An invoice is a document that you send to customers to request or collect payment for a good or service that has already been provided. The invoicing process starts when the business fulfills the order and delivers it to the customer. In Wave, you can create professional-looking invoices quickly and easily. In our example below, we’ll use a sample invoice from Wave to illustrate what a good invoice looks like.

Create unlimited invoices, estimates, and bills for FREE with Wave |

|

Key takeaways

- Invoices provide information on how much and when customers should pay the amount due.

- Invoices can be used as evidence of existing receivables from customers.

- There are nine basic components in an invoice:

- Company details

- Recipient’s information

- Invoice number and due dates

- Terms

- Mode of shipment

- Sales representative

- Method of payment

- Itemized list of services and costs

- Notes

- Invoices should follow a unique numbering system to maintain the integrity of each invoice.

Purposes of an Invoice

- Demand for payment: An invoice is an official notification for payment. When an invoice is issued, it signifies that you have provided the goods or performed the services. Among the most important of all accounts receivable (A/R) best practices is issuing an invoice within 48 hours of providing the goods or performing the services.

- Business promotion: You can insert promotions or exclusive offers in invoices. If you have a customer loyalty program, you can talk about membership benefits and exclusive discounts. You can also insert special promotions like warehouse sales and discounts for bulk purchases.

- Charge disputes: Invoices provide the customer with a detailed listing of what exactly they’re being charged for and offer them an opportunity to dispute the charges. Customers should be encouraged to raise any issues they find because the sooner you can smooth over any differences, the sooner you’ll get paid.

An invoice can also be called as a “commercial invoice.” It should be distinguished with a pro forma invoice, which is used for information purposes only. To know the differences in function and applications, read our comparison between pro forma invoice and commercial invoice to know more.

Components of an Invoice

Invoice designs may differ, but they must contain all basic components. Our sample invoice below is from Wave and shows the essential items that every invoice should possess. Let’s do a deep dive into each component.

Sample invoice from Wave

Your invoices should always include your name or your company’s name. State your business address and, preferably, your business email and phone number at the top of the invoice. You may also add your logo and colors for branding.

Sample company details

In the sample invoice from Wave, you’ll see the company name and business address email address. The company logo is located on the left side of the invoice.

Do you need a free email address? See our buyer’s guide on the free business emails.

As with your contact information, you should likewise include all the same details of the recipient, so be sure to include the name of the client’s contact who handles your account.

Sample recipient’s information

In our example above, we billed the invoice to John Fraser Doe because he’s the point of contact for transactions with JD Enterprises.

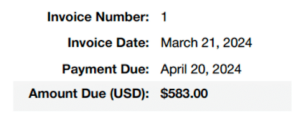

Devise a unique numbering system for every customer and invoice. This will help both you and the customer track the transactions. Read our article about invoice numbers and learn how you can design a numbering system.

For instance, instead of saying, “That invoice I sent you last month,” you can note, “Refer to invoice #71190.” Ensure you assign numbers to your invoices systematically just to keep everything in line.

Sample invoice number and important dates

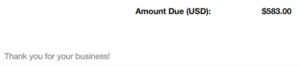

In Wave, invoice numbers are auto-generated whenever you enter a transaction. Below the invoice number, Wave included the invoice date, payment due date, and amount due. Combining these three items provides users with a glance at the due date and amount payable.

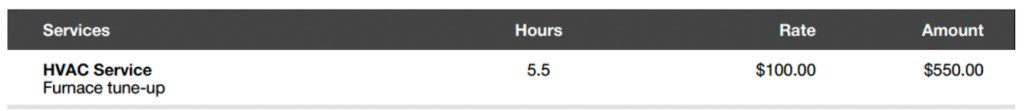

People always want to know what they’re paying for. Don’t use a general description, such as “Design.” Tell your client exactly what they have received from you—and be as specific as possible. Include a breakdown of the goods or services that you provided and what you charged.

Sample itemized list of services and costs

Here’s a list to help you:

- Detailed description of the work or products provided

- Date the service was performed or when the product was ordered

- Number of products purchased or the number of hours you worked

- Product cost or your hourly rate/service charge

- Total price, including any delivery fees and taxes

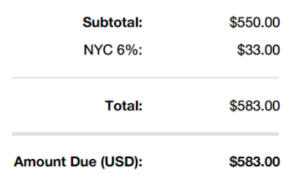

The invoice must clearly show how it arrived at the final amount due. It must include discounts deducted and sales taxes added to the subtotal. Though not shown in the sample below, you may add shipping fees if applicable. In some cases, mistakes happen when you send an invoice. If you overcharged a customer, you can just send a credit invoice (also called credit memo) to adjust the invoice amount. Otherwise, you need to send a debit invoice.

Sample amount due computation

It’s a good idea to add a message box to your invoice template. You can note important account information and mention seasonal promotion details—or you can simply say, “Thank you for your business!” if you want a more generalized note.

Sample notes

Frequently Asked Questions (FAQs)

While they may contain similar information, an invoice is a request for payment for goods and services provided, whereas a receipt is the confirmation of payment by the customer.

It’s a unique number generated and assigned to an invoice document—so no invoice should share the same number. It can be a simple sequential numbering system or a specifically crafted number that combines a customer account number plus a sequential number. For example, invoice number 2201-33 may pertain to invoice #33 of a customer with an account number of 2201.

The terms “invoice” and “bill” are two accounting terms that are often misunderstood. An invoice is a document that you send to customers to ask for payment, while a bill is a document you receive from vendors requesting payment. In other words, what the sender refers to as an invoice is often called a bill by the customer.

Bottom Line

Invoices are an important request for payment sent to clients. Invoicing is an important process that provides your customers with confirmation of the products and services you provided and lets them know it’s time for them to pay. With the help of accounting software programs like Wave, you can create and send invoices to customers easily.