Rental property depreciation is the process of deducting the cost of your rental property over time. With it, investors in income-producing property can deduct the cost of the asset over a series of tax years; the cost of land is not depreciated. The annual depreciation deduction is based on two factors:

- Your basis in the property; usually the purchase price

- Whether the rental property is commercial or residential

Depreciation of rental property stops when either the asset is no longer used or its basis has been fully recovered. This means that for a domestic piece of residential real estate, there would no longer be a depreciation deduction to take on that piece of property after 27.5 years.

How to Calculate Rental Property Depreciation

Step 1: Determine the Initial Basis of the Property

The process for determining your initial basis in the rental property depends on how the property was acquired.

The primary ways of obtaining property are listed below:

- Purchased property: The initial basis of rental property is equal to what you paid for it. The cost includes both the purchase price and any closing costs. Points paid to a mortgage company should not be included but instead amortized over the life of the mortgage.

- Inherited property: Your adjusted basis of inherited property held for rent is the fair market value (FMV) of the property on the date of death.

- Gifted property: If you received your rental property as a gift, your adjusted basis is equal to the adjusted basis that the donor had at the time of the gift. You’ll need a copy of the donor’s depreciation records to determine this amount.

- To calculate the adjusted basis, take the original cost and subtract the amount of depreciation the donor claimed. If the FMV of the property is less than the donor’s adjusted basis, then your adjusted basis is equal to the FMV.

Regardless of how you acquired your rental property, the initial basis calculated above can be increased by the amount spent to prepare the property to be rented for the first time. Repair and maintenance costs incurred to prepare the property for subsequent tenant rentals are fully deductible in the year incurred.

Step 2: Determine if Rental Property Is Residential or Commercial

The depreciation deduction can be claimed for any rental property, regardless of location, as soon as it is placed in service. Under the MACRS Modified Accelerated Cost Recovery System , depreciation for rental property:

- Within the US is calculated using 27.5 years for residential rental properties and 39 years for commercial rental properties

- Outside of the US is calculated over a 30- or 40-year period, depending on when it was first rented and if it is designated for commercial or residential use; you can find more information on depreciation for foreign rental properties in IRS Publication 946.

Types of Depreciable Real Estate

Here are some typical examples of the property types that fall into residential or commercial rental property:

Residential Rental Property | Commercial Rental Property |

|---|---|

Single and multi-family homes | Warehouses |

Condominiums | Office buildings |

Apartment complexes | Manufacturing facilities |

Mobile homes | Shopping malls |

Houseboat secured to land | Self-storage units |

You cannot claim depreciation on any property that you sublet because you do not own it. However, if you own a house you’re renting out as an Airbnb or a factory you’re renting out as an industrial facility, you can claim depreciation.

Step 3: Calculate Rental Depreciation Expense

Depreciation on real property is calculated using straight line depreciation and the mid-month convention. This means that no matter what day of the month the property is placed into service, the mid-month convention applies. With straight line depreciation, the asset’s adjusted basis is steadily lowered over time, and the same amount of depreciation is allocated for each year.

Your MACRS depreciation deduction can be calculated using one of two methods:

- The depreciation method and convention that applies over the recovery period of the property.

- The percentage from the MACRS percentage tables.

Calculating MACRS depreciation should be left to either tax preparation software or tax preparation services, but it’s still a good idea to learn how this works. Let’s discuss how to calculate rental property depreciation manually, and then you can compare it to depreciation from the tables.

Depreciation in the first year differs slightly from subsequent years. Let’s take a look at the formula you’ll use to calculate depreciation for the year the property was placed in service.

First Year Depreciation | = | Depreciable Basis Recovery Period | × | Convention |

Since property is rarely purchased on January 1 of the year or disposed of on the last day of the year, depreciation in the first and final year must be prorated. A convention determines when the depreciation should start and end.

Using the mid-month convention, the property is treated as placed in service during the middle of the month. For example, if an asset was placed in service anytime during the month of April, then you must calculate depreciation for 8.5 months (April 15 to December 31).

In the above equation, convention for the April acquisition would be: 8.5 ÷ 12.

Annual depreciation is equal to the depreciable basis divided by the MACRS life of the asset. If there have been no other tax adjustments, the depreciable basis is equal to the asset cost. Let’s take a look at that equation:

Annual Depreciation | = | Depreciable Basis Recovery Period |

To calculate depreciation in the year of disposition, you can use the following formula:

Year of Disposal | = | Depreciable Basis Recovery Period | × | Convention |

Just like depreciation for the year the property was placed in service, the depreciation in the year of disposal must also be prorated. Using the mid-month convention, the property is treated as disposed of in the middle of the month. For example, if the rental property was sold on April 2, then you would calculate depreciation for 3.5 months (January 1 to April 15).

Given the equation above, convention for April disposal is: 3.5 ÷ 12.

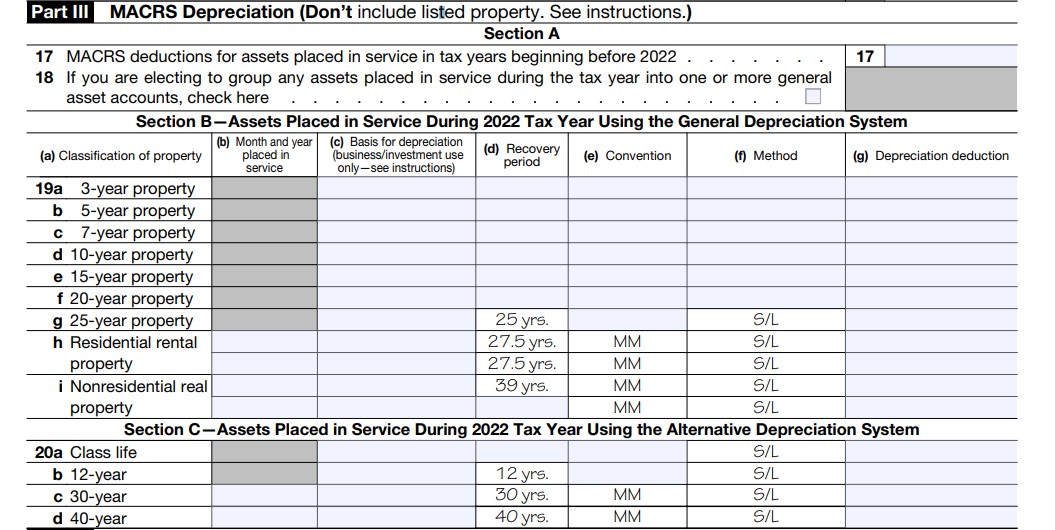

Step 4: Report Depreciation on Your Tax Return

Once you have figured out how much depreciation you can claim, you’ll need to report your depreciation deduction on IRS Form 4562. The line that you are required to report this information on depends on the type of property you own.

- Residential rental property: Part III, Section B, line h

- Commercial real estate: Part III, Section B, line i

IRS Form 4562 Part III

Then, depending on whether you are a real estate investor or real estate professional, you will report the deduction on Schedule E or Schedule C, respectively.

Example of Residential Rental Property Depreciation

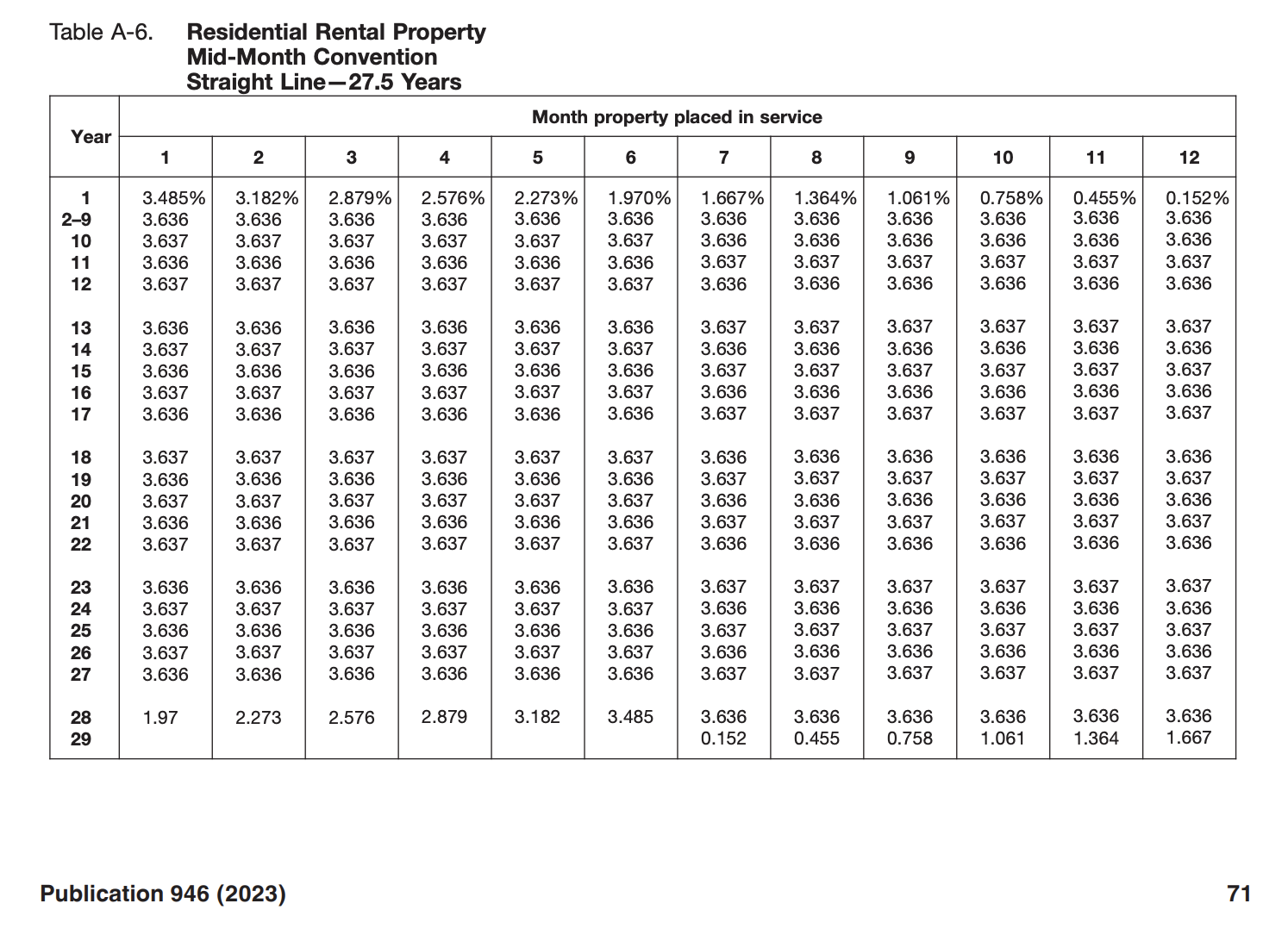

The IRS provides a percentage table (shown below) to indicate how much depreciation to take for newly acquired real estate in the year of acquisition. We’ll use this percentage table to work through an example that illustrates the process of rental property depreciation.

- On January 1, 2023, Mr. X purchased a single-family home to operate an Airbnb for $250,000.

- The purchase price represents land with an FMV of $100,000 and the structure with an FMV of $150,000. Because land is not subject to depreciation, only the value of the structure itself will be taken into account.

- Per IRS rules, Mr. X must use the straight line method and mid-month convention to calculate his depreciation deduction.

- Since he purchased the building on January 1, 2023, depreciation began on January 15, 2023, as per the rules of the mid-month convention.

Let’s look at his depreciation schedule. For each year, we will multiply the basis by the depreciation rate. You can follow along using the facts above and Table A-6 from IRS Publication 946.

Table A-6 from IRS Publication 946

Let’s assume that Mr. X sells the property in June 2028 for $500,000. He would be allowed the following yearly depreciation:

The total depreciation claimed for years 2023 through 2028 is $29,544.

Step 1: Calculate the Adjusted Cost Basis of the Rental Property

Using the purchase price minus the annual depreciation calculated above, we can calculate the adjusted cost basis, which comes to $220,456:

Adjusted basis: $250,000 – $29,544 = $220,456

Step 2: Calculate the Gain on the Sale of the Rental Property

The gain on the sale is the $500,000 sales price less the $220,456 adjusted basis:

Gain: $500,000 – $220,456 = $279,544

The entire gain of $279,544 is referred to as a Section 1231. Section 1231 gains are usually treated as capital gains unless you have other 1231 losses in excess of this gain.

Calculating tax on Section 1231 property gains and losses is complicated and probably deserves the attention of a tax professional. However, the basic idea is that after netting all of your 1231 transactions, if you have an overall:

- Gain—then all 1231 transactions are treated as capital

- Loss—then all 1231 transactions are treated as ordinary income

Example of Commercial Rental Property Depreciation

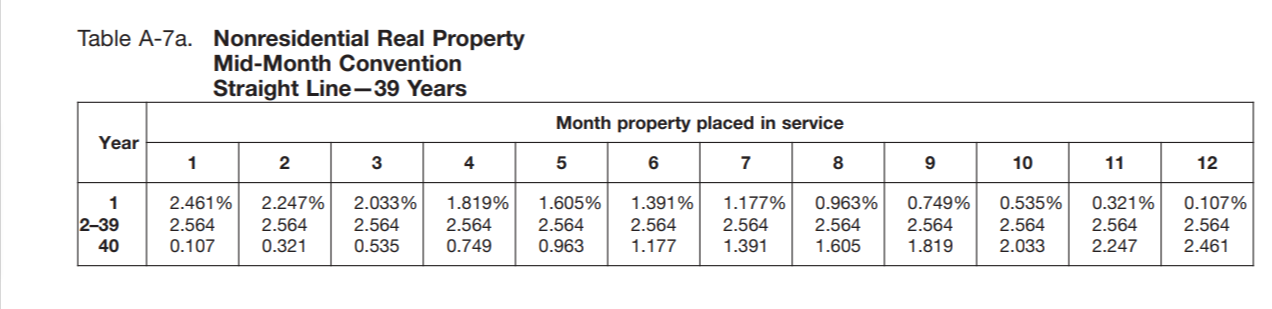

Let’s look at another example using the same facts as above, except Mr. X purchased a warehouse on June 1, 2023, that he plans to use for his business, Widgets ‘R’ Us.

- Mr. X wants to sell his property in about seven years, so he went to his accountant, Ms. Y, to get tax projections for the coming years.

- He plans to sell the building for $800,000.Since land is not subject to depreciation, only the value of the building itself will be taken into account.

- Mr. X must use the straight line method and the mid-month convention to figure out his depreciation deduction.

- Since he bought the building on June 1, 2023, depreciation began on June 15, 2023, as per the mid-month convention.

Let’s look at his depreciation schedule. For each year, we will multiply the basis by the depreciation rate. You can follow along using the facts above and Table A-7a from IRS Publication 946.

Table A-7a from IRS Publication 946

Let’s assume that Mr. X sells the property in June 2030 for $800,000. He would be allowed the following yearly deprecation:

The total depreciation claimed for the years 2023 through 2030 is $26,928.

Step 1: Calculate the Adjusted Cost Basis of the Rental Property

Using the purchase price minus the annual depreciation, we can calculate the adjusted cost basis, which comes to $223,072:

Adjusted basis: $250,000 – $26,928 = $223,072

Step 2: Calculate the Gain on the Sale of the Rental Property

The gain on the sale is the $800,000 sales price less the $223,072 adjusted basis:

Gain: $800,000 – $223,072 = $576,928

Like in the previous example, the entire gain of $576,928 is referred to as a Section 1231.

Depreciation for a Personal Residence Converted to Rental Property

Since no depreciation deduction is permitted for a personal residence, permanently converting property from personal use to rental requires special consideration. Depreciation begins on the date the property begins being used for rental purposes—and the basis used for depreciation must be calculated as of that date.

Determining Depreciable Basis Upon Conversion to Rental

The basis for converted property is computed as the lesser of the following two items:

- Adjusted basis at conversion date

- FMV at conversion date

Here is an example of a converted property basis calculation:

- In 2020, Julie Jones moved to Buffalo, NY, to take on a teaching position and purchased a home for $350,000 the same year. The home was used as her primary residence.

- $50,000 of that purchase price was allocated to the land the home was built on.

- In 2024, Julie decided that she had enough of the cold and moved to Phoenix, AZ. That same year, instead of selling her Buffalo home, she decided to rent it out, starting on January 1.

- At this time, the home had an FMV of $425,000.

- During her time living in the home, Julie made several upgrades, which cost her $100,000 and resulted in an adjusted basis of $450,000 in the home.

So on January 1, 2024, when the home is officially converted to rental property, the basis on which Julie can take depreciation is $425,000. The home will be depreciated over 27.5 years, in accordance with IRS rules for residential real estate depreciation in 2024.

Julie would have gotten more benefits from her upgrades if they had been done after converting the home to a rental property. Repair expenses would have been deductible, and the higher basis obtained from the non-deductible upgrades would have worked to her advantage.

Frequently Asked Questions (FAQs)

The depreciation method used for rental property is MACRS, which requires straight line depreciation over 27.5 years for a residential property and 39 years for commercial property.

Depreciation adjustments, sometimes known as “catch-up,” are made when it turns out that no depreciation was claimed in prior years or you claimed more or less than the allowable amount of depreciation. If you need to make this adjustment, you can do so using IRS Form 3115.

No, you can’t, as land can never be depreciated. Since land is not depreciable, the cost basis for depreciation must be calculated by allocating a portion of the purchase price to the building.

A 1031 exchange may allow you to avoid paying depreciation recapture upon disposal of rental property. This exchange involves reinvesting the sale proceeds into a similar piece of property and deferring multiple levels of tax.

Bottom Line

Depreciation is a powerful tool that can be used to reduce your tax liability and increase your cash flow. If you’re a real estate investor, you do not want to miss out on this deduction this tax season.