Purchasing a turnkey property is ideal for those who want to dive into the real estate market without the hassles of renovations or tenant management. It’s also a viable way for seasoned investors to diversify their portfolios with lower time commitments. Based on property prices, location, average return on investment (ROI), and fees, we found the best turnkey real estate companies for new and seasoned real estate investors:

- Best for streamlining the process of buying turnkey properties: Roofstock

- Best for access to an inventory of high-yield properties: Norada Real Estate Investments

- Best for personalized, hands-on purchasing assistance: Howard Hanna Real Estate Services

- Best for investors in the mid-south region: REI Nation

- Best for owners looking for in-house property management: Turnkey Properties

- Best for retirement-oriented real estate investments: Rent To Retirement

Best Turnkey Real Estate Companies at a Glance

Provider | Number of States They Operate In | Property Types Available | In-house Property Management Services | Customer Support |

|---|---|---|---|---|

26 |

| ✕ | Phone and email | |

15 |

| ✕ | Phone and email | |

| 13 |

| ✕ | Phone and email |

| 6 |

| ✓ | Phone and email |

3 |

| ✓ | Phone and email | |

| 10 |

| ✕ | Phone and email |

A turnkey property is a fully renovated home or apartment that is rent-ready. Real estate investors will buy the property and pass on the property management to a turnkey real estate company to manage. By doing this, investors can benefit from the expertise and efficiency of a turnkey investment company. Turnkey investment companies will process tenant screening, rent collection, property maintenance, ongoing communication with tenants, etc.

This arrangement allows investors to enjoy the benefits of real estate ownership without the burdens of hands-on property management. Having turnkey properties is an attractive option for those seeking a passive income stream or diversification of their investment portfolio. With a turnkey investment company handling the operational and administrative tasks, investors can focus on the financial aspects of their investment.

It’s essential to recognize that there are pros and cons to consider with any real estate investment. Turnkey properties offer convenience and immediate rental income; however, it’s important to carefully assess factors such as upfront costs and needing to consistently rely on a third-party company.

We’ve identified the pros and cons of purchasing a turnkey property:

| PROS | CONS |

|---|---|

| Turnkey property companies have well-established networks of contractors | Returns on investments may not be as high compared to properties purchased at a lower price point |

| Renovation costs are typically included in the purchase price | Performance and profitability of turnkey properties are still subject to market conditions |

| Ability to select an area in which you want to invest in without being limited to where you live | Investors may have limited control over certain aspects of property management, like tenant selection |

| Reduced learning curve with the help of an experienced property manager | Limited options for customization if it's a renovated property by the turnkey company |

Roofstock: Best for Streamlining the Process of Buying Turnkey Properties

Pros

- 30-day money-back guarantee

- Online inventory of rent-ready properties

- Allows investors to buy properties in any region

Cons

- Property management services are outsourced

- Limited multi-family home availability

- Lacks hands-on purchasing assistance

Roofstock Details

- States Roofstock operates in: AL, AZ, AR, CA, FL, GA, IL, IN, KS, KY, MI, MN, MS, MO, NV, NJ, NY, NC, OH, OK, PA, SC, TN, TX, VA, and WI

- Property price range: $57,500 – $1,200,000

- Property management fees: Fees will vary depending on the third-party company chosen by the investor

- Cap rate range: -0.6% – 16.8%

Our Expert Opinion on Roofstock

Roofstock is revolutionizing the traditional real estate industry through its online marketplace exclusively for locating real estate investment properties. Roofstock gives investors direct access to certified, inspected, and exclusive listings of turnkey rental properties with tenants. This unique feature allows you to start earning rental income from day one, regardless of your geographic location. The extensive vetting process provided by Roofstock ensures properties meet stringent standards for quality and potential return.

As one of the top turnkey real estate companies, its user-friendly online marketplace allows investors to browse rent-ready properties from the comfort of their own homes. Its platform simplifies the buying process by providing a wealth of information about each property, including inspection reports, projected returns, and neighborhood data. However, Roofstock could enhance its services by providing more personalized assistance and hands-on support to investors using its platform.

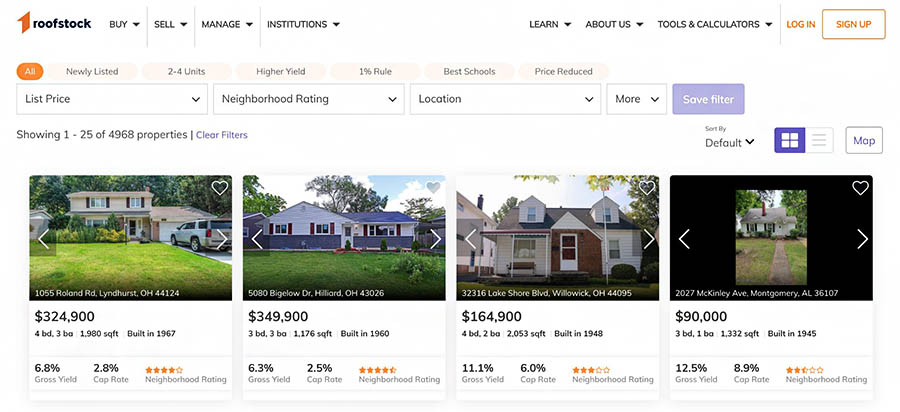

Online marketplace (Source: Roofstock)

- Financing calculator: An easy-to-use tool to estimate potential returns and make informed investment decisions.

- Roofstock Guarantee: Offers a 30-day money-back guarantee if the investor isn’t satisfied with the property.

- Vacancy protection: Roofstock provides up to six months of vacancy protection to cover the rent on your ready-to-lease property until a signed lease is secured.

- Neighborhood ratings: An insightful data-driven assessment of neighborhood quality to help investors make informed decisions about property locations.

Roofstock has been commended by customers for its robust real estate investing platform. A significant highlight of the platform mentioned by a former client is its comprehensive database of prescreened properties boasting good return on investment (ROI). While newcomers might find certain aspects of the platform confusing, the consensus is that Roofstock offers a great overall platform for investors. Roofstock received an overall customer review rating of 2.9 out of 5.

Some clients have expressed dissatisfaction with Roofstock’s customer service. They cite unresponsive support and difficulty reaching agents as some key issues. Reviewers have also found the platform to be more expensive than its counterparts and believe there are other services that provide better support. Clients looking for better customer service should consider Howard Hanna Real Estate Services. It is known for its personalized purchasing assistance.

Roofstock charges a marketplace fee of 0.5% of the contract price or $500 (whichever is greater) when you purchase a property. Sellers also pay a 3% listing fee or $2,500 (which is greater).

Norada Real Estate Investments: Best for Access to Inventory of High-yield Properties

Pros

- Provides comprehensive real estate education resources

- Assists with financing options through its network of lenders

- In-depth market research to identify properties with high growth potential

Cons

- Lack of an online marketplace

- Does not offer in-house property management services

- Not all properties are available to investors in all states

Norada Details

- States Norada operates in: AL, AR, FL, IL, IN, MI, MO, MD, NC, OH, OK, PA, TN, TX, and UT

- Property price range: $92,900 – $1,050,000

- Property management fees: Percentage of the collected rent

- Cap rate range: Up to 10%

Our Expert Opinion on Norada Real Estate Investments

Norada Real Estate Investments offers a broad selection of turnkey real estate across the United States. By offering a wide selection, it empowers investors to diversify their portfolios and tap into profitable markets that might otherwise be out of reach. Norada caters to new and experienced investors looking for hands-off real estate investment opportunities and substantial passive income.

Norada Real Estate Investments shines when it comes to providing access to a vast inventory of high-yielding properties. Its strong focus on market research allows them to identify properties with great cash flow and growth potential across the United States. Norada could include more immersive education offerings like video guides and lectures on the real estate process in addition to its audio podcasts.

Passive real estate investing guide

(Source: Norada)

- Investor Network: A free membership platform for the exchange of knowledge and opportunities in a community of informed investors.

- Real Estate Podcast: Norada’s real estate podcast offers valuable information and expert advice to help investors stay up to date with market trends and investment strategies.

- Real Estate Blog: It delivers in-depth articles and guides to support investors’ continuous learning and decision-making.

- Rent Guarantee: Norada’s rent guarantee on some properties ranges from three months to one year.

Clients have given Norada an overall customer review rating of 4.9 out of 5 based on its exceptional customer service team. One Norada representative was instrumental in guiding new investors through every step of the investment process. The representatives were applauded for offering knowledge and reassurance. The Norada team was also praised for its quick response time, patience, and willingness to answer pressing questions.

Some customers have expressed dissatisfaction with Norada’s support team post-purchase. Reviewers said the team was not helpful when they decided to sell their investment properties. The client noted that while Norada was prompt and helpful during the buying process, the company was less than supportive regarding reselling. Clients have also criticized the fees charged by Norada, with particular concern raised about a $5,000 fee for listing properties on its website. For a more affordable selling fee, consider Roofstock’s selling pricing structure instead.

Norada Real Estate Investments pricing varies based on factors like the specific property and the market. Contact its sales team for more information.

Visit Norada Real Estate Investments

Howard Hanna Real Estate Services: Best for Personalized, Hands-on Purchasing Experience

Pros

- Access to commercial real estate

- Luxury property specialist available

- Ability to pull public records on their website

Cons

- No tenant-occupied properties

- In-depth financial analysis on investment is not offered

- Brokerage not directly geared toward property investors

Howard Hanna Details

- States Howard Hanna operates in: CT, IN, KY, MD, MI, NJ, NY, NC, PA, OH, SC, VA, and WV

- Property price range: $2,000 – $4,100,000

- Property management fees: Contact sales team for information

- Cap rate range: 6% – 10%

Our Expert Opinion on Howard Hanna Real Estate Services

Howard Hanna Real Estate Services has been operating since 1957. As a family-owned real estate brokerage, Howard Hanna is known for its personalized service and trusted reputation. It offers a broad range of services that includes experienced agents available to guide investors through the turnkey real estate process. These specialists can also assist with property acquisition and property management.

For those who value personalized service, Howard Hanna Real Estate Services excels in providing hands-on assistance. Its in-house agents walk investors through every step of the turnkey investing process—from identifying suitable properties to closing the deal. They don’t need to outsource to other brokerages that may not uphold their standard of personal and professional service. Howard Hanna could improve by expanding its digital platform’s capabilities to simplify and modernize the property search.

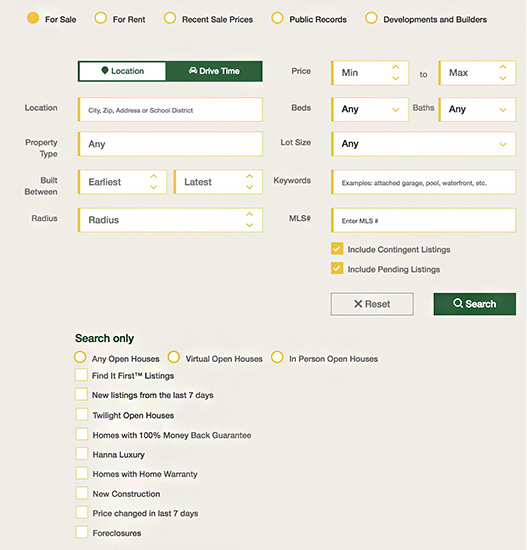

Advanced property search (Source: Howard Hanna)

- Money-back guarantee homes: A unique Money-back Guarantee program provides homebuyers with added peace of mind by promising to buy back the home if the buyer is not completely satisfied.

- Free market analysis: Provides valuable insights into local real estate market trends and helps investors make informed decisions.

- Multiple market presence: Operates in various states, which allows access to diverse real estate markets.

- Dedicated agents: Experienced real estate agents provide personalized expert guidance for investors.

Clients have praised Howard Hanna Real Estate Services for its professionalism, punctuality, and reliability. They were particularly impressed with the thorough preparation of comparable properties, which provided a detailed context for their investments. The inclusion of the commission in the sales cost was appreciated, showcasing transparency in its fee structure. Overall, customers have expressed satisfaction with their customer review rating of 4 out of 5.

One client voiced concerns about their experiences with Howard Hanna pertaining to an issue with the Seller’s Disclosure. An instance was cited where the disclosure provided had illegible handwriting and incomplete sections, and the Howard Hanna agent did not provide additional documentation. The buyer consequently discovered significant problems after conducting their own home inspections. For a turnkey investment property company with high ratings, consider Norada Real Estate Investments.

Since Howard Hanna operates as a typical real estate brokerage, its fees regarding turnkey properties are not explicitly listed. For real estate selling and purchasing, Howard Hanna charges a flat broker fee for buyers.

The remaining portion of the fee is paid by the listing broker. The specific fees for sellers charged by Howard Hanna are not explicitly mentioned in the terms and conditions, but will usually be listed in the listing agreement. Contact its sales team for more information.

Visit Howard Hanna Real Estate Services

REI Nation: Best for Investors in the Mid-south Investment Market

Pros

- Strict quality standards for property selection

- In-house property management services

- Education resources available for investors

Cons

- No online marketplace for viewing properties

- Limited property variety beyond single-family homes

- Lacks a retirement planning component

REI Nation Details

- States REI Nation operates in: TN, AR, OK, TX, MO, and AL

- Property price range: Average renovation costs $36,000, with each project ranging from $25,000 to as high as $60,000

- Property management fees: 10% property management fee and one month’s rent (8.33%) for every new tenant; also 15% fee on top of repairs and fixes

- Cap rate range: 5.20%

Our Expert Opinion on REI Nation

REI Nation is a premier provider of turnkey investment properties only specializing in single-family homes. With over 15 years in the industry, it has honed its ability to identify markets and properties with excellent potential. Its approach to investment consists of acquisition, renovation, property management, and vacancy prevention—providing an excellent investor experience. The company’s commitment to quality over quantity is reflected in its handpicked selection of properties, ensuring that each meets strict quality standards and offers attractive returns.

REI Nation is the go-to platform for investors interested in the mid-south real estate market. It has deep expertise and knowledge of this region, and its rigorous selection process ensures that only properties with high potential are offered. While REI Nation specializes in the mid-south region, diversifying its property offerings across other regions could make the platform more appealing to a broader range of investors.

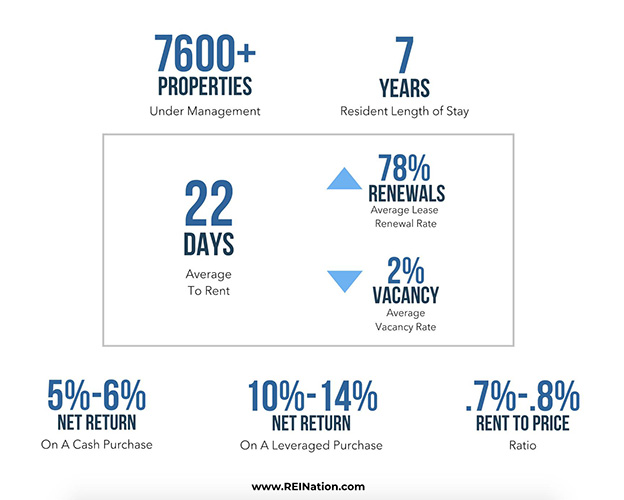

Infographic of investment statistics (Source: REI Nation)

- Vacancy prevention: REI Nation employs effective strategies to minimize rental property vacancies.

- Monthly reporting: Detailed monthly reports keep investors informed about the financial performance of their properties. This includes rental income, expenses, and other important metrics.

- Marketing management: REI Nation utilizes its marketing expertise to attract and secure quality tenants to ensure consistent cash flow for investors.

- Maintenance management: The maintenance and repairs for rental properties are handled in-house, so necessary upkeep is promptly addressed.

REI Nation received an overall customer review rating of 4.2 out of 5. Clients appreciate its personalized services. The team takes the time to understand individual financial objectives and tailors investment plans accordingly. Its expertise in identifying properties with rental income and appreciation potential has impressed many clients. Once the properties are selected, the REI Nation team handles all aspects, including the purchase process and property management for investors.

Some customers have expressed frustration with REI Nation. They are particularly frustrated with communication issues. Reviewers have reported difficulties in obtaining timely responses from the company. This lack of communication has led to a sense of mistrust and dissatisfaction among some investors. To alleviate some of the communication issues, customers should consider companies with online inventory like Roofstock so they are less reliant on getting immediate responses.

Contact REI Nation to get a free consultation and custom pricing.

Turnkey Properties: Best for Owners Looking for In-house Property Management

Pros

- Online marketplace of properties

- Offers investment education

- Ability to invest in large multi-family properties

Cons

- Limited property market

- Does’t specialize in commercial property

- No transparency of fees

Turnkey Properties Details

- States Turnkey Properties operates in: TN, AR, and MS

- Property price range: $99,500 – $490,900

- Property management fees: Contact sales team for information

- Cap rate range: 8% – 12%

Our Expert Opinion on Turnkey Properties

Turnkey Properties specializes in controlling every aspect of the turnkey investment process—from acquiring and rehabbing to managing properties. This allows investors to benefit from real estate investment without worrying about the typical challenges associated with property ownership and management. By curating a portfolio of high-quality, rent-ready properties, Turnkey Properties offers a hassle-free investment experience.

For investors seeking a truly hands-off investment experience, Turnkey Properties is the company to choose because they handle all property management in-house. Its in-house team deals with everything—from tenant placement to maintenance and rent collection—providing peace of mind and freeing up investors’ time. Turnkey Properties could add a retirement planning component to its services to cater to investors looking to secure comfortable retirement income.

The Turnkey Process (Source: Turnkey Investment Properties)

- Home warranty: Turnkey Properties offers a home warranty to provide added protection and peace of mind for investors.

- The Turnkey Blog: An informative blog is available to provide up-to-date market information and resources to educate and support investors.

- Full Turnkey: Full turnkey solutions let Turkey Properties handle every aspect of the investment process, from property acquisition to management, providing a hassle-free investment experience.

- Rent-ready properties: Rent-ready properties are in optimal condition and usually with tenants, allowing investors to start generating rental income immediately.

Turnkey Properties has received numerous positive reviews from satisfied investors. It received an overall customer review rating of 4.9 out of 5. Clients highlight the company’s ability to deliver high-quality turnkey rental properties. Reviews said the experience was hassle-free and provided consistent rental income. The hands-on approach and personalized service provided by Turnkey Properties have also garnered praise. Clients noted the team at Turnkey was attentive and supportive.

With the high praise from clients, there was only one negative experience expressed by a customer of Turnkey Properties. In this particular case, the reviewer expressed disappointment after the contract signing. However, a few days later, they were informed that the owner no longer wanted to sell the property. Clients looking for a turnkey company motivated to sell should consider businesses like REI Nation.

Call Turnkey Properties for pricing details.

Rent To Retirement: Best for Retirement-oriented Real Estate Investments

Pros

- Services cater to investors of all experience levels

- Offers investor education resources

- Active inventory accessible to investors

Cons

- Limited investment markets

- Pricing transparency not provided

- Doesn't offer commercial real estate opportunities

Rent To Retirement Details

- States Rent To Retirement operates in: MO, OH, FL, AL, IN, AR, MN, IA, IL, and MI

- Property price range: $80,000 – $500,000

- Property management fees: Contact sales team for pricing

- Cap rate range: Contact sales team for the rate

Our Expert Opinion on Rent To Retirement

Rent To Retirement takes a unique approach to turnkey real estate investment by integrating retirement planning into its services. It offers a complete suite of services, including sourcing quality rental properties, property management, and strategic retirement planning. This strategic focus on long-term wealth building sets them apart from many other companies in the industry.

Rent To Retirement stands out as one of the great turnkey rental property companies for its unique focus on retirement-oriented real estate investments. This forward-thinking approach caters to investors aiming to secure a comfortable retirement through passive income from real estate. Although Rent To Retirement’s focus on retirement planning is unique, expanding its turnkey properties for shorter investment periods could attract a new demographic of investors.

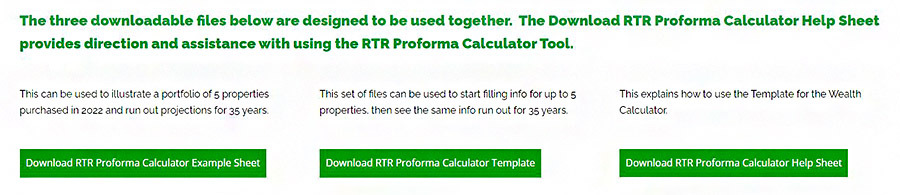

Calculation tools (Source: Rent To Retirement)

- Real estate videos: Informative real estate videos that educate and guide investors to provide valuable knowledge.

- Portfolio wealth calculator: Allows investors to assess the potential growth and returns of their real estate portfolio.

- Vacation rentals: Provides options for investors interested in exploring this segment of the investment market.

- Private lending opportunities: Connects investors with private lending opportunities to help them diversify their investment portfolio and potentially earn passive income through lending arrangements.

There were no reviews available on third-party websites for Rent To Retirement. In our expert evaluation of the platform, we found its real estate videos provide valuable educational resources. The videos equip investors with knowledge and insights to make informed decisions. The service package, including property sourcing, financing assistance, and retirement planning, makes it easy for investors to access lucrative investment opportunities.

While Rent To Retirement offers valuable retirement-oriented real estate investment services, there are areas where it could enhance its offerings to align with competitors in the market. Expanding its educational resources beyond real estate videos to include webinars, live seminars, or educational articles could further empower investors with knowledge. Rent To Retirement could also consider diversifying its investment options by exploring different asset classes or geographies to provide investors with a broader range of opportunities like those at Roofstock.

Contact Rent To Retirement to review pricing options.

How We Evaluated the Best Turnkey Real Estate Companies

Turnkey investment property companies focus on streamlining the investment process by taking charge of property rehabilitation, tenant selection, and property management. These efforts are aimed at saving investors significant time and effort along with maximizing their return on investment (ROI). We considered several key factors to ensure they provided high-quality service to real estate investors when evaluating the best companies. Factors such as the investment process, average ROI, and real estate markets available were some of the key indicators for identifying the best turnkey companies.

Criteria we considered when evaluating the top turnkey real estate companies:

- Turnkey process: This investment process includes property rehabilitation, tenant selection, and fully operational, rent-ready properties to investors.

- Average return on investment (ROI): The profitability and potential financial gains offered by the turnkey properties provided by each company.

- Location of inventory: The areas in which the companies’ inventory is located were taken into account to determine the geographic diversification options.

- Average property prices: Allows investors to gauge affordability and align their investment goals with the price range that suits their budget and investment strategy.

- Suitability for investors: Identifying which types of investors each company is most suitable for helps potential investors determine if the company aligns with their investment objectives. They could be new to real estate investing, experienced investors, vacation property owners, or investors focused on retirement income.

- Fees: The fees charged by the companies, like marketplace fees or property management fees, enable investors to consider the cost implications and factor them into their investment calculations.

Frequently Asked Questions (FAQs)

Turnkey companies primarily make money through property sales and property management fees. When selling turnkey properties to investors, the company earns revenue from selling the properties themselves. In some cases, they mark up the purchase price to cover their costs and generate profit.

Additionally, turnkey companies often offer property management services to investors who purchase their properties. These services come with management fees that can be a percentage of the rental income generated by the property.

Turnkey properties offer several advantages, especially for new or busy investors. First, they eliminate the need for hands-on involvement in renovations and management. Second, because the property is rent-ready, you can start earning rental income almost immediately. Finally, since turnkey companies often operate in multiple markets, you can invest in profitable locations outside of your local area.

Like any investment, turnkey property investment is not without risk. Potential challenges can include overpaying for the property, dealing with unreliable turnkey companies, or facing unexpected vacancies or maintenance issues. Thorough due diligence is crucial to mitigate these risks.