Learn everything you need to know about certified payroll, from how it works to what state and federal laws regulate it.

What Is Certified Payroll & How to Comply

This article is part of a larger series on How to Do Payroll.

Certified payroll is a weekly payroll report required by the US Department of Labor (DOL) for government contractors on federally funded projects with a contract value of over $2,000. The payroll report details employee wages, benefits, hours worked, and the type of work performed.

To comply with certified payroll, government contractors must submit Form WH-347 every week and include a statement of compliance. The goal is to ensure that employees are paid the prevailing wage for their job. (We’ll take an in-depth look at prevailing wage below.)

Some states, such as California and New York, have specific laws that impact certified payroll. Make sure to always check with state laws and regulations before processing or reporting certified payroll for your employees.

Some of the best payroll software providers have certified payroll features that will automate this for you. ADP RUN’s Point North Certified Payroll Reporting is flexible enough to handle union and nonunion contractors and will meet your state-specific reporting requirements. Get a free quote today and your first three months for free.

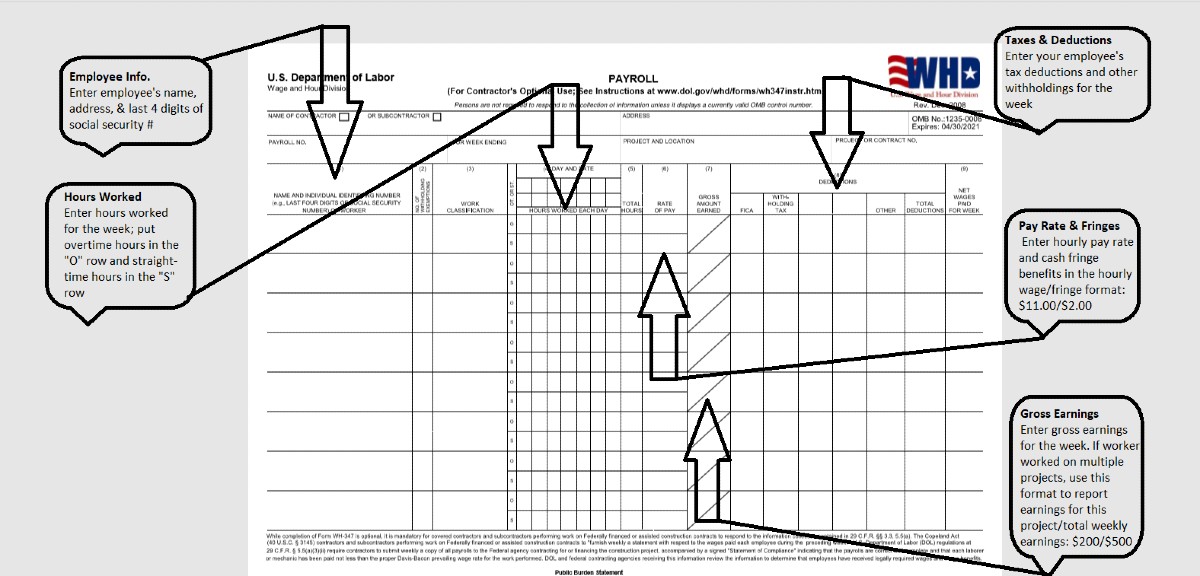

How to Fill Out Form WH-347

While initially overwhelming, doing certified payroll is just filling out details in a form. You need to be careful to provide accurate information, but once you do this a couple of times, it’ll become routine and hassle-free.

To make filling out the basic payroll information easier, keep accurate records of the employee’s pay rate, hours worked, deductions, and fringe benefits. Reporting fringe benefits and worker classification can be challenging, especially if employees perform multiple types of work. Separate line items are required on the certified payroll form for each job performed.

Companies and industries that most commonly need to use certified payroll are those in construction. This can include ancillary areas such as:

- Plumbing

- Electrical

- Painting

- Highway projects

- Public works initiatives

If you decide that doing your certified payroll manually is the best option, we’re here to help. Below, you’ll find screenshots and line-by-line guidance to help you fill out Form WH-347.

This table provides a quick overview of the basic information you’ll need to add to the top of the form. Then, we’ll get into the employee specifics and work details you’ll enter in the rest of the form.

Form Section | What to Input |

|---|---|

Business Name | The full legal company name, plus whether you’re a contractor or subcontractor |

Business Address | Your company’s full business location |

Payroll Number | The unique number designated for each week that is assigned in your federal contract |

Week Ending | The last day of the current pay period |

Project and Location | The name of the project and its location |

Project or Contractor Number | This information is listed in your contract |

Enter the following information about your employees and their work details:

Column 1: Name and Identifying Number: You must enter the employee’s full name, and you can use the last four digits of the worker’s Social Security number as an identifying number.

Column 2: Withholding Exemptions: This column is optional—if you want to complete it for convenience, you can. It should reflect on their W-4 form. If not, then disregard it.

Column 3: Work Classifications: List the classification of work actually performed by each laborer or mechanic. Check the classification and minimum wage schedule in the contract for more information.

If your employee worked in more than one classification, you can show this with an accurate breakdown of hours worked in each classification. They must be shown on separate entries.

Column 4: Hours Worked: Enter the day and date for all time worked, with straight time and overtime hours worked in the applicable boxes. On all contracts subject to the Contract Work Hours and Safety Standards Act (CWHSSA), enter hours worked over 40 in a week as “overtime.” The row with “O” under the “OT OR ST” column is for overtime hours, and the row with “S” is for straight-time hours.

Column 5: Total: Add all hours, straight and overtime, and enter the total.

Column 6: Rate of Pay (including fringe benefits): In the straight time box for each worker, labeled as “S” in the “OT OR ST” column, enter the hourly rate you paid for straight time worked plus cash paid in lieu of fringe benefits paid.

To prevent confusion, separate the straight-time hourly rate and cash paid in lieu of fringe benefits like this: “$10.15/.60.” This would reflect a $10.15 base hourly rate plus 60 cents for fringe benefits. This comes in handy when computing overtime.

When an employee works overtime, show the overtime hourly rate paid, plus any cash in lieu of fringe benefits paid in the overtime box; if there was no overtime, you may skip this box. If the work falls under the CWHSSA, you must pay the employee overtime at a rate of 1.5 times the regular rate if the prime contract exceeds $100,000.

Column 7: Gross Amount Earned: Enter gross earnings on this project. If the worker earned part of their money from projects other than the project you’re reporting on this payroll form, enter the following in column 7:

- Amount earned on the federal or federally assisted project

- Gross earnings during the week on all projects

For example, if you entered $200.00/$420.00, it would reflect that a worker earned $200.00 on a federally funded construction project during a week that they earned a total of $420.00 on all work.

Column 8: Deductions: The form gives you five columns to show deductions taken. If you need more, use the first four columns and show the balance of the remaining deductions under the “Other” column. Show the grand total (first four deductions plus total other) under the “Total Deductions” column. In the payroll’s attachment, describe the deduction(s) contained in the “Other” column.

If one of your workers works on other jobs in addition to this project, show actual deductions from their weekly gross wages and indicate that deductions are based on gross wages.

Column 9: Net Wages Paid for Week: Subtract total deductions from the gross amount earned and enter here.

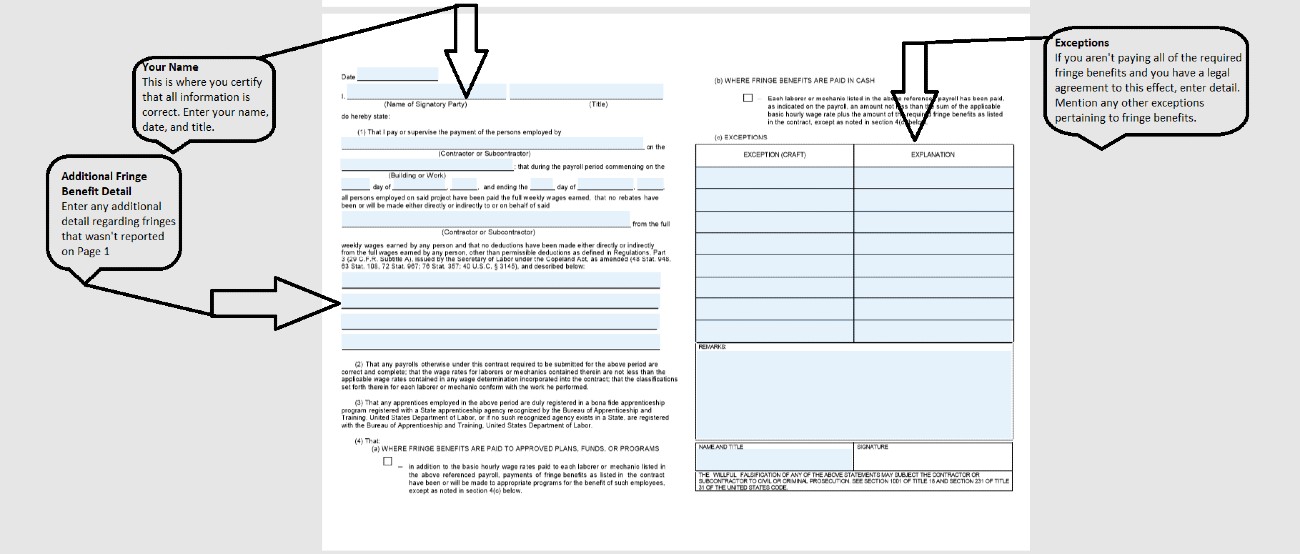

Statement Required by Regulations: This is the statement of compliance that accompanies the payroll report. Once it’s signed, the report is certified. You don’t need to have it notarized, but you do need to be sure the information presented is correct. By signing, you certify that the information included is accurate; you are subject to a fine, possible imprisonment of up to five years, or both if you’re wrong.

Items 1 and 2: Enter the date and your name and title above Item 1. Then, enter your business name and project (building or work). Lastly, enter the starting and ending dates of the pay period before re-entering your business name.

Use the space above Item 2 of the statement to describe any deductions made. If all deductions made are adequately reflected in the Deductions column on Page 1, Column 8, state “See Deductions column in this payroll.”

Item 4: Fringe Benefits: If you pay all required fringe benefits to approved plans, funds, or programs (instead of cash) per the amount in the prevailing wage determination, only show the straight-time hourly rate and overtime rate paid to each worker on the face of the payroll, i.e., don’t add it to Column C on Page 1, and check paragraph 4(a) of the statement to indicate the payment. If you paid in cash, check Box 4(b). Note any exceptions in section 4(c).

No fringe benefits: If you’re not paying any or all of the fringe benefits you’re required to under the prevailing wage law, you must pay any remaining fringe benefit amounts to each worker in cash. Then, update the straight time (S) row of the “Rate of Pay” column on Page 1 with an amount that is at least equal to the prevailing wage rate for your worker’s classification, plus the amount of fringe benefits required.

How to Determine Prevailing Wage

As we mentioned earlier, the point of certified payroll is to ensure that you are paying employees the prevailing wage for their job. When you sign the Statement of Compliance accompanying the certified payroll report, you’re confirming you’ve paid all laborers and mechanics at least the local prevailing wages and fringe benefits for similar work completed in the area per the Davis-Bacon Act (DBA).

Use the Wage Determinations Online Search to find a DBA wage determination. Look for the minimum rate for the specific worker in question and comply with both the minimum pay and fringe rates. You must comply with prevailing pay and fringe rates published by the DOL to ensure compliance with payroll laws.

Apprentices and trainees are not required to receive the predetermined wage rate. Instead, apprentices must be enrolled in a program that specifies the minimum wage rate, and trainees must receive on-the-job training in a construction occupation under a DOL-approved program.

Calculating Fringe Benefits

Under the DBA, contractors must provide employees with certain fringe benefits. This requirement can be satisfied by using funded or unfunded fringe benefits.

- A funded fringe benefit plan often includes health insurance, life insurance, and retirement plans. These plans must be funded at least in part by the employer.

- An unfunded fringe benefit plan includes paid holidays, sick pay, and other benefits generally covered by the employer. These fringe benefit plans must be wholly covered by the employer and must be a commitment from the employer to employees.

To calculate fringe benefit contributions, contractors must annualize the rate of contributions for all employee hours worked, not just those worked on DBA-covered projects. Fringe benefits must also be paid for all hours worked, including overtime.

For calculating fringe benefits, contractors should refer to the prevailing wage determination issued by the DOL. A contractor’s fringe benefits must meet or exceed the prevailing wage determination issued by the DOL for the particular job classification and location. To determine the hourly credit, deduct the basic hourly rate paid from the total hourly fringe rate. If the basic hourly rate paid is less than the hourly credit, the contractor must make up the difference by paying the employee the additional amount, or by adding benefits.

Federal Laws vs State Laws on Prevailing Wage

In your efforts to comply with federal prevailing wage laws and certified payroll requirements, keep in mind that some states have their own prevailing wage laws. Currently, about 20 states have their own prevailing wage regulations.

California, for example, has a lower threshold value than the DOL at $1,000. This means your company must comply with certified payroll requirements if you have a state contract with a value of $1,000 or more. Meanwhile, Missouri has a higher threshold requirement of $75,000. So if your business has a state contract with Missouri that’s valued at less than $75,000, you won’t have to comply with certified payroll, unless there is federal funding involved.

Use the map below to determine whether you need to consider state rules and what threshold your contract must meet to be subject to them:

If you’re in a state that doesn’t have its own prevailing wage laws, you only need to follow federal regulations for certified payroll.

Penalties for Not Complying With Certified Payroll Laws

Submitting detailed weekly reports in addition to your regular payroll process can be daunting. However, it’s necessary to avoid the negative consequences that result from not complying with prevailing wage and certified payroll laws.

Here are the penalties for violating Davis-Bacon laws:

- Debarment: Debarment from future contracts for up to three years

- Payments placed on hold: Contract payments may be withheld to pay for unpaid wages and award damages that result from overtime violations

- Termination: Termination of the federal contract

- Prosecution: Falsification of records could lead to civil or criminal prosecution, which could be punishable by fines and imprisonment

If the Wage and Hour Division determines you violated applicable laws, you can challenge the determination before an administrative law judge. You can also appeal decisions made by the administrative law judge to the Administrative Review Board (ARB), and if you’re unhappy with the ARB’s decision, you can appeal to the federal courts.

Bottom Line

To comply with the Davis-Bacon Act, it’s crucial to understand your required federal and state prevailing wage and certified payroll requirements. Take your time when calculating total wages and fringe benefits, and ensure to maintain detailed payroll records. If needed, consider outsourcing your payroll to a provider that can handle certified payroll for you.

You can simplify this process by utilizing the services of ADP RUN. This service allows you to take full advantage of a comprehensive suite of tools that automate and streamline your entire payroll process, including certified payroll, so you can stay compliant and keep your government contracts. Get three months free today.