A balance sheet displays a company’s assets, liabilities, and owner’s equity at any given point in time. It provides a snapshot of what a company owns and owes as of the balance sheet date and the amount invested by its owners, so note that the owner’s equity isn’t equal to the company’s fair market value. It’s one of several major financial statements that a bookkeeper should compile.

The following accounting equation is used to create a balance sheet:

Assets = Liabilities + Owner’s Equity

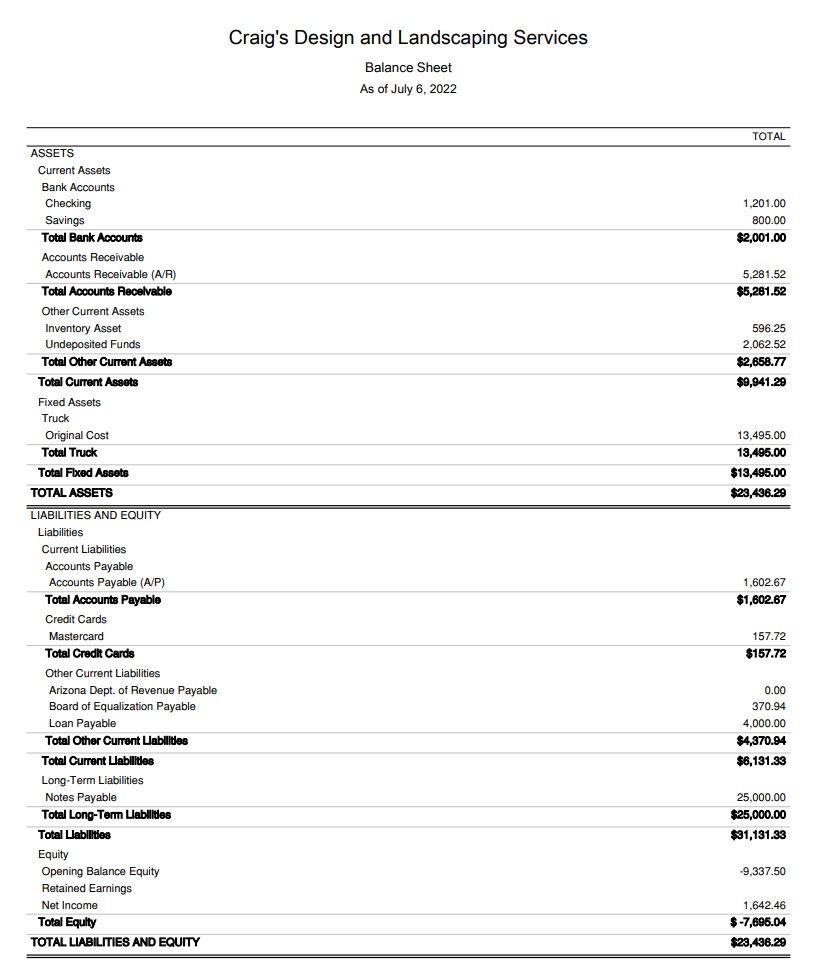

This is one of the many concepts discussed in our Accounting 101 article, and please see our example below for a better understanding of what’s included on a balance sheet:

Sample balance sheet from QuickBooks Online

You can generate a balance sheet in seconds with the right accounting software. Read our best small business accounting software guide to know more.

What Is on a Balance Sheet? 3 Components

There are three major components of a balance sheet: assets, liabilities, and owner’s equity. Essentially, assets are any items that your business owns, and liabilities are amounts your business owes. Owner’s equity is the difference between assets and liabilities.

Assets

The assets section of your balance sheet breaks down what your business owns of value that can be converted into cash within a year or less. There are three main categories of assets on your balance sheet: current assets, fixed assets, and other assets.

Current Assets

Current assets can easily be converted to cash within a year or less. They’re broken down further on the balance sheet by the following categories:

- Cash and cash equivalents: This is the most liquid of assets and can include currency, checks, treasury bills, and short-term certificates of deposit (CDs).

- Marketable securities: This includes both equity and debt securities owned for which there’s a liquid market and the business expects to sell them within one year. Marketable securities are generally shown on the balance sheet at their original cost or current value, whichever is lower.

- Accounts receivable (A/R): A/R refers to open invoices that customers are yet to pay. Open invoices might be reduced by an allowance for doubtful accounts, which is an estimate of what customers will never pay.

- Inventory: Inventory includes any assets that are owned with the intention of selling them to customers. This includes materials that will be used to manufacture items to sell. Inventory is shown on the balance sheet at the lower of the cost or market price.

- Prepaid expenses: These amounts represent the value of expenses that have already been paid for, but not yet used. For instance, if you pay six months of insurance premiums in advance, they’ll initially be shown as a prepaid expense. They’ll be transferred gradually to an expense on the income statement as the time period covered by the policy progresses.

Fixed Assets

Fixed assets refer to a long-term tangible piece of property or equipment that a company owns and uses in its operations to generate income. They provide a long-term financial benefit to the business, aren’t sold to customers, and can include property, buildings, machinery, computer equipment, software, vehicles, and furniture. Fixed assets on the balance sheet must be reduced by any accumulated depreciation.

Other Assets

These include the following:

- Long-term marketable securities: This can include most investments, such as stocks, bonds, and exchange-traded funds (ETFs) that the business doesn’t expect to sell within one year.

- Intangible assets: This type includes intellectual property and goodwill. They’re generally only listed on the balance sheet if they’re acquired rather than developed in-house.

Liabilities

Liabilities are the money that your company owes to others, including loan repayments and other forms of debt, such as mortgages. They can also include deferred revenues, accrued expenses, and warranties and are broken down further into current and long-term liabilities.

Current Liabilities

Current liabilities usually are considered to be short-term and concluded within a year or less, with cash. Some examples of current liabilities include accounts payable (A/P) and accrued expenses, which are expenses incurred by not yet paid like payroll and utilities.

- A/P: The amount of money owed to vendors or creditors for goods and services

- Wages payable: The total amount of wages employees have earned but you haven’t yet paid

Accrued expenses, such as wages payable, change as additional expenses are incurred and not paid. For instance, each day your employees work increases wages payable. It’s unnecessary to record these daily changes in your accounting records. Most companies only update accrued expenses as of the date of the balance sheet.

- Dividends payable: This amount represents what’s owed to shareholders after when a dividend is declared but not yet paid.

- Unearned revenues: This amount represents the company’s liability to deliver goods or services at a future date after being paid in advance. Once the product or service is delivered, this amount will be reduced with an offsetting entry that recognizes revenue on the income statement.

Like accrued expenses, unearned revenue changes daily and only needs to be updated in the accounting records as of the balance sheet date.

- Interest payable: This represents the interest on credit purchases and loans to be paid in the short term.

Long-term Liabilities

Long-term liabilities refer to long-term debts and nondebt financial obligations due after a period of more than one year. They can include:

- Deferred tax liability: This liability stems from timing differences between when income and expenses are shown on the tax return versus when they’re included on the income statement. This is a very complicated liability that S corporations (S-corps), partnerships, and sole proprietors don’t have to deal with. However, C corporations (C-corps) required to comply with generally accepted accounting principles (GAAP) will likely need to hire a certified public accountant (CPA) to make this calculation.

- Long-term debt: This includes principal on bonds and loans that will be paid in greater than one year.

- Pension fund liability: This represents underfunded pension plans. It’s another complicated calculation that most small businesses won’t have to deal with unless they’re required to comply with GAAP and will likely require a CPA to compute.

Owner’s Equity

Owner’s equity represents what has been invested into the business by the owners, plus net income that has been retained by the company. Comparing it from one period to the next reflects how your business is doing. If the equity has declined, then the company had a net loss for the period or made distributions to the owner in excess of net income. Either way, that’s a signal to review and potentially make changes. If it has increased, that’s a positive sign.

Depending on your business structure, equity is handled differently.

- Sole proprietorship: Equity represents the owner’s investment in the business and consists of:

- Capital contributed: Cash and other assets transferred to the business by the owner, less any liabilities transferred to the business., plus net income of the business

- Retained earnings: Net earnings over the life of the company less any draws paid to the owner.

- Corporation: Owner’s equity is called shareholder’s equity, and consists of:

- Stock: Par value of stock issued to the corporate owners

- Additional paid-in capital (APIC): Amounts paid for stock purchased issued to the owners in excess of the stock’s par value.

- Retained earnings: Net earnings over the life of the corporation, less any amounts that have been distributed to the shareholders. it represents the value of corporate stock and retained earnings or undistributed amounts.

While it’s helpful to understand the different components of a balance sheet, you may want to consider hiring a bookkeeper to provide financial analysis. Check out our guide to bookkeeping for more information about the tasks that bookkeepers perform.

Why Is a Balance Sheet Important?

A balance sheet is an important tool for analyzing your company’s financial position through financial ratio analysis. This can provide valuable insights into your company’s liquidity, efficiency, and solvency.

Examples of situations when a balance sheet is important include:

- When a company needs to know if they have enough current assets to pay current debts

- When a potential investor is valuing the business

- When a company is trying to determine if its financial position is stable enough to begin paying back debts

- When expansion or a merger is being considered

- When a bank is trying to determine if your business qualifies for additional loans or credit

Bottom Line

A balance sheet consists of three primary sections: assets, liabilities, and equity. It offers a quick view of a company’s financial standing at a particular date and acts as a decision-making tool. By comparing the current assets to the current liabilities, you’ll get a clear picture of the liquidity of your business.