Black business owners looking for training and certifications, access to funding, and assistance with key business operations like HR and sales can unlock access to programs and opportunities to help them succeed. We’ve created a list of resources for Black-owned businesses in the following areas:

- Training and certifications: Get certified as a Black-owned business and become eligible for government and private-sector programs and training.

- Organizations and associations: Join organizations and associations that support the growth and prosperity of Black-owned businesses.

- Sales, marketing, and promotions: Take advantage of directories and websites created to promote the products and services of Black-owned businesses.

- HR and hiring resources: Use these resources to hire a diverse workforce based on race, sex, industry, and more.

- Tax credit for diversity: Apply for the Work Opportunity Tax Credit (WOTC) with this list of services that can secure minority-specific tax credits.

- Funding and financing: Access resources for grants, loans, and investments, including information on Black-owned banks and similar institutions.

Read on for more information in these six areas, including easy-to-follow links on how to take advantage of these opportunities.

Training & Certifications for Black-owned Businesses

The SBA’s 8(a) certification is a training program for small business owners who want to be certified to accept government contracts. (Source: SBA)

Certification as a minority-owned or Black-owned small business can open doors to certain government and private sector business and economic growth programs. It can also open up access to financial resources to expand your business. Here is a list of training and certification programs with links to the relevant application forms:

- U.S. Small Business Administration Minority-owned Business Certification: Use this process to get certified as an 8(a) minority-owned small business.

- HUBZone Business Certification: The HUBZone program helps small business growth in historically underutilized business zones.

- Disadvantaged Business Enterprise Development Certification: The Department of Transportation’s for-profit socially and economically disadvantaged small business development certification is for those contracting with state transportation agencies.

- Minority Business Enterprise (MBE) Certification from the National Minority Supplier Development Council (NMSDC): The NMSDC facilitates business growth for systematically excluded communities of color and creates connections between MBEs, corporations, and the public sector.

- MBE Certification from Individual States: Several states have state-level MBE certifications. Visit these departments directly for more information:

- Alaska: Disadvantaged Business Enterprise (DBE) Program

- Arkansas: Minority and Women-Owned Business Enterprise (MWBE) Certification

- California: Minority Business Enterprise Certification

- Colorado: Minority Business Office

- Connecticut: Small/Minority Business Enterprise (S/MBE) Certification

- Florida: Minority Business Enterprise (MBE) Certification

- Georgia: Minority Business Enterprise Certification

- Hawaii: Disadvantaged Business Enterprise Program

- Illinois: Commission on Equity and Inclusion’s (CEI) Business Enterprise Program (BEP) Certification

- Iowa: Targeted Small Business (TSB) Program

- Kansas: Minority and Women Business Enterprise (MWBE) Program

- Maryland: Minority Business Enterprise (MBE) Program

- Massachusetts: Diversity Certification

- Michigan: Minority Business Enterprise (MBE) Certification

- Minnesota: Disadvantaged Business Enterprise Program (DBE)

- Mississippi: Minority Business Certification

- Nebraska: Minority and Women-Owned Businesses (MBE/WBE) Certification

- New Jersey: Minority and/or Women Business Enterprise (M/WBE) Certification

- New Mexico: Minority Business Development Agency Business Center

- New York: NYS Minority and Women Business Development (MWBE) Program

- North Carolina: Minority Business Development Agency Business Center

- North Dakota: Disadvantaged Business Enterprise (DBE) Program

- Oregon: Minority/Women Business Enterprise Certification

- Pennsylvania: Minority Business Development Authority (PMBDA)

- Rhode Island: Minority Business Enterprise Certification Program

- South Carolina: Small and Minority Business Contracting and Certification

- South Dakota: Disadvantaged Business Enterprise (DBE) Program

- Tennessee: Go Disadvantaged Business Enterprise (Go-DBE) Certification

- Texas: Minority-Owned Business Certification

- Utah: Minority Business Development Agency (MBDA) Certification

- Vermont: Minority and Women-Owned Business Enterprises

- Virginia: Disadvantaged Business Enterprise (DBE) Certification

- Washington: Minority & Women’s Business Enterprises

- Wisconsin: Supplier Diversity Program

Organizations & Associations for Black-owned Businesses

Various programs and organizations aim to foster economic growth by supporting and advancing Black- and minority-owned small businesses. Their services range from providing one-on-one confidential business advice to promoting Black-owned businesses while connecting them to Black-owned business mentors. Check out the list below:

- National Minority Supplier Development Council (NMSDC): The NMSDC advances business opportunities for certified minority business enterprises and connects them to corporate members.

- African Business Roundtable: This non-profit, non-partisan Black business organization promotes trade, commerce, and cultural exchange through education between the United States and countries of the African Diaspora.

- Black Business Association (BBA): The BBA advocates and promotes the development of African-American-owned businesses.

- Black Founders: This group is “creating an ecosystem that stimulates tech entrepreneurship and fosters economic growth.”

- Black Business and Professional Association (BBPA): The nonprofit, charitable organization addresses equity and opportunity for the Black community in business, employment, education, and economic development.

- National Black Chamber of Commerce (NBCC): This non-profit, non-partisan, non-sectarian organization is dedicated to the economic empowerment of African American communities.

- America’s Small Business Development Centers: These centers offer a network of assistance for small businesses and are partially funded by the U.S. Congress and the Small Business Administration (SBA).

Sales, Marketing & Promotions for Black-owned Businesses

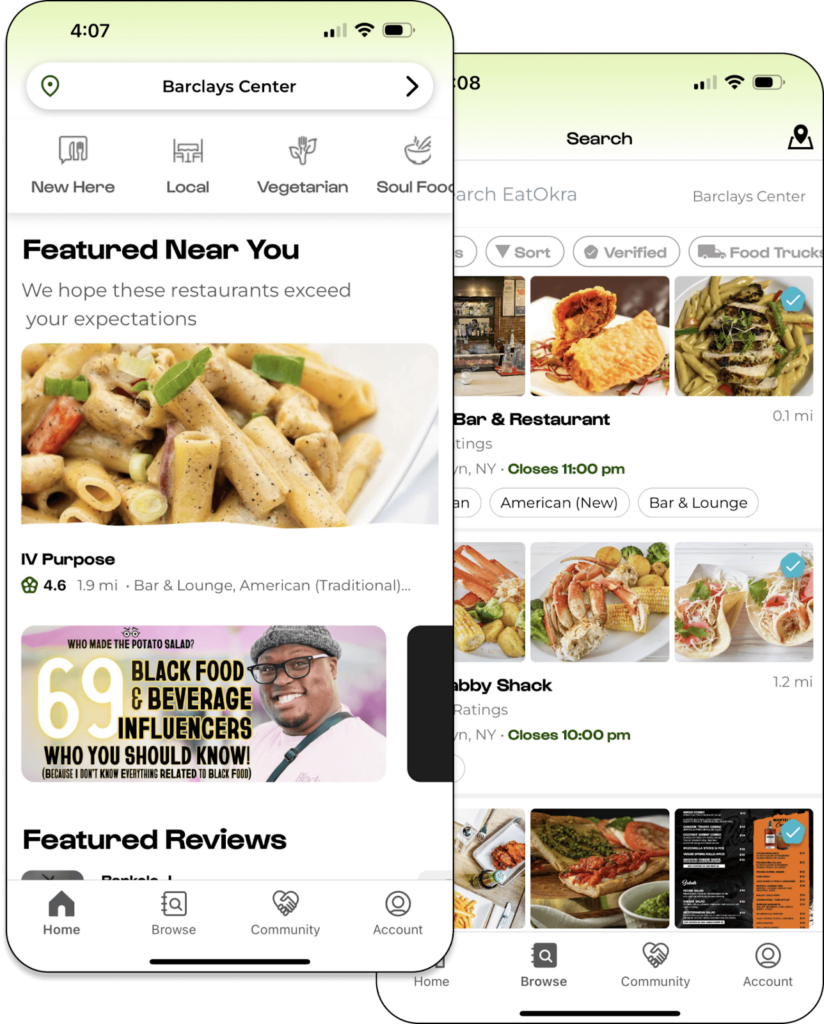

Platforms like the EatOkra app are an excellent way to find customers who want to support Black-owned businesses. (Source: EatOkra)

One of the best ways to target customers explicitly wanting to support Black-owned businesses is to list your business in a directory that highlights Black companies. These apps and websites are a great way to market your business for little to no cost. See the full list here:

- Black Business Focus Group: This Facebook group is designed to support Black-owned Businesses (BOB). Members can list their businesses, and others commit to making three purchases a month.

- EatOkra: Submit your restaurant to this Black-owned eatery directory. The app has over 2,600 restaurants and more than 150,000 users. Basic listings are free, but you can access additional marketing features for $9.99 per month.

- Black Wallet: Submit your business and events to the Black Wallet website and app for free. You can purchase web design, app development, and other business services directly from Black Wallet to help boost your brand’s aesthetic.

- Shoppe Black: This website profiles Black businesses and interviews entrepreneurs and professionals all over the world. In addition to serving as a resource for all things Black content, Shoppe Black also has a directory of Black-owned businesses.

- Support Black Owned: List your business for free in this Black-owned directory. You can also pay for extended services like home page features, articles written about your business, and social media promotion.

- Squire: If you run a barbershop, use Black-owned Squire to help manage your business. You can use this point-of-sale (POS), payroll, customer relationship management (CRM), and scheduling tool whether you’re an independent barber, have multiple locations, or serve one location.

- Official Black Wall Street: For a membership payment of $50 to $89 per year, you can list your business on the website and the Official Black Wall Street app. Your membership also includes access to resources like webinars, pitch competitions, and legal advice.

- Naspora: Use this platform (Formerly called WeBuyBlack)to list your products and services for a commission fee of 10%. You can even migrate your Etsy or Shopify store using its CSV importer in under five minutes.

HR & Hiring Resources for Black-owned Businesses

Diversity is a hot topic in today’s climate, and businesses are answering the call. If you want your business to provide more quality job opportunities for Black candidates, consider registering with some of the top minority recruiting platforms. These sites target specific groups based on race and sometimes gender, industry, and more. Check out the resources below:

- Black Career Women Network: This site supports Black women with resources for professional development and career mentorship.

- Black Career Network: A diversity recruitment platform on which you can post job openings.

- National Urban League: You can partner with a local chapter to provide jobs to Blacks and others in underserved communities. The organization has initiatives focused on job re-entry, tech jobs, apprenticeships, youth candidates, and senior candidates.

- National Black MBA Association (NBMAA): Partner with NBMAA to post your open positions to a diverse candidate base. You can search resumes and load branding videos.

- National Society of Black Engineers: You can post jobs and internship opportunities as well as access recruiting tools to help you find Black engineers.

- Black Jobs: Promote your job openings to over 300,000 Black professionals, many of whom are new college graduates.

SMB Tax Credits for Diverse Businesses

As you hire a diverse workforce, you can qualify for the Work Opportunity Tax Credit (WOTC), which is a federal credit employers receive for hiring job candidates within groups outlined by the Department of Labor. Having a payroll service that automatically checks for these opportunities can save you taxes and help you employ someone who may find it hard to get a job.

These services also offer a ton of human resources (HR) support, such as consulting, training, and applicant tracking, in addition to payroll. Check out the options below:

- ADP: The software is flexible enough to support small businesses and mid- to large-sized businesses. It has eight different product plans you can choose from.

- Paychex: You only pay a fee if the service finds credits.

- Paycor: The software integrates the hiring platform with the WOTC screening program.

- Paycom: Once you hire a candidate, all information collected for WOTC screening will automatically flow to your payroll records—you won’t have to manually organize and enter the information.

Funding & Financing Opportunities for Black-owned Businesses

There are many grants, loans, and investment programs geared toward financing Black-owned businesses. Whether you’re looking for a short-term working capital loan, minority grant program, or venture capital firm, there are options specific to helping Black- and other minority-owned businesses secure funding. See the list here:

- Minority Small Business Grants From Black Enterprise: This aggregated list has the top 10 grant opportunities for minority entrepreneurs.

- Minority Business Development Agency (MBDA): This agency is part of the U.S. Department of Commerce and offers loans and grant programs to minority businesses.

- Accion Opportunity Fund: A nonprofit community organization providing fairly priced and flexible loans to minority small business owners.

- List of Black Investors & VC Firms: This list from HBCUvc showcases 40 Black investors and venture capitalists (VCs) who support Black-owned businesses.

- Backstage Capital: The investment firm funds underrepresented founders, including people of color.

- Interactive Map of Black-owned Banks: This map from the Blackout Coalition shows Black-owned banks and credit unions to support your small business.

General Business Support for Black-owned Businesses

Sometimes you need a source for ongoing advice or pop-up questions. These platforms and organizations are great places to find and connect with other Black business owners.

- Minority Business Development Agency: The MBDA is a federal agency dedicated to helping minority-owned businesses access capital, contracts, and markets. They provide free business consulting, help with accessing capital, and offer specialized business development programs through their network of business centers across the country.

- Hello Alice’s Black-owned Business Resource Center: This free online networking site helps small business owners connect with funding and with other small business owners who can offer advice and mentorship. Their Black-owned Business Resource Center is an excellent place for Black entrepreneurs to connect with a business community.

- SBDCNet.org’s Resources for Minority-owned Businesses: Small Business Development Centers provide free in-person and online business training and advice.

Frequently Asked Questions (FAQs)

Click through the sections below to read answers to common questions about Black-owned businesses:

Use dedicated directories and apps like EatOkra, Black Wallet, and Official Black Wall Street to find and shop at Black-owned businesses in your area, and help amplify their visibility by leaving positive reviews and sharing their products or services on social media.

While certification isn’t required to operate your business, getting certified as a minority-owned business through programs like the SBA’s 8(a) certification, state-level MBE certifications, or the National Minority Supplier Development Council can help you access government contracts, funding opportunities, and business development programs.

A successful Black business strategy involves utilizing available resources and programs designed for Black entrepreneurs: get certified as a minority-owned business to access government contracts, join professional organizations like the National Black Chamber of Commerce for networking and support, list your business in dedicated directories for increased visibility, and explore specialized funding options through Black-owned banks and minority-focused grant programs.

Bottom Line

Supporting Black-owned businesses goes beyond individual purchases—it requires a comprehensive network of resources, funding, and professional development opportunities to ensure sustainable growth. From federal programs like the SBA’s 8(a) certification to state-level MBE certifications, from specialized directories like EatOkra to dedicated funding sources through Black-owned banks, there are numerous resources available to help Black entrepreneurs succeed.