Almost all states in the United States (except for Alaska, Delaware, Montana, New Hampshire, and Oregon) have sales tax laws, and chances are that you are living in a state that charges sales tax. The journal entry for sales taxes involves recognizing a liability for the amount collected from customers and payable to the taxing authority.

Key Takeaways

- Sales tax collected from customers creates a liability to the taxing authority.

- The remittance of sales tax to the taxing authority reduces the liability created when the sales tax was collected.

- Sales tax paid on the purchase of goods or services is not accounted for separately and should be added to the cost of the goods or services purchased.

Sales Tax Journal Entry

Upon collecting sales taxes from customers, we need to create the liability account, sales tax payable. This account will be increased for all sales taxes collected from customers and decreased for all sales taxes remitted to the taxing authority.

Are you unsure how journal entries work? Read our guide on journal entries in accounting to learn how to properly record transactions in double-entry bookkeeping. You may also want to check out our breakdown of debits and credits to refresh your memory on the basics and rules.

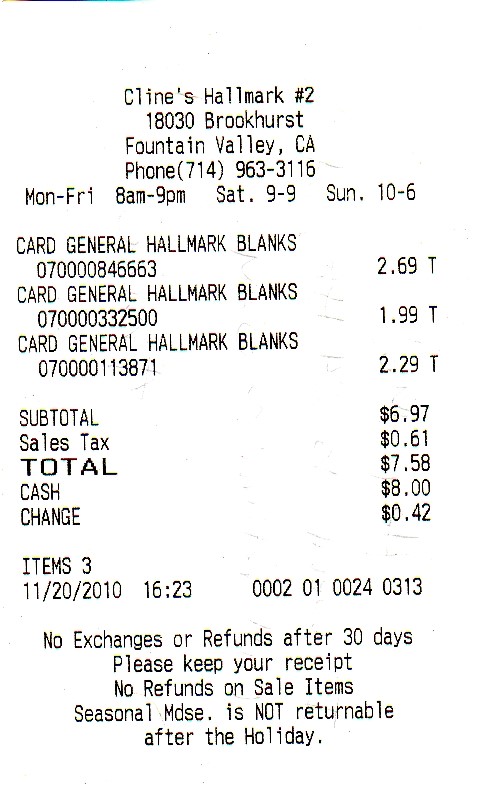

To illustrate, refer to the sample receipt below. It shows a sales tax of 61 cents based on total sales of $6.97. Since the business is in California, the applicable sales tax rate is 8.75%.

Sample Receipt with Sales Tax (Source: Wikimedia Commons)

The journal entry to record the sale, cash collection, and sales tax would be:

Debit | Credit | |

|---|---|---|

Cash Sales Sales tax payable | $7.58 | $6.97 $0.61 |

Notice that the sales tax is excluded from the credit to the sales account because it is not revenue but, rather, a liability you owe. The sales tax collection is payable to the state taxing authority, and it is your responsibility to remit them.

If you’re selling goods on account, such as accounts receivable (A/R), you are still responsible for recording sales taxes even if there is no cash flow. To illustrate, let’s assume that the receipt above is a sale on account. The entry would be:

Debit | Credit | |

|---|---|---|

Accounts Receivable Sales Sales tax payable | $7.58 | $6.97 $0.61 |

Notice that even though the customer will pay at a later date, you still have the liability to collect and remit the sales tax. So, if the sales tax return due date comes before the invoice due date, you’re still obligated to pay the sales tax collections even if the customer hasn’t paid.

Since you’ll be using a part of your working capital to pay for sales taxes on outstanding invoices, you’ll need to exercise control in granting credit to customers. Ensure that only loyal customers get to have longer credit terms. For more tips, check out our A/R best practices.

You can make sales tax accounting easier with the right invoicing software for recording sales taxes in the invoice and tracking them in the liability account. Check out our best invoicing software guide to find a platform that fits the bill.

Remittance of Sales Tax Journal Entry

Remittance of sales taxes to taxing authorities may differ across states, and we recommend that you coordinate with your state’s taxing authority for compliance. But for illustration purposes, let’s say that we have to remit sales taxes amounting to $3,500.

The sales tax journal entry to record the remittance would be:

Debit | Credit | |

|---|---|---|

Sales tax payable Cash | $3,500 | $3,500 |

As shown in the entry, the remittance of sales tax is not an expense, but rather reduces your sales tax liability account.

Sales Tax Paid on Purchases Journal Entry

For purchases, sales taxes aren’t accounted for separately. They are part of the cost of the item purchased. Let’s assume you purchased goods worth $200, plus $12 sales tax. The journal entry would be:

Debit | Credit | |

|---|---|---|

Purchases Cash | $212 | $212 |

Take note that sales taxes are necessary costs to obtain ownership of goods or to purchase services, which is why you shouldn’t forget to include sales taxes in costing your products. There are no separate sales tax accounting procedures for purchases.

Frequently Asked Questions (FAQs)

It is treated either as a product cost or as an expense. If goods purchased are intended for sale, then the sales tax paid is capitalized as inventory. Otherwise, it is an expense as incurred.

The credit to the sales account represents the selling price of the goods exclusive of sales taxes. The amount of sales taxes are separately credited to a liability account called sales tax payable.

Bottom Line

Sales tax accounting is necessary for compliance with state laws. Sales taxes must be accounted for properly to avoid getting into trouble with state tax authorities. Having accounting software that can record and track sales taxes can help in ensuring that you’re properly reporting all sales tax collections. We recommend QuickBooks Online, and you can read our QuickBooks Online review to learn how this software tracks and records sales taxes.