A real estate holding company is a legal entity that acts as the parent company for a single property or a large portfolio of properties. Investors and property owners benefit from starting a holding company for their investment business because it protects their assets, gives tax advantages, and streamlines financial management. Read along as we guide you through the steps of how to start a real estate holding company, why it’s advantageous, and the associated costs.

1. Choose a Business Name

The first step in the process of creating a real estate holding company is selecting a distinctive name. The chosen name should represent your business effectively and comply with state regulations. Each state has specific requirements for business names. For example, your business name cannot imply a government unit or illegal activity.

Perform a thorough search to ensure the name is unique and not in use by another registered entity in your jurisdiction. Your business name should also align with your business goals, resonate with the target audience, and position your property holding company for growth. When selecting a business name, the following items should help guide your decision:

- Reflect your brand and niche: Your business name should convey the essence of your real estate holdings. It should provide a glimpse into your niche or specialization, whether it’s residential, commercial, or a specific type of real estate.

- Keep it unique and memorable: A unique name is essential for legal and branding reasons. Ensure it’s distinct from existing businesses in your industry and easy to remember. Avoid generic or overly common names that may lead to confusion.

- Consider future expansion: Think about the long-term potential of your business. Consider whether the name will still be relevant if you decide to expand into other regions or markets.

- Avoid limiting terms: Be cautious with names that include geographical or time-specific terms. While they may be relevant now, they could hinder your business’ growth if circumstances change.

- Simplicity is key: A concise, easy-to-spell, and easy-to-pronounce name is generally more effective. It facilitates word-of-mouth referrals and minimizes potential spelling errors.

2. Build Your Team of Experts

There are legal contracts and documents needed to open a real estate holding company. Building a strong team of experts can help you navigate the complexities of the real estate market and optimize your returns. They are also beneficial when investing in properties outside of your current jurisdiction since they are able to provide localized knowledge.

Each team member should have the skills and knowledge to enhance their ability and thrive in real estate investment. For example, the expertise of an attorney or legal professional is advisable to ensure legal compliance. Other team members that should be available during this process are:

3. Select a Business Structure & Business Registration

Selecting the right business structure for your holding company for real estate will impact your legal and financial aspects. Many opt for the Limited Liability Company (LLC) structure due to its flexibility, simplicity, and tax advantages. LLCs offer a favorable blend of personal liability protection and pass-through taxation. These benefits make LLCs an attractive choice for real estate investors. Corporation business structures are more complex but are preferred for larger enterprises looking to raise capital through stock offerings.

The registration process varies based on your chosen real estate holding company structure and the geographic location of your business. This process usually involves submitting the necessary paperwork and paying the required fees. Successful registration secures your company’s legal identity and allows you to conduct business under its name. The U.S. Small Business Administration website can guide you through how to register a real estate company, or you can work with an attorney or accountant to set this up for you.

For more information on various business structures, visit our article LLC vs S-corp vs C-corp: What Is the Best for Small Business?

4. Obtain Required Licenses & Permits

Before fully operating your real estate holding company, you must secure the necessary licenses and permits. The specific requirements can vary widely based on your location and the type of real estate activities. Perform research through your Department of State to identify the permits and licenses relevant to your operations. Most real estate holding companies commonly need tax registration certificates and construction permits if you’re looking to perform any property renovations.

Construction permit example (Source: Fast Company)

5. Open Business Banking Accounts

Maintaining a clear separation between your personal and business finances is fundamental with a real estate holding company. The financial separation helps protect your personal assets from potential legal claims or liabilities associated with your real estate activity. It also makes it easier to report income and expenses accurately come tax time.

To achieve this, open dedicated business banking accounts in the name of your company. These accounts should be used exclusively for your real estate holding company’s financial transactions, including rent collection, property maintenance expenses, and tax payments.

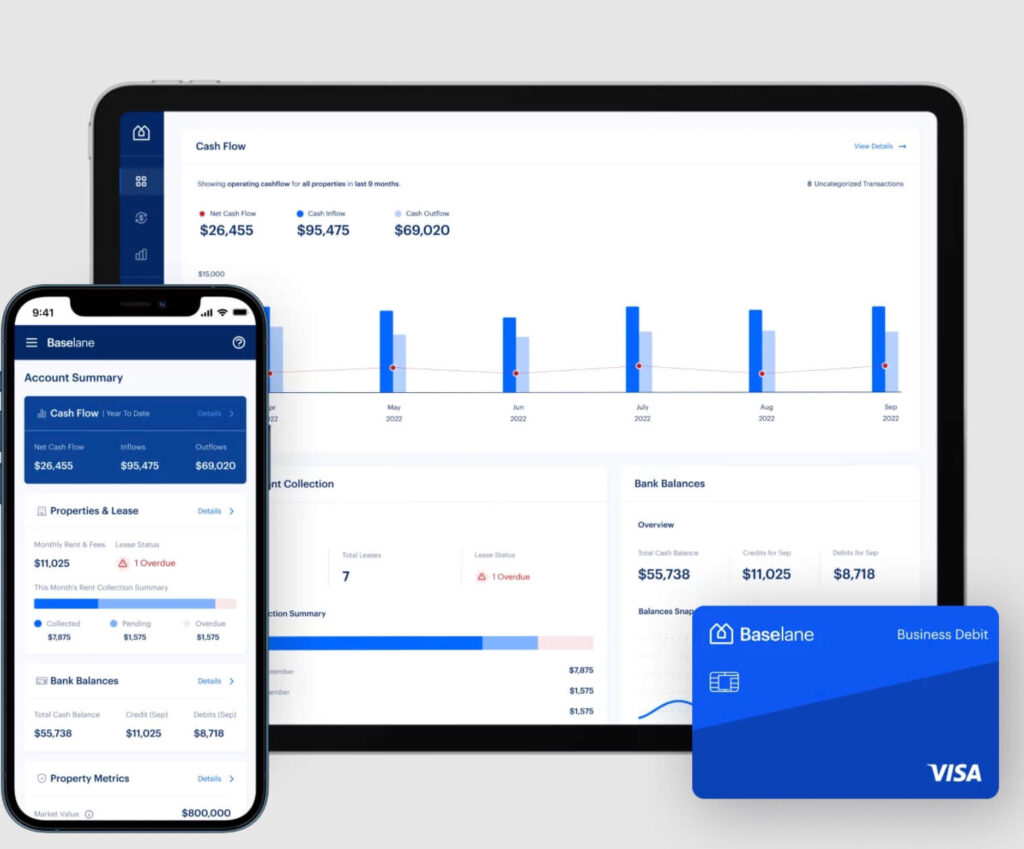

Financial reporting is accessible on multiple devices (Source: Baselane)

For help with opening a bank account, investors can utilize Baselane. It is an online platform streamlining an investor’s banking needs like opening dedicated business accounts, financial reporting, and analytics. Baselane also offers features like expense tracking and automated rent collection—identifying cost savings. The mobile application also lets you access your accounts from anywhere.

6. Purchase & Close on Properties Under Your LLC

With the legal and financial groundwork in place, it’s time to acquire and manage real estate properties. This involves finalizing the purchase of all real estate under your holding company. Once the properties are successfully acquired and titled in the name of your real estate holding company, you can begin to execute your investment strategy. This can involve using the properties as rental income, property appreciation, or other strategies outlined in your investment business plan.

Property documents (Source: Northern Title Agency)

Leverage the assistance of an attorney or title company to transfer any personal real estate to your holding company. The process involves transferring property titles to the holding company. It’s important to be aware that, in many cases, mortgage companies may have restrictions that prevent or complicate such transfers. Therefore, it’s vital to consult with both legal and financial experts to navigate this process effectively.

Why Form a Holding Company for Your Real Estate Investments?

Understanding how to start a real estate holding company is the first step in leveraging its numerous advantages, but it’s important to understand why a holding company is advantageous to investors. This legal entity safeguards your assets from potential risks associated with real estate investments. Furthermore, holding companies offer investors significant tax benefits by preventing double taxation, ultimately reducing overall tax expenses.

Investors should be aware of the potential disadvantages of a holding company as well. Establishing multiple LLCs can lead to added costs from legal fees and higher interest rates. If investors fail to navigate capital gains tax effectively, they may face higher unexpected taxes. Overall, investors should do their due diligence to determine if this structure is best for them.

Costs of Setting Up a Real Estate Holding Company

The expenses associated with establishing a real estate holding company can fluctuate depending on whether or not you opt for external assistance. You can create your own LLC and apply for your business licenses to save on costs, but when you start enlisting the services of attorneys, your overall costs will increase. Research your state’s specific requirements and fees for creating a business, as they can vary significantly.

Setting up an LLC is relatively affordable compared to other business structures. Therefore, it’s important to budget for these costs as part of your real estate holding company’s startup expenses. Here are some key expenses you can expect when forming a holding company:

Expense | What It Is | Approximate Cost Range |

|---|---|---|

Filing Fee | To create an LLC, you'll need to file articles of organization with your state's Secretary of State office | $50 to $500 |

Registered Agent Fee | Fee paid to a reliable point of contact for receiving legal documents | $100 to $300 |

Operating Agreement | A legally binding document that outlines the internal structure, management, and operational procedures of an LLC | $100 to $500 |

Business License | Legal authorization issued that allows the holding company to conduct its business activities within a specific jurisdiction | $25 to a few hundred dollars |

Annual Report Fee | A fee required by some states to maintain the legal status of a business entity | $35 to $500 |

EIN Application | A request for a unique identification number for a business | Usually free |

These initial costs are just the beginning of your investment journey. Once you begin purchasing and managing real estate, you’ll encounter additional expenses. These ongoing costs may include property taxes, insurance premiums, maintenance and repair costs, property management fees, etc. Investors must budget for these ongoing expenses and factor them into their investment strategy for the long-term financial health of your business.

Frequently Asked Questions (FAQs)

Opting for an LLC as the business structure for a real estate holding offers several key advantages. First, an LLC provides personal liability protection and safeguarding the assets of investors from potential legal claims. LLCs offer flexible management options like simplified administrative requirements and the opportunity for pass-through taxation. These attributes make LLCs an attractive choice for real estate holding companies.

The specific permits or licenses required to operate a real estate holding company vary significantly depending on the scope of business activities. Commonly, these may include real estate brokerage licenses, property management permits, and zoning permits, among others. Individuals considering the establishment of a real estate holding company must thoroughly research and understand the local and state regulations in their area. Consulting with legal professionals or regulatory authorities may also be necessary to determine the specific permits and licenses required for their specific circumstances.

No, a holding company is not a requirement for investing in property. Property investment can be done individually as a personal investor. The decision of whether to establish a holding company depends on factors like asset protection, tax considerations, and your specific investment strategy. While a holding company can provide benefits such as liability protection, it’s not a mandatory prerequisite for property investment. The choice of structure should be based on your circumstances and objectives.

Bottom Line

Establishing a real estate investment company, or holding company, is a strategic maneuver for mitigating the personal liability and risks that come with real estate investments. Like all businesses, there are legal and financial aspects to consider. By following these steps, investors can build a strong foundation for their real estate endeavors.