2024 promises to be a year of challenge and growth for small businesses. Everyone may be tired of hearing about COVID, but those years changed the nature of business. In 2024, small business owners are still dealing with inflation, supply chain issues, and changes in what employees expect from the workplace.

Below are 50 statistics relevant to small businesses. The sources are mostly from 2023 data to give you the most current information and help you make sound business decisions for 2024.

Key Takeaways

- Small businesses said their top concerns for 2024 were inflation (up to 78%), supply chain issues (68%), and labor (19%).

- While employees are concerned about inflation and pay (38%), they also strive for work/life balance (34%). Most small businesses are making this a priority when recruiting and retaining employees.

- While 70% of Americans shop online, only 20% of small businesses invest in expanding their online presence.

- 68% of small businesses try to avoid getting a loan, turning to their personal finances or reserves, but the SBA still backed 5,700 7(a) loans in FY23.

Small Business Survival & Growth Stats

In 2023, the Small Business Association published statistics saying there are 33.2 million small businesses in the United States, but the information is based on 2019 census data. A study by the Federal Reserve Bank of America showed that business openings mostly outnumbered business closings from the second half of 2020 through 2022.

Further, the SBA itself said it has processed over 16 million new business applications between 2021 and 2023. Based on this data, we’d estimate there are over 40 million small businesses, although there is no definitive study to verify this.

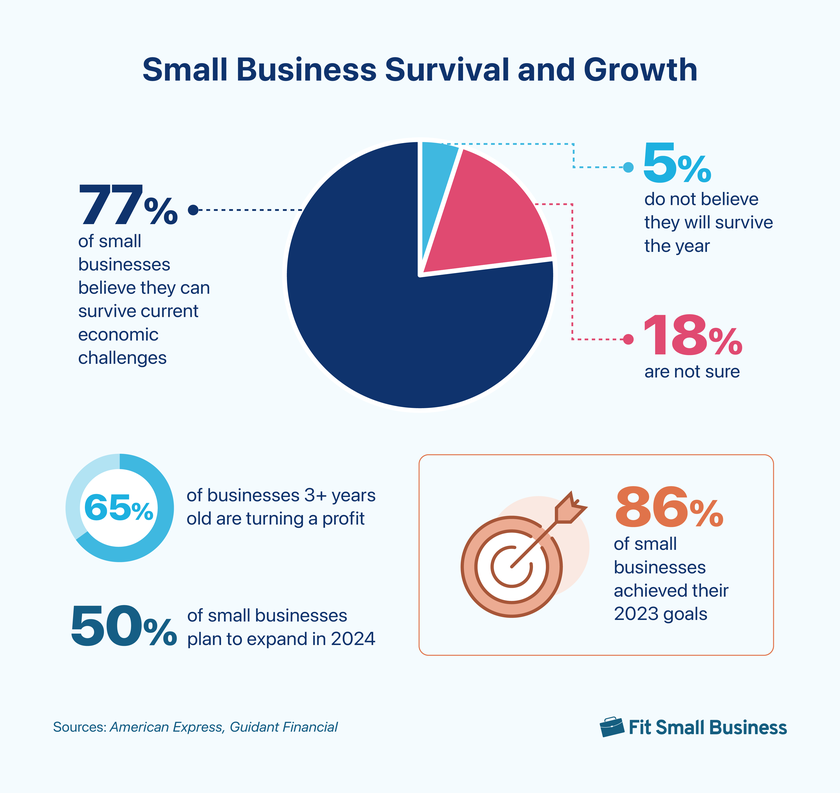

Looking toward 2024, over 77% of small businesses are optimistic about the future, with many saying they were able to grow in 2023 and plan to expand in 2024. Nonetheless, they are concerned about the impact of inflation, supply chain issues, and recruiting and retaining employees.

- 77% of small businesses say they believe they can survive current economic challenges; 18% are not sure, and 5% do not believe they will survive the year. (Guidant Financial, 2024)

- The biggest economic factors impacting success are increased prices (29%), loss of revenue (17%), and wage increases (11%). (Guidant Financial, 2024)

- Supply chain concerns have decreased from 80% in 2022 to 68% in 2023, but it’s still a top concern. Supply chain concerns include rising prices, difficulty sourcing products, and delivery delays. (Bank of America, Women & Minority Business Owner Spotlight)

- 86% of small businesses said they achieved their 2023 goals, and 50% said they plan to expand in 2024. (American Express, 2024)

- At the end of 2023, 47% of businesses said they had new customers. (Slack/OnePoll, 2024)

- 65% of fledgling businesses (<three years) are turning a profit. (Guidant Financial, 2024)

Small Business Stats on Inflation

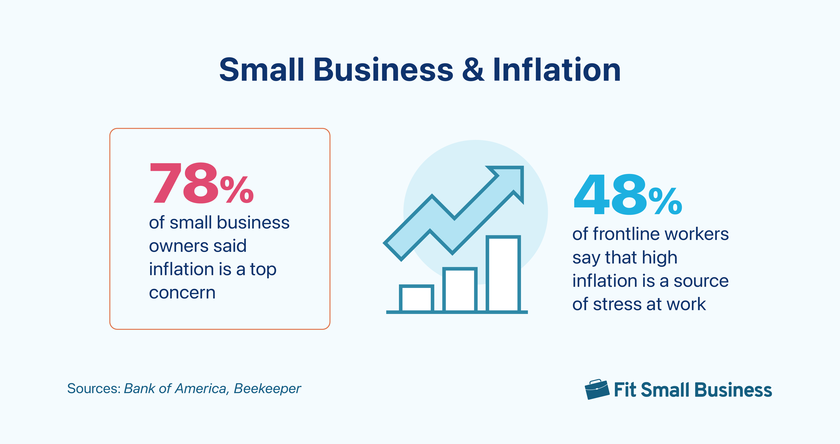

Inflation is a top concern for small businesses—a valid concern, considering the average of the past four years has been 4.5%. However, the CPI Inflation Calculator estimates 2024’s inflation will be 3.09% if current levels hold. Inflation in 2023 was 3.1%, with energy prices going down slightly but commodities and especially transportation being higher than the overage.

Employees, too, are concerned about inflation and the buying power of their salary, which adds stress to the workplace and makes it harder to attract new employees.

- The all-items index rose 3.1% for the 12 months ending January, a smaller increase than the 3.4% increase for the 12 months ending December. (Bureau of Labor Statistics, 2024)

- 78% of small business owners said inflation is a top concern. (Bank of America, Women & Minorities, 2023)

- 23% of small businesses say inflation and price increases are their biggest challenges, while 16% say it’s cash flow problems. (Guidant Financial, 2024)

- 48% of front-line workers say high inflation/low wage growth is a source of stress at work. For managers, it was 36%, just below staffing problems (37%). (Beekeeper, 2024)

Small Business Statistics on Employment & Recruiting

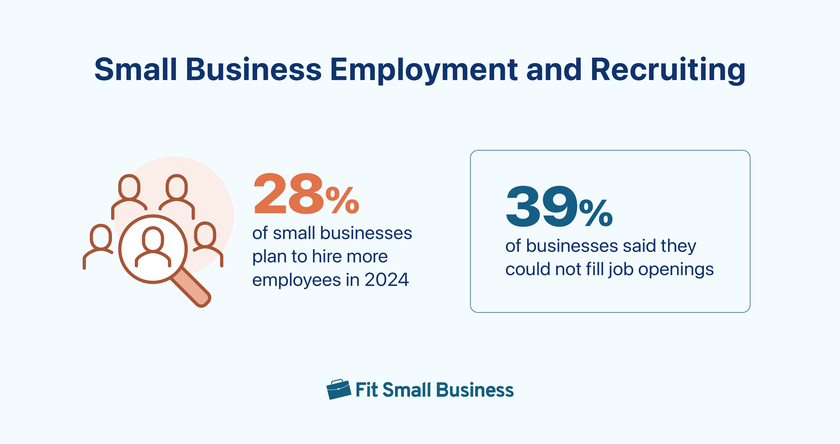

Labor shortages are still a major concern, although the problem is decreasing. Many small businesses plan on hiring this year and recognize that higher salaries and better work-life balance are key to recruiting the best employees. However, the majority is working on improving salaries and working conditions to retain their current employees.

The workforce itself is fluctuating, with up to 57% of front-line employees changing jobs in 2023. Ironically, understaffed shifts were a major player in people leaving. However, employees are mostly seeking a supportive workplace, fair pay, and a good work-life balance.

- 19% of small businesses say recruiting and retaining employees is their biggest challenge for 2024. (Guidant Financial, 2024)

- 28% of small businesses plan to hire more employees in 2024, with 46% being businesses with 101–500 employees. (American Express, 2024)

- 46% say labor shortages are affecting their business, down greatly from 2022 (61%). (Bank of America, Women & Minority Business Owner Spotlight, 2024)

- 39% of businesses said they could not fill job openings. With 55% of business owners trying to hire in January 2024, 89% reported getting few or no qualified applicants. (NFIB, 2024)

- Businesses said they had trouble filling positions because candidates lacked needed experience (20%), a low number of applicants (19%), candidates lacked needed soft skills (15%) or hard skills (13%), and competition (25%). However, businesses did see more interest in applicants in the past year. (Guidant Financial, 2024)

- 69% of small businesses are working harder to keep their employees, with increased wages (24%), training (18%), remote work opportunities (16%), and better benefits (combined 38%). (Truist, 2023)

- To attract more employees, 39% of businesses upped their compensation, according to NFIB, while American Express said 57% plan to offer flexible work options to employees. (NFIB, 2024), (American Express, 2023)

Employee Perceptions to Consider

- 29% to 57% of front-line workers changed their jobs in 2023 (Beekeeper, 2024). Retail was the lowest at 29%, while hospitality (53%) and hospitality (57%) were the highest. (Beekeeper, 2024)

- The top reasons for changing jobs were wages and pay (38%), work/life balance (34%), and better prospects (24%). 40% of workers also cited a toxic workplace, either by managers (23%) or employees (17%) as a reason for leaving. (Beekeeper, 2024)

- Understaffed shifts (36%) were listed as the primary reason for low productivity, followed by a lack of recognition (26%) and poor team communication (18%). (Beekeeper, 2024)

- Across industries, receiving positive customer feedback was the front-liners’ top motivator (43%). The top motivation for construction workers, however, was getting the job done (45%). (Beekeeper, 2024)

Online Business Statistics

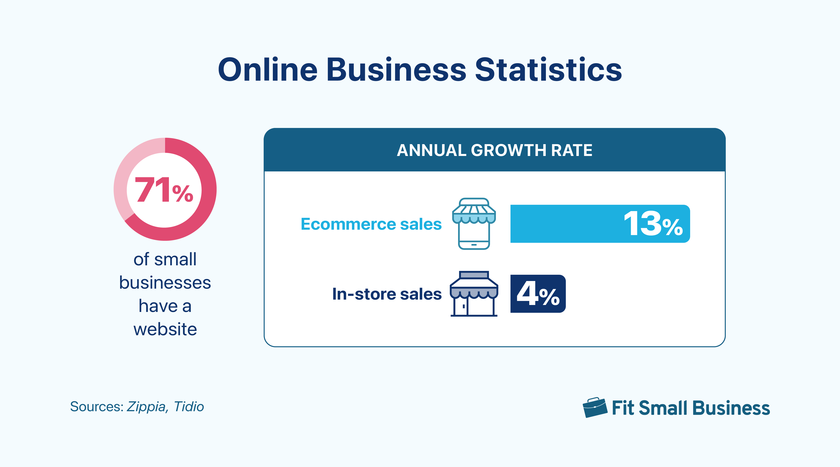

Smart businesses are capitalizing on the growing online shopping trends, although there’s still a huge opportunity for those just starting out. Online shopping, particularly through social media, is expected to continue increasing, with over 95% of items purchased online by 2040. Even so, there’s still a huge interest in brick-and-mortar stores, with 80% of shoppers going on-location to shop.

- 71% of small businesses have a website. (Zippia, 2023)

- There are more than 12 million online stores, 4 million powered by Shopify. (Tidio, 2024)

- 20% of small business owners said they were investing in an online presence, ecommerce, or website in 2023. Another 19% said they planned to invest in search engine marketing. (Truist, 2023)

- The annual growth rate for in-store sales is about 4%, while for ecommerce sales, it’s almost 13%. (Tidio, 2024)

- 70% of Americans are shopping online. Worldwide, that number drops to 27%. (Tidio, 2024)

- By 2024, global online sales are expected to surpass $7 trillion (Tidio, 2024) and pass $8 trillion by 2027. (Statista, 2024)

- In 2024, 83.4% of US retail sales will come from physical stores, according to InsiderIntelligence’s November 2023 forecast. (InsiderIntelligence, 2024)

Consumer Online Shopping Trends

- Americans spend over $3,400 per year online; globally, it’s $2,300, although in the UK, it’s $4,200. (Tidio, 2024)

- 81% of shoppers choose to research a business online before making a purchase. (Zippia, 2023)

- In mid-2023, 17% of social media users have bought something directly on a social media platform in the past three months, rising to 22% of Gen Z and 27% of millennials. (HubSpot, 2023)

- 47% of social media users feel comfortable buying through social apps, and 42% trust social media platforms with their card information, a rise over 2022. (HubSpot, 2023)

- Americans don’t like data tracking: 52% of US adults usually decline to have their personal data tracked, 19% usually allow it, and 29% say it depends on the company. (HubSpot, 2023)

Small Business Expenses

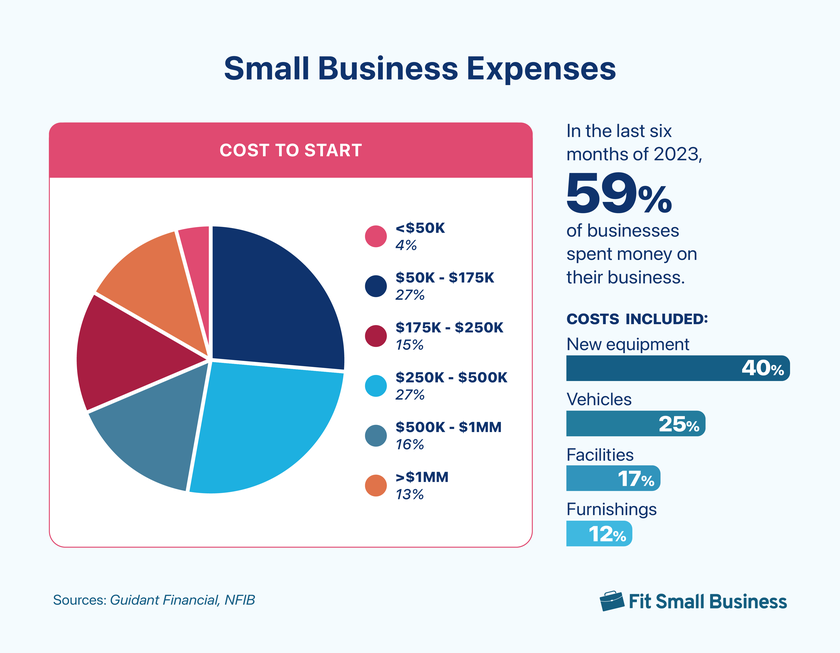

The cost of starting a small business varies widely. The majority of small businesses cost either $50K–$175K or $250K–$500K to start. (Guidant Financial, 2024) Despite the challenges of inflation and rising labor costs, existing small businesses plan on updating both hardware (e.g., equipment) and software. Small businesses were especially interested in inventory management and productivity software.

- 26% of businesses updated their technology in 202—41% of those implemented productivity or collaboration technology. (Slack/OnePoll, 2024)

- In the last six months of 2023, 59% of businesses spent money on their business including new equipment (40%), vehicles (25%), and facilities (17%) or furnishings (12%). (NFIB, 2024)

- On the software side, businesses were pretty evenly split among email automation (17%), online invoicing (15%), financial payments processing (13%), inventory management (12%), and decision support/analytics software (11%). (Truist, 2023)

Small Business Stats for Marketing

In order to grow, many businesses are looking into marketing, although it’s not their highest priority, investment-wise. Digital marketing is taking the lead, but businesses are seeing the importance of keeping existing customers via improved service.

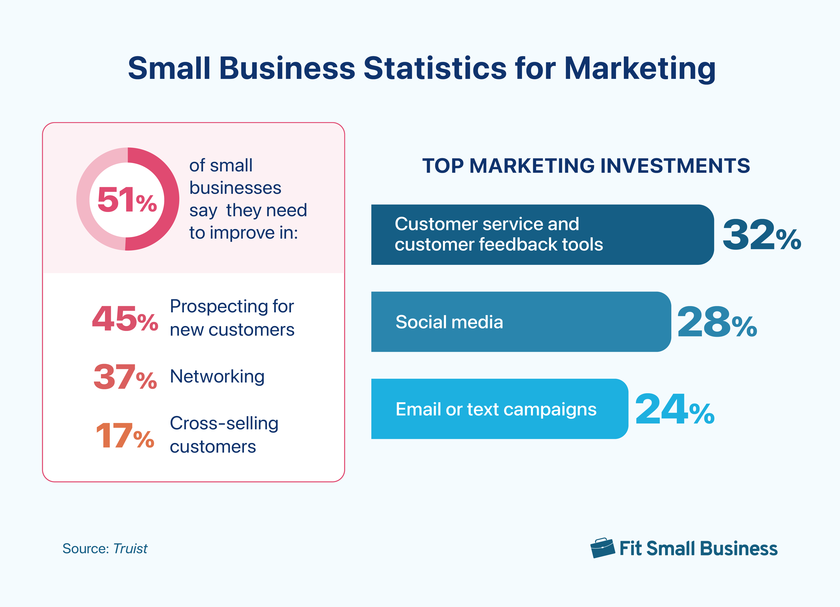

- 51% of small businesses are looking to grow, saying they need to improve in prospecting for new customers (45%), networking (37%), and cross-selling customers (17%). (Truist, 2023)

- 18% of businesses are prioritizing digital marketing this year, while 10% say they are planning to invest more in traditional marketing. (Guidant Financial, 2024)

- Top marketing investments are split between social media (28%) and email or text campaigns (24%), while 32% say customer service and customer feedback tools are a priority. (Truist, 2023)

- In 2023, 41% of consumers have discovered a product on social media. (HubSpot, 2023)

Small Business Financing Statistics

Since COVID, businesses have been doing better financially, with fewer cash shortfalls. However, many are still looking for their own funds or business loans to stay afloat or grow. Most small business owners don’t want to get a business loan, and those who did say it was harder. Nonetheless, the SBA provided over 57,000 loans in FY23.

- 55% of small businesses have $50,000 or more in their business banking accounts. 14% have less than $10,000, 13% have between $10,000 and $24,999, and 23% report having $250,000. (NerdWallet Survey, 2023)

- Cash shortfalls have declined from 91% in 2021 to 73% in 2023. (Truist, 2023)

- 36% of small business owners put their own money into their businesses, and 21% take out personal loans to make up for shortfalls. (Truist, 2023)

- 7% of business owners have cut their own wages to stay afloat. (Guidant Financial, 2024). 26% of owners stop taking a salary. (Truist, 2023)

- 62% of businesses said they are not interested in getting a loan. Of those who did get loans, 6% said it was harder this time, and 18% said they are paying higher interest rates. (Truist, 2023)

- SBA backed more than 57,300 7(a) loans worth $27.5 billion to small businesses in FY23. (SBA, 2023)

Use of AI in Small Businesses

AI is much talked about but still not much used in small businesses. Small business statistics say those on the larger side are more interested, perhaps because they have the resources to explore it. Those using AI are most interested in it for marketing, customer support, and inventory. Interestingly, many business programs are making great use of AI within the programs for analysis and prediction; small businesses polled did not take that into consideration.

- 17% of businesses surveyed say they use AI, mostly in the form of writing tools (21%), image generation (4%), and inventory management (2%). (Guidant Financial, 2024)

- By contrast, 40% of full-time employees use AI at work, and 75% of them say it’s effective. (HubSpot, 2023)

- 77% of small business owners say they aren’t clear on the benefits of AI. (Guidant Financial, 2024)

- Of larger SMBs, 41% are prioritizing AI, with 48% using it for advertising, 46% for marketing, and 46% for customer service. (American Express, 2023)

Methodology

In compiling our list of small business statistics for 2024, we looked at sources like the US Census Bureau and the Small Business Association; however, many of the stats we found, while published in 2023 and 2024, were based on much older data. The most current small business stats came from polls and studies by companies like American Express and Guidant Financial. We strove to use only statistics published in 2023 and 2024, and selected the ones we thought would best help small businesses in making sound decisions.

Bottom Line

People believe in small businesses: 85% of Americans believe small businesses have a positive impact on people’s lives. (Bentley University and Gallup) 52% of consumers say they’re more likely to purchase a product made by a small business (a rise of 18% from 2022). (HubSpot, 2023) While there are still challenges with inflation, labor, and supply, the outlook for small businesses is bright in 2024.