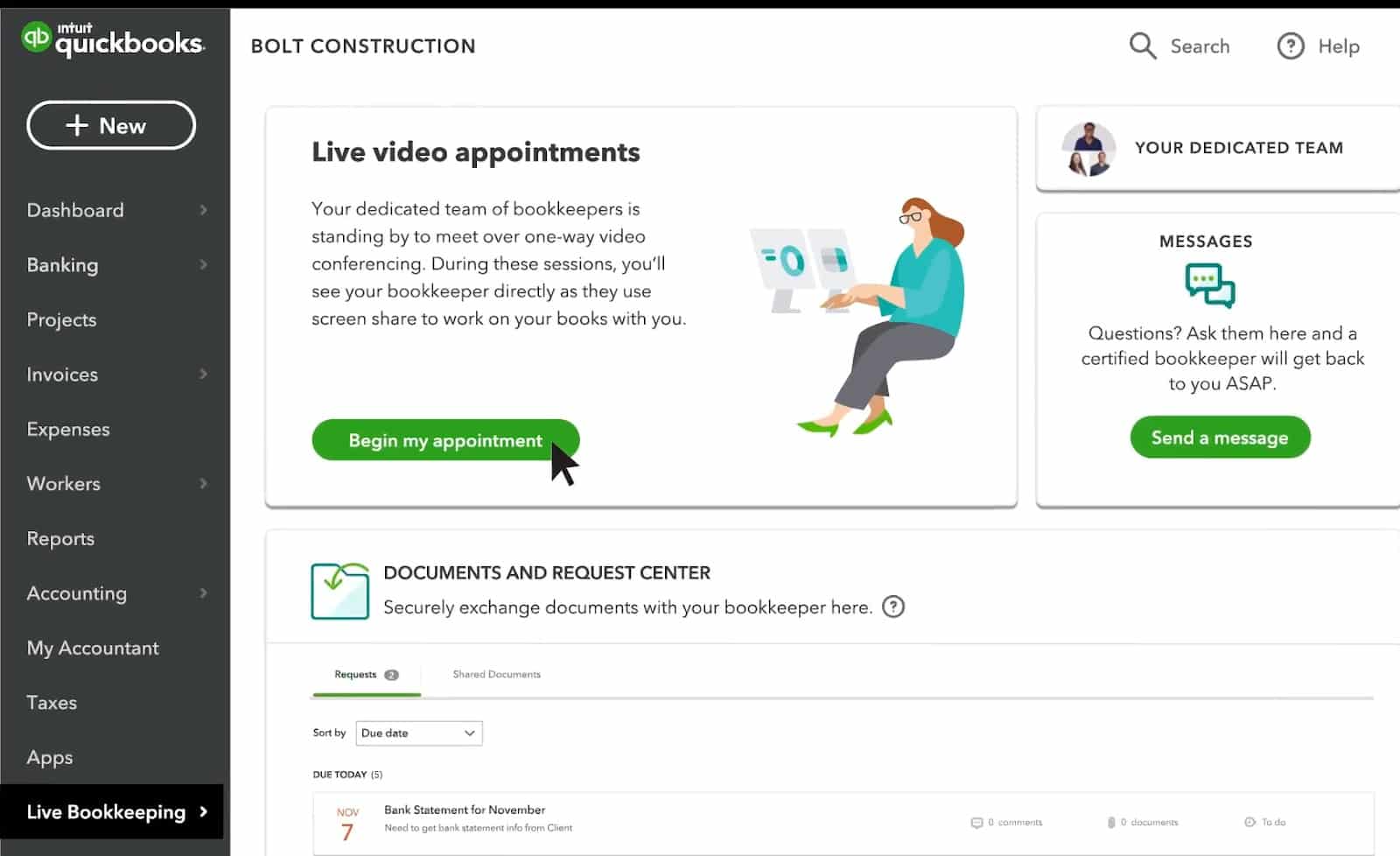

QuickBooks Live offers a seamless approach to virtual bookkeeping, allowing you to contact your bookkeeper through your preferred means of communication, which includes one-way video conferencing, a feature that Pilot lacks. You’ll be granted access to the QuickBooks Live Hub, which is a secure portal where your bookkeeper will post their ongoing action item list that will be updated as tasks are completed. It allows you to check on your bookkeeper’s progress and make an appointment for a virtual meeting.

QuickBooks Live Hub (Source: QuickBooks)

Pilot Bookkeeping customers will find that the software is easy to use, but there are a couple of requirements to keep in mind. Besides having to use QuickBooks Online, Pilot requires you to have electronic transaction access and expense reporting software. Also, to ensure the accuracy of your books, Pilot doesn’t allow any commingling of personal expenses.

Integrations: QuickBooks Live Wins

| ||

|---|---|---|

Built-in Integrations | 3 | 1 |

Third-party Integrations | 450+ | 9 |

QuickBooks Online users who work with QuickBooks Live have access to several built-in and third-party integrations while Pilot Bookkeeping has far fewer integrations:

- QuickBooks Live integrations: QuickBooks Payroll, QuickBooks Time, QuickBooks Payments, Shopify, Fathom, Method:CRM, Insightly, Hubdoc, AutoEntry, TradeGecko, and more

- Pilot Bookkeeping integrations: QuickBooks, Stripe, Square, Gusto, Rippling, Shopify, Brex, BILL, and Ramp

Mobile App: Tie

With either service, you’ll have access to the QuickBooks Online mobile app to work on your books while away from the office, so we call this category a tie. However, neither QuickBooks Live nor Pilot Bookkeeping offers a mobile app that allows communicating with your bookkeeper or uploading documents.

With the QuickBooks Online mobile app, you’ll be able to receive real-time cash flow updates, access to reports and spending categories. You won’t be able to correspond with and share documents with your bookkeeper, schedule appointments, and receive due date reminders.

Customer Support: QuickBooks Live Wins

| ||

|---|---|---|

Unlimited Support | ✓ | ✓ |

Email Support | ✓ | ✓ |

Community Support | ✓ | ✕ |

One-way Video Chat | ✓ | ✕ |

Live Chat Support | ✓ | ✕ |

Phone Support | ✓ | ✕ |

Searchable Knowledge Base | ✓ | ✕ |

Free Software Training | ✕ | ✕ |

QuickBooks Live offers more customer support options than Pilot Bookkeeping, which only allows you to speak with your account manager through the QuickBooks portal or by email. In contrast, QuickBooks Live provides unlimited support via phone, email, live chat, and one-way video calls, which is why we awarded it as the winner of this category. You can also browse the searchable knowledge base and reach out for support from the user community.

How We Evaluated QuickBooks Live vs Pilot Bookkeeping

We evaluated QuickBooks Live vs Pilot Bookkeeping based on the following criteria:

35% of Overall Score

Because each plan depends on many factors, we looked at the value provided in terms of the time and potential money that you’re saving by using the service.

20% of Overall Score

You should be able to access a dedicated bookkeeper for any questions or advice and one-on-one assistance.

15% of Overall Score

The best online bookkeeping service should offer a wide range of bookkeeping solutions, including catch-up bookkeeping, invoicing, bill pay, bank reconciliation, payroll, and tax filing.

10% of Overall Score

We evaluated whether the online bookkeeping service offered tax and consulting, and the scope of those services.

20% of Overall Score

We consider the opinions of users and the service’s ratings on various review sites. These criteria were disregarded for providers where no reviews were found.

Frequently Asked Questions (FAQs)

When we compare QuickBooks Live and Pilot Bookkeeping, we find that they differ mainly in the types of services they offer and the level of customer support available. While QuickBooks Live offers more basic bookkeeping services like categorization of transactions and financial reporting, Pilot also offers the option of tax, CFO advisory, and A/P and A/R services. However, QuickBooks Live offers more customer support options than Pilot, which includes unlimited support via phone, email, live chat, and one-way video calls.

Yes, Pilot Bookkeeping handles all of its bookkeeping in QuickBooks Online.

QuickBooks Live charges from $200 to $400 per month, depending on your company’s monthly expenses.

No, Pilot Bookkeeping only performs accrual-based bookkeeping.

The best bookkeeping service for QuickBooks depends on your specific business needs, the size of your business, and your budget. If you’re seeking basic services and don’t require assistance with taxes, invoicing, or billing, QuickBooks Live could be a good fit. If your business has more advanced needs, such as CFO and tax filing services, Pilot is a good choice. It also integrates with QuickBooks to ensure seamless syncing of your financial data.

Bottom Line

QuickBooks Live and Pilot are two very different virtual bookkeeping services. While both offer a choice of three subscription plans for basic bookkeeping services, Pilot allows for additional services that are geared towards rapidly growing companies, like technology startups and ecommerce businesses. These include CFO advisory, payroll, tax management, and back-office services, such as paying bills and invoicing customers, for an additional fee. Because of this, we chose Pilot as the winner in this comparison.

[1]Capterra | QuickBooks Live

[2]G2.com | QuickBooks Live

[3]G2.com | Pilot

[4]Product Hunt | Pilot