TaxSlayer and TurboTax are accounting software that differ in key aspects that cater to distinct user needs. After assessing both software, I like that TaxSlayer offers tiered, cost-effective solutions and find it to be better suited for self-employed individuals. While TurboTax is pricier, I find that it provides a user-friendly and comprehensive experience that’s best for those with complex tax situations. Both products offer free versions. Before any add-ons, TaxSlayer’s pricing tops out at $59.95 while TurboTax maxes at $219.

Ultimately, the choice between TaxSlayer vs TurboTax depends on individual preferences, tax requirements, and budget considerations. Here’s where I see best use for either product:

- TaxSlayer: Self-employed individuals who need a low-cost do-it-yourself (DIY) or assisted filing solution.

- TurboTax: Small businesses with complex tax situations seeking full-service tax preparation and filing

TaxSlayer vs TurboTax at-a-glance comparison Relevant factors shown in the comparison chart represent features of both online and desktop versions.

Best For | Self-employed individuals who need a low-cost do-it-yourself (DIY) or assisted filing solution | Small businesses seeking full-service tax preparation and filing |

Pricing |

| |

Free Federal Return for Active Duty Military | ✓ | ✕ |

Schedule C Business Income & Loss | ✓ | ✓ |

Data Import | ✕ | ✓ |

Audit Guidance and/or Defense | ✓ | ✓ |

Deduction Maximizer | ✕ | ✓ |

Tax Pro Assistance | Premium & Self-Employed only | ✓ |

S Corporation (S-corp) & Partnership Returns | ✕ | ✓ |

Average User Review Score on Third-party Sites | 4.2 out of 5 | 4.6 out of 5 |

Taxes are easier with clean books. Get on top of your financials today with Merritt Bookkeeping. |

|

Use cases and pros & cons

Pricing: TaxSlayer wins

From a purely economic standpoint, TaxSlayer comes out as the clear winner. However, TaxSlayer doesn’t offer desktop software and lacks full-service tax preparation and filing. While it charges significantly less for DIY online filing and assisted filing, it doesn’t support business forms such as Forms 1065, 1120, and 1120S. As a result, it is limited to only individual returns, including Schedule C.

Live assistance: TurboTax wins

TaxSlayer | TurboTax | |

|---|---|---|

Communication Method | Phone, email, and live chat | Phone, chat, and one-way video conferencing |

Qualifications of Professionals | CPAs, enrolled agents (EAs), or tax specialists | CPAs, EAs, or tax specialists |

Tax Pro Assistance for Individual Returns | Premium & Self-Employed plans | ✓ |

Tax Pro Assistance for Business Returns | N/A | |

Full-service Filing for Individual Returns | N/A | ✓ |

Full-service Filing for Business Returns | N/A | ✓ |

Both TaxSlayer and TurboTax provide live assistance for individual returns but only TurboTax offers assistance with business returns. Unfortunately, the live assistance is limited to 20 states. Full-service tax preparation and filing is unavailable with TaxSlayer, but TurboTax offers it for all states for both business and individual returns.

Helpful tools: TurboTax wins

TaxSlayer | TurboTax | |

|---|---|---|

Accuracy Guarantee | ✓ | ✓ |

Audit Support | ✓ | ✓ |

Tax Calculator | ✓ | ✓ |

Free Plan | ✓ | ✓ |

Deduction Maximizer | ✕ | ✓ |

Cryptocurrency Support | ✕ | ✓ |

Data Import | ✕ | ✓ |

TurboTax wins the battle of TurboTax vs TaxSlayer when it comes to helpful tools. TaxSlayer lacks many features that TurboTax has, such as a deduction maximizer, cryptocurrency support, and the ability to import data. However, both offer an accuracy guarantee, audit support, a tax calculator, and a free plan.

Mobile app: TaxSlayer wins

TaxSlayer | TurboTax | |

|---|---|---|

Availability | iOS and Android | iOS and Android |

Talk Live With Tax Specialist | ✓ | ✓ |

Prepare More Complicated Returns | ✓ | ✕ |

E-file Return | ✓ | ✓ |

Scan & Upload W-2 | ✓ | ✓ |

IRS Refund Tracking | ✓ | ✓ |

View, Print & Save Return as PDF | ✕ | ✕ |

Based on user experience, TaxSlayer comes out as the better of the two options for preparing complicated returns. Both offer a mobile app for iOS and Android users. With either product, customers can communicate with a tax specialist directly through the app, prepare and e-file returns, scan and upload W-2 forms, and track IRS refunds.

Neither app allows you to view, print, or save your return as a PDF. While the two products are virtually equal in most categories, the user experience for TaxSlayer’s handling of more difficult returns gives it the win.

Customer service & ease of use: Tie

TaxSlayer | TurboTax | |

|---|---|---|

User Interface (UI) | Easy to use | Clean and simple to navigate |

Support Channels | Phone, email, and live chat | Phone, live chat, and one-way videoconferencing |

Expert Help Offered | ✓ | ✓ |

Additional Services | Zero out-of-pocket fees, Ask a Tax Pro, and tax refund calculator | Self-employed expense estimator and check your refund status |

TaxSlayer and TurboTax are tied for customer service and ease of use, given that they don’t offer distinguishably different options. Both products offer customer support through various channels, including email, phone, and live chat. Users can reach out to the respective support teams for assistance with tax-related questions and technical issues.

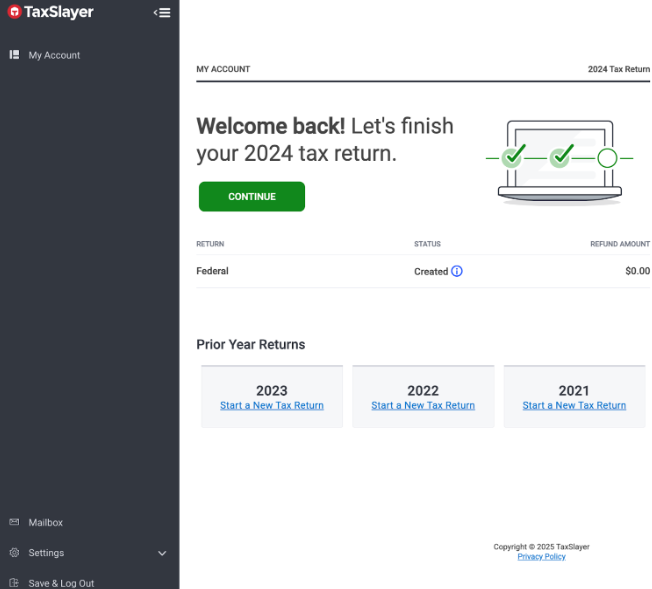

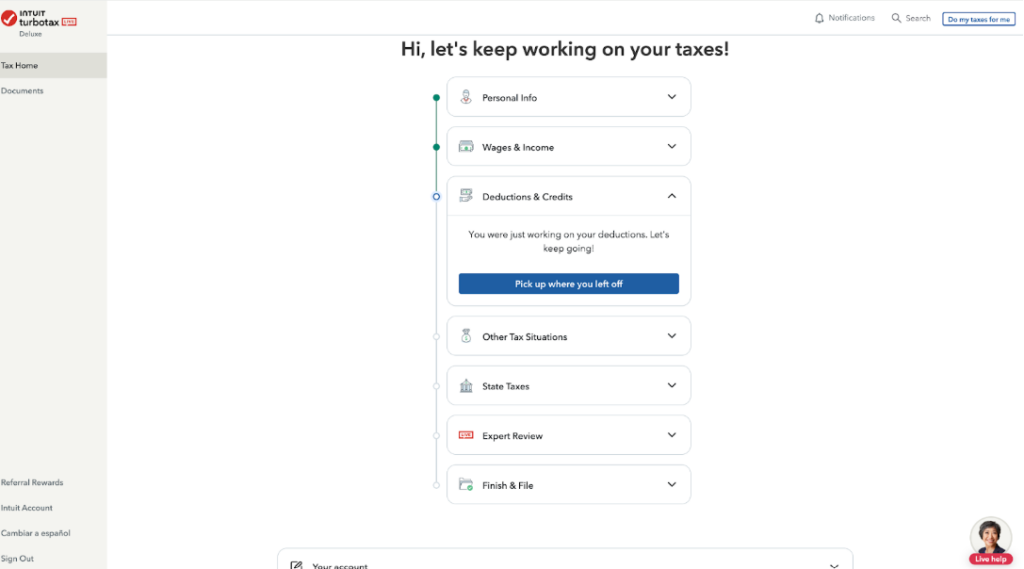

TaxSlayer and TurboTax both provide an online knowledge base with frequently asked questions (FAQs) and helpful articles to guide users through common tax situations and software functionalities. Each software platform has a relatively intuitive interface, making it easy for users to navigate through the tax preparation process. You can see examples of each product’s interface below.

TaxSlayer dashboard (Source: TaxSlayer.com)

TurboTax dashboard (Source: Turbotax.com)

User reviews: TurboTax wins

TaxSlayer | TurboTax | |

|---|---|---|

Users like | ||

Users dislike | ||

Average user rating | 4.2 | 4.6 |

In the course of my evaluation, I noted that user review scores varied widely across websites. Some sites showed collective user reviews between 1 and 2 out of 5 for both TaxSlayer and TurboTax. I don’t agree that either software deserves such a low overall rating because thousands of people file returns with both products and have no issues. Self-prep of a tax return is difficult, and some of that difficulty might manifest itself in low user ratings.

Across multiple websites, TurboTax emerged as the overall winner between the two due to its solid platform and ease of navigation.

How I evaluated TaxSlayer vs TurboTax

I compared TaxSlayer and TurboTax based on these criteria:

- Features: I considered product characteristics such as ease of data import, navigation, refund tracking tools, and in-product support.

- Pricing: I verified the availability of free trials and confirmed pricing for varying tax prep packages.

- Technical support: Being able to access help when needed is a primary concern for users, so I assessed the ease of access to product experts via phone, email, or chat options.

- Ease of use: Particularly with DIY software, it’s important that software be easy to navigate. I reviewed how easy it is to move around the product from inception to completion of the tax return.

Frequently Asked Questions (FAQs)

Yes, both TaxSlayer and TurboTax allow users to import the previous year’s tax data from their own software or other tax preparation platforms.

To qualify for TaxSlayer’s free filing option, Simply Free, your taxable income must be less than $100,000, you must not claim any dependents, your filing status must be Single or Married Filing Jointly, and you must take the standard deduction. In addition, your types of income must be limited to wages, salaries, tips, taxable interest of $1,500 or less, and unemployment compensation.

Yes, TurboTax has a mobile app that is available for both iOS and Android.

While both providers offer live tax assistance, only TurboTax offers full-service preparation and filing of tax returns.

If you’re looking for the cheapest option, TaxSlayer is the better option. However, based on third-party user reviews, TurboTax is the preferred option for most users.

Yes, TaxSlayer is IRS-approved. In fact, for 2025, TaxSlayer is the software provider for the IRS free tax prep VITA program.

Bottom Line

TaxSlayer stands out with its affordable pricing and user-friendly interface, making it an excellent choice for individuals with straightforward tax situations. Meanwhile, TurboTax excels with its robust customer support and comprehensive range of tools, making it ideal for both individuals and businesses seeking assisted or full-service filing.