Before implementing tip pooling in your restaurant, it’s important to completely understand what’s involved. Learn more about the practice, including applicable laws.

Restaurant Tip Pooling: Ultimate Guide (+ Free Template)

This article is part of a larger series on How to Do Payroll.

Tip pooling is when a portion or all of the tip money collected in a day is redistributed among tip-eligible employees, either evenly or by a set percentage. This practice can increase morale and is a great option for some restaurants. However, it’s important to implement correctly, as there are laws—like those forbidding management participation—that must be followed to avoid being fined.

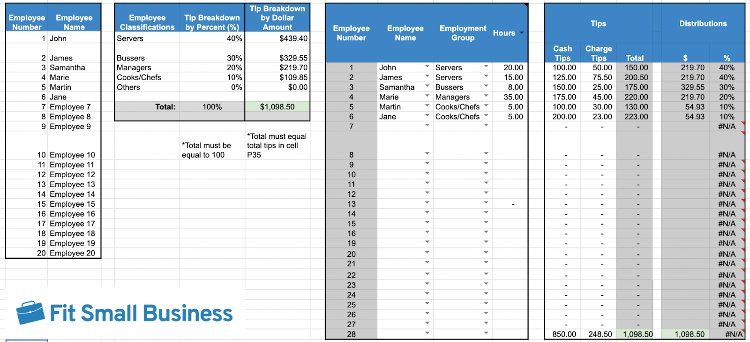

As calculating tips using a tip pooling method can get confusing, we’ve created a simple-to-use template that will help you divide your tips in a matter of minutes. Download it for free below.

Summer Savings: Get 70% off QuickBooks for 3 months. Ends July 31th. |

|

What Is Tip Pooling?

To understand tip pooling, you must have a firm grasp of the following key terms:

- Tip: According to the IRS, a tip is a voluntary amount of money left by a customer to pay workers for their service. It is money paid in addition to regular wages and is taxable if it exceeds $20 monthly.

- Tipped employees: As defined by the FLSA, they are those who customarily and regularly receive more than $30 per month in tips.

- Tip credit: Based on federal law, this amount is $5.12. This is the difference between federal minimum wage ($7.25 per hour) and what employers are allowed to pay tipped employees ($2.13)—provided they receive enough tips to compensate for the difference. If the tips aren’t enough, the employer is required to pay the remainder. However, several states (like Alaska, California, Minnesota, Montana, Nevada, Oregon, and Washington) do not allow tip credit.

There are many ways to handle tip pooling, the methods of which depend on what works best for your business. Generally, tipped employees collect all of the cash tips they receive throughout their shift and combine them with tips from each participating employee working the same shift. Once tips are totaled, the employer or employees divide them evenly among tip pool participants. Tips received by credit or debit card can be distributed the same night (if enough cash is on hand) or paid with the next payroll.

Tip pooling can help ensure staff members are fairly compensated for their work, but can be a point of contention for waitstaff who spent the whole night juggling tables and saw others taking a break in the walk-in.

In the News

The Department of Labor issued a final rule Sept. 24, 2021, that withdrew and modified two portions of the 2020 Tip Laws. Effective Nov. 23, 2021, the DOL:

- Restored its ability to assess CMP (Civil Money Penalty) against employers who violate the FLSA by taking tips earned by their employees, regardless of whether those violations are repeated or willful

- Adopted the same rules, procedures, and amount considerations for CMPs for keeping tips as it applies to other Fair Labor Standards Act CMPs

- Addressed when minimum wage or overtime violations of the FLSA are considered “willful” and thus subject to a Civil Money Penalty assessment

- Clarified that while managers or supervisors may not receive tips from tip pools, managers and supervisors are not prohibited from contributing to mandatory tip pools

- Clarified that managers and supervisors may only keep tips that they receive from customers directly for services that the manager or supervisor directly and “solely” provides

Since the updated FLSA rules went into effect in April 2021, labor groups like One Fair Wage have encouraged employers to compel their front-of-house (FOH) employees to include back-of-house (BOH) staff in the tip pool. Though no law requires including BOH workers in tip pools, and industry groups like the National Restaurant Association and the Independent Restaurant Association have not taken a position one way or the other.

There’s still no official guidance regarding how much servers should tip out, but it’s a good idea to have some sort of methodology behind your allocation. And some states—like California—require employers that enforce a tip pool to provide employees with a written copy of the tip pool policy. If your employees create a tip pool on their own, they can decide how much to redistribute and who they want to share it with.

Typically, when pooling tips includes BOH employees, it isn’t an even divide. Allocations are generally based on a percentage of sales or a percentage by job title. Usually, servers receive the bulk, at least 70%—but it can be under 50%.

A sample tip pooling arrangement by percentages is as follows:

- Servers: 70%

- Runners: 12%

- Bussers: 10%

- Bar Staff: 8%

Tip Pooling Laws

Although the federal government is in the process of changing the rules for tip pooling, many states have yet to do so. However, states with preexisting laws that disallow paying tipped employees below minimum wage (California, Nevada, etc.) were automatically granted permission to include BOH employees in their tip pooling arrangements. This is because all staff within establishments were already earning at least minimum wage—a requirement for restaurateurs wanting tips shared with non-tipped staff.

Common tip pooling violations employers make are including ineligible employees in a required tip pool and not paying employees all tips received. Per the DOL, if you violate any federal tip pooling laws, you’ll have to pay the employees back for any tips they were owed but didn’t receive, tip credits claimed, and an additional amount for liquidated damages. If you also violate tip pooling laws at the state level, you’ll likely owe additional penalties.

Federal Tip Pooling Laws

Aside from who can participate in a tip pool, the DOL has other regulations you need to be aware of to protect you from liability. It’s important to remember that all tips (not service charges) belong to your employees. Even when paid to your restaurant through a credit or debit card transaction, you’re prohibited from keeping any of the tips for yourself or your business. You’re also not allowed to pool and distribute them to any employees in a supervisory position.

Here are some quick rules to be aware of regarding pooling tips:

- Notify employees: You must notify tipped employees of any required tip pool contribution amounts and to whom they will be redistributed before their participation. It’s a good idea to have a standard notice on hand to provide upon hiring.

- Don’t keep tips for the business or yourself: Employers are prohibited from retaining employees’ tips for any purpose other than verifying or processing with their next paycheck. All tips are the property of the employees.

- Exclude managers and supervisors: Managers and supervisors are explicitly not allowed to participate in a tip pool under any circumstances.

- Require reasonable contribution amount: You can’t require employees to pay more into the tip pool than is customary and reasonable. In 2011, the DOL initially defined this as 15% of tips received or 2% of daily sales, but there are no hard rules as it hasn’t yet established a maximum contribution amount. Many restaurant employees pay above 15%.

In December 2021, the 80/20 rule, which states that employers can utilize the tip credit as long as 80% or more of the work is tip-generating (providing table service, serving food, etc.), and not more than 20% is directly supporting work (setting tables, wiping down the bar, etc.), was revived. It had been temporarily replaced with more flexible guidelines during the Trump administration.

Did you know?

Though you cannot retain any tips for yourself, federal law allows business owners to retain the credit card processing fees from tips paid on credit and debit cards. However, many state laws expressly ban this practice. Check your local laws before attempting to withhold processing fees from credit card tips.

State Tip Pooling Laws

As mentioned earlier, although federal laws have been changing, tip pooling laws still vary widely by state. To check the tip pooling laws that apply to yours, check out our state payroll guide directory below:

Alternatives to Mandatory Tip Pooling

To avoid the legal complexities associated with mandatory tip pooling, as well as some of the disadvantages, you should consider alternatives. First, determine why you want to implement a mandatory policy. Common reasons are to raise wages for BOH employees, ensure all tipped employees receive compensation for their service regardless of how well their customers tipped, and reduce bickering over certain customers.

If your goal is to even the income disparity between FOH staff (like servers) and BOH staff, consider regularly increasing hourly wages for BOH employees. The pain point BOH workers feel is that their wages don’t fluctuate, which means they don’t rise like that of tipped staff. If you offer performance raises or bonuses, BOH employees are more apt to retain their motivation.

If you’re worried about how regular wage increases will affect your bottom line, consider taking advantage of the tip credit. Per federal law, you can pay tipped employees an hourly wage as low as $2.13 an hour as long as they receive enough tips (individually and in a valid tip pooling arrangement) to earn the $7.25 hourly minimum wage rate.

Just keep in mind that if you opt for the tip credit, you can’t revert to requiring FOH workers to pool or share tips with BOH employees—it must be optional. You’ll also need to check your local labor laws; some states or counties prohibit a sub-minimum tipped wage.

Mandatory tip pooling means you require your employees to pay their tips into a pool to be redistributed. Voluntary tip pooling is similar but is organized completely by the staff. They may ask you if you will help facilitate by distributing through payroll or counting and paying it out in cash, like you would automatically do if it was mandatory, and it’s your decision as to whether you’re willing to do so.

For this setup to be voluntary, you cannot have any say-so in how tips are collected or redistributed. When it comes to tips received electronically and by check, you have a say in how quickly you will pay them out (albeit the upcoming pay period is the latest you’re allowed to pay) because the tips are paid to your restaurant. You still don’t get to decide who gets what or how much.

In this scenario, you can still participate in the tip credit (if permitted by your local labor laws) and possibly be assured your BOH staff receives tips—if FOH employees decide to include them. The key to establishing a legal voluntary tip pooling arrangement is to ensure it’s adequately reflected that you didn’t coerce or force employees into the agreement. You could request that they sign a document to verify that their decision to establish a tip pooling arrangement was independent of you.

If you need help learning about other payroll regulations, check out our payroll compliance guide.

Tip Pooling vs Tip Sharing

Most labor laws—including the FLSA—only use the term tip pool. But that doesn’t mean these laws don’t apply to tip sharing; the law simply doesn’t distinguish between the two terms. The difference between the two is a matter of restaurant operations. Tip pooling and tip sharing are just different ways to distribute communal tips among tipped restaurant employees.

In a tip share, employees who process payments and collect the tips (servers, bartenders, etc.) retain their own tips and give a portion of their individual tips to the other staff that supported them (bussers, barbacks, etc.). Tip sharing is also called “tipping out,” and is the most common tip distribution arrangement in the restaurant industry. It can be voluntarily arranged by tipped employees or operate with tip out percentages enforced by the restaurant.

In a tip pool, all of the collected tips for a shift are gathered in a single pot and distributed among all of the tipped employees based on a set percentage (as in the template included in this article). Tip pools are most common in fine dining restaurants and high-volume operations, where they help compensate all the tipped employees equally no matter what tasks they are assigned. Like a tip share, a tip pool can be voluntarily arranged by tipped employees or be managed by the employer.

Under the 2018 final amendment, restaurateurs who pay at least minimum wage to all their staff can mandate that BOH employees are compensated from either tip sharing or pooling arrangements. That is, unless your state laws prohibit it.

The DOL’s guidance states, “An employer that pays the full minimum wage and takes no tip credit may allow employees who are not tipped employees (for example, cooks and dishwashers) to participate in the tip pool.” Many states have laws that still don’t allow establishments to mandate tipped employees share tips with BOH employees. It’s also important to note that for pooling to occur, all or a portion of employee tips must be totaled before distribution. Traditionally, many servers who shared tips with BOH employees did so out of their own individual tips—meaning they didn’t pool them.

It helps to understand the differences between, and the history of, tip pooling and tip sharing so that you’re not confused as new federal and state legislations are passed.

Tip Pooling Law Frequently Asked Questions (FAQs)

Tip pooling can be a great way to encourage teamwork, improve customer service, and ensure that tipped staff are compensated equitably. If you choose to establish a tip pool at your restaurant, though, it is important to make sure everyone in the pool is contributing to the work. Tensions can arise if your tipped employees feel that someone in the pool is not pulling their weight. If you do not have the managerial bandwidth to coach a high performance out of your entire team, a tip pool will likely frustrate your high-performing staff and could reduce sales.

There are several ways to calculate pooled tip distributions. You can distribute tips by percentage of the pool, by hours worked, or based on a points system. We describe all of these options in detail (and include the relevant equations) in our guide to restaurant tip outs.

Restaurants that run a tip pool typically do so to encourage teamwork and provide a higher level of customer service. When staff members work in a tip pool, they tend to have less tunnel vision on their assigned section while excluding the rest of customers in the house. In a pooled house, everyone is earning a share of the tips from every table. So if a customer needs attention, it is in everyone’s best interest to help them, regardless of which restaurant section employees are currently assigned.

A restaurant can enforce a reasonable tip sharing or tip pooling arrangement as a condition of employment. Federal law only requires that the tip distribution is “reasonable” (though the law does not stipulate exactly what reasonable means). So, if a server or bartender chooses to withhold tips in violation of your restaurant’s reasonable tip share or tip pool policy, that could be a reason for dismissal.

Though the law is unclear on what would make a tip sharing policy unreasonable, restaurant owners or managers should take care that their tip share or tip pool policy is not too severe. If your tip out percentages are too high, you’ll likely lose high-performing staff who feel they can earn higher tips elsewhere.

In nearly every scenario, it is against the law for owners, managers, or supervisors to participate in tip pools or tip shares. However, there are some cases where managers may receive tips. The FLSA final rule that was updated in September 2021 carves out an exception for tips that are given directly to managers for tasks that managers perform solely. And in some states—like California—supervisors that do not have the ability to hire or fire staff, and who perform the same work as the employees they supervise (like coffee shop employees who are both supervisors and baristas) can be included in a tip pool.

Bottom Line

Tip pooling laws are complex and vary widely from state to state. Various state laws are unclear about allowing or prohibiting BOH tip participation, withholding credit card processing fees, or allowing some supervisors to participate in tip pools. Ensuring you follow all rules may require a legal adviser; otherwise, you can be charged thousands of dollars for violations.